Institute of Actuaries of India 2010 CT-5 Contingencies Core Technical ( ) - exam paper

INSTITUTE OF ACTUARIES OF INDIA

EXAMINATIONS 18th May 2010

Subject CT5 - General Insurance, Life and Health Contingencies Time allowed: Three Hours (10.00 - 13.00 Hrs)

Total Marks: 100

INSTRUCTIONS TO THE CANDIDATES

1) Please read the instructions on the front page of answer booklet and instructions to examinees sent along with hall ticket carefully andfollow without exception

2) Mark allocations are shown in brackets.

3) Attempt all questions, beginning your answer to each question on a separate sheet. However, answers to objective type questions could be written on the same sheet.

4) In addition to this paper you will be provided with graph paper, if required.

Q. 1) If T represents the present value of a temporary annuity due with a term of n years, derive the variance of T in terms of assurance functions for a life aged x.

Q. 2) What is meant by direct expenses incurred by a life insurance company in respect of a life insurance contract? Describe three different categories of direct expenses and give an example of each.

Q. 3) A life insurer issues 20-year term assurance policies to lives aged 45 exact. The sum assured, which is payable immediately on death, is Rs. 5,00,000 for the first 10 policy years, and Rs. 1,00,000 thereafter. Level annual premiums of Rs.1897.24 are payable for 20 years or until death, if earlier.

i) Find the prospective reserve at the end of 10th policy year. (3)

ii) Using your answer to part (i), describe the disadvantages to the insurer after 10th policy year for selling these policies. Suggest any two changes in the product design so as to remove the disadvantages? (6)

Following bases is used to calculate the premiums and reserves:

Mortality: AM92 Ultimate

Interest: 4% per annum

Expenses: nil.

Q. 4) A population is subject to two modes of decrement, a and P, between ages x and x+1. In the single decrement tables;

Da Dp

{ x = 1 - t2/x; and 1 x = t/x;

Where 0 t 1

Write down an integral expression for (aq) . Hence obtain an expression for this probability in term of x only.

Q. 5) A level premium with-profit 20-year endowment assurance policy, issued to a life aged exactly 40 has a sum assured of Rs. 10,000. the death benefits are payable at the end of the year of death. Premiums are calculated assuming AM92 Select mortality, 4% pa interest, initial expenses of Rs.150 and claim related expenses of 3% of the base sum assured (payable on death or maturity).

Calculate the annual premium if the policy is assumed to provide compound bonuses of 4% pa of the sum assured vesting at the end of each policy year.

[4]

Q. 6) A life insurance company issue a 5 year unit linked pension plan to a life aged 45 exact on 1st Jan 2009 under which level premiums are payable yearly in advance. 95% of the premiums are allocated to units in all five policy years. A fund management charge of 2.5% of the fund value is deducted at the end of each policy year. A fixed administration charge of Rs 720 p.a. is deducted at the start of each policy year.

The management charges are deducted from the fund before any death benefits are paid.

The death benefit is equal to the fund value and the benefits are paid only at the end of the year.

The investment managers follow a passive investment strategy which mimics the nifty index.

The Company uses the following assumptions in its profit test for this policy:

Interest on non unit CF 5% per annum

Mortality rate 2 per 1000 for all ages

Acquisition Expense Rs 500

Renewal Expenses Rs 500 per annum at the beginning of the year

First Year Commission 4% of premium

Renewal Commission 4% of premium

Ignore Taxes

Ignore withdrawals

The company expects the Nifty index to behave in the following manner.

|

Date |

Nifty Index |

|

01-Jan-2009 |

4000 |

|

31-Dec-2009 |

3800 |

|

31-Dec-2010 |

4294 |

|

31-Dec-2011 |

4766 |

|

31-Dec-2012 |

4290 |

|

31-Dec-2013 |

4977 |

a. Calculate the account value at the end of five policy years showing detailed calculations assuming annual premium is Rs.1,00,000. (5)

b. The product also guarantees on maturity a 2.5% return per annum compounded on the premiums paid. Therefore the maturity value is equal to the higher of fund value at maturity or the guaranteed amount at maturity. Calculate the Value of new business assuming an RDR of 12%. Value of new business is equal to the present value of profits divided by the annual premium. (8)

c. The Chief Actuary now decides to build up a reserve for the guaranteed payout equal to 2.5% of the year end fund value in the first four policy years. This reserve would be released in the fifth policy year to meet the guarantee, if required. Recalculate the value of new business allowing for this new requirement.

(5)

d. Calculate the IRR to the customer based on assumptions available at the time of pricing the product.

(2)

[20]

Q. 7) A life insurer sells single premium deferred annuity policies to male lives aged 40 exact. Under each policy, the contract provides an annuity due of Rs.100,000 per annum and a death benefit of the return of the single premium payable under the contract. The annuity payment commences at age 60 and the death benefit is payable at the end of the year of death provided death occurs after age 60.

i) Calculate the single premium payable under the policy

(3)

ii) Calculate the mortality profit during 25th policy year. You are given that there are 1000 inforce policies at the end of 24th policy year and 10 lives die during 25th policy year. (8)

iii) Explain why the insurer has incurred a mortality loss or mortality profit in 25th policy

year (2)

Use the following basis:

Mortality: AM92 Ultimate

Interest Rate: 4% per annum

Initial Expenses: Rs.1000 per policy + 1% of single premium

Renewal Expenses: Rs.200 per annum per policy from second year onwards

Expenses are incurred at the beginning of the year.

