The Institute of Chartered Financial Analysts of India University 2010 C.A Chartered Accountant Integrated Professional Competence (IPCC) Revision Test s- 1–Accounting - Question Paper

May 2010: The Institute of Chartered Accountants of India - Revision Test ques. papers (RTPs) Integrated Professional Competence Course (IPCC) Examination: Paper one Accounting: May 2010 University ques. paper

PAPER- 1 : ACCOUNTING

QUESTIONS

Profit or Loss Prior to Incorporation

1. A firm which was carrying on business from 1st January, 2009 gets itself incorporated as a company on 1st May, 2009. The first accounts are drawn up to 30th September, 2009. The gross profit for the period is Rs.56,000. The general expenses are Rs.14,220, directors' fee Rs.12,000 p.a.; formation expenses Rs.1,500. Rent up to 30th June is Rs.1,200 p.a., after which it is increased to Rs.3,000 per annum. Salary of the manager, who upon incorporation of the company was made a director, is Rs.6,000 p.a. His remuneration thereafter is included in the above figure of fee to directors.

Give Profit and Loss Account showing pre-and post-incorporation profits. The net sales are Rs.8,20,000, the monthly average of which, for the first four months of 2009 is half of that of the remaining period, the company earned a uniform profit. Interest and tax may be ignored.

Investment Accounts

2. On 1.4.2009, Shridhar has 2,500 equity shares of A' Ltd., at a book value of Rs.15 per share (Face value Rs.10). On 20th June, he purchased another 500 shares of the company @ Rs.16 per share. The directors of A Ltd., announced a bonus and rights issue. No dividend was payable on these issues. The terms of the issue are as follows:

Bonus basis 1 : 6 (Date 16th August).

Rights basis 3 : 7 (Date 31st August) Price Rs.15 per share.

Due date for payment - 30th September.

1

Shareholders can transfer their rights in full or in part. Accordingly, Shridhar sold 33-%

of his entitlement to Manohar for a consideration of Rs.2 per share and exercised the remaining rights.

Dividends for the year ended 31st March at the rate of 20% were declared by A Ltd., and received by Shridhar on 31st October. Dividends for shares acquired by him on 2nd June are to be adjusted against the cost of purchase.

On 15th November, Shridhar sold 2,500 equity shares at a premium of Rs.5 per share.

Required: Prepare Investment Account in the books of Shridhar.

For your exercise, assume that the books are closed on 31.12.2009 and shares are valued at average cost.

Accounting for Hire Purchase Instalments

3. From the following information extracted from the books of Perfect Investment Pvt. Ltd. prepare Hire Purchase Trading account for the year ended 31.3.2009, showing the profit in respect of the hire-purchase business of the company:

(i) Instalments due but not received on 1.4.2008 - Rs.60,000.

(ii) Instalments due but not received on 31.3.2009 - Rs. 1,00,000.

(iii) Cash received during the financial year 2008-2009 by way of a hire-purchase Instalments Rs.80,00,000.

(iv) Value of Stock out' on hire-purchase as at 1.4.2008 at hire-purchase price (loading 20% above cost) Rs.2,40,000.

(v) (a) Cost price of truck out' on hire-purchase as at 31.3.2009 - Rs.40,00,000.

(b) Total amount of instalments receivable in respect of v (a) above Rs.48,00,000.

(c) Total amount of instalments received and due up to 31.3.2009 in respect of v

(b) above Rs.36,00,000.

(vi) Purchase of trucks during the financial year 2008-09 Rs.80,00,000.

(vii) Sale of trucks, otherwise than on H.P. (at a profit of 6.25% of cost thereof), Rs.8,50,000.

(viii) Body building charges in respect of truck, sold on H.P. Rs.4,00,000.

(ix) Interest paid was Rs.80,000 and unsold trucks on 31.3.2009 at cost price were Rs.1,60,000 (Hire-purchase price Rs.1,92,000).

Insurance Claim for Loss of Stock

4. The premises of Sad Ltd. caught fire on 22nd January, 2010 and the stock was damaged. The firm made up accounts to 31 March each year and on 31st March, 2009 the stock at cost was Rs. 13,27,200 as against Rs. 9,62,200 on 31st March 2008.

Purchases from 1st April, 2009 to the date of fire were Rs. 34,82,700 as against Rs.

45.25.000 for the full year 2008-09 and the corresponding sales figure were Rs.

49.17.000 and Rs. 52,00,000 respectively.

