Pre University Board 2009 ACCOUNTANCY (y ) in Pdf - Question Paper

ACCOUNTANCY paper is in Pdf format Below

Code No. 30

Total No. of Questions : 24 ] [ Total No. of Printed Pages : 16

June/July, 2009

( Kannada and English Versions )

Time : 3 Hours 15 Minutes ] [ Max. Marks : 100

( Kannada Version )

X>Ad)rt> /d)addi 0 Jo. 0ddo oXrt> :

8 x 2 = 16

1. aX dodo d d <o 0- do oXJrt>o

2. d odd> dd 0oddeo ?

cp

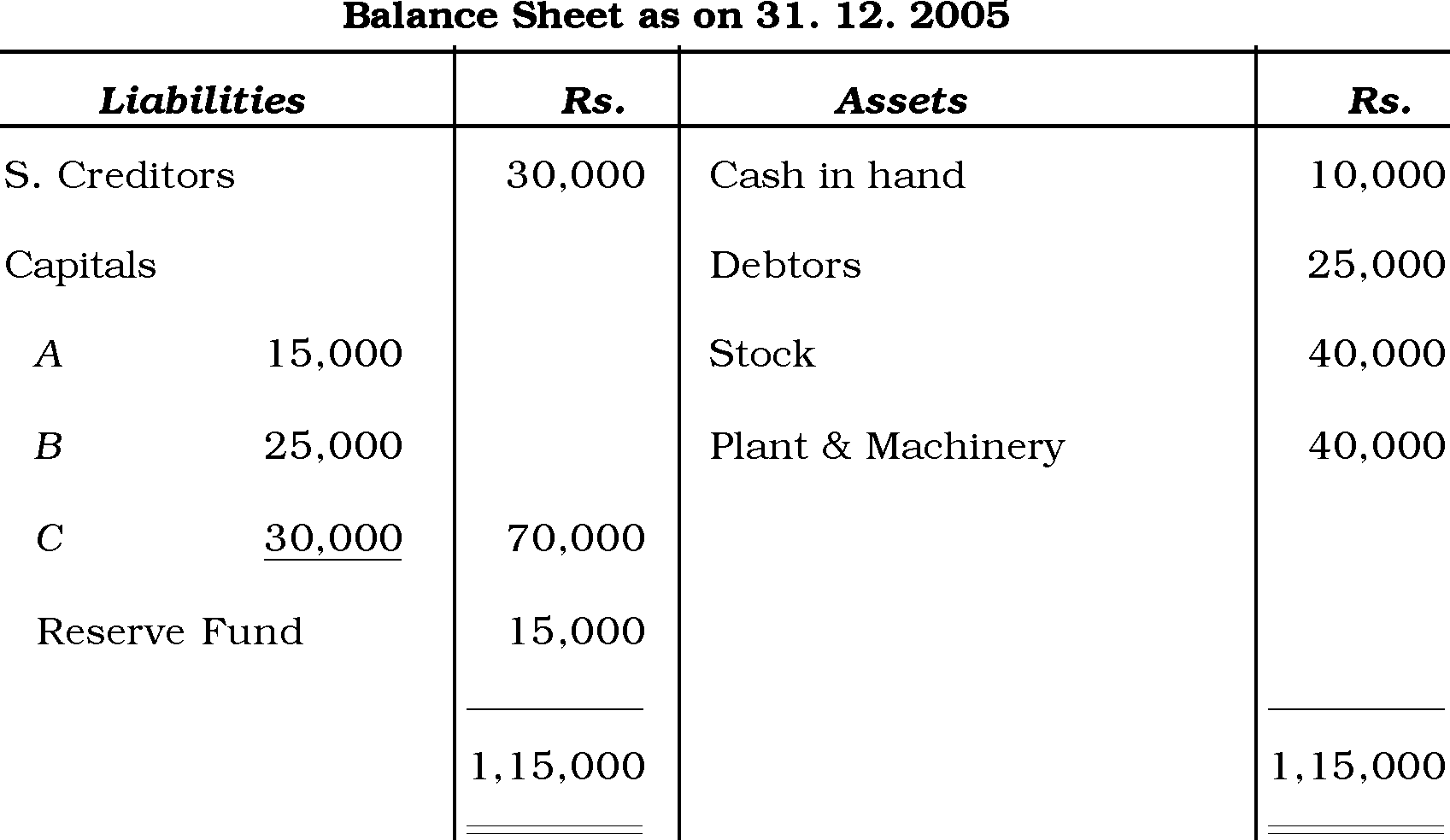

3. n$X dd/ra 0oddeo ?

