The Institute of Chartered Financial Analysts of India University 2010 C.A Chartered Accountant Final Revision Test s- 2 – Management Accounting and Financial Analysis (old ) - Question Paper

May 2010: The Institute of Chartered Accountants of India - Revision Test ques. papers (RTPs) Final Examination: Paper two Management Accounting and Financial Analysis (old course): May 2010 University ques. paper

PAPER -2 : MANAGEMENT ACCOUNTING AND FINANCIAL ANALYSIS

QUESTIONS

Foreign Exchange Risk Management

1. (i) The rate of inflation in USA is likely to be 3% per annum and in India it is likely to be

6.5%. The current spot rate of US $ in India is Rs.43.40. Find the expected rate of US $ in India after one year and 3 years from now using purchasing power parity theory.

(ii) On April 1, 3 months interest rate in the UK and US $ are 7.5% and 3.5% per annum respectively. The UK /US $ spot rate is 0.7570. What would be the forward rate for US $ for delivery on 30th June?

2. Wenden Co is a Dutch-based company which has the following expected transactions. One month: Expected receipt of 2,40,000

One month: Expected payment of 1,40,000

Three months: Expected receipts of 3,00,000

The finance manager has collected the following information:

Spot rate ( per ): 1.7820 0.0002

One month forward rate ( per ): 1.7829 0.0003

Three months forward rate ( per ): 1.7846 0.0004

Money market rates for Wenden Co:

Borrowing Deposit One year Euro interest rate: 4.9% 4.6

One year Sterling interest rate: 5.4% 5.1

Assume that it is now 1 April.

Required:

(a) Calculate the expected Euro receipts in one month and in three months using the forward market.

(d) Calculate the expected Euro receipts in three months using a money-market hedge and recommend whether a forward market hedge or a money market hedge should be used.

3. CQS plc is a UK company that sells goods solely within UK. CQS plc has recently tried a foreign supplier in Netherland for the first time and need to pay 250,000 to the supplier in six months' time. You as financial manager are concerned that the cost of these supplies may rise in Pound Sterling terms and has decided to hedge the currency risk of this account payable. The following information has been provided by the company's bank:

Spot rate ( per ): 1 '998 0 '002

Six months forward rate ( per ): 1 '979 0 '004 Money market rates available to CQS plc:

Borrowing Deposit

One year Pound Sterling interest rates: 6'1% 54%

One year Euro interest rates: 4 '0% 3 '5%

Assuming CQS plc has no surplus cash at the present time you are required to evaluate whether a money market hedge, a forward market hedge or a lead payment should be used to hedge the foreign account payable.

4. Best of Luck Ltd, London will have to make a payment of $3,64,897 in six month's time. It is currently 1st October. The company is considering the various choices it has in order to hedge its transaction exposure.

Exchange rates:

Spot rate $1.5617- 1.5773

Six-month forward rate $1.5455 - 1.5609

Money market rates:

Borrow(%) Deposit(%)

US 6 4.5

UK 7 5.5

Foreign currency option prices (1 unit is 12,500):

Exercise price Call option (March) Put option (March)

$1.70 $0.037 $0.096

By making the appropriate calculations and ignoring time value of money (in case of Premia) decide which of the following hedging alternatives is the most attractive to Best of Luck Ltd:

(a) Forward market

(b) Cash (Money) market;

(c) Currency options.

Capital Budgeting with Risk

5. Soft True P Ltd. is a company specializing in the development of business software. The company's managers believe that its future growth potential in the software sector is limited hence are considering diversifying into other activities. One suggestion from operation department is Internet auctions, and financial management team in consultation with the operation department has produced the following draft financial proposal.

(a) The initial cost of the project (capital outlay) of the project will be Rs. 27,00,000.

(b) The year-wise working capital requirement will be as follows:

Year 0 12 3 4

Working capital 4,00,000 24,000 24,000 25,000 26,000

(c) Details of inflows and other outflows is as follows:

|

Year |

0 |

1 |

2 |

3 |

4 |

|

Auction fees Outflows: |

43,00 |

66,20 |

81,00 |

82,00 | |

|

Maintenance costs |

- |

12,10 |

18,50 |

19,20 |

21,25 |

|

Telephone Expenses |

- |

12,15 |

19,10 |

22,30 |

24,20 |

|

Wages |

- |

14,60 |

15,20 |

16,80 |

17,30 |

|

Salaries Allocated head office |

400 |

550 |

600 |

650 | |

|

overhead |

- |

85 |

90 |

95 |

1,00 |

|

Marketing Royalty payments for |

5,00 |

4,20 |

2,00 |

2,00 |

- |

|

use of technology Research & |

6,80 |

5,00 |

3,00 |

2,00 |

2,00 |

|

Development |

1,10 |

- |

- |

- | |

|

Rent of office |

- |

2,80 |

2,90 |

3,00 |

3,10 |

|

Total outflows |

12,90 |

55,70 |

67,10 |

72,25 |

75,35 |

|

Profit before tax Additional information: |

(12,90) |

(12,70) |

(90) |

8,75 |

6,65 |

(i) All data include the estimated effects of inflation on costs and prices wherever relevant. Inflation in India is forecast to be 2% per year for the foreseeable future.

(ii) The investment in IT infrastructure and the initial working capital will be financed by a 6 year 5'5% fixed rate term loan. Other years outlays will be financed from existing cash flows.

(iii) It is expected that Government of India shall give a 1% per year subsidy to the cost of the loan to support the creation of jobs associated with this project.

(iv) It is expected that highly skilled IT staff would need to be taken from other activities resulting in a loss of Rs.80,000 per year pre-tax contribution for three years.

(v) Head office cash flows for overheads will increase by Rs. 50,000 as a result of the project in year one, rising by Rs.5,000 per year after year one.

(vi) Corporate tax is at a rate of 24'5% per year, payable in the year that the tax liability arises. The company has other profitable projects.

(vii) Tax allowable depreciation on IT infrastructure is 20% for the first year, and straight line thereafter. The IT infrastructure has an expected working life of six years after which major new investment would be required.

(viii) The company's current weighted average cost of capital is 7 '8%.

(ix) The company's equity beta is 1 '05.

(x) The average equity beta of companies in the Internet auctions sector is 1 '42.

(xi) The market return is 9 '5% per year and the risk free rate 4% per year.

(xii) Soft True's capital gearing is:

Book value 55% equity, 45% debt Market value 70% equity, 30% debt

(xiii) The average gearing of companies in the Internet auction sector is 67% equity, 33% debt by market values.

(xiv) The market research survey was undertaken three weeks ago.

(xv) After tax operating net cash flows after year 4 are expected to stay approximately constant in real terms. The royalty payment will remain at Rs.200,000 in money terms.

(xvi) Issue costs on debt are 1 '5%. These costs are not tax allowable.

Required:

Suppose you are an external consultant and you have been approached by the Soft

True to prepare a report on the proposed diversification of the company into Internet

auctions.

(a) The report must include a revised financial analysis. Make relevant assumptions as required.

(b) Also include in your report discussion of other financial and nonfinancial factors, including real options that Soft True might consider prior to making the investment decision.

Business Valuation

6. Suppose you are verifying a valuation done on an established company by a well-known analyst has estimated a value of Rs. 750 lakhs, based upon the expected free cash flow next year, of Rs. 30 lakhs, and with an expected growth rate of 5%.

You found that, he has made the mistake of using the book values of debt and equity in his calculation. While you do not know the book value weights he used, you have been provided following information:

(a) Company has a cost of equity of 12%.

(b) After-tax cost of debt of 6%.

(c) The market value of equity is three times the book value of equity, while the market value of debt is equal to the book value of debt.

You are required to estimate the correct value of company.

7. ABC (India) Ltd., a market leader in printing industry, is planning to diversify into defense equipment businesses that have recently been partially opened up by the GOI for private sector. In the meanwhile, the CEO of the company wants to get his company valued by a leading consultants, as he is not satisfied with the current market price of his scrip.

He approached consultant with a request to take up valuation of his company with the following data for the year ended 2009:

Share Price Rs. 66 per share

Outstanding debt 1934 lakh

Number of outstanding shares 75 lakh

Net income 17.2 lakh

EBIT 245 lakh

Interest expenses 218.125 lakh

Capital expenditure 234.4 lakh

Depreciation 234.4 lakh

Working capital 44 lakh

Growth rate 8% (from 2010 to 2014)

Growth rate 6% (beyond 2014)

Free cash flow 240.336 lakh (year 2014 onwards)

The capital expenditure is expected to be equally offset by depreciation in future and the debt is expected to decline by 30% by 2014.