You are given the following further information:

(i) In July, 2009, goods costing Rs. 1,00,000 were given away for advertising purposes, no entries being made in the books.

(ii) During 2009-2010, a clerk misappropriated unrecorded cash sales. It is estimated that the defalcation averaged Rs.2000 per week from 1st April, 2009 until the clerk was dismissed on 18th August, 2009.

(iii) The rate of gross profit is constant.

From the above information, make an estimate of the stock in hand on the date of fire. Managerial Remuneration

5. Calculate the managerial remuneration from the following particulars of Astha Ltd. due to the managing director of the company at the rate of 5% of the profits. Also determine the excess remuneration paid, if any:

|

Rs. | |

|

Net Profit |

2,00,000 |

|

Net Profit is calculated after considering the following: | |

|

Depreciation |

40,000 |

|

Preliminary expenses |

10,000 |

|

Tax provision |

3,10,000 |

|

Director's fee |

8,000 |

|

Bonus |

15,000 |

|

Profit on sale of fixed assets (original cost: Rs.20,000 written down | |

|

value:Rs.11,000) |

15,500 |

|

Provision for doubtful debts |

9,000 |

|

Scientific research expenditure (for setting up new machinery) |

20,000 |

|

Managing Director's remuneration paid |

30,000 |

|

Other information: | |

|

Depreciation allowable under Schedule XIV of the Companies Act |

35,000 |

|

Bonus liability as per Payment of Bonus Act, 1965 |

18,000 |

Self Balancing Ledgers

6. On 1st April, 2009 the details of the balances owed by customers were as following:-

Rs.

A 1,500

B (Considered to be 60% bad; adequate provision maintained) 2,100

C 1,800

Others 35,600

41.000

Less: Advance by E 2,000

39.000

Sales during the month totaled Rs.1,55,500 including Rs. 1, 11,400 as cash sales; of the credit sale, a sale of Rs.2,600 was to E. A returned goods to the extent of Rs.500 and sent a bill receivable accepted by X for the balance. A sum of Rs.450 was received from B and the balance was written off. On instructions from Y. C's balance was transferred to Y's account in the Creditors Ledger. X's acceptance as dishonoured and noting charges were Rs.10. G sent an advance of Rs.1,800 for supply of goods. Out of the amount due from "others on April 1, 2009 a sum of Rs.27,300 was received; the customers had earned 21/2% discount on the amount paid. Similarly, out of the sales in April, a sum of Rs.9,750 had been received, earning discount at the same rate.

F who owed Rs.1,100 and G who owed Rs.800 turned doubtful; a provision of 50% of the amounts due was created. All other debts were considered good.

Prepare Total Debtors account for April 2009.

Partnership -Admission cum Retirement

7. Glad and Happy, who make up their accounts to 30 September in each year, carried on business in partnership under the firm name of Feelings.

Their partnership agreement provided:

(1) Profits and losses should be shared Glad - two-third and Happy - one-third.

(2) Interest on capital accounts should be allowed at the rate of 6% per annum but no interest should be allowed or charged on current accounts.

(3) On the retirement or admission of a partner:

(i) If the change takes place during any accounting year, such partner's share of profits or losses for the period up to retirement or from admission is to be arrived at by apportionment on a time basis except where otherwise agreed.

(ii) No account for goodwill is to be maintained in the firm's books, any adjusting entries for transactions between the partners being made in their capital accounts.

(iii) Any balance due to an outgoing partner is to carry interest at 8% per annum from the date of his retirement to the date of payment.

Glad retired from the firm on 31st March 2009 and, on the same day, Happy took into partnership Joy, an employee of the firm. It was agreed that the terms of the previous partnership agreement should apply in all respects except that, as from the date, profits or losses are to be shared: Happy - three-fifth, Joy - two-fifth.

The trial balance extracted from the books of the firm as on 30th September 2009 was as

follows:

Particulars Rs. Rs.

Capital Accounts - 30 September 2009

Glad - 8,000

Happy - 6,000

Current Accounts - 30 September 2009

Glad - 2,400

Happy - 1,600

Joy - Cash introduced 31st March, 2009 - 3,000

Plant and machinery at cost 14,000 -

Plant and machinery: Provision for depreciation -30th September, - 2,800

2008

Motor vehicles at cost

Motor vehicles: provision for depreciation - 30th September 2008 Purchases

6,200 -- 3,400

62,000

12,400

14,600

10,800

4,600

- 96,000 1,600 -

1,400

600

1,200

Stock - 30th September 2008

Wages

Salaries

Debtors

Sales

Trade expenses Creditors Rent and rates Bad debts Balance at bank

1,29,400 1,29,400

You are given the following further information:

(1) The value of the firm's goodwill as on 31st March 2009 was agreed to be Rs.12,000.