[13]

Q. 8) a) A life insurer offers a product that provides Rs.5 lacs if the insured survives 5.5 years.

Calculate the value of this benefit for a life insured aged 55 assuming the interest rate of 5% per annum and the constant force of mortality of 0.02. (2)

b) The profit signature, before setting up non unit reserves, for a 6 year life insurance contract, is as under:

(-100, 200, -100, +100, -100, +100)

Now the company has to set up the non unit reserve to zeroise negative cash flows. Determine the revised profit signature. Ignore interest rates. (3)

[5]

Q. 9) a) A life insurance company has sold 1000 single premium endowment assurance policies to lives aged 30 for a policy term of 20 years and sum assured of Rs.100,000 each. If the Company expects that 2 lives will dies each year and it will earn an interest rate of 5% per annum, calculate the single premium. Assume that the Company incurs expense of 5% of the single premium only at the time of policy issue. (3)

b) An Indian life insurance company publishes its premium rate table for urban lives and uses age rating of 5 years for rural lives e.g. the premium rate of age 40 for the rural lives is same as the premium rate of age 35 of an urban life. Explain the rationale for this approach. (2)

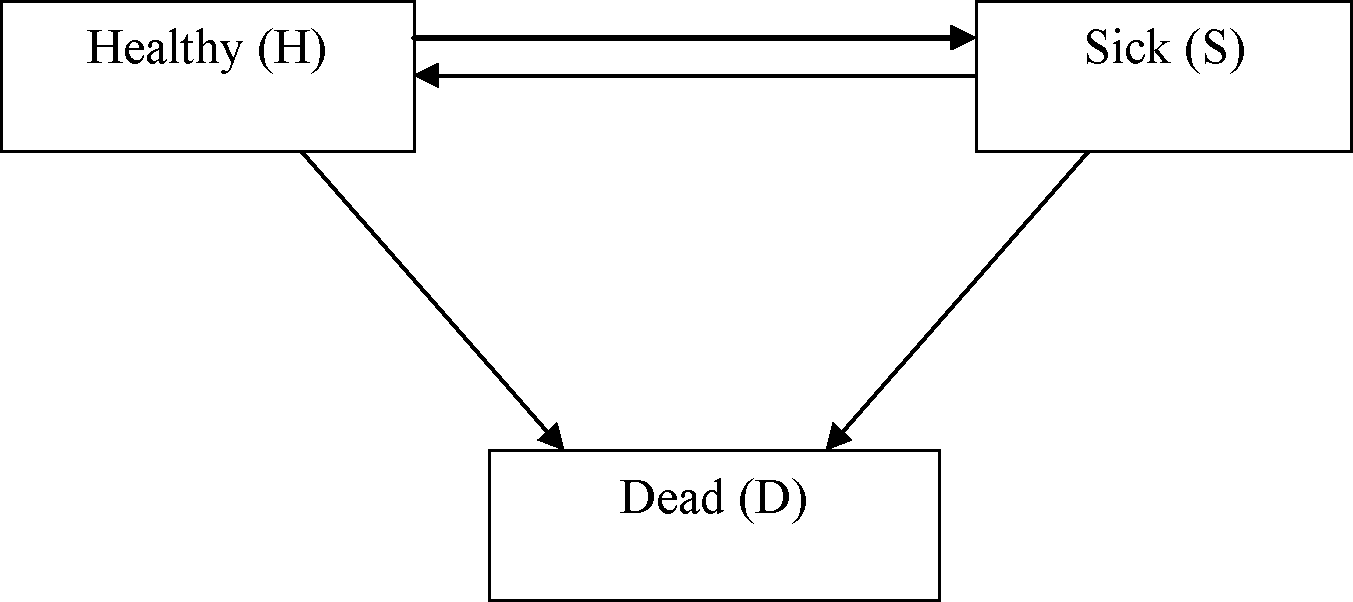

A life insurance company uses the following 3 state model, to estimate the profit in respect of a 2 year combined death benefit and sickness policy issued to a healthy policyholder aged exact 55 at inception.

In return for a Single premium of Rs 25,000 payable at the outset the company will pay the following benefits:

IAI

Q. 10)

Rs 50,000 if the policyholder dies within 2 years, payable at the end of the year of death:

Rs 35,000 at the end of each of the 2 years if the policyholder is sick at those times.

Let St represent the state of the policyholder at age 55+t, so that S0 = H and for t=1 and 2, St = H, S or D

The company uses transition probabilities defined as follows:

For t =0 and 1 the transition probabilities are:

Ps5+t= o 09 A&+t = o io P$5+t = 0 6 Pss+f = o.l6

(a) One possible outcome for this policy is that the policyholder is healthy at times

0, 1 and 2. List all possible outcomes and the associated cash flows. (3)

(b) Calculate the probability that each outcome occurs (5)

(c) Assuming a rate of interest of 5% per annum, calculate the net present value at time 0 of

the profit for each outcome. (2)

(d) Calculate the mean and standard deviation of the net present value at time 0 of the profit

for the policy. (5)

Q. 11) A life Insurance Company sold a number of 3-year single premium polices with a guaranteed amount payable at maturity. The life insurance company invests the premium in a 3-year zero coupon bond at an average interest rate of 6.5% effective per annum.

The insurance company guarantees a return of 6.0% per annum at maturity. On death the return is not guaranteed but the company promised to pay out the full market value of the related asset immediately at the date of death.

If the distribution of (1+i) is log-normal with parameters p= 0.003 and o= 0.01, and mortality follows ELT15 (Males), calculate the probability that the office makes a loss on a policy sold to a male aged exactly 60. You should assume that company does not make a loss at the time of death.

[6]

Q. 12) If an annuity is payable to (y) on the death of (x) for a maximum of n years then the expected present value can be expressed as:

t =

jV t P xy Mx+t ay+tn dt = ay.n + V n P y aX-.y+n - a.xy

t=0

Prove this result.

[9]

Page 6 of 6

|

Attachment: |

| Earning: Approval pending. |