Required:

Estimate the value of the company and ascertain whether the ruling market price is undervalued as felt by the CEO based on the foregoing data. Assume that the cost of equity is 16%, and 30% of debt repayment is made in the year 2014.

Interest Rate Risk Management

8. 9 year Government of India security is being quoting at 10.5%. The 364 T Bill (Treasury Bill) is being quoted at 11.25. Last year Indian National Bank had issued a fixed rate bond under statutory requirement at 15% coupon for a period of 10 year. Now when remaining 9 years are yet to expire the Bank wants to convert their fixed rate obligation to floating rate due to anticipation of decline in interest rates. Market quotation for fixed to floating rate swap is T-Bill rate is 75/85 bp over 9 year Government of India security. If T-Bill decline 20 bp over the current year and rises by 5 bp every year thereafter what is the effective cost of funds to Indian National Bank. To hedge interest rate Indian National Bank undertakes swap transaction every year.

9. Ageit Charter has been asked to operate a very light aircraft plane for a mining company exploring north and west of Maastricht. Ageit will have a firm one-year contract with the mining company and expects that the contract will be renewed for the five-year duration of the exploration program. If the mining company renews at year 1, it will commit to use the plane for four more years.

Ageit Charter has the following choices.

Buy the plane for 500,000.

Take a one-year operating lease for the plane. The lease rate is 118,000, paid in advance.

Arrange a five-year, noncancelable financial lease at a rate of 75,000 per year, paid in advance.

These are net leases: all operating costs are absorbed by Ageit Charter.

How would you advise Bart Ageit, the charter company's CEO? Assume five-year, straight-line depreciation for tax purposes. The company's tax rate is 35 percent. The weighted-average cost of capital for the very light aircraft plane business is 14 percent, but Ageit can borrow at 9 percent. The expected inflation rate is 4 percent.

Ms. Ageit thinks the plane will be worth 300,000 after five years. But if the contract with the mining company is not renewed (there is a 20 percent probability of this outcome at year 1), the plane will have to be sold on short notice for 400,000.

If Ageit Charter takes the five-year financial lease and the mining company cancels at year 1, Ageit can sublet the plane that is, rent it out to another user.

Make additional assumptions as necessary.

International Capital Budgeting

10. OJ Ltd. Is a supplier of leather goods to retailers in the UK and other Western European countries. The company is considering entering into a joint venture with a manufacturer in South America. The two companies will each own 50 per cent of the limited liability company JV(SA) and will share profits equally . 450,000 of the initial capital is being provided by OJ Ltd. and the equivalent in South American dollars (SA$) is being provided by the foreign partner. The managers of the joint venture expect the following net operating cash flows, which are in nominal terms:

SA$ 000 Forward Rates of exchange to the Sterling

Year 1 4,250 10

Year 2 6,500 15

Year 3 8,350 21

For tax reasons JV(SV) the company to be formed specifically for the joint venture, will be registered in South America.

Ignore taxation in your calculations.

Assuming you are financial adviser retained by OJ Limited to advise on the proposed joint venture.

(i) Calculate the NPV of the project under the two assumptions explained below. Use a discount rate of 18 per cent for both assumptions.

Assumption 1: The South American country has exchange controls which prohibit the payment of dividends above 50 per cent of the annual cash flows for the first three years of the project. The accumulated balance can be repatriated at the end of the third year.

Assumption 2 : The government of the South American country is considering removing exchange controls and restriction on repatriation of profits. If this happens all cash flows will be distributed as dividends to the partner companies at the end of each year.

(ii) Comment briefly on whether or not the joint venture should proceed based solely on these calculations.

Options and Derivatives

11. You are given three call options on a stock at exercise price of Rs. 30, Rs. 35 and Rs. 40 with expiration date in three months and the premium of Rs. 4, Rs. 2 and Re. 1 respectively. Show how the option can be used to create a butterfly spread. Construct a table with different market prices and show how profit changes with stock prices ranging from Rs. 20 to 50 for the butterfly spread.

12. From the following data for certain stock, find the value of a call option:

Price of stock now = Rs.80

Exercise price = Rs.75

Standard deviation of continuously compounded = 0.40 annual return

Maturity period = 6 months

Annual interest rate = 12%

Given

|

Number of S.D. from Mean, (z) 0.25 0.30 0.55 0.60 |

Area of the left or right (one tail) 0.4013 0.3821 0.2912 0.2578 |

e.12xo.o5 = 1.0060

In 1.0667 = 0.0645

Dividend Policy

13. The target payout ratio for Cryzal Ltd. is 0.4. The dividend per share for the current year is $12.9. The weightage given to the current year earnings is 0.55. The dividend per share in previous year was $11.1. The number of common stock outstanding in the company is 10,00,000. If P/E multiple is 8, applying Lintner Model of dividend policy to the company what is the market capitalization of the company.

14. CMC plc has an all-common-equity capital structure. If has 200,000 share of 2 par value equity shares outstanding. When CMC's founder, who was also its research director and most successful inventor, retired unexpectedly to settle down in the South Pacific in late 2005, CMC was left suddenly and permanently with materially lower growth expectations and relatively few attractive new investment opportunities. Unfortunately, there was no way to replace the founder's contributions to the firm. Previously, CMC found it necessary to plough back most of its earnings to finance growth, which averaged 12% per year. Future growth at a 5% rate is considered realistic; but that level would call for an increase in the dividend payout. Further, it now appears that new investment projects with at least the 14 % rate of return required by CMC's shareholders (ke = 14%) would amount to only 800,000 for 2006 in comparison to a projected 2,000,000 of net income. If the existing 20 % dividend payout were continued, retained earnings would be 16,00,000 in 2006, but, as noted, investments that yield the 14 % cost of capital would amount to only 800,000.

The one encouraging thing is that the high earnings from existing assets are expected to continue, and net income of 20,00,000 is still expected for 2006. Given the dramatically changed circumstances. CMC's board is reviewing the firm's dividend policy.

(a) Assuming that the acceptable 2006 investment projects would be financed entirely by earnings retained during the year, calculate DPS in 2006, assuming that CMC uses the residual payment policy.

(b) What payout ratio does your answer to part a imply for 2006?

(c) If a 60 % payout ratio is adopted and maintained for the foreseeable future, what is your estimate of the present market price of the equity share? How does this compare with the market price that should have prevailed under the assumptions existing just before the news about the founder's retirement? If the two values of P0 are different. Comment on why?

(d) What would happen to the price of the share if the old 20% payout were continued? Assume that if this payout is maintained, the average rate of return on the retained earnings will fall to 7.5% and the new growth rate will be

G = (1.0- Payout ratio) x (ROE)

= (1.0 - 0.2) (7.5%) = (0.8) (7.5%) = 6.0%

15. AB Ltd. is a firm of recruitment and selection consultants. It has been trading for 10 years and obtained a stock market listing 4 years ago. It has pursued a policy of aggressive growth and specializes in providing services to companies in high-technology and high growth sectors. It is all-equity financed by ordinary share capital of Rs. 500 lakh in shares of Rs. 20 nominal (or par) value.

The company's results to the end of March 2009 have just been announced. Profits before tax were Rs.1,266 lakh. The Chairman's statement included a forecast that earnings might be expected to rise by 4%, which is a lower annual rate than in recent years. This is blamed on economic factors that have had a particularly adverse effect on high-technology companies.

YZ Ltd. is in the same business but has been established much longer. It serves more traditional business sectors and its earnings record has been erratic. Press comment has frequently blamed this on poor management and the company's shares have been out of favour with the stock market for some time. Its current earnings growth forecast is also 4% for the foreseeable future. YZ Ltd. has an issued ordinary share capital of Rs.1800 lakh in Rs.100 shares. Pre-tax profits for the year to 31 March 2009 were Rs.1,125 lakh.

