Institute of Actuaries of India 2009 CT-4 Models Core Technical ( ) - exam paper

INSTITUTE OF ACTUARIES OF INDIA

EXAMINATIONS 20th May 2009 Subject CT4 - Models

Time allowed: Three Hours (10.00 - 13.00 Hrs)

Total Marks: 100

INSTRUCTIONS TO THE CANDIDATES

1. Please read the instructions on the front page of answer booklet and instructions to examinees sent along with hall ticket carefully and follow without exception

2. Mark allocations are shown in brackets.

3. Attempt all questions, beginning your answer to each question on a separate sheet. However, answers to objective type questions could be written on the same sheet.

4. In addition to this paper you will be provided with graph paper, if required.

AT THE END OF THE EXAMINATION Please return your answer book and this question paper to the supervisor separately.

Q 1) List three advantages of the two-state model over the Binomial model for the estimation of transition intensities in a case where exact dates of entry into and exit from observation are known. [3]

Q 2) (i) State the age ranges over which Gompertz Law is an appropriate model for human

mortality. (1)

(ii) Show that, under Gompertz Law, the probability of survival from age x to age x + t is equal to:

c x ( c t - 1 )

t x

Where g is defined as log g = -B/log c (3)

[4]

Q 3) You have been asked to investigate whether the rate of surrender of policies of an insurance company varies with their duration of the policy.

The companys records show:

- the policy issue date

- the calendar year in which policy is surrendered

- policy maturity date

- date of exit, in case of exits due to any other reasons

In the context of this investigation consider the following types of censoring

a. Left censoring

b. Right censoring

c. Interval censoring

d. Informative censoring

For each type of censoring above;

- Describe the feature of censoring

- State whether or not that type of censoring is present in these data

- If that particular type of censoring is present, explain how it arises

Q 4) a) How would you describe a stochastic model? Give two advantage of stochastic

model over deterministic model. (3)

b) A Markov jump process has transition probabilities given bypy (t).

(i) Set out the formula for the transition rates aij (t) in terms of the transition probability py (t). Clearly state any assumptions that you make. (2)

(ii) Show that the sum of transition rates out of any state is zero. (3)

[8]

Q 5) An operational researcher is analyzing switching of market share between two products. She knows that in period 1 the market shares for the two products were 55% and 45% but that in period 2 the corresponding market shares were 67% and 33% and in period 3, 70% and 30%. The researcher believes that an accurate representation of the market share in any period can be obtained using Markov processes. Assuming her belief is correct:

a) Estimate the transition matrix of how the buyers switch buying preference. (5)

b) Calculate the market shares in period 4 using the estimated transition matrix. (2)

c) If the actual market shares for period 4 were 71% and 29% would you revise your estimate of the transition matrix? Give reasons for your decision. (1)

[8]

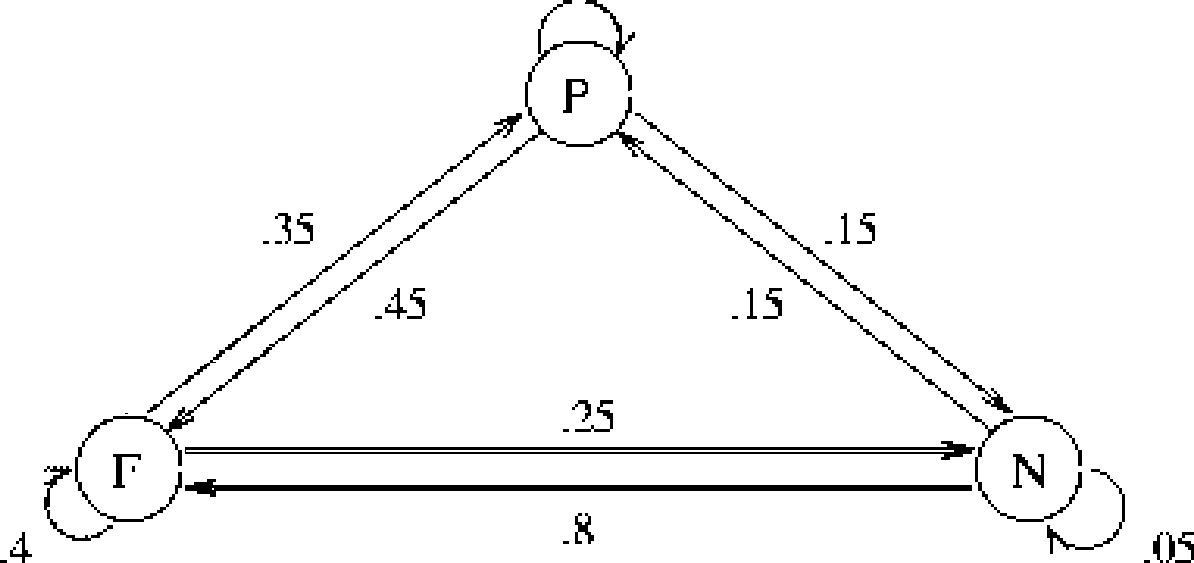

Q 6) A math teacher, who does not want to be predictable, decided to assign homework based on probabilities. On the first day of class, she drew this picture on the board to tell the students whether to expect a full assignment (F), a partial assignment (P) or no assignment (N), the next day. The probability of getting full, partial or no assignment tomorrow also depends upon the type of assignment given today. The children go to school only 5 days a week from Monday to Friday.

a) Construct the transition matrix that corresponds to this drawing. (1)

|

.4 |

|

b) Today is Wednesday and students have a partial assignment. Calculate the probability that they will have no homework on Friday? (2)

c) Calculate up to two decimal places, the matrix to which it would appear converged

after many days. (3)

d) Explain the meaning of your solution to problem c. above.

