The Institute of Cost and Works Accountants of India 2009 CWA Inter Stage I Cost and Management Accounting - Question Paper

December 2009: The Institute of Cost and Works Accountants CWA Inter Stage I: Cost and Management Accounting: December 2009 University ques. paper

CWA Inter - Stage I- Cost and Management Accounting - December 2009

1-5(CMA)-RE Revised Syllabus

Time Allowed : 3 Hours Full Marks : 100

The figures in the margin on the right side indicate full marks.

Part A questions are compulsory. Attempt all of them.

Part B has seven questions each carrying 16 marks. Attempt any five of them.

Please: (1) answer all bits of a question at one place.

(2) open a new page for answer to a new question.

(3) Do not attempt more than the requisite number of questions

PART A

Marks

1. (a) In each of the cases below one out of four given answers is correct. Indicate 1x10= the correct answer by writing the capital letter (A, B, C or D): 10

(i) The effect of using the last in, first out (LIFO) method of stock valuation rather than the first in, first out (FIFO) method in a period of rising price is

A. to report lower profits and a lower value of closing stock.

B. to report higher profits and higher value of closing stock.

C. to report lower profits and higher value of closing stock.

D. to report higher profits and a lower value of closing stock.

(ii) The profits shown in the financial accounts was Rs.1,58,500 but the cost accounts showed a different figure. The following stock valuation were used:

Stock valuations Cost accounts Financial accounts

Rs. Rs.

Opening stock 35,260 41,735

Closing stock 68,490 57,336

What was the profit in the cost accounts?

A. Rs.1,63,179

B. Rs.1,40,871

C. Rs.1,76,129

D. Rs.1,53,821

(iii) At the end of a period, in an integrated cost and financial accounting system, the accounting entries for overhead over-absorbed would be

A. DR Profit and loss account

CR Work-in-progress control account

B. DR Profit and loss account CR Overhead control account

C. DR Work-in-progress control account CR Overhead control account

D. DR Overhead control account CR Profit and loss account

(iv) The management accountants report shows that fixed production overheads were over-absorbed in the last accounting year. The combination that is certain to lead to this situation is

Production activity and Fixed overhead expenditure

A. lower than budget and higher than budget

B. higher than budget and higher than budget

C. as budgeted and as budgeted

D. higher than budget and lower than budget

(v) Riceol Processing Limited has identified that an abnormal gain of 160 litres occurred in its refining process last week. Normal losses are expected and have a scrap value of Rs.2.00 per litre. All losses are 100% complete as to material cost and 75% complete as to conversion costs.

The company uses the weighted average method of valuation and last weeks output was valued using the following cost per equivalent unit:

Materials Rs.9.40

Conversion costs Rs.11.20

The effect on the profit and loss account of last weeks abnormal gain is

A. Debit Rs.2,528

B. Debit Rs.2,828

C. Credit Rs.2,528

D. Credit Rs.2,828

The following information is required for sub-questions (vi) to (viii):

The incomplete process account relating to period 4 for a company which manufactures paper is shown below:

Units

Units

Rs.

Rs.

700

Material

Labour

Production overhead

4,000 16,000 Finished goods 2,750

8,125 Normal loss 400

3,498 Work-in-progress 700

There was no opening work-in-process (WIP); closing WIP, consisting of 700 units, was complete as shown:

Material

Labour

Production overhead

100%

50%

40%

Losses are recognised at the end of the production process and are sold for Rs.1.75 per unit.

(vi) Given the outcome of the process, which ONE of the following

accounting entries is needed to complete the double entry to the process account?

Debit

A. Abnormal loss account

B. Process account

C. Abnormal gain account

D. Process account

(vii) The value of the closing WIP was

Credit Process account Abnormal loss account Process account Abnormal gain account

A

C

B

D

Rs.3,868,

Rs.4,158,

Rs.4,678,

Rs.5,288

(viii) The total value of the units transferred to finished goods was

A

C

B

D

Rs.21,052.50,

Rs.21,587.50,

Rs.22,122.50,

Rs.2

(ix) Ambyvalley operates a continuous process producing three products and one by-product. Output from the process for a month was as follows:

Product Selling price Units of output

per unit

Rs.18

Rs.25

Rs.20

Rs.2

from process

10,000

20,000

20,000

3,500

1

2

3

4 (by-product)

Total output costs were Rs.2,77,000.

What was the unit valuation for product 3 using the sales revenue basis for allocating joint cost?

A B C D

A Rs.4.70, B Rs.4.80, C Rs.5.00, D Rs.5

(x) North-West Limited manufactures and sells two products, J and K,

Annual sales are expected to be in the ratio of J:1, K:3. Total annual sales are planned to be Rs.4,20,000. Product J has a contribution to sales ratio of 40%, whereas that of product K is 50%. Annual fixed costs are estimated to be Rs.1,20,000.