AB Ltd. has recently approached the shareholders of YZ Ltd. with a bid of 5 new shares in AB Ltd. for every 6 YZ Ltd. shares. There is a cash alternative of Rs. 345 per share. Following the announcement of the bid, the market price of AB Ltd. shares fell 10% while the price of YZ Ltd. shares rose 14%. The P/E ratio and dividend yield for AB Ltd., YZ Ltd. and two other listed companies in the same industry immediately prior to the bid announcement are shown below.

|

High Low Company 425 325 AB Ltd. 350 285 YZ Ltd. |

2009 P/E Dividend yield % 11 2.4 7 3.1 |

Both AB Ltd. and YZ Ltd. pay tax at 30%.

AB Ltd.'s post-tax cost of equity capital is estimated at 13% per annum and YZ Ltd.'s at 11% per annum.

Assuming that you are a shareholder in YZ Ltd. You have a large, but not controlling interest.

You bought the shares some years ago and have been very disappointed with their performance. Based on the information and merger terms available, plus appropriate assumptions, to forecast post-merger values, evaluate whether the proposed share-for-share offer is likely to be beneficial to shareholders in both AB Ltd. and YZ Ltd. Also identify why the price of share of AB Ltd. fell following the announcement of bid.

Note: As a benchmark, you should then value the two companies AB Ltd. and YZ Ltd. using the constant growth form of the dividend valuation model.

Portfolio Management

|

16. Mr. Sunil Mukharjee has estimated probable under different macroeconomic conditions for the following three stocks: | |||||||||||||||||||||||

| |||||||||||||||||||||||

|

Mr. Sunil Mukharjee is exploring if it is possible to make any arbitrage profits from the above information. | |||||||||||||||||||||||

Required

Using the above information construct an arbitrage portfolio and show the payoffs under different economic scenarios.

|

17. Consider the following information relating to Stock A and the market for the last five years: | |||||||||||||||||||||

| |||||||||||||||||||||

|

calculate the alpha (a ), beta (R) and Unsystematic Risk. | |||||||||||||||||||||

(b) The total variance of the return from the stock A and the components of variance that are explained by the market index and not explained by the market index.

Mutual Funds

18. Ms. Sunidhi is working with an MNC at Mumbai. She is well versant with the portfolio management techniques and wants to test one of the techniques on an equity fund she has constructed and compare the gains and losses from the technique with those from a passive buy and hold strategy. The fund consists of equities only and the ending NAVs of the fund he constructed for the last 10 months are given below:

Month Ending NAV (Rs./unit) Month Ending NAV (Rs./unit)

December 2008 40.00 May 2009 37.00

January 2009 25.00 June 2009 42.00

February 2009 36.00 July 2009 43.00

March 2009 32.00 August 2009 50.00

April 2009 38.00 September 2009 52.00

Assume Sunidhi had invested a notional amount of Rs.2 lakhs equally in the equity fund and a conservative portfolio (of bonds) in the beginning of December 2008 and the total portfolio was being rebalanced each time the NAV of the fund increased or decreased by 15%.

You are required to determine the value of the portfolio for each level of NAV following the Constant Ratio Plan.

19. A has invested in three Mutual Fund Schemes as per detailed below:

|

MF A |

MF B |

MF C | |

|

Date of investment |

01.12.2008 |

01.01.2009 |

01.03.2009 |

|

Amount of investment |

Rs. 50,000 |

Rs. 1,00,000 |

Rs. 50,000 |

|

Net Asset Value (NAV) at entry date |

Rs. 10.50 |

Rs. 10 |

Rs. 10 |

|

Dividend received upto 31.03.2009 |

Rs. 950 |

Rs. 1,500 |

Nil |

|

NAV as at 31.03.2009 |

Rs. 10.40 |

Rs. 10.10 |

Rs. 9.80 |

Required:

What is the effective yield on per annum basis in respect of each of the three schemes to Mr. X upto 31.03.2009?

Buy back of Securities

20. Following information is available in respect of dividend, market price and market

condition after one year.

Market condition Probability Market Price Dividend per

share

Rs. Rs.

Good 0.25 115 9

Normal 0.50 107 5

Bad 0.25 97 3

The existing market price of an equity share is Rs. 106 (F.V. Re. 1), which is cum 10% bonus debenture of Rs. 6 each, per share. M/s. X Finance Company Ltd. had offered the buy-back of debentures at face value.

Find out the expected return and variability of returns of the equity shares.

And also advise-Whether to accept buy back after?

Economic Value Added

21. Herbal Gyan is a small but profitable producer of beauty cosmetics using the plant Aloe Vera. This is not a high-tech business, but Herbal's earnings have averaged around Rs.

12 lakh after tax, largely on the strength of its patented beauty cream for removing the pimples.

The patent has eight years to run, and Herbal has been offered Rs. 40 lakhs for the patent rights. Herbal's assets include Rs. 20 lakhs of working capital and Rs. 80 lakhs of property, plant, and equipment. The patent is not shown on Herbal's books. Suppose Herbal's cost of capital is 15 percent. What is its Economic Value Added (EVA)?

Adjusted Present Value

22. TLC is considering a perpetual project with initial investment is Rs.10,00,00,000, and the expected cash inflow is Rs. 85,00,000 a year in perpetuity. The opportunity cost of capital with all-equity financing is 10 percent, and cost of debt is 8%. Since the project is based on the solar technology Government is subsiding the cost of debt by 1%.

Corporate tax rate is 35%.Use APV to calculate this project's value assuming that.

(a) First that the project will be partly financed with Rs. 4,00,00,000 of debt and that the debt amount is to be fixed and perpetual.

(b) The initial borrowing will be increased or reduced in proportion to changes in the future market value of this project.

Also explain the reasons difference between above two answers

Swap

23. Suppose a dealer quotes All-in-cost' for a generic swap at 8% against six month LIBOR flat. If the notional principal amount of swap is Rs.5,00,000.

(i) Calculate semi-annual fixed payment.

(ii) Find the first floating rate payment for (i) above if the six month period from the effective date of swap to the settlement date comprises 181 days and that the corresponding LIBOR was 6% on the effective date of swap.

(iii) In (ii) above, if the settlement is on Net' basis, how much the fixed rate payer would pay to the floating rate payer?

Generic swap is based on 30/360 days basis.

24. Explain the Lintner' s Dividend Model.

25. Write Short Notes on

(i) Drawbacks of investments in Mutual Funds

(ii) ESOS and ESPS

(iii) Factoring and Bill discounting

SUGGESTED ANSWERS/HINTS

1. (i) According to Purchasing Power Parity forward rate is

1+h

1 + rF

Spot rate

So spot rate after one year

1 + 0.065'

43.40

1+ 0.03 = 43.40 (1.03399) = 44.8751 After 3 years

3

1 + 0.065'

= 43.40 (1.03398)3

43.40

1 + 0.03 = 43.40 (1.10544) = Rs.47.9762 As per interest rate parity

"l + in A

Si = S0

1 + in B

12

Si = 0.7570

12

1 + (0.035) x 3

1 + (0.075) x 3

= 0.7570 x 1.0099 = 0.7645

1.01875

1.00875

= 0.7570

Si = UK 0.7645 / US$

(a) Forward market evaluation

2

Net receipt in 1 month = 2,40,000 - 1,40,000

= 1,00,000 1.7832 per = 56,079 = 3,00,000 1.7850 per = 1,68,067

WendenCo needs to sell Sterlings at an exchange rate of (1.7829 + 0.0003)

Euro value of net receipt = 1,00,000/ 1.7832

Receipt in 3 months

Wenden Co needs to sell Sterlings at an exchange rate of 1.7846 + 0.0004 Euro value of receipt in 3 months = 3,00,000/ 1.7850

(b) Evaluation of money-market hedge

Expected receipt after 3 months

= 300,000 = 5.4/ 4 = 1.35%

= 296,004 = 1.7822 per = 166,089 = 1.15% = 167,999

Sterling interest rate over three months

Sterlings to borrow now to have 300,000 liability

after 3 months = 300,000/ 1.0135

Spot rate for selling Sterling = 1.7820 + 0.0002

Euro deposit from borrowed Sterling at spot = 296,004/ 1.7822

Euro interest rate over three months = 4.6/ 4

Value in 3 months of Euro deposit = 166,089 x 1.0115

The forward market is marginally preferable to the money market hedge for the Sterling receipt expected after 3 months.

CQS plc should place sufficient Euros on deposit now so that, with accumulated interest, the six-month liability of 250,000 can be met. Since the company has no surplus cash at the present time, the cost of these Euros must be met by a short-term Pound Sterling loan.

