Institute of Actuaries of India 2009 CT-8 Financial Economics Core Technical ( ) - Question Paper

INSTITUTE OF ACTUARIES OF INDIA

EXAMINATIONS 25th May 2009 Subject CT8 - Financial Economics

Time allowed: Three Hours (14.30 - 17.30 Hrs) Total Marks: 100 INSTRUCTIONS TO THE CANDIDATES

1) Please read the instructions on the front page of answer booklet and instructions to examinees sent along with hall ticket carefully and follow without exception

2) Mark allocations are shown in brackets.

3) Attempt all questions, beginning your answer to each question on a separate sheet. However, answers to objective type questions could be written on the same sheet.

Q 1) (a) Explain the difference between an efficient market and an arbitrage-free

INSTITUTE OF ACTUARIES OF INDIA

market. (2)

(b) Outline the claim of excessive volatility in stock markets made by Shiller,

INSTITUTE OF ACTUARIES OF INDIA

[5]

Q 2) (a) You manage a risky portfolio with an expected rate of return of 20% and a standard deviation of 25%. A passive portfolio, that is one invested in a risky portfolio that mimics the BSE-Sensitive stock index, yields an expected rate of return of 15% with a standard deviation of 20%. The risk-free rate of return is 5%.

(i) Your client chooses to invest 60% of a portfolio in your fund and 40% in a risk-free asset. What is the expected value and standard deviation of the rate of return on his portfolio? (1)

(ii) Your client ponders whether to switch the 60% that is invested in your fund to the passive portfolio. Explain to him the disadvantage of the switch. Show him the maximum fee you could charge (as a percentage of the investment in your fund, deducted at the end of the year) that would leave him at least as well off investing in your fund as in the passive one. (6)

(b) VaR is frequently calculated assuming a normal distribution of returns. State

INSTITUTE OF ACTUARIES OF INDIA

an advantage and a disadvantage of this approach (1)

(c) Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows:

|

Expected Return |

Standard Deviation | |

|

Stock A |

9% |

18% |

|

Stock B |

8% |

15% |

The correlation between the stock returns is -1

Suppose it is possible to borrow at the risk-free rate. What must be the value

Q 3) Suppose that the index model for two stocks, ACC and Wipro, is estimated with the following results:

Racc = 2.20% + 1.20 Rm + eACC

RWipro 2.

80% + 1.30 Rm + eWipro gm = 22%; oacc = 31.55%; OWipro = 31.98%

Where,

Racc is the return on ACC stock

Rwipro is the return on Wipro stock

Rm is the return on the market

gm is the standard deviation of market return

oACC is the standard deviation of return on ACC

GWipro is the standard deviation of return on Wipro

eACC is the random variable representing the component of Racc not related to the market

eWipro is the random variable representing the component of RWipro not related to the market

a. If rf were constant at 5%, are the intercepts of the two regressions consistent with the CAPM? Interpret their values. (2)

b. For which stock does market movement explain a greater fraction of

INSTITUTE OF ACTUARIES OF INDIA

return variability? (1)

c. What are the covariance and correlation coefficient between the two

INSTITUTE OF ACTUARIES OF INDIA

stocks? (1)

d. You form a portfolio P with investment proportion of 0.40 in ACC and

0.60 in Wipro.

(i) What is the standard deviation of portfolio P? (2)

(ii) Break down the variance of portfolio P into systematic and

INSTITUTE OF ACTUARIES OF INDIA

firm specific components. (2)

(iii) What is the covariance between the portfolio P and the market

INSTITUTE OF ACTUARIES OF INDIA

index? (1)

e. Now you form a portfolio Q with investment proportion of 0.40 in P, 0.50 in the market index and 0.10 in T-bills.

(i) What is the standard deviation of portfolio Q? (2)

(ii) Break down the variance of portfolio Q into systematic and

Q 4) A market consists of three securities A, B and C with capitalizations of Rs. 220 crores, Rs. 330 crores and Rs. 220 crores respectively. Annual returns on the three shares (Ra, Rb and Rc) have the following characteristics:

Asset Standard deviation A 40%

B 20%

C 10%

The expected rate of return on the market portfolio is 22.86% p.a.

The correlation between the returns on each pair of distinct securities is 0.5.

The risk-free rate of return is 3.077% p.a. No adjustments to an investors portfolio are possible within the year.

(a) Calculate the expected returns on assets A, B and C if the CAPM is assumed

to hold. (7)

(b) The assets earn rates of return as follows in each of the three possible states of the world:

State Probability Asset A Asset B Asset C

1 0.2 40% 20% 10%

2 0.3 20% 5% 20%

3 0.5 10% 10% 7%

Determine the market price of risk assuming CAPM holds. (3)

(c) Explain what happens to the systematic and specific risk of a portfolio when it

[11]

Q 5) (a) Give reasons why continuous-time lognormal model may be inappropriate for

modeling investment returns. (3)

(b) Distinguish between the lognormal model of security prices and the Wilkie

[5]

Q 6) The process for the stock price is described by the following equation

dSt = juStdt + aStdZt

Where |i, o are constants and Zt is a standard Brownian motion process. Explain carefully the difference between this model and each of the following:

dSt = jndt + odZt dSt = juStdt + odZt dSt = jndt + crStdZt dSt = LiStdt + aStdZt

Why is the model a more appropriate model

of stock price behavior than any of these three alternatives?

