Institute of Actuaries of India 2006 CT5 Contingencies Core Technical - Question Paper

Faculty of Actuaries Institute of Actuaries

12 September 2006 (pm)

Subject CT5 Contingencies Core Technical

Time allowed: Three hours INSTRUCTIONS TO THE CANDIDATE

1. Enter all the candidate and examination details as requested on the front of your answer booklet.

2. You must not start writing your answers in the booklet until instructed to do so by the supervisor.

3. Mark allocations are shown in brackets.

4. Attempt all 12 questions, beginning your answer to each question on a separate sheet.

5. Candidates should show calculations where this is appropriate.

Graph paper is not required for this paper.

A T THE END OF THE EXAMINA TION

Hand in BOTH your answer booklet, with any additional sheets firmly attached, and this question paper.

In addition to this paper you should have available the 2002 edition of the Formulae and Tables and your own electronic calculator.

1 In a certain country, pension funds always provide pensions to retiring employees. At the point of retirement, the fund can choose to buy an annuity from a life insurance company, or pay the pension directly themselves on an ongoing basis.

A mortality study of pensioners has established that the experience of those whose pension is received through annuities paid by insurance companies is lighter than the experience of those being paid directly by pension funds.

Explain why the mortality experiences of the two groups differ. Your answer should include reference to some form of selection. [4]

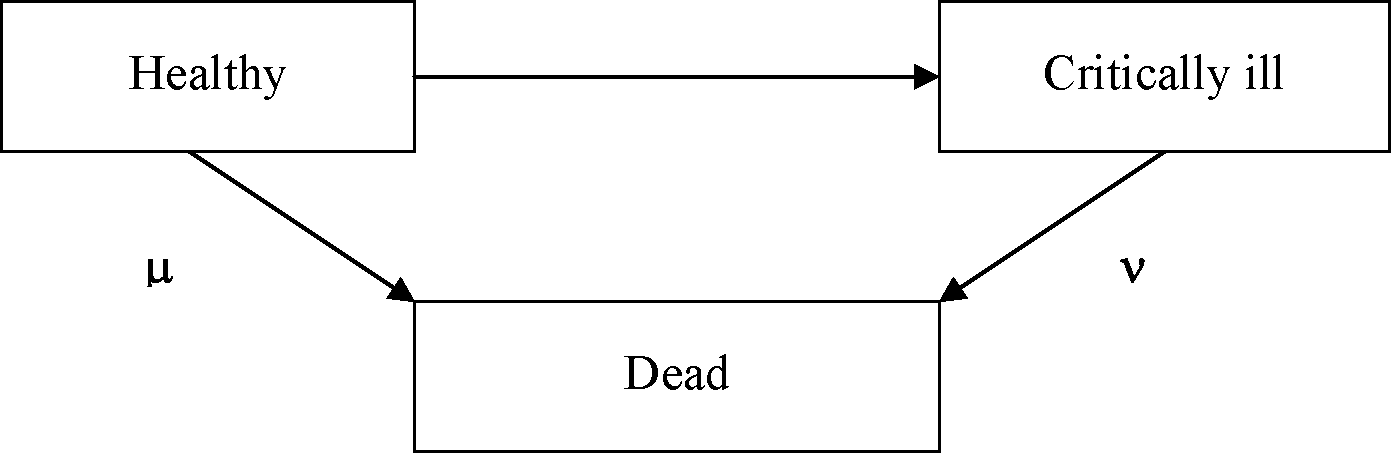

2 A life insurance company uses the following three-state continuous-time Markov model, with constant forces of transition, to price its stand-alone critical illness policies:

Under these policies, a lump sum benefit is payable on the occasion that a life becomes critically ill during a specified policy term. No other benefits are payable.

A 20-year policy with sum assured 200,000 is issued to a healthy life aged 40 exact.

(i) Write down a formula, in integral terms, for the expected present value of benefits under this policy. [2]

(ii) Calculate the expected present value at outset for this policy.

Basis:

a:

v:

Interest:

0.01

0.02

3H

8% per annum

[3]

[Total 5]

3 Calculate the exact value of 4 assuming the force of mortality is constant between consecutive integer ages.

Basis: Mortality: ELT15 (Males)

Interest: 7.5% per annum

4 A life insurance company issues a reversionary annuity contract. Under the contract an annuity of 20,000 per annum is payable monthly for life, to a female life now aged 60 exact, on the death of a male life now aged 65 exact. Annuity payments are always on monthly anniversaries of the date of issue of the contract.

Premiums are to be paid monthly until the annuity commences or the risk ceases.

Calculate the monthly premium required for the contract.

Basis: Mortality: PFA92C20 for the female PMA92C20 for the male Interest: 4% per annum Expenses: 5% of each premium payment 1.5% of each annuity payment

5 Tx and Ty are the complete future lifetimes of two lives aged x and y respectively: Let the random variable g(T) take the following values

aT if Tx Ty aT if Tx>Ty

g(T) =

Describe the benefit which has present value equal to g(T). Express E[g(T)] as an integral.

(i)

(ii)

(iii)

[2]

[2]

Write down an expression for the variance of g(T) using assurance functions.

[2]

[Total 6]

6 A member of a pension scheme is aged 55 exact, and joined the scheme at age 35 exact. She earned a salary of 40,000 in the 12 months preceding the scheme valuation date.