(2) On 31st March, 2009, Joy had paid Glad Rs.5,000 on account of the balance due to him on retirement. But no entry had been made in the books in respect of this payment. The balance due to Glad after taking into account this payment remained unpaid as on 30th September, 2009.

(3) Glad on retirement had taken over one of the firm's motor vehicles and it was agreed that he should be charged for it at its written down value on the date of his retirement. The vehicle had cost Rs.1,400 and up to 30th September, 2009 depreciation of Rs.625 had been provided on it.

(4) The stock as on 30th September 2009 was valued at Rs.14,200.

(5) Partners' drawings which are included in salaries were as follows:

Glad Rs.1,800; Happy Rs.2,400; Joy Rs.900.

(6) Salaries also included Rs.1,200 paid to Joy prior to his being admitted as a partner and which is to be charged against the half-year profits of the firm.

(7) Professional charges of Rs.250 included in trade expenses are specifically attributable to the second half of the year.

(8) The whole of the charge of Rs.600 for bad debts related to the period upto 31st March, 2009.

(9) A bad debts provision specifically, attributable to the second half of the year of 5% of the total debtors is to be made as on 30th September 2009.

(10) As on 30th September 2009, rent paid in advance amounted to Rs.400 and trade expenses accrued amounted to Rs.180.

(11) Provision is to be made for depreciation on plant and machinery and on motor vehicles at the rates of 10% and 25% per annum respectively, calculated on cost.

You are required to prepare:

(a) The Trading and profit and loss account for the year ended 30th September 2009.

(c) The balance sheet as on that date.

Accounting for Not for Profit Organisation

8. The accountant of City Club gave the following information about the receipts and payments of the club for the year ended 31st March, 2009:

Receipts: Rs.

Subscriptions Fair receipts

690

22,350

Variety show receipts (net)

Interest

Bar collections

Payments:

Premises

30.000 2,400 3,780 1,410 5,350 2,520 7,170

11.000 17,310

960

37,800

Rent

Rates and taxes Printing and stationary Sundry expenses Wages

Fair expenses Honorarium to secretary Bar purchases (payments)

Repairs

New car (less proceeds of old car Rs. 9,000)

The following additional information could be obtained:-

1.4.2008 31.3.2009

Rs.

450

24,420

Rs.

Nil

Cash in hand

Bank balance as per cash-book

| |||||||||||||||||||||||||||

|

provided at 5% on written down value. Depreciation on new car is to be provided at 20%. |

You are required to prepare the Receipts and Payments Account and Income and Expenditure Account for the year ended 31.3.2009.

Accounts from Incomplete Records

9. The following information relates to the business of Mr. Shiv Kumar, who requests you to prepare a Trading and Profit & Loss Account for the year ended 31st March, 2009 and a Balance Sheet as on that date:

|

Balance as on 31st |

Balance as on 31st | |

|

March, 2008 |

March, 2009 | |

|

Rs. |

Rs. | |

|

Building |

3,20,000 |

3,60,000 |

|

Furniture |

60,000 |

68,000 |

|

Motorcar |

80,000 |

80,000 |

|

Stocks |

- |

40,000 |

|

Bills payable |

28,000 |

16,000 |

|

Cash and Bank balances |

1,80,000 |

1,04,000 |

|

Sundry Debtors |

1,60,000 |

- |

|

Bills receivable |

32,000 |

28,000 |

|

Sundry Creditors |

1,20,000 |

- |

|

Cash transactions during the year included the following besides certain other | ||

|

items: | ||

|

Rs. |

Rs. | |

|

Sale of old papers and |

Cash purchases |

48,000 |

|

miscellaneous income |

20,000 Payment to creditors 1,84,000 | |

|

Miscellaneous Trade expenses |

Cash sales |

80,000 |

|

(including salaries etc.) |

80,000 | |

|

Collection from debtors |

2,00,000 | |

(c) Other information:

(i) Bills receivable drawn during the year amount to Rs. 20,000 and Bills payable accepted Rs. 16,000.

(ii) Some items of old furniture, whose written down value on 31st March, 2008 was Rs. 20,000 was sold on 30th September, 2008 for Rs. 8,000. Depreciation is to be provided on Building and Furniture @ 10% p.a. and on Motorcar @ 20% p.a. Depreciation on sale of furniture to be provided for 6 months and for additions to Building for whole year.