Six-month Euro deposit rate = 3 5/2 = 1 75%

Current spot selling rate = 1 998 - 0 02 = 1 996 per

Six-month Pound Sterling borrowing rate = 61/2 = 35%

Euros deposited now = 250,000/1 175 = 2,45,700

Cost of these Euros at spot = 245,700/1 996 = 1,23,096

Pound Sterling value of loan in six months' time = 123,096 x 1 305 = 1,26,850

Forward market hedge

Six months forward selling rate = 1 979 - 0 04 = 1 975 per

Pound Sterling cost using forward market hedge = 2,50,000/1 975 = 1,26,582 Lead payment

Since the Euro is appreciating against the Pound Sterling, a lead payment may be worthwhile.

Pound Sterling cost now = 2,50,000/1 996 = 1,25,251

This cost must be met by a short-term loan at a six-month interest rate of 3 5%

Pound Sterling value of loan in six months' time = 1,25,251 x 1 305 = 1,29,071

The relative costs of the three hedges can be compared since they have been referenced to the same point in time, i.e. six months in the future. The most expensive hedge is the lead payment, while the cheapest is the forward market hedge. Using the forward market to hedge the account payable currency risk can therefore be recommended.

4.

(A) Forward Market

= $ 3,64,897

= 2,36,103

= $3,64,897 = $3,56,867 = 2,28,512

= 2,36,510

(i) Exposure

(ii) Forward Rate 1 = $1.5455

(iii) Outflow (6 month later) $3,64,897/$1.5455

(B) Cash (Money Market)

(i) Maturity in $ after 6 months

(ii) Present value of {$364897/(1 +(0.045/2))}

(iii) Borrow at spot to make up $3,56,867 (at 1 = $1.5617)

(iv) Amount to be discharged including interest 2,28,512 (1+0.07/2)

(C) Currency options =17.17 contracts

(i) Number of contracts 3,64,897/21,250 (can be rounded off to 17 contracts)

(ii) Exposure covered through put option 17*21,250 =$3,61,250

(iii) Balance to be covered through forward market $3647

(iv) Premia payable in (17X12,500X0.096) $20,400

(v) premia payable in 13,063 [use spot Bid]

Put option Forward

$361250 $3647

Exposure covered Premia

17 contract pyt. ($3,61,250/$1.70) Forward pyt.

13,063 -

2,12,500 -

2,360

2,25,563 2,360 Total outflow 2,27,923

Students may improve upon the above solution with 18 contracts that would result in excess dollars to be sold in the forward. The final answer is 2,27,554.

Strategy: Choose currency option because of lower cash outflow

Note :

The quote is indirect one.

the quote is for per pound, expressed in dollars

one unit or contract is equal to 12,500 of $21,250 (12,500 x 1.70)

Normally under direct quote situations, importing firm would hedge the positions by holding calloptions whereas UK based importing company would hedge by holding put option.

[Rationale: Instead of claiming purchase of dollars to settle the supplier, the UK company would sell pounds]

Similarly importing company used to purchase foreign currency at offer rate [selling price of Authorised dealer is the purchase price of importing company]. But in London on account of indirect quote, importers use bid rate.

Time value of money for the payment of premia is ignored.

For 18 contracts. The premia would be 13,831 [(13,063+17) x 18]. For excess dollars realised through put option, the importing company would buy pounds resulting in inflow.

When the put option lapses, the situation would be more favourable for the company and the maturity spot result in fewer outflows of pounds.

5. Report on the proposed Internet auction investment.

(a) Normally IT infrastructure requires major new investment after six years, therefore our period of the financial evaluation is six years. The adjusted present value technique (APV) will be used for the evaluation of the proposal requiring the estimation of the base case NPV of operating cash flows, and, separately, the present value of any financing side effects.

Assumptions:

(i) The market research is a sunk cost.

(iii) Working capital is assumed to be released at the end of year 6. Working capital in year 5 is assumed to increase by the 2% inflation rate in India.

(iii) The financing side effects of the investment are the tax relief on interest payments, the issue costs and the benefit from the government subsidy.

(i) The discount rate for the base case NPV should be the ungeared cost of equity, taking into account the risk of the investment. In order to reflect the risk of the investment, the ungeared equity beta of the Internet auction sector will be used.

Assuming corporate debt to be virtually risk free:

Beta ungeared = Beta equity x E

E+D (1-1)

Q-7

Beta ungeared = 1 42 x-= 1.035

67 + 33(1-0245)

Using CAPM

Keug = Rf + (Rm - Rf) Beta

Keug = 4% + (9 -5% - 4%) 1 '035 = 9 '69% rounded to 10%

10% will be used as the discount rate to estimate the base case NPV.

(ii) Tax relief on interest payments

The benefit from the tax shield will be estimated based upon the debt used for the investment, although it could be argued that this should be based upon the percentage debt capacity of the company.

Total borrowing for the investment is Rs.31,00,000

Annual tax relief on borrowing Rs.31,00,000 x 4'5% (net of the subsidy) x 0 '245 = Rs. 34,177.

The discount rate used will be the risk free rate as the tax relief is offered by a highly stable government in India.

The present value of tax relief for 6 years is: Rs. 34,177 x 5 '242 = Rs. 1,79,158

The benefit from the government subsidy is an interest saving of 1% per year. Rs. 31,00,000 x 1% = Rs.31,000

The present value for six years, discounted at the risk free rate, is Rs.31,000 x 5'242 = Rs.162,502

Issues costs are Rs.31,00,000 x 1 '5% = Rs.46,500 The estimated present value of the financial side effects is:

Rs. 1,79,158 + Rs. 1,62,502-Rs. 46,500 = Rs. 2,95,160

Revised financial data:

|

|

The expected base case NPV is (Rs. 2,810,000)

The estimated APV of the investment is (Rs.28,10,000) - Rs.2,95,160 = (Rs.25,14,840)

From a financial perspective this appears to be a very poor investment.

However, there are a number of other factors to consider. The data contains no information about what happens after four years, or in the case of the revised estimates, six years. Although major new investment would be needed after six years there is likely to be a realisable value or going concern value at that time which could be substantial. Several real options could exist at year six, including the option to reinvest and possibly expand operations, or perhaps to use the existing Internet auction clientele for other purposes such as Internet marketing. The initial investment decision should ideally take into account the expected present value from real call options such as these, although even if sophisticated option pricing models are used, real options are very difficult to accurately value. It would also be useful to investigate the effect on cash flow of the option to abandon the project part way through its expected life (effectively a put option).

(b) Although from financial perspective this proposal appears to be a very poor investment.

However, there are other important factors which need to be considered is as follows:

(i) The accuracy of data. How confident is Soft True that the forecast sales and costs will occur?

(ii) Sensitivity and/or simulation analysis would be useful to investigate the impact of different assumptions on net cash flows.

(iii) Has the risk of the venture been accurately assessed? The discount rate of the operating cash flows is based on CAPM, and is subject to its theoretical and practical problems.

(iv) Are there new technologies involved in the investment which are not yet fully developed and proven?

(v) What will be the reaction of other Internet auction providers? Will they cut auction listing costs?

(vi) Are there alternative investments that would provide a better strategic fit for Trosoft?

(vii) Are there existing or possible future government regulations that would affect the investment?