(2)

[8]

Q 7) An investigation into the risk factors associated with mortality from breast cancer among women was undertaken. The purpose of the investigation was to establish whether a new treatment was effective in prolonging survival. Two groups of patients were identified. One group was given the new treatment and the other was given the existing treatment. Other factors taken into consideration were the patients general state of health at time of diagnosis (recorded as able to care for self or unable to care for self), and the type of tumor (recorded as Inflammatory, Ductal, Lobular or Invasive).

A Cox proportional hazards model of the hazard of death was estimated. The table below shows an extract from the results.

|

Covariaie |

Parameter |

Standard error |

|

General state of health at time of diagnosis | ||

|

Able to care for self |

-0.6 |

0.05 |

|

Unable to care for self |

0 | |

|

Treatment | ||

|

New |

-0.2 |

0.15 |

|

Existing |

0 | |

|

Type of tumour | ||

|

Inflammatory |

0 | |

|

Ductal |

-0.4 |

0.3 |

|

Lobular |

0.35 |

0.2 |

|

Invasive |

0.45 |

0.25 |

(i) Defining all the terms you use, write down a general expression for the Cox proportional hazards model in terms of a set of covariates, their associated parameters and a baseline hazard function. (2)

(ii) In the context of the investigation described above, state the class of women to which the baseline hazard refers. (2)

(iii) Compare the new treatment with the previous one. Does it improve the chances of survival, make them worse, or is it not possible to say? Justify your answer.

(iv) Calculate the proportion by which the risk of death for women with Invasive type tumors who were able to care for themselves at the time of diagnosis is greater than that for women with inflammatory type tumors who were unable to care for themselves at the time of diagnosis.

|

A new life insurance company in a developing country has investigated the recent mortality experience of its male annuitants. The following is an extract from the results. | ||||||||||||||||||||||||||||||||

|

# as per the standard table

(i) Use the Chi-square goodness of fit test to compare this experience with the standard table. This was the mortality basis used to determine the price of these annuities. State the null hypothesis you are testing and comment on the results of your test including any aspect which chi square test failed to detect.

(7)

(1)

(ii) Comment on the financial impact on the company if it continues to sell these annuities with an unchanged mortality basis.

(iii)State how your test in (i) would vary if you were to test graduated mortality

o

rates for adherence to the above data. The graduated rates, by fitting the relationship

were determined

o s

qx =(a+bx)qx

where qx are rates from standard table. No further calculation is required.

(2)

(iv)Explain why the crude rates will require graduation, and suggest with reasons an appropriate method of graduation in the above case.

Q 9) Three actuarial students have each conducted their own investigations into the mortality of a certain group of lives. Each student has used a different definition to group the deaths and each has calculated the exposed-to-risk in a manner appropriate to his grouping of deaths.

The various definitions by which the deaths and the exposed to risks have been tabulated by the students are summarized in the tables below, together with the data values for x=50.

|

Grouping of deaths | ||||||||||||

|

|

Exposed-to-risk | ||||||||||||

|

(i) State which definition for tabulating deaths corresponds with which definition for exposed to risk. ( . )

(ii) In each case, state the type of rate interval implied by the data pairing. (3)

(iii)Use each students data for x=50, i.e. each pairing of d50 and exposed-to-risk

0 0

data and calculate q50+f and m50+f (3)

(iv)In each case, give the age 50+f for which q50+f estimates of q50+f is

applicable explaining any assumptions you make in evaluating f. (4.5)

[12]

An insurance company offers a no claims discount system of 10% for each claim free year up to a maximum of 50%. A customer initially has no discount. For each year the customer does not make a claim, 10% is added to the discount, unless the discount is already 50% in which case there is no change. If the customer does make a claim then the discount is reduced to 0%. Suppose that the probability of a given customer making a claim in any year is p, and is independent of whether a claim is made in any other year.

a) Explain how to model the level of discount as a Markov chain. (2)

c) Calculate the probability that the customers discount level in year 4 is 20% given

that he is at 0% discount level currently i.e. in year 0. (4)

d) Calculate the probability that the customers discount level in year 16 is 0%. (4)

[13]

c) Suppose that Nt is a Poisson process with rate X. Show that

( n\

V r J

d) Suppose that Nt is a Poisson process with rate X, and that Xk are independent, identically distributed random variables with mean m and variance s2

Let

Nt

Yt = X Xk

k=1

Find E(Yt) and Var (Yt). (3)

[13]

Page 7 of 7

|

Attachment: |

| Earning: Approval pending. |