(iii) Of the Debtors, a sum of Rs. 8,000 should be written off as Bad Debt and a reserve for doubtful debts is to be provided @ 2%.

(iv) Mr. Shivkumar has been maintaining a steady gross profit rate of 30% on turnover.

(v) Outstanding salary on 31st March, 2008 was Rs. 8,000 and on 31st March, 2009 was Rs. 10,000 on 31st March, 2008. Profit and Loss Account had a credit balance of Rs. 40,000.

(vi) 20% of total sales and total purchases are to be treated as for cash.

(vii) Additions in Furniture Account took place in the beginning of the year and there was no opening provision for doubtful debts.

Average Due Date

10. A' lent Rs. 25,000 to B' on 1st January, 2009. The amount is repayable in 5 half-yearly installments commencing from 1st January, 2010. Calculate the average due date and interest @ 10% per annum.

Cash Flow Statement

11. MNG Fertilizers presents the following Balance Sheets as at 31.3.2009 and 31.3.2008.

You are required to prepare cash flow statement.

Balance Sheet (Rs. in thousand) 31.3.2009 31.3.2008

Equity share capital 8,500 7,000

General Reserve 3,800 4,000

Profit and Loss Account 0 250

Share Premium Account 1,500 750

Shareholders' Funds 13,800 12,000

Secured Loans 4,800 5,000

Unsecured Loans 5,350 4,000

Loan Funds 10,150 9,000

Sources 23,950 21,000

Fixed Assets

22,400

3,450

18,950

1,860

1,650

17,800

0

2,320

2,510

1,090

120

1,700

_0

5,420

1,050

30

0

3,400

4,480

2,600

1,200

280

200

500

4,780

1,200

0

500

2,800

4,500

(B)

940

550

280

600

23,950

21,000

Gross Block

Less: Accumulated Depreciation Net Block

Capital work-in-progress Investments

Current Assets, Loans and Advances

Inventories

Debtors

Cash & Bank Balances Loans

Advance Tax

Less: Creditors Outstanding expenses Tax Provision Proposed Dividend

Net Current Assets (A) - (B) Miscellaneous Expenditure Applications Other information:

(A)

(1) Fixed assets costing Rs. 4,00,000, accumulated depreciation Rs. 3,00,000 were sold for Rs.1,50,000.

(2) Actual tax liability for 2008-2009 was Rs. 5,00,000.

(3) Loans represent long term loans given to other companies.

(4) Interest on loan funds for 2009-2010 was Rs. 14,21,000 and interest and dividend income were Rs.4,02,000.

(5) Investments costing Rs. 20,00,000 were sold for Rs. 25,00,000.

Internal Reconstruction of a Company

12. Following is the Balance Sheet of ABC Ltd. as at 31st March, 2007:

Liabilities Rs. Assets Rs.

Share capital: Plant and machinery 9,00,000

2,00,000 Equity shares of Furniture and fixtures 2,50,000

Rs 10 each fully paid up 20,00,000 Patents and copyrights 70,000

|

6,000 8% Preference |

Investments (at cost) |

68,000 | |

|

shares of Rs. 100 each |

6,00,000 |

(Market value Rs. 55,000) | |

|

9% Debentures |

12,00,000 |

Stock |

14,00,000 |

|

Bank overdraft |

1,50,000 |

Sundry debtors |

14,39,000 |

|

Sundry creditors |

5,92,000 |

Cash and bank balance |

10,000 |

|

Profit and Loss A/c |

4,05,000 |

|

45,42,000 |

45,42,000 |

The following scheme of reconstruction was finalised:

(i) Preference shareholders would give up 30% of their capital in exchange for allotment of 11% Debentures to them.

(ii) Debentureholders having charge on plant and machinery would accept plant and machinery in full settlement of their dues.

(iii) Stock equal to Rs.5,00,000 in book value will be taken over by sundry creditors in full settlement of their dues.

(iv) Investment value to be reduced to market price.

(v) The company would issue 11% Debentures for Rs.3,00,000 and augment its working capital requirement after settlement of bank overdraft.

Pass necessary Journal Entries in the books of the company. Prepare Capital Reduction

account and Balance Sheet of the company after internal reconstruction.