6 Step 1: Solve for the cost of capital used by the analyst by applying Free Cash Flow to

Firm (FCFF) Model as follows:

f Fi V fcff1

of Firm = V0 = -L

kc _ gn

where

FCFF1 = Expected FCFF kc = Cost of Capital gn = Growth rate forever Thus

Rs. 750 lakhs = Rs. 30 lakhs / (kc - g)

Since g = 5% then kc = 9%

Step 2: Let X be the weight of Debt

Given Cost of equity = 12%; Cost of debt = 6%

then

12% (1-X) + 6% X = 9%

Hence X = 0.50 : So book value weight for debt was 50%

Step3: Correct weights should be 75% of equity and 25% of debt Cost of capital = kc = 12 %( 0.75) + 6% (0.25) = 10.50%

Step 4: Correct firm value = Rs. 30 Lakhs /(0.105-0.05) = Rs. 545.45 lakhs

EBIT = Rs. 245 lakh

Interest = Rs. 218.125 lakh

PBT = Rs. 26.875 lakh

PAT = Rs. 17.2 lakh

Tax paid = Rs. 9.675 lakh

Tax rate = Rs. 9.675 /26.875 = 0.36 =36%

ii. Computation for increase in working capital

Working capital (2009) = Rs. 44 lakh

Increase in 2010 = Rs. 44 X 0.08 = Rs. 3.52 lakh

It will continue to increase @ 8% per annum.

iii. Weighted average cost of capital Present debt = Rs. 1934 lakh

Interest cost = Rs. 218.125 lakh / Rs. 1934 = 11.28 %

Equity capital = Rs. 75 lakh X Rs. 66 = 4950 lakh

4950 1934

Kc = x 16% +- x 11.28(1 - 0.36)

1934+4950 1934+4950

= 11.51 + 2.028 = 13.54

iv. As capital expenditure and depreciation are equal, they will not influence the free cash flows of the company.

|

v. Computation of free cash flows upto 2012 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Present value of free cash flows upto 2014 = Rs. 354.99 lakh vi. Cost of capital

Debt = 0.7 XRs. 1934 = Rs. 1353.8 lakh

Equity = Rs. 4950 lakh

4950 1353.8

Kc =-4950-x 16% +-13538 x 13.54 (1 - 0.36)=14.42%

4950 +1353.8 4950 +1353.8

viii. Continuing value

- x (1/1.1354)

240.336 ......_5

0.1442-0.06 = Rs. 1,512.735 lakh

(a) Value of the firm = PV of free cash flows upto 2005 + continuing value -

Market value of outstanding debt

= Rs. 354.99 lakh + Rs. 1,512.735 lakh - Rs. 1,353.80 lakh = Rs. 513.925 lakh

(b) Value per share = Rs. 513.925 lakh/ 75 lakh = Rs. 6.852 < Rs. 66

(present market price)

Therefore, the share price is overvalued in the market.

8. In order to convert obligation from fixed to floating Indian National Bank will have to pay 9 year Government of India security rate + 75 bp. Accordingly, the cost of interest over next 9 years will be as under:-

The current Government of India security price plus 75 bp will be the applicable rate for swap transaction. Therefore, effective cost during the current year will be

15% - (10.5% + 0.75%) + 11.25%

Further, the cost will change based on expected changes only in T-Bills.

Effective cost of funds

(1.15 x 1.148 x 1.1485 x 1.1490 x 1.1495 x 1.15 x 1.1505 x 1.151 x 1.1515)1/9 - 1 = .14977 say 14.98%

9. Firm's after-tax borrowing rate: 0.65 X 0.09 = 0.0585 = 5.85%

Consider first the choice between buying and a five-year financial lease. Ignoring salvage value, the incremental cash flows from leasing are shown in the following table:

'000

|

Year 0 |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 | |

|

Buy: 0.80 probability that contract will be renewed for 5 years | ||||||

|

Initial cost of plane |

500.00 | |||||

|

Depreciation tax shield |

-35.00 |

-35.00 |

-35.00 |

-35.00 |

-35.00 | |

|

Lease payment |

-75.00 |

-75.00 |

-75.00 |

-75.00 |

-75.00 |

- |

|

Lease payment tax shield |

26.25 |

26.25 |

26.25 |

26.25 |

26.25 |

. |

|

Total cash flow (1) |

451.25 |

-83.75 |

-83.75 |

-83.75 |

-83.75 |

-35.00 |

Buy: 0.20 probability that contract will not be renewed

Initial cost of plane 500.00 -

Depreciation tax shield - -35.00

Lease payment -75.00 -

Lease payment tax

shield 26.25 -

Total cash flow (2) 451.25 -35.00

Expected cash flow = 451.25 -74.00 -67.00 -67.00 -67.00 -28.00 0.80(1) + 0.20 (2)

PVF (at 5.85%) 1 0.9447 0.8925 0.8432 0.7966 0.7526

PV (at 5.85%) 451.25 -69.91 -59.80 -56.49 -53.37 -21.07

Total PV(at 5.85%) = 190.61

The table above shows an apparent net advantage to leasing of 190610.

However, if Ageit buys the plane, it receives the salvage value. There is an 80% probability that the plane will be kept for five years and then sold for 3,00,000 (less taxes) and there is a 20% probability that the plane will be sold for 4,00,000 in one year. Discounting the expected cash flows at the company cost of capital (these are risky flows) gives:

0.80 X

+0.20X

(1.14)5

(1.14/

J

=151200

The net gain to a financial lease is: ( 1,90,610 - 1,51,200) = 39,410

(Note that the above calculations assume that, if the contract is not renewed, Ageit can, with certainty, charge the same rent on the plane that it is paying, and thereby zero-out all subsequent lease payments. This is an optimistic assumption.)

The after-tax cost of the operating lease for the first year is:

(1-0.35) X 1,18,000 =76,700

Assume that a five-year old plane is as productive as a new plane, and that plane prices increase at the inflation rate (i.e., 4% per year). Then the expected payment on an operating lease will also increase by 4% per year. Since there is an 80% probability that the plane will be leased for five years, and a 20% probability that it will be leased for only one year, the expected cash flows for the operating lease are as shown in the table below:

'000

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Lease: 0.80 probability that contract will be renewed for 5 years

After-tax lease payment -76.70 -79.77 -82.96 -86.28 -89.73 0.00

Lease: 0.20 probability that contract will not be renewed

After-tax lease payment -76.70

Expected cash flow -76.70 -63.81 -66.37 -69.02 -71.78 0.00

PVF (at 14%) 1 0.8772 0.7695 0.6750 0.5921 0.5194

PV (at 14%) -76.70 -55.97 -51.07 -46.59 -42.50 0.00

Total PV (at 14%) =

-272.83

These cash flows are risky and depend on the demand for light aircraft. Therefore, we discount these cash flows at the company cost of capital (i.e., 14%). The present value of these payments is greater than the present value of the payments from the financial lease, so it appears that the financial lease is the lower cost alternative. Notice, however, our assumption about future operating lease costs. If old planes are less productive than new ones, the lessor would not be able to increase lease charges by 4% per year.

10. (i) (a) With Exchange Controls

|

Year |

Profit after tax SA$000 |

OJ share SA$000 |

50% div SA$000 |

OJ Share 000 |

Disc Factor @ 16% |

Disc Cash flow 000 |

|

0 |

(450) |

1.000 |

(450) | |||

|

1 |

4,250 |

2,125 |

1,062 |

106 |

0.862 |

91 |

|

2 |

6,500 |

3,250 |

1,625 |

108 |

0.743 |

80 |

|

3 |

8,350 |

4,175 |

2,088 |

100 |

0.641 |

64 |

|

4,775 |

227 |

0.641 |

146 | |||

|

Net Present Value |

(69) | |||||

|

(b) Exchange controls removed and all earnings distributed as dividends | ||||||||||||||||||||||||||||||||||||

|

(ii) If exchange controls exist in the south American Country the project has a negative and should not be undertaken, Investing in countries with a history of high inflation and political volatility adds to the risk of the project and OJ Ltd should proceeds with caution.