(0)

The budgeted break-even sales value (to the nearest Rs.1,000) is

A B C D

A Rs.1,96,000, B Rs.2,00,000, C Rs.2,53,000, D Rs.2

5 5 5

5 5 5

PART B

(b) The following information is required for sub-questions (i) and (ii):

|

n (J P" |  |

|

Outputand safes (units) | |

ui

cc

(U

u

SI

(U

T3

C

ra

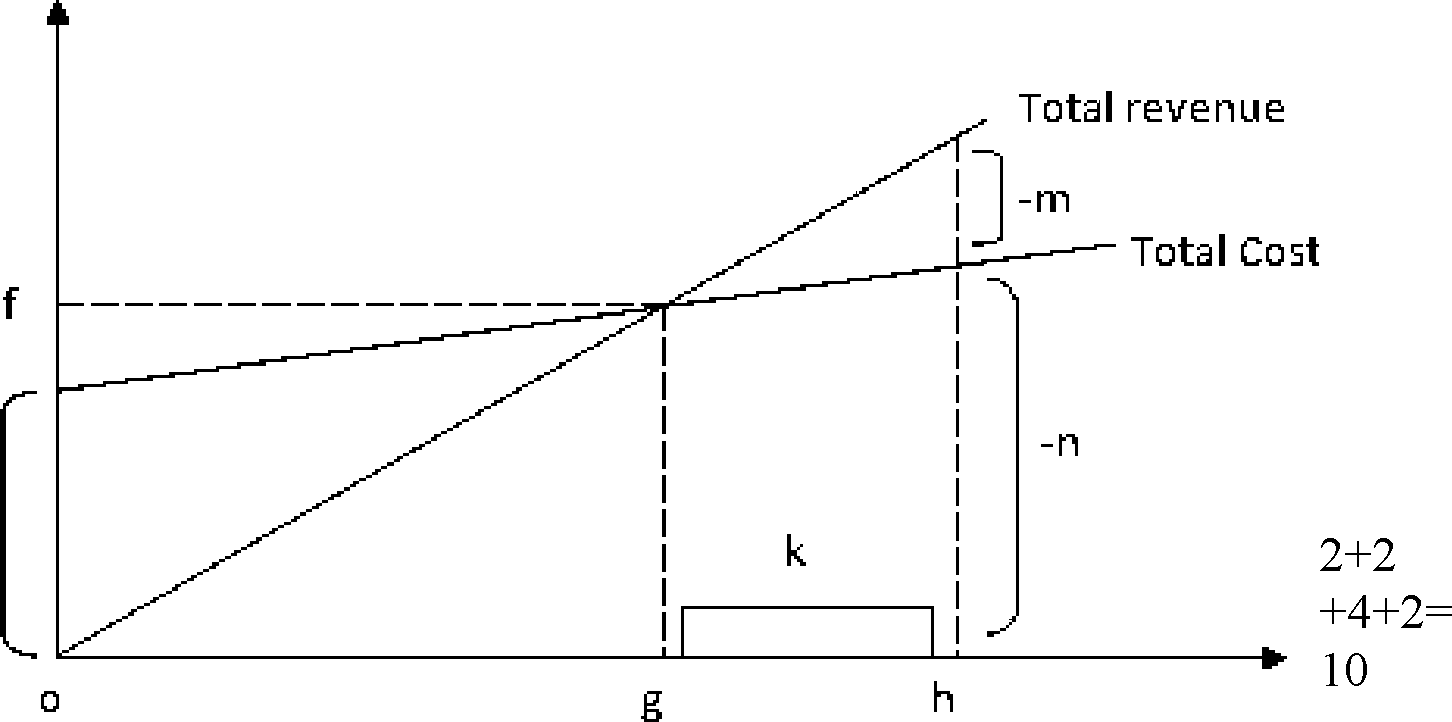

The Company expects to sell h units in the next accounting period.

(i) The margin of safety is shown on the diagram by

A B C D

km n p

(ii The effect of an increase in fixed costs, with all other costs and ) revenue remaining the same, will be.

A. . B . , C fD...

an increase in m an increase in k an increase in f a reduction in p

(iii) The following data relate to company, X Ltd. X Ltd. can choose from five mutually exclusive projects. The project will each last for one year only and their net cash inflows will be determined by the prevailing market conditions. The following annual cash inflows and their associated probabilities are shown below:

Market conditions Poor Good Excellent

|

Probability |

o 0 0 .0 .2 s. 0. R |

0.50 Rs.000 |

0.30 Rs.000 |

|

Project L |

500 |

470 |

550 |

|

Project M |

400 |

550 |

570 |

|

Project N |

450 |

400 |

475 |

|

Project O |

360 |

400 |

420 |

|

Project P |

600 |

500 |

425 |

Perfect information about the state of the market is also available for a price. The value of such information is

A B C D

A Nil B Rs.5,000 C Rs.26,000 D Rs.40,000

Show your working in support of your answer.

(iv CB Ltd. makes three components: S, T and U. The following costs ) have been recorded:

Component

S

unit cost Rs.

Component

T

unit cost Rs.

Component

U

unit cost Rs.

|

2.50 2.00 |

8.00 8.30 |

5.00 3.75 | ||

|

4.50 |

16.30 |

8.75 | ||

Another company has offered to supply the components to CB Ltd. at the following prices:

Variable cost Fixed cost Total cost

Price/unit Price/unit Price/unit

S T U

Rs.4.00 Rs.7.00 Rs.5.50

Which components, if any, should CB Ltd. consider buying in?