4. doonoX ,o, <o d aesXoo XoOJo de&o n aes.

cp 1$ ct

5. o/o rt edort > dort d 0odde ? odo >d} Xs.

6. X> d)rt> Xodao dd d,XoY /d JOddd X>n Je0,0 ?

a) djdoX d

b) edo &,eoodj

7. , dXtf 0d do 5drart>o

8. wo-d z>J<o </d)d3dd) 0dd oX\rart>o

9. rt raSeXJ X@ d/dXo dbl

10. rt raSeXJ d 4,0 0oddeo ?

X>Ad)rt> </d)dd dodo drt$n Jo. d dn -d oXrt>o:

3 x 6 = 18

11. d,eraD odD ,o, <d , d ,oJ dertya.fi

Z/ cp co co7 o3 v

d,3 ort> d3,dod d&. 2,000 rt>o JrtdDXoadD d>&rX eX> 12

ZS ZS * co ct _o

d oJ 31. 12. 2008 X@ Xrtd ddrX@ dD ,oJ dertyA >d rad doe a <dd ,d,o da dd (dD XodDaDo.

oa cp co

12. odD onoX ,o, <dD ,de, ddoe doJ dDe dKDnddAdD, dd

Cp CO _0 CO

2 : 2 : 1 d djd/rad, O-jd0 dodDd, ddDeD ,o,poo ad dodDJ. ddoe ad) <dD oJd ,de doJ dDdedddD onoXo

_0 _0 _D

cdo ,dDA doX><o ,dD3d. ,de doJ dodeddd rt$X

* ct s *J 0 0

dd/rad XoDaDO.

13. A, B doJ C dKDTOddAdo O3$-j dd/d) 2:2:1 doJ d. a>oX 31. 12. 2005 X@ dd Bd d,X X>Xodod :

|

&}ndQirt>o |

d&. |

rt& |

d&. |

|

dan> |

30,000 |

x, n d |

10,000 |

|

UDn >o |

25,000 | ||

|

A 15,000 |

,dXDrt>o |

40,000 | |

|

B 25,000 |

d d doJ doJ, Cp o y |

40,000 | |

|

C 30,000 |

70,000 | ||

|

oe,<D aa |

15,000 | ||

|

1,15,000 |

1,15,000 |

a>oX 30. 06. 2006 d oD A ad oad. d d>d,>dart , ,eyddD :

CO CO

a) d odd>, oa ddrd d d,X(dDoJ.

b) d d De,D aa, oa ddrd d d,X(dDoJ.

c) d d c,, ad asoXdddrt, oa ddrd cdo wo.

d) d d Serdfi<,w, X>d 3o@ ddrrt> c>d ,d,o<dD dDdD ddrrt> noean ,d 0od don. X>d oa co@ ddrrt> c> :

2002 - d. 23,000 ; 2003 - d&. 20,000 ; 2004 - d. 19,000 ; dDJo 2005 - d. 18,000.

a doad d<Dnd dd,rodart ,,,ey3d Dj dJdo XodDaoo.

14. rod5, Xoa<bb d&. 100 bbn(b 1,000 6% aodDrt>bJ abrtd /ab.

ot

be X>Xoo XeXb :

a) Foart d&. 20

b) C}d be d&. 30

c) b bb ob Xdoart d&. 50.

0> a o dbrt >o on/Ab rab ,0/A d<b>bb.

