Institute of Actuaries of India 2011 CT-5 Contingencies Core Technical ( ) - Question Paper

INSTITUTE OF ACTUARIES OF INDIA

EXAMINATIONS 19th May 2011 Subject CT5 - General Insurance, Life and Health Contingencies

Time allowed: Three Hours (10.00 - 13.00 Hrs) Total Marks: 100

INSTRUCTIONS TO THE CANDIDATES

1) Please read the instructions on the front page of answer booklet and instructions to examinees sent along with hall ticket carefully and follow without exception

2) Mark allocations are shown in brackets.

3) Attempt all questions, beginning your answer to each question on a separate sheet. However, answers to objective type questions could be written on the same sheet.

4) In addition to this paper you will be provided with graph paper, if required.

Q. 1) State whether the following equations are correct or not, and, where applicable, suggest correction.

AX\n\ = Ax-.t\ +

Q. 2) i) Calculate the value of 17545 5 on the basis of mortality table AM92 Ultimate and

assuming that deaths are uniformly distributed between integral ages. (3)

ii) Explain how occupation affects morbidity and mortality. Your explanation should also be

supported by examples. (3)

Q. 3) i) A temporary life annuity is payable continuously to a life exactly aged 60 for a 10 year term. The rate of payment during the first 5 years is Rs. 50,000 per annum and thereafter it is Rs.60,000 per annum. The force of mortality for this life is 0.03 between the ages of 60 and 65, and 0.04 between the ages of 65 and 70.

Calculate the expected present value of this annuity assuming a force of interest of 5% per annum. (5)

ii) Assuming that mortality and interest rates are as in (i) above, calculate the expected present value of:

(a) A 10-year term assurance issued to the life in (i) for a sum assured of Rs. 2,50,000 payable immediately on death

(b) A 10-year endowment assurance issued to the life in (i), which pays Rs. 2,50,000 on maturity or immediately on earlier death. (4)

Q. 4) Let X be a random variable representing the present value of the benefits of a pure endowment contract and Y be a random variable representing the present value of the benefits of a term assurance contract which pays the death benefit at the end of the year of death. Both contracts have unit sum assured, a term of n years and were issued to the same life aged x.

(i) Derive and simplify as far as possible using standard actuarial notation an expression for

the covariance of X and Y. (3)

(ii) Hence or otherwise, derive an expression for the variance of (X+Y) and simplify it as far

as possible using standard actuarial notation. (4)

Q. 5) A population is subject to two modes of decrements, a and P, between ages x and x + 1. In the single decrement tables

where 0 < t < 1.

Write down an integral expression for (aq)xa and hence obtain an expression for this probability in terms of x only.

Q. 6) Twins exactly aged 30 years purchase a special annuity policy providing a fully continuous joint life annuity along with a provision for joint life insurance. Their future lifetimes are independent and identically distributed. The policy pays the following benefits:

Rs. 100,000 per year while both are alive

Rs. 100,000 at the time of the first death

Rs. 60,000 per year after the first death until the second death

Rs. 80,000 at the time of the second death

The constant force of interest (5) is 5% per annum and the constant force of mortality (ix(t) = 0.04 for all x and t.

(a) Show that:

a i xy =

S + 211

(b) Calculate the actuarial present value of this special annuity (with insurance provision). (6)

Q. 7) An insurer sells a product providing the life insurance and sickness benefit of term 20 years to healthy lives aged 35. The policies pay a lump sum of Rs. 200,000 immediately on death, with an additional Rs. 100,000 if the deceased is sick at the time of death. There is also a benefit of Rs. 30,000 per annum payable continuously to sick policyholders. There is no waiting period before benefits are payable. Annual premiums of Rs. 5,000 are payable continuously by healthy policyholders.

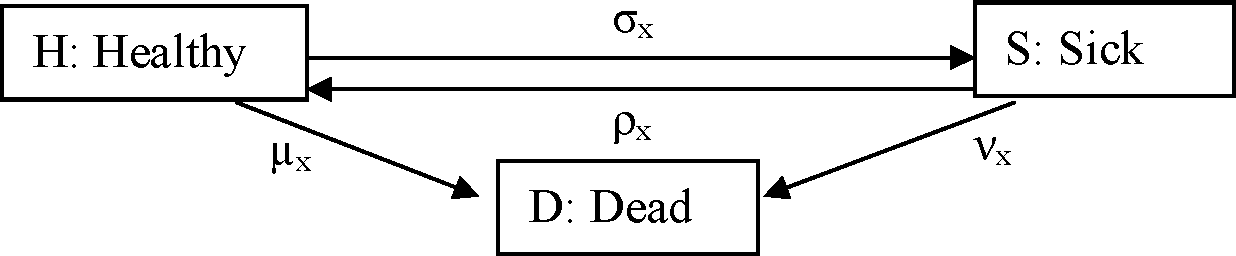

The mortality and sickness of the policyholders are described by the following multiple state model, in which the forces of transition n, v, p and o depend on age.

pghx,t is the probability that a life aged x in state g (g = H, S, D) will be in state h at age x + t (t > 0 and h = H, S, D). The force of interest is 5.

Express in integral form, using the probabilities and the various forces of transition, the expected present value of a policy at its commencement.