|

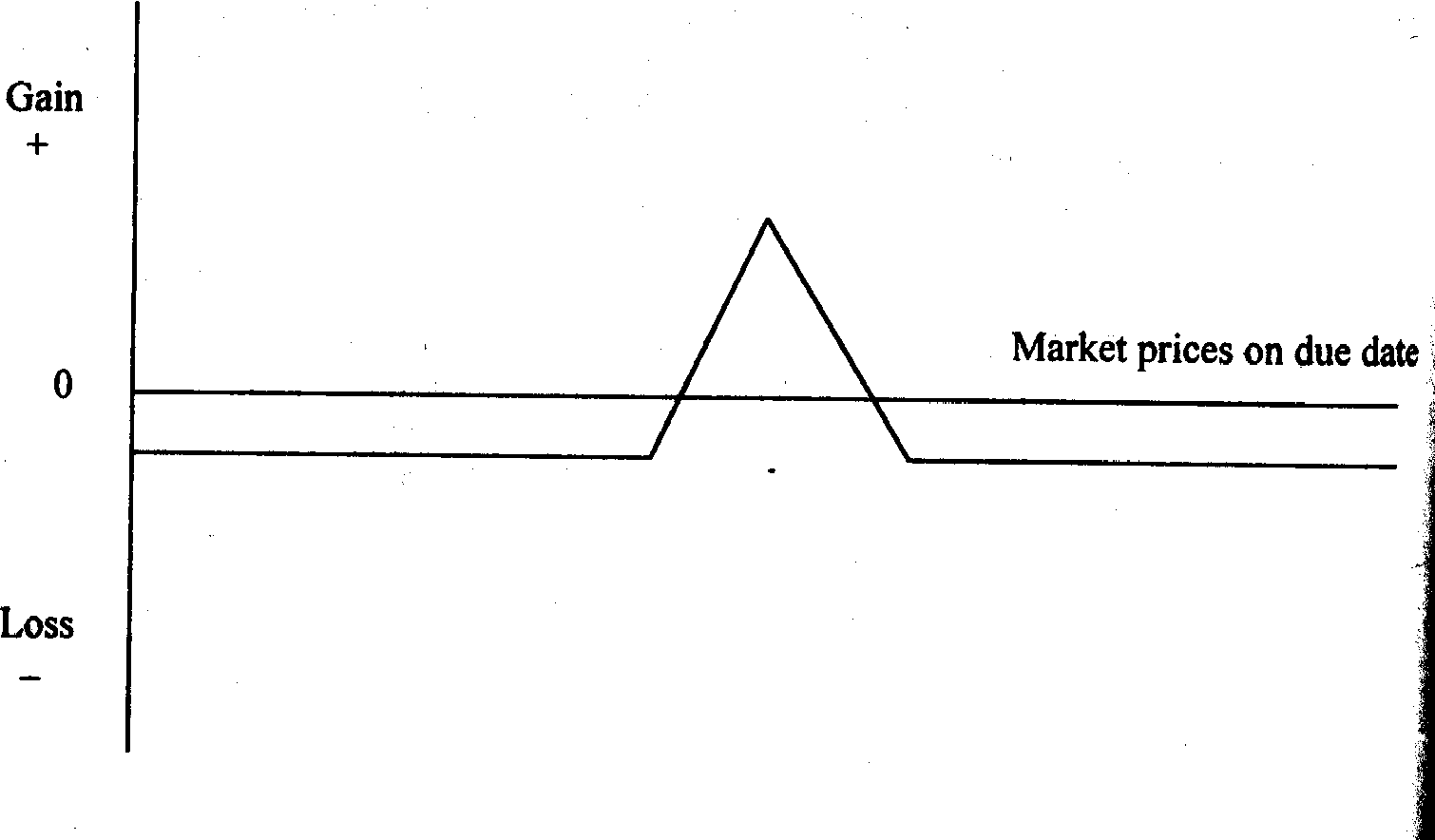

11. A butterfly spread can be constructed by buying a call option with a relatively low exercise price (Rs. 30) and buying a call with a relatively high strike price (Rs. 40) and also selling two call options with a strike price (Rs. 35/-) in between the high (Rs. 40) and low (Rs. 30). The pattern of pay off can be shown in tabular form as under: | |||||||||||||||||||||||||

|

|

Market Price on due date Rs. |

Pay off |

Net Premium - 4 + (2 x 2) - 1 = - 1 Rs. |

Total | |||

|

E = Rs.30, one Contract purchased |

E = Rs.35, two Contract sold |

E = Rs.40, one Contract purchased |

Total Pay-off |

Rs. | ||

|

20 |

0 |

0 |

0 |

0 | ||

|

22 |

0 |

0 |

0 |

0 | ||

|

24 |

0 |

0 |

0 |

0 | ||

|

26 |

0 |

0 |

0 |

0 | ||

|

28 |

0 |

0 |

0 |

0 | ||

|

30 |

0 |

0 |

0 |

0 | ||

|

32 |

2 |

0 |

0 |

2 |

+ 1 | |

|

34 |

4 |

0 |

0 |

4 |

+ 3 | |

|

35 |

5 |

0 |

0 |

5 |

+ 4 | |

|

36 |

6 |

-2 |

0 |

4 |

+ 3 | |

|

38 |

8 |

-6 |

0 |

2 |

+ 1 | |

|

40 |

10 |

-10 |

0 |

0 | ||

|

42 |

12 |

-14 |

2 |

0 | ||

|

44 |

14 |

-18 |

4 |

0 | ||

|

46 |

16 |

-22 |

6 |

0 | ||

|

48 |

18 |

-26 |

8 |

0 | ||

|

50 |

20 |

-30 |

10 |

0 | ||

12. Applying the Black Scholes Formula,

Diagrammatically

Value of the Call option now:

The Formula C = S.N(d1)-Ke(-Rt) N(d2 )

d2 = di CT Vt"

d2 = ln(S/K> + Rt - 0.5aVt

CTVt

Where,

C = Theoretical call premium

S = Current stock price

t = time until option expiration

K = option striking price

R = risk-free interest rate

N = Cumulative standard normal distribution

E = exponential term

a = Standard deviation of continuous compound rate. In = natural logarithim

= l"(10667)+(12%)0-5 + 0.5X0.4075:50

0.40V0.5

0.0645+0.06 .....

-+0.1414

0.40X0.7071

0.1245

+0.1414

0.2828

= 0.5817

d2 = 0.5817- 0.2828 = 0.2989

N(d1) = N (0.5817) = 0.7195 N(d2) = N (0.2989) = 0.6175 Value of option

C = S.N(d1) - Ke(-Rt)N(d2)

= Rs. 80 x N(d1) - [Rs.75/(1.0060)] x N(d2)

75

Price = Rs. 80 x 0.7195 -- x0.6175

1.0060

= Rs.57.56 - Rs.74.55 x 0.6175 = Rs.57.56 - Rs.46.04 = Rs.11.52

13. cDt = dividend per share for the current year

c = weightage given to the current earnings of the firm r = target payout ratio

EPSt = earnings per share for the current year Dt-1 = dividend per share for the previous year Dt - Dt-1 = target change Dt =target ratio X (EPSt - Dt-1)

12.9 = 0.55x0.4xEPSt + (1-0.55)11.1 EPSt = $35.93

Market capitalization = $ 35.93x8 x10,00,000= $ 28,74,40,000

Projected net income 2,000,000

Less projected capital investments (800,000)

Available residual 1,200,000

Shares outstanding 200,000

DPS =1,200,000/200,000 shares =6 = D1

(b) EPS = 2,000,000/200,000 shares = 10 Payout ratio = DPS/EPS = 6/10 = 60% or

Total dividends/NI = 1,200,000/2,000,000 = 60%

p r* r*

(c) Currently, P0 = =---= = 66.67

Ke - g 0.14 -0.05 0.09

Under the former circumstances, D1 would be based on a 20% payout on 10 EPS, or 2. With Ks = 14% and g=12%, we solve for P0:

Di 2 2

P0 = =-=-= 100

0 Ke -g 0.14-0.12 0.02

Although CMC has suffered a server setback, its existing assets will continue to provide a good income stream. More of these earnings should now be passed on to the shareholders, as the slowed internal growth has reduced the need for funds. However, the net result is a 33 % decrease in the value of the shares.

(d) If the payout ratio were continued at 20%, even after internal investment opportunities had declined, the price of the stock would drop to 2/(0.14-0.06) =25 rather than to 66.67. Thus, an increase in the dividend payout is consistent with maximizing shareholder wealth.

Because of the downward-sloping IOS curve, the greater the firm's level of investment, the lower the average ROE. Thus, the more money CMC retains and invests, the lower its average ROE will be. We can determine the average ROE under different conditions as follows.

Old situation (with founder active and 20% payout):

g = (1.0-Payout ratio)(Average ROE)

12%= (1.0-0.2) (Average ROE)

Average ROE = 12%/0.8 = 15% > ke = 14%

Note that the average ROE is 15 %, whereas the marginal ROE is presumably equal to 14 %.

New situation (with founder retired and a 60 % payout) g = 6 %=( 1.0-0.6) (ROE)

ROE=6%/0.4=15% > ks=14%

This suggests that the new payout is appropriate and that the firm is taking on investments down to the point at which marginal returns are equal to the cost of capital.

Assumption: Though in the question it is assumed that there is no operating synergy and so no increase on the combined earnings; it is unlikely a bid would be launched if substantial synergy was not estimated.

Share for share offer

AB Ltd.

1,266.00

379.80

YZ Ltd.