CO CO <=i

de&b n rt>b CdO.

ot

15. rt raSeX X@ Qb 3bXrt>344 ?

e)rt - C

x>A)rt> /)d x4 p. a<b@ oxn>o:

4 X 14 = 56

16. &,b5rabb X bb b X, ), Xn>b dadb>. X>Xo

> C> CO o ct 0

/&3bo a>oX 31. 12. 2005 dob bbo )fd5f

.sdC ,bb </O :

6 cp 0 ot

|

01. 01. 2005 d&. |

31. 12. 2005 d&. | |

|

<boe Xdrartb |

20,000 |

20,000 |

|

&ede Xdrartb |

2,000 |

2,000 |

|

eid ydb |

10,000 |

10,000 |

|

Ubrt >d |

10,000 |

16,000 |

|

,CXd |

12,000 |

13,000 |

|

nb |

8,000 |

5,000 |

|

>rt> |

20,000 |

10,000 |

|

x& n > |

25,000 |

25,000 |

w r Cd d&. 3,800 n>b .daod ,,oX, >Xoadbd bb

co ct 6 ci u _o _o

d&. 1,200 bb>, dXbrtb, rt >b eAXoacbsd. < w

V t y _o _o co

fS d&. 5,000 rt>b bO ot.CX, ACd> d.

co ct t3 6 u -c

odXrt>o : a) wdo oro> be 2e. 5 do a XeXb

* CS>

b) Ubrt > be Xd d ,<X@ 2e. 10 be,b rtao

d) bort> be 2e. 5 bb &edeXdrart> be 2e. 10 ,X$ rtbO.

17. -3/ oo $e/ 3on3ddo o& da 2 : 1 d /radS 0 Xodo. S3oX 31. 12. 2008 do d X X>Aorf :

|

0531. 12. 2008 mSjX | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

Xo/dart X>A Xo3dort> oed 3on3OXrt e aed3oo.

a) 0 1 d rnrt d3X, d. 80,000 oo

4 * * u o

SeFoA d. 30,000 rt o deXo.

b) deFjio.b, ><o 3on3ddb oX, d<oo3 d.

6 ot $ _o

c) (oort> oed e. 10 -j ,X$ JrtoO.

d) &ede Xdra d&. 2,000 rtoO.

' o co

e) Xddo ,3< oe,o d. 2,400 -rj

f) rt> roSodo d. 4,400 Xe53fio. woOo > Jrto3>3.

* CO CO ot

18. dk. doto Aet3 d>on3da3Ado, dd 3 : 2 - dd/rad d3odo 0

& o co ZS co <=i

Xd do. sdoX 31. 12. 2006 d od dd dd d,X X>Aot d :

|

0531. 12. 2006 mSjX | ||||||||||||||||||||||||||||||||||||||||||||

|

doe a>oXdodo eddo d>onoX ,o, (doo ,rdo, .adedo

Cp ct CO 0

a) dtX4 dooart> d&. 7,500; ,TOdcb doto ,dXo d,X dd<do e. 10 -y Xado, <dootedXdra e. 5 dd drt, Xjd d. 12,000 X@ >X;o doto 3erdji,d dd dAd .

6 co

b) &ededXdra doto sXrt> dodo XdodA d&. 4,000 dot dk& doto Aets trtdoXoSd d. ,&f nor d&. 600. 0d ortrt

0 CO CO CO

d&d d/d dArf.

d wX ztrt>o doo.

6 t

19. aioX 01. 01. 2005 dodD d,aed DoJedXdradrfD d&. 30,000 X@ Xod. aioX 30. 06. 2007 X@ d>d Xod <DoJ,edXdrad d&. 10,000 d irtdD d&. 7,200 X, d/Odi. de adodD d. 8,000 X, d, <doJedXdradrfD

v co u ZJ t

noea d/adi. ,d> dezi ,dX$ dd d,yid di&rX e. 10 doJ ,dX$ >a&. 4

CO Cp

drrtrt (DoJedXdra ,dX$(D Z3Jrt>D Jeo.

20. X>A did d,X dDJ wD-d ziJ >1,0 elf X, >o don , oodjd :

|

_S30g 31. 12. 2007 - __ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

e0ujrtXrt& :

a) 2008 e d rd deyid dort d&. 6,000.

b) 2009 e d rd dDDortd ddacbd dort d. 2,000.

c) wtd ,id/Drt> dDe d&. 10,000 dDJ &ededXdrart> dDe d&. 1,000 ,dX$ JnDO.

d) dde dDCd oddieXO.

e) Xd leyid ,o> d. 3,600 dDJo d,j d d&. 600.