Q. 8) A life insurance company has been selling 3 year unit linked policies to lives aged exactly

30 years. The charges under the policies are as under:

Allocation Charge: First Year 20%, other years 2%

Policy charge: Rs. 600 at start of first year and subsequently inflating at 5%

per annum

Mortality Charge: 110% * Standard Table mortality rate * max (Sum Assured -

Unit Fund, 0)

Fund Management Charge: 1.25% per annum

All charges, except Fund Management Charge (FMC), are deducted at start of the year. The mortality charge is calculated after deducting the policy charge from the unit fund at start.

FMC is deducted at end of year.

The other details are as follows:

Annual premium: Rs. 10,000

Sum Assured (SA): Rs. 100,000

Unit growth rate: 8% per annum

|

Standard Table mortality rates: | ||||||||

|

The company is planning to offer an additional guaranteed benefit equal to 5% of the annual premium payable on maturity. To be able to meet this guarantee cost, it intends to have an additional charge expressed as percentage of unit fund. This guarantee charge would be deducted at start of each year after deducting the policy charge and mortality charge from the unit fund at start. The guarantee charge would be invested such that it earns 6% per annum. (Ignore premium lapses and surrenders).

(a) By projecting the unit fund for all 3 years, show that a guarantee charge of 0.9% per

annum would be sufficient to meet the guarantee cost. (8)

Each year, the company allocates units to the policyholder based on the allocated premium and the unit price at start of year. Unit price is defined as:

Unit price (t) = Unit Fund (t) / Number of Units (t), at time t

Only policy charge, mortality charge and guarantee charge is deducted by cancellation of units based on the unit price at start of year. Unit price at start of year 1 is 10.

(b) Based on the results in part (a), determine the number of units and the unit price at end of each year. (5)

Q. 9) A life insurance company issued five-year term assurance policies exactly two years ago to lives all aged exactly 34 years then, for a regular premium of Rs. 500 and a sum assured of Rs. 125,000. The number of policies remaining is 25 and reserve per policy is Rs. 231, as on date. The expected future profit for the remaining three years from this block of policies is (?, 1800, 1700).

The company has total assets of Rs. 25,000 as on date.

The company expects to sell 10 policies of four-year without profit endowment assurance to policyholders all aged exactly 35 years for a single premium of Rs. 50,000 and a sum assured of Rs. 62,500 payable on maturity or at the end of the year of death if earlier. On surrender, the policyholder would receive single premium paid less surrender penalty.

The company uses the following best estimate assumptions for endowment assurance for profit testing:

|

Year |

Mortality Rate |

Surrender rate |

Surrender Penalty (as % of single premium) |

Expenses at start year per policy |

|

1 |

0.0015 |

5.0% |

10.0% |

1000 |

|

2 |

0.0020 |

2.5% |

5.0% |

200 |

|

3 |

0.0025 |

1.5% |

2.5% |

210 |

|

4 |

0.0030 |

0.0% |

0.0% |

220 |

Mortality rate and expense for future years for term assurance are the same as in the above table starting from Year 2. Lapse rate assumption for the third policy year is zero and for future years it is not provided.

Deaths and surrenders occur at the end of the year. The surrender rates are applied to the number of policies in force at each year end i.e. on policies remaining after deaths.

Reserves at the end of each year are equal to the present value of all future benefits and expenses less present value of future premiums. Surrenders are ignored while calculating the reserves. The mortality assumption and expense assumption are 15% higher than the best estimate assumption for reserving purpose. Valuation interest rate is 5% per annum.

(a) Calculate the reserves per policy at end of each year for endowment assurance. (3)

Net Assets is defined as total assets less total reserves. Net Assets increase or decrease by the amount of profit/loss in a given year.

(b) If the embedded value is equal to the Net Assets plus the net present value, determine the embedded value at end of next year. Use an investment rate of 6.5% per annum and a risk discount rate of 13% per annum. (14)

(c) Without doing any further calculations, explain the impact of a decrease in the valuation interest rate on the embedded value. (2)

[19]

Q. 10) (a) Two life insurance companies in the same country maintain records of inforce policies and deaths subdivided by age and policy duration. Outline the advantages and disadvantages of pooling the data of the two companies to form one mortality rate estimate for each combination of age and policy duration. (3)

(b) Mortality levels for a certain country have been studied at national and regional level.

Under what circumstances a particular region may have an Area Comparability Factor of 0.5. (1)

[4]

Q. 11) On 1 January 1996 a life office issued a number of 20-year pure endowment policies to a group of lives aged 40 exact. In each case, the sum assured was Rs. 75,000 and premiums were payable annually in advance.

On 1 January 2010, 500 policies were still in force. During 2010, 3 policyholders died, and no policy lapsed for any other reason.

The office calculates net premiums and net premium reserves on the following basis:

Interest: 4% per annum Mortality: AM92 Select

(i) Calculate the profit or loss from mortality for this group for the year ending

31 December 2010. (7)

(ii) Explain why the mortality profit or loss has arisen. (2)

[9]

Q. 12) The premiums payable under a deferred annuity contract issued to women aged exactly 60 are limited to 5 years. The annuity commences at age 65, provided the policyholder is still alive at that age. The annuity provides payments of Rs. 35000 payable annually in advance for 5 years certain (i.e. it continues to be paid for 5 years even if the annuitant dies before age 69) and for life thereafter. There is no benefit if the policyholder dies before age 65.

(i) Calculate the annual premium. (6)

(ii) Calculate the retrospective and prospective reserves after the policy has been in force for each of 5 and 10 years. (8)

Basis: PFA92C20 mortality, 4% pa interest

[14]

Page 7 of 7

|

Attachment: |

| Earning: Approval pending. |