1,125.00

337.50

Combined

2,391.00

717.30

Profit before tax (Rs. lakh) Less: Tax @ 30%

Profit after Tax Number of shares (lakh)

886.20

787.50

1,673.70

25.00

18.00

40.00

Earnings Per Share (Rs.) 35.45 43.75 41.84

P/E ratio 11 7

Share price (pre bid) (Rs.) 389.93 306.25 381.52*

Market Value of company (Rs. lakh) 9,748.20 5,512.50 15,260.70

* Rs15,260 70lakh = Rs. 381.52 40 lakh

Post Bid Price (Combined Entity)

Rs. 41.84 X 11 = Rs. 460 per share Share for Cash offer

Rs. 460 per share

Thus cash offer is more beneficial for AB Ltd.

Reasons (partially) for the fall in the market price of the shares in the market

Wealth of a shareholder of YZ Ltd. holding 6 shares in YZ Ltd. (Rs.306.25 X 6) Rs. 1,837.50 Wealth of a shareholder of YZ Ltd. holding 5 shares in combined entity (Rs.381.52X 5) Rs. 1,907.60 Thus there seems to be transfer of wealth from the AB Ltd. to YZ Ltd.

Value of shares using the Dividend Growth Model

35.45X1.04)

AB = (35X1.04) = Rs.409.66

(0.13 - 0.04)

43.75X1.04)

YZ = (4375X1 04> = Rs.650.00

(0.11-0.04)

This would suggest that AB is slightly undervalued, but that YZ is hugely undervalued in the marketplace. It is possible that the market does not believe YZ's growth estimates, given its poor performance to date.

16. The rates of return in different scenarios should be changed in to rupee pay - off per share as indicated below:

|

Stock |

Price |

Price under various Macroeconomic Scenarios | ||

|

Rs. |

Recession |

Moderate Growth |

Boom | |

|

Him Ice Ltd. |

12 |

12(1-0.12) = 10.56 |

12(1+0.15) = 13.8 |

12(1+0.35) = 16.20 |

|

Kalahari Biotech |

18 |

18(1+0.20) = 21.60 |

18(1 +0.12)=20.16 |

18(1 -0.05)=17.10 |

|

e! PS |

60 |

60(1 +0.18)=70.80 |

60(1 +0.20)=72.00 |

60(1 +0.15)=69.00 |

Construction of an arbitrage portfolio requires formation of a zero investment portfolio. The essential condition is that portfolio must not give a negative return.

If we short sell two stocks each of the Him Ice Ltd and Kalahari Biotech one stock of Puma Softech can be purchased and this portfolio will qualify as zero investment portfolio.

(-2) x Rs.12 + (-2) x Rs.18 + Rs.60 = 0

|

The payoff from this arbitrage portfolio under different market conditions: | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

Net payoff from the portfolio clearly shows that this is an arbitrage portfolio as it has produced positive return in all the market scenarios.

| |||||||||||||||||||||||||||||||||||

|

n = 5; Y = 0.138; X = 0.04 |

y = a + Px

o = nExy - (EX) (EY) = 5(0.0495) - (0.69)(0.2) = 0 277 nEX2 - (EX)2 5(0.087) - (0.2)2 '

Alpha = Y - p X = 0.138 - 0.277(0.04) = 0.1269

|

Regression equation Y = 0.1269 + 0.277 X | |||||||||||||||||||||||||||||||||||||||||||||||||

|

X N(Rx -Rx)2 = 0.1256

aY -Ry)2 = 0.1439

Total risk (Variance of the security return)

(Ry Ry )2 /N = 0.0207

Rx

Ry Ry

= 0.00438

1 N

vxy = 77 Rx N

Covxy R =- = 0.242

X Y

r2 = Coefficient of determination = 0.059 Unsystematic risk = (1- 0.059) x 0.0207 = 0.019

1 - 2

b. Total variance for Stock A is (RY Ry)2 = 0.0207

N Y

Explained by Index = 0.059 x 0.0207 = 0.0012 18. Constant Ratio Plan:

|

Stock Portfolio NAV (Rs.) |

Value of buy -hold strategy (Rs.) |

Value of Conservative Portfolio (Rs.) |

Value of aggressive Portfolio (Rs.) |

Total value of Constant Ratio Plan (Rs.) |

Revaluation Action |

Total No. of units in aggressive portfolio |

|

40.00 |

2,00,000 |

1,00,000 |

1,00,000 |

2,00,000 |

- |

2500 |

|

25.00 |

1,25,000 |

1,00,000 |

62,500 |

1,62,500 |

- |

2500 |

|

1,25,000 |

81,250 |

81,250 |

1,62,500 |

Buy 750 units |

3250 | |

|

36.00 |

1,80,000 |

81,250 |

1,17,000 |

1,98,250 |

- |

3250 |

|

1,80,000 |

99,125 |

99,125 |

1,98,250 |

Sell 496.53 units |

2753.47 | |

|

32.00 |

1,60,000 |

99,125 |

88,111.04 |

1,87,236.04 |

- |

2753.47 |

|

38.00 |

1,90,000 |

99,125 |

1,04,631.86 |

2,03,756.86 |

- |

2753.47 |

|

1,90,000 |

1,01,878.43 |

1,01,878.43 |

2,03,756.86 |

Sell 72.46 units |

2681.01 | |

|

37.00 |

1,85,000 |

1,01,878.50 |

99,197.37 |

2,01,075.87 |

- |

2681.01 |

|

42.00 |

2,10,000 |

1,01,878.50 |

1,12,602.42 |

2,14,480.92 |

- |

2681.01 |

|

43.00 |

2,15,000 |

1,01,878.50 |

1,15,283.43 |

2,17,161.93 |

- |

2681.01 |

|

50.00 |

2,50,000 |

1,01,878.50 |

1,34,050.50 |

2,35,929 |

- |

2681.01 |

|

2,50,000 |

1,17,964.50 |

1,17,964.50 |

2,35,929 |

Sell 321.72 units |

2359.29 | |

|

52.00 |

2,60,000 |

1,17,964.50 |

1,22,683.08 |

2,40,647.58 |

- |

2359.29 |

|

Hence, t |

he ending value of the mechanical strategy is Rs.2,40,647.58 and buy & ho | |||||

strategy is Rs.2,60,000.

|

Scheme |

Investment |

Unit Nos. |

Unit NAV 31.3.2009 |

Total NAV 31.3.2009 | |

|

Rs. |

Rs. |

Rs. | |||

|

MFA |

50,000 |

4761.905 |

10.40 |

49,523.812 | |

|

MFB |

1,00,000 |

10,000 |

10.10 |

1,01,000 | |

|

MFC |

50,000 |

5,000 |

9.80 |

49,000 | |

|

Scheme |

NAV Dividend (+) / ) Received |

Total Yield |

Number of days |

Effective Yield (% P.A.) | |

|

Rs. |

Rs. |

Rs. | |||

|

MFA (-)476.188 |

950 |

473.812 |

121 |

2.858% | |

|

MFB (+)1,000 |

1,500 |

2,500 |

90 |

10.139% | |

|

MFC (-)1,000 |

Nil |

(-)1,000 |

31 |

(-)24% | |

|

The Expected Return of the equity share may be found as follows: | |||||

|

Market Condition |

Probability |

Total Return |

Cost (*) |

Net Return | |

|

Good |

0.25 |

Rs. 124 |

Rs. 100 |

Rs. 24 | |

|

Normal |

0.50 |

Rs. 112 |

Rs. 100 |

Rs. 12 | |

|

Bad |

0.25 |

Rs. 100 |

Rs. 100 |

Rs. 0 | |

|

Expected Return = |

(24 x 0.25) + (12 |

x 0.50) + (0 x 0.25) = |

= 12 | ||

jx 100 = 12% 100 )

The variability of return can be calculated in terms of standard deviation.

V SD = 0.25 (24 - 12)2 + 0.50 (12 - 12)2 + 0.25 (0 - 12)2 = 0.25 (12)2 + 0.50 (0)2 + 0.25 (-12)2 = 36 + 0 + 36 SD = V72

SD = 8.485 or say 8.49

(*) The present market price of the share is Rs. 106 cum bonus 10% debenture of Rs. 6 each; hence the net cost is Rs. 100 (There is no cash loss or any waiting for refund of debenture amount).

M/s X Finance company has offered the buyback of debenture at face value. There is reasonable 10% rate of interest compared to expected return 12% from the market.

Considering the dividend rate and market price the creditworthiness of the company seems to be very good. The decision regarding buy-back should be taken considering the maturity period and opportunity in the market. Normally, if the maturity period is low say up to 1 year better to wait otherwise to opt buy back option.