' -e t ti

i) WdiD dDJ dd ziJ

_o

21. aiod 31. 12. 2008 - doa a<ooJ, ,el d Ji> j

X>Aorf :

|

31. 12. 2008 - | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

eoujrtXrt& :

a) edo oro> oe e. 15 doJ dkdo&i oe,So.

ot

b) oe,o apn d&. 10,000 n>o

c) ,id oJo <ooJ, oe e. 10 ,d$ JrtoO.

' cp -0 V 0

d) d J oe e. 5 d oJ ,d$ Jrtoo.

e) 31. 12. 2008 X@ oo ,ddo 5<o@ d&. 12,000.

oJo ] ZiJ, aert ZiJ oJo "S

&Xoo artaJ J</0.

>J ot CO

0rfo Jo. do odrt>o :

2 X 5 = 10

22. doao ,xo /ooo J/o. (Jdoan /J)

23. da do iJvd oa-&oSrt>>rto J i<oid id,oid

O & ot,

ZiJ J/o.

24. X> jrt> o doio oJbo orta :

a) 3\J6. o

* e) 6 -e co

b) rtrad ooJaod od ra

c) d ortrt>o ddddo

co

d) axn> doe a

CS>

e) d J d dert d dddo

eo co

( English Version ) SECTION - A

Answer any eight questions, each carrying two marks. 8 x 2 = 16

1. State the two merits of single entry system.

2. What is fixed capital system ?

3. What is 'Benefit Ratio' ?

4. Give Journal Entry for Realisation Expenses paid on dissolution of firm.

5. What is issue of shares at a discount ? Give one example.

6. Under what heading are the following items shown in the company's Balance Sheet ?

a) Preliminary Expenses

b) Share Premium.

7. State any two causes of depreciation.

8. State any two features of Income and Expenditure Account.

9. Give the meaning of Computerised Accounting.

10. What is a file in computer ?

Answer any three questions, each carrying six marks. 3 x 6 = 18

11. Mr. Praveen, a partner in a firm withdrew Rs. 2,000 at the beginning of each month for his private use. Calculate interest on drawings of Praveen at 12% p.a. for the year ended 31-12-2008 under Average Period Method.

12. Suresh, Ramesh and Mahesh are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Ramesh retires from the firm. Suresh and Mahesh agrees to share the future profits equally.

Calculate the benefit ratio of partners.

A died on 30. 06. 2006. His executors should be entitled to :

13. A, B and C are partners sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet as on 31. 12. 2005 was as follows :

a) his capital on the date of last Balance Sheet.

b) his proportion of reserve on the date of last Balance Sheet

c) his proportion of profit to the date of death, on the basis of previous year's profit.

d) his share of goodwill is calculated on the basis of three years' purchase of average profits of the past four years.

The profit of the firm for the past four years were :

2002 - Rs. 23,000 ; 2003 - Rs. 20,000 ; 2004 - Rs. 19,000 and 2005 - Rs. 18,000.

You are required to ascertain the amount payable to the executors of the deceased partner.

14. Bharat Company issued 1,000 6% debentures of Rs. 100 each payable as under :

a.) on application Rs. 20

b) on allotment Rs. 30

c) on first and final calls Rs. 50.

All the debentures were subscribed and amounts were duly received.

Pass necessary Journal Entries.

15. What are the advantages of computerised accounting ?

Answer any four from the following questions, each carrying fourteen marks : 4 x 14 = 56

16. Priyadarshini keeps her books on single entry system. From the following information, prepare a Statement of profits or losses for the year ended 31-12-2005 and a Revised Statement of Affairs as on that date :

|

Particulars |

01. 01. 2005 Rs. |

31. 12. 2005 Rs. |

|

Machinery |

20,000 |

20,000 |

|

Furniture |

2,000 |

2,000 |

|

Motor car |

10,000 |

10,000 |

|

Debtors |

10,000 |

16,000 |

|

Stock |

12,000 |

13,000 |

|

Cash |

8,000 |

5,000 |

|

Creditors |

20,000 |

10,000 |

|

Buildings |

25,000 |

25,000 |

During the year, she has withdrawn Rs. 3,800 for personal use and used goods valued Rs. 1,200 for domestic purpose. She had also introduced Rs. 5,000 as additional capital during the year.