Do not buy any

C

Buy T only D Buy in S and U

2. A company absorbs fixed overhead in its production using a pre-determined machine hour rate.

In year 1, machine hours budgeted were 1,32,500 and the absorption rate for fixed production overheads was Rs.18.20 per machine hour. Overheads absorbed and incurred were Rs.24,42,440 and Rs.23,17,461 respectively. In year 2, machine hours were budgeted to be 5% higher than those actually worked in year 1. Budgeted and 6+6 actual fixed production overhead expenditure were Rs.26,20,926 and Rs.26,95,721 +4=16 respectively, and actual machine hours were 1,39,260.

Required:

(a) Analyse, in as much detail as possible, and (b) state the reasons for under-/over-absorption of fixed production overhead occurring in year 1 and 2, and (c) the change in absorption rate between the two years.

3. (a) Describe the role of the cost accountant in a manufacturing organization. 7

(b) Explain whether you agree with each of the following statements:

(i) All direct costs are variable 3

(ii) Variable costs are controllable and fixed costs are not. 3

..... Sank costs are irrelevant when providing decision making

(iii) information.

8+8=1

6

4. Distinguish between and provide an illustration of:

(a) avoidable and Unavoidable costs;

(b) cost centres and cost units.

5. (a) Miss travels to work by train to her 5-day week job. Instead of buying daily tickets she finds it cheaper to buy a quarterly season ticket which costs Rs.188 for 13 weeks.

MS, an acquaintance, who also makes the same journey, suggests that they both travel in Misss car and offers to give her Rs. 120 each quarter towards her car expenses. Except for weekend travelling and using it for local college attendance near her home on three evening each week to study for her CWA stage 3, the car remains in Misss garage.

Miss estimates that using her car for work would involve her, each quarter,

in the following expenses:

Rs.

Depreciation (proportion of annual figure) 200 Petrol and oil 128

Tyres and miscellaneous 52

You are required to state whether Miss would accept MSs offer and to draft a statement to show clearly the monetary effect of your conclusion.

(b) A company with a financial year 1 September to 31 August prepared a sales budget which resulted in the following cost structure:

% of sales

Direct materials 32

Direct wages 18

Production overhead: variable 6

fixed 24

Administrative & selling costs: Variable 3

fixed 7

8

Profit 10

After ten weeks, however, it became obvious that the sales budget was too optimistic and it has now been estimated that because of a reduction in sales volume, for the full year, sales will total Rs.25,60,000 which is only 80% of the previously budgeted figure.

You are required to present a statement showing the amended sales and cost structure in Rs. and percentages, in a marginal costing format.

6. Novice has overheard the following conversation whilst being measured for a suit: There are different costs for different purposes-you can classify costs in a number of ways.

8x2=1

6

Novice is baffled by this, and asks you for your opinion as a cost accountant. You are required to (a) suggest eight different bases under which cost may be classified, and for each basis, (b) suggest the different classifications of costs contained therein.

7. You are advising a cheese wholesaler who sells four main products through a large number of depots. The accounting system is weak and the directors have in the past had little reliable information about depot profitability.

You have assembled the data available for the last calendar year about depot profitability for all depots which reveals a wide disparity in depot results. Data for three depots with good profitability, and bad depots, together with other information which you have obtained, are set out below:

Comparative table of depot profitability for the year ended 31 December 2008.

|

Depot | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Sales are affected from depots by representatives to retail shops, malls, hotels, restaurants and other large and small outlets. It is a weekly trade and representatives are notified each week the minimum prices at which they can sell large orders of each product. Due to varying local market conditions, varying sizes of sales orders and the infrequency of some orders, representatives have opportunities to obtain better than minimum prices and are expected so to do.

Delivery charges are made for use of transport delivering from depots to customers either separately or in the selling prices charged; these charges are standard according to the vehicle used and the size of order. No discounts are given. Sales invoices are issued weekly.

Because of the large number of depots, the company has been unable as a routine to account in the costing and financial books for the movement of stocks into and out of depots. For this reason, supplies are charged to depots according to the sales of each week at prices which are designed to give depots a standard gross margin for all products on the minimum selling prices set.

Each depot is the responsibility of a manager and its operations include selling by representations, operation of the depots store, operation of a local transport fleet and an accounting and general office.

You are required:

(a) To specify, using the data given in the table, four indices or ratios which you

would use to rank the performance of the six depots

To suggest four reasons for the seeming failure fully to recover transport ( ) costs in all cases.

To specify three sales factors which you would consider critical in terms of ( ) weekly control of depot profitability by management, giving your reasons.

4x4=1

6

8. Write short notes on any four the following:

|

(a) |

Angle of incidence; |

|

(b) |

Principal budget factors and means of overcoming them; |

|

(c) |

Merits and demerits of ratio analysis; |

|

(d) |

Cash flow statement; |

|

(e) |

Value added activities; |

|

(f) |

Types of and need for variance analysis. |

|

Attachment: |

| Earning: Approval pending. |