Q 7) (a) The share price of a non-dividend-paying company was Rs. 2,000 on a given

day. The share price is expected to grow at 15% p.a. The current risk free rate (continuously compounding) is 10% p.a. What should be the price for a 1 year forward contract on 1 share of the company?

(b) XYZ Life Insurance Co sells a single premium unit-linked product where the benefit payable on maturity is the higher of the fund value and the single premium. The premiums are invested in a fund that is invested 100% in equities. The company levies a charge for providing this guarantee. How would the following affect the charge?

(i) Term of the contract

(ii) Prevalent interest rates (2)

(c) Derive the lower bound on the price of a European call option on a nondividend-paying share. (3)

(d)

i) Use a 2-step binomial tree to calculate the price of a European put option on a non-dividend-paying share. The following parameters are given:

Current Share price: 50 Strike price: 55

Risk free rate: 10% p.a. (continuously compounding)

Time to maturity: 2 months

Upward or downward move over a month: 10%

Probability of upward move over a month: 25% (3)

ii) Recalculate the price of the option if it were an American option (2)

Q 8) A fund manager has shares of ABC Ltd, a non-dividend-paying share, in its portfolio. The shares are currently trading at Rs 1,000 and the fund manager wants to protect the portfolio from a fall in the price of ABC Ltd for the next 1 year. He decided to buy at-the-money European put options to hedge the risk.

[11]

i) Calculate the price of the put option on each share, given the following: Continuously compounding risk free rate = 8% p.a.

Volatility of the share = 35%

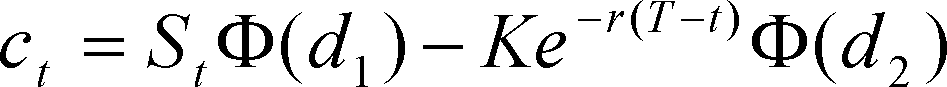

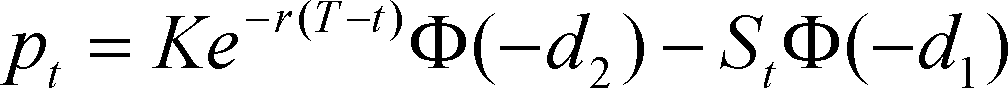

The Black-Scholes formula for a call and put option on a non-dividend paying security is

S r2

ln(-f) + (r +~ )(T -1)

K_2_

rV T -1

dj -rVT -1

d 1

where

d 2

and St = current price g = volatility T - t = time to expiry K = strike price

(4)

(4)

(2)

(2)

[12]

r = risk free rate (continuously compounding)

ii) The fund manager thinks that he can fund the premium for the put option by going short on European call options on ABC Ltd. Calculate the strike price of the call option (with a reasonable degree of accuracy) such that the premium of the put option can be funded by selling the call options.

iii) What are the implications of selling the call options?

iv) What is the delta of the portfolio comprising the underlying shares, the put options and the call options?

i) State the martingale representation theorem. (2)

Q 9)

ii) Define a replicating portfolio. (1)

V = e -(T-t)E [X\F ]

iii) It is proposed that t Q t is the fair price at time t for a

derivative with a random payoff X at time T. The derivative is based on an

B = ert

underlying share with value St, t >= 0. Let t denote the value at time t of a simple cash process. In this formula, Q is the risk neutral probability

measure. LetDt = e St. Show that Dt is a martingale under Q. (3)

INSTITUTE OF ACTUARIES OF INDIA

[6]

(a) The following is a list of zero rates (with continuous compounding) for zero coupon bonds of various maturities.

Q 10)

|

Maturity (Years) |

Zero Rates |

|

1 |

10% |

|

2 |

11% |

|

3 |

12% |

|

4 |

13% |

In addition to the zero coupon bonds, investors may also purchase a two-year maturity coupon bond, paying coupons once per year with a coupon rate of 10%. The face value of the coupon bond is Rs. 1000.

IAI_CT8 0509

(i) What are the forward rates for the second, third and the fourth years? (3)

(ii) At what price will the coupon bond sell for today? (2)

(iii) If you forecast that the yield curve in one year will be flat at 12%, what is your forecast for the expected rate of return on the coupon

bond for the 1-year holding period? (3)

(b) You have been asked to calibrate a Vasicek model and the following information is provided:

The short rate = 8.5%, the prices of a 1-year and 2-year zero coupon bonds with face value of Rs. 100 are Rs. 91.7245 and Rs. 84.0245.

Assume that the speed of mean reversion (a) = 0.25.

The price of zero-coupon bond at time t and maturing at time T under a Vasicek model is given by:

where,

T = T -1

(XT

1 - e-

b(T) =-

INSTITUTE OF ACTUARIES OF INDIA

a

a(r) = (b(r)- r)( - r) -b(r)2 2a 4a

(6)

[14]

(a) What is a credit event? (1)

Q 11)

(b) What are the possible outcomes of default on a corporate bond? (2)

(c) What is a recovery rate? (1)

[4]

Page 7 of 7

|

Attachment: |

| Earning: Approval pending. |