Adjustments :

a) Provide 5% interest on opening capital

b) Reserve 10% on debtors for Bad debts

c) Outstanding salaries Rs. 300

d) Depreciate Machinery by 5% and Furniture by 10%.

17. Rama and Bheema are partners sharing profits and losses in the ratio of

2 : 1. Their Balance Sheet as on 31. 12. 2008 was as follows :

|

Balance Sheet as on 31. 12. 2008 | ||||||||||||||||||||||||||||||||||||||||

|

Kumar is admitted into partnership on the following terms :

a.) He should bring Rs. 80,000 as capital for 4 share and Rs. 30,000 towards goodwill.

b) Goodwill is withdrawn by the old partners

c) Machinery is depreciated by 10%

d) Furniture is written down by Rs. 2,000

e) Increase R.B.D. by Rs. 2,400

f) An amount of Rs. 4,400 due to a creditor is not likely to be claimed and hence to be written off.

Prepare :

i) Revaluation Account

ii) Partners Capital Account

iii) New Balance Sheet.

18. Rashmi and Geetha are partners sharing profits and losses in the ratio of

3 : 2. Their Balance Sheet as on 31-12-2006 is as follows :

|

Balance Sheet as on 31. 12. 2006 | ||||||||||||||||||||||||||||||||||||||||||||

|

On the above date the firm was dissolved and the assets were realised as follows :

a) Bills Receivable Rs. 7,500, Sundry Debtors and Stock 10% less than the book value ; value of the Machinery is to be increased @5%. Buildings realised Rs. 12,000. Goodwill is considered worthless.

b) Furniture and investments were taken over by Rashmi and Geetha @ Rs. 4,000 each respectively. Dissolution expenses were Rs. 600. All the liabilities were discharged in full.

Show the necessary Ledger Accounts.

19. On 01-01-2005 Mr. Pradeep purchased Machinery for Rs. 30,000. On 30-06-2007 he sold a part of the machinery costing Rs. 10,000 for Rs. 7,200. On the same day he bought new machinery for Rs. 8,000. Every year depreciation was charged at 10% per annum on Straight Line Method.

Show the Machinery Account and Depreciation Account for four years.

20. Following is the Balance Sheet and Receipts and Payments Account of Bellary Sports Club, Bellary.

Balance Sheet as on 31. 12. 2007

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Outstanding Salary |

4,000 |

Cash Balance |

14,600 |

|

Capital Fund |

65,000 |

Outstanding Subscriptions |

2,400 |

|

Sports Materials |

32,000 | ||

|

Furniture |

20,000 | ||

|

69,000 |

69,000 |

|

Receipts and Payments Account for the year ended 31. 12. 2008 | ||||||||||||||||||||||||||||||||||||||||

|

Adjustments :

a) Subscriptions outstanding for the year 2008 - Rs. 6,000

b) Subscriptions received in advance for the year 2009 - Rs. 2,000

c) Depreciate Sports Materials by Rs. 10,000 and Furniture by Rs. 1,000

d) Capitalise Entrance fees

e) Outstanding salaries Rs. 3,600 and lighting charges Rs. 600.

Prepare :

i) Income and Expenditure Account

ii) Balance Sheet as on 31. 12. 2008.

|

Trial Balance as on 31. 12. 2008 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Adjustments : |

a) Dividend at 15% on Share capital is to be provided

b) Transfer Rs. 10,000 to Reserve fund

c) Depreciate Plant and Machinery at 10%

d) Provide depreciation on Buildings at 5%

e) Stock on 31-12-2008 was valued at Rs. 12,000.

Prepare Trading, Profit and Loss Account, Profit and Loss Appropriation Account and Balance Sheet in the prescribed form.

SECTION - D ( Practical Oriented Questions )

Answer any two of the following questions. Each question carries five marks : 2 x 5 = 10

22. Prepare a proforma of a company Balance Sheet (with heads only).

23. Prepare Executor's Account with at least five imaginary figures.

24. Classify the following receipts into revenue and capitals :

a.) Legacies received

b) Sale proceeds of computers

c) Subscription received

d) Interest on investments

e) Building donations received.

}JlFdbioX Z3

ii) ooTOdd oro> zaJrto

iii) ($ 3 X

|

Attachment: |

| Earning: Approval pending. |