The scheme provides a pension on retirement for any reason of 1/80th of final pensionable salary for each year of service, with fractions counting proportionately. Final pensionable salary is defined as the average salary over the three years prior to retirement.

Using the functions and symbols defined in, and assumptions underlying, the Example Pension Scheme Table in the Actuarial Tables:

(i) Calculate the expected present value now of this members total pension. [4]

(ii) Calculate the contribution rate required, as a percentage of salary, to fund the future service element of the pension. [2]

[Total 6]

7 The following data relate to a certain country and its biggest province:

|

Country Province | ||||||||||||||||||||||||

|

The population figures are from a mid-year census along with the deaths that occurred in that year.

There were 25,344 deaths in the province in total.

Calculate the Area Comparability Factor and a standardised mortality rate for the province. [6]

8 A pure endowment policy for a term of n years payable by single premium is issued to lives aged x at entry.

(i) Derive Thieles differential equation for tV, the reserve for this policy at time t (0 < t < n). [5]

(ii) Explain the effect of each term in your answer in (i). [2]

(iii) State the boundary condition needed to solve the equation in (i). [2]

[Total 9]

9 A life insurance company issues a 3-year unit-linked endowment assurance contract to a female life aged 60 exact under which level premiums of 5,000 per annum are payable in advance. In the first year, 85% of the premium is allocated to units and 104% in the second and third years. The units are subject to a bid-offer spread of 5% and an annual management charge of 0.75% of the bid value of the units is deducted at the end of each year.

If the policyholder dies during the term of the policy, the death benefit of 20,000 or the bid value of the units after the deduction of the management charge, whichever is higher, is payable at the end of the year of death. On survival to the end of the term, the bid value of the units is payable.

The company holds unit reserves equal to the full bid value of the units but does not set up non-unit reserves.

It uses the following assumptions in carrying out profit tests of this contract:

|

Mortality: Surrenders: Expenses: Initial: Renewal: Unit fund growth rate: Non-unit fund interest rate: Risk discount rate: |

AM92 Ultimate None 600 100 at the start of each of the second and third policy years 6% per annum 4% per annum 10% per annum |

(i) Calculate the expected net present value of the profit on this contract. [10]

(ii) State, with a reason, what the effect would be on the profit if the insurance company did hold non-unit reserves to zeroise negative cashflows, assuming it used a discount rate of 4% per annum for calculating those reserves. (You do not need to perform any further calculations.) [2]

[Total 12]

10 A life insurance company is reviewing the 2005 mortality experience of its portfolio of whole life assurances.

You are given the following information:

Age exact on Sum assured in force Reserves at 31 Dec 2005 of policies 1 Jan 2005 on 1 Jan 2005 in force on 31 Dec 2005

69 500,000 175,000

70 400,000 150,000

There were 2 death claims during 2005 arising from these policies as follows:

Date of issue of Age exact at issue of Sum assured policy policy

1 Jan 1980 45 12,000

1 Jan 1982 46 10,000

All premiums are payable annually on 1st January throughout life.

Sums assured are payable at the end of the year of death.

Net premium reserves are held, based on mortality of AM92 Ultimate and interest of 4% per annum.

(i) Calculate the mortality profit or loss for 2005 in respect of this group of policies. [8]

(ii) (a) Calculate the amount of expected death claims for 2005 and compare it

with the amount of actual claims.

(b) Suggest a reason for this result compared with that obtained in (i).

[4]

[Total 12]

11 A life insurance company issues identical deferred annuities to each of 100 women aged 63 exact. The benefit is 5,000 per annum payable continuously from a womans 65th birthday, if still alive at that time, and for life thereafter.

(i) Write down an expression for the random variable for the present value of future benefits for one policy at outset. [3]

(ii) Calculate the total expected present value at outset of these annuities.

Basis: Mortality: PFA92C20

Interest: 4% per annum [2]

(iii) Calculate the total variance of the present value at outset of these annuities, using the same basis as in part (ii). [8]

[Total 13]

12 A life insurance company issues a 10-year decreasing term assurance to a man aged 50 exact. The death benefit is 100,000 in the first year, 90,000 in the 2nd year, and decreases by 10,000 each year so that the benefit in the 10th year is 10,000. The death benefit is payable at the end of the year of death.

Level premiums are payable annually in advance for the term of the policy, ceasing on earlier death.

(i) Calculate the annual premium.

Basis:

6% per annum AM92 Select

Interest:

Mortality:

Initial expenses:

Renewal expenses:

Claim expenses: Inflation:

200 and 25% of the total annual premium (all incurred on policy commencement)

2% of each premium from the start of the 2nd policy year and 50 per annum, inflating at 1.923% per annum, at the start of the second and subsequent policy years 200 inflating at 1.923% per annum For renewal and claim expenses, the amounts quoted are at outset, and the increases due to inflation start immediately. [8]

Write down an expression for the gross future loss random variable at the end of the ninth year, using whatever elements of the basis in (i) that are relevant.

(ii)

(iii)

(iv)

[3]

Calculate the gross premium reserve at the end of the ninth year, using the premium basis. [3]

Comment on any unusual aspect of your answer.

[2]

[Total 16]

CT5 S20067

|

Attachment: |

| Earning: Approval pending. |