21. EVA = Income earned - (Cost of capital x Total Investment)

Total Investments

Particulars Amount

Working capital Rs. 20 lakhs

Property, plant, and equipment Rs. 80 lakhs

Patent rights Rs. 40 lakhs

Total Rs. 140 lakhs

Cost of Capital 15%

EVA = Rs. 12 lakh - (0.15 x Rs. 140 lakhs) = Rs. 12 lakh - Rs. 21 lakh = -Rs. 9 lakh Thus Herbal Gyan has a negative EVA of Rs. 9 lakhs.

22. a. Base case NPV = -Rs. 10,00,00,000 + (Rs. 85,00,000/0.10) = -Rs. 1,50,00,000

PV (tax shields) = 0.35 x Rs. 4,00,00,000 = Rs. 1,40,00,000

APV = -Rs. 1,50,00,000+Rs. 1,40,00,000= -Rs. 10,00,000

b. PV(tax shields, approximate) = (0.35 x 0.07 x Rs. 4,00,00,000)/0.10 = Rs. 98,00,000

APV = -Rs. 1,50,00,000+ Rs. 98,00,000= -Rs. 52,00,000

PV (tax shields, exact) = Rs. 98,00,000 x (1.10/1.07) = Rs. 1,00,74,766

APV = -Rs. 1,50,00,000 + Rs. 1,00,74,766 = -Rs. 49,25,234

The present value of the tax shield is higher when the debt is fixed and therefore the tax shield is certain. When borrowing a constant proportion of the market value of the project, the interest tax shields are as uncertain as the value of the project, and therefore must be discounted at the project's opportunity cost of capital.

23. (i) Semi-annual fixed payment = (N) (A/c) (Period)

Where N = Notional Principal amount = Rs.5,00,000 A/c = All-in-cost = 8% = 0.08

= 5,00,000 x 0.08 (0.5) = 5,00,000 x 0.04 = Rs.20,000/-

Floating Rate Payment = N (LIBOR)

V 360 y 181

= 5,00,000 x 0.06 x -

360

= 5,00,000 x 0.06 (0.502777)

= 5,00,000 x 0.30166 = Rs. 15,083

(iii) Net Amount = (i)- (ii)

= Rs.20,000 - Rs. 15,083 = Rs. 4,917

24. Lintner developed a simple model which is consistent with following "stylized facts:

1. Firms have long-run target dividend payout ratios. Mature companies with stable earnings generally pay out a high proportion of earnings; growth companies have low payouts (if they pay any dividends at all).

2. Managers focus more on dividend changes than on absolute levels. Thus, paying a $2.00 dividend is an important financial decision if last year's dividend was $1.00, but no big deal if last year's dividend was $2.00.

3. Dividend changes follow shifts in long-run, sustainable earnings. Managers "smooth dividends. Temporary earnings changes are unlikely to affect dividend payouts.

4. Managers are reluctant to make dividend changes that might have to be reversed. They are particularly worried about having to rescind a dividend increase.

This model explains the dividend as follows:

Suppose that a firm always stuck to its target payout ratio. Then the dividend payment in the coming year (DIV1) would equal a constant proportion of earnings per share (EPS1):

DIV1 = target dividend

= target ratio X EPS1

The dividend change would equal

DIV1 - DIV0 = target change

=target ratio X EPS1 - DIV0

A firm that always stuck to its target payout ratio would have to change its dividend whenever earnings changed. But as per Lintner's survey managers were reluctant to do

this. They believed that shareholders prefer a steady progression in dividends. Therefore, even if circumstances appeared to warrant a large increase in their company's dividend, they would move only partway toward their target payment. Their dividend changes therefore seemed to conform to the following model:

DIVi - DIV0 = adjustment rate X target change

= adjustment rate X (target ratio X EPSi - DIV0)

The more conservative the company, the more slowly it would move toward its target and, therefore, the lower would be its adjustment rate.

Lintner's simple model suggests that the dividend depends in part on the firm's current earnings and in part on the dividend for the previous year, which in turn depends on that year's earnings and the dividend in the year before. Therefore, if Lintner is correct, we should be able to describe dividends in terms of a weighted average of current and past earnings as follows:

DIVt = aT(EPS t) + (1 - a)DIVt-i

Where DIVt = Dividend for the Current Year

DIVt-i= Dividend for the Previous Year

T = Target Payout Ratio

a= Adjustment Rate

EPS t = Earning Per Share of the Current Year

The probability of an increase in the dividend rate should be greatest when current earnings have increased; it should be somewhat less when only the earnings from the previous year have increased; and so on.

The model establishing the relationship between current year's DPS with current year's EPS and previous year's DPS otherwise known as lagged dividend is explained below:

Dt = a + blEt + b2Dt-i+ eti

Where,

Dt= DPS in period t,

Et = EPS in period t,

Dt-i = DPS in period t-1, e = error term,

a, b, c are constants and subscript i represents the company.

The essential elements of Lintner's "partial adjustment modelof dividends are:

- Managers have target dividend/profits payout ratios

- Mangers believe shareholders prefer pay-outs to remain constant or rise slowly

- Managers therefore will move only partly toward their target payout ratio each year

Tests have found his model constitutes a very good predictor of dividend behavior. Of three dividend polices, the stable rupee dividend is by far the most common. In a study by Lintner, corporate managers were found to be reluctant to change the dollar amount of the dividend in response to temporary fluctuations in earning from year to year. This aversion was particularly evident when it came to decreasing the amount of the dividend from the previous level. Thus, a corporate manager makes every effort to avoid a dividend cut, attempting instead to develop a gradually increasing dividends series over the long-term future. However, if a dividend reduction is absolutely necessary, the cut should be large enough to reduce the probability of future cuts.

25. (i) Drawbacks of investment in mutual funds

(a) There is no guarantee of return as some Mutual Funds may under perform and Mutual Fund Investment may depreciate in value which may even effect erosion / Depletion of principal amount

(b) Diversification may minimize risk but does not guarantee higher return.

(c) Mutual funds performance is judged on the basis of past performance record of various companies. But this can not take care of or guarantee future performance.

(d) Mutual Fund cost is involved like entry load, exit load, fees paid to Asset Management Company etc.

(e) There may be unethical Practices e.g. diversion of Mutual Fund amounts by Mutual Fund /s to their sister concerns for making gains for them.

(f) MFs, systems do not maintain the kind of transparency, they should maintain

(g) Many MF scheme are, at times, subject to lock in period, therefore, deny the market drawn benefits

(h) At times, the investments are subject to different kind of hidden costs.

(i) Redressal of grievances, if any , is not easy

|

Employee Stock Option Scheme means a scheme under which the company grants option to employees. Auditors' Certificate to be placed at each AGM stating that the scheme has been implemented as per the guidelines and in accordance with |

Employee Stock Purchase Scheme means a scheme under which the company offers shares to employees as a part of public issue. No such Certificate is required. |

It is transferable after lock in period.

Not applicable.

the special resolution passed.

Transferability

It is not transferable.

Consequences of failure

The amount payable may be forfeited. If the option are not vested due to non-fulfillment of condition relating to vesting of option then the amount may be refunded to the employees.

Lock in period

Minimum period of 1 year shall be there between the grant and vesting of options. Company is free to specify the lock in period for the shares issued pursuant to exercise of option.

4

5

One year from the date of allotment. If the ESPS is part of public issue and the shares are issued to employees at the same price as in the public issue, the shares issued to employees pursuant to ESPS shall not be subject to any lock in.

(iii) Factoring and Bill discounting: The main differences between Factoring and Bill

discounting are:

(1) While factoring is management of book-debts, bill discounting is a sort of borrowing from commercial banks.

(2) In factoring no grace period is given, whereas in bill discounting grace period is 3 days.

(3) For factoring there is no Specific Act, whereas in case of bill discounting Negotiable Instruments Act applies.

(4) Factoring is a portfolio of complementary financial services whereas bill discounting is usually on case to case basis.

(5) In factoring the basis of financing is turnover. Whereas in bill discounting it is the security provision as well as the requirement of finance which determine the amount of financing.

(6) In factoring the risk of bad debts is passed on to the factor, whereas in bill discounting it is still retained by the business.

100

|

Attachment: |

| Earning: Approval pending. |