Amalgamation of Companies

13. Following are the summarised Balance Sheets of A Ltd. and B Ltd. as at 31.3.2008:

|

Particulars |

A Ltd. |

B Ltd. |

|

Share capital: Equity shares 10 each (fully paid up) |

10,00,000 |

6,00,000 |

|

Securities premium |

2,00,000 |

- |

|

General reserve |

3,00,000 |

2,50,000 |

|

Profit and loss account |

1,80,000 |

1,60,000 |

|

10% Debentures |

5,00,000 |

- |

|

Secured loan |

- |

3,00,000 |

|

Sundry creditors |

2,60,000 |

1,70,000 |

|

24,40,000 |

14,80,000 | |

|

Land and building |

9,00,000 |

4,50,000 |

|

Plant and machinery |

5,00,000 |

3,80,000 |

|

Investment (5,000 shares of B Ltd.) |

80,000 |

- |

|

Stock |

5,20,000 |

3,50,000 |

|

Debtors |

4,10,000 |

2,60,000 |

|

Cash at bank |

30,000 |

40,000 |

|

24,40,000 |

14,80,000 |

The companies agree on a scheme of amalgamation on the following terms:

(i) A new company is to be formed by name AB Ltd.

(ii) AB Ltd. to take over all the assets and liabilities of the existing companies.

(iii) For the purpose of amalgamation, the shares of the existing companies are to be valued as under:

A Ltd. = Rs.18 per share

B Ltd. = Rs.20 per share

(iv) A contingent liability of A Ltd. of Rs.60,000 is to be treated as actual existing liability.

(v) The shareholders of A Ltd. and B Ltd. are to be paid by issuing sufficient number of shares of AB Ltd. at a premium of Rs.6 per share.

(vi) The face value of shares of AB Ltd. are to be of Rs.10 each.

You are required to:

(i) Calculate the purchase consideration (i.e., number of shares to be issued to A Ltd. and B Ltd.).

(ii) Pass journal entries in the books of A Ltd. for the transfer of assets and liabilities.

(iii) Pass journal entries in the books of AB Ltd. for acquisition of A Ltd. and B Ltd.

(iv) Prepare the Balance Sheet of AB Ltd.

Profit and Loss Appropriation Account

14. The Articles of Association of S Ltd. provide the following:

(i) That 20% of the net profit of each year shall be transferred to reserve fund.

(ii) That an amount equal to 10% of equity dividend shall be set aside for staff bonus.

(iii) That the balance available for distribution shall be applied:

(a) in paying 14% on cumulative preference shares.

(b) in paying 20% dividend on equity shares.

(c) one-third of the balance available as additional dividend on preference shares and 2/3 as additional equity dividend.

A further condition was imposed by the articles viz. that the balance carried forward shall be equal to 12% on preference shares after making provisions (i), (ii) and (iii) mentioned above. The company has issued 13,000, 14% cumulative participating preference shares of Rs. 100 each fully paid and 70,000 equity shares of Rs. 10 each fully paid up.

The profit for the year 2008 was Rs. 10,00,000 and balance brought from previous year Rs. 80,000. Provide Rs. 31,200 for depreciation and Rs. 80,000 for taxation before making other appropriations. Prepare Profit and Loss Account -below the line.

Partnership- Death of a partner

15. A, B and C were partners of a firm sharing profits and losses in the ratio of 3 : 4 : 3. The Balance Sheet of the firm, as at 31st March, 2008 was as under :

_ 2,20,000

The firm had taken a Joint Life Policy for Rs. 1,00,000; the premium periodically paid was charged to Profit and Loss Account. Partner C died on 30th September, 2008. It was agreed between the surviving partners and the legal representatives of C that :

(i) Goodwill of the firm will be taken at Rs. 60,000.

(ii) Fixed Assets will be written down by Rs. 20,000.

(iii) In lieu of profits, C should be paid at the rate of 25% per annum on his capital as on 31st March, 2008.

Policy money was received and the legal heirs were paid off. The profits for the year ended 31st March, 2009, after charging depreciation of Rs. 10,000 (depreciation upto 30th September was agreed to be Rs. 6,000) were Rs. 48,000.

Partners' Drawings Accounts showed balances as under :

A Rs. 18,000 (drawn evenly over the year)

B Rs. 24,000 (drawn evenly over the year)

C (up-to-date of death) Rs. 20,000

On the basis of the above figures, please indicate the entitlement of the legal heirs of C, assuming that they had not been paid anything other then the share in the Joint Life Policy.

Accounting for Bonus Issue of Shares

16. The following is the Balance Sheet of Trinity Ltd. as at 31.3.2008 :

Balance Sheet of Trinity Ltd. as at 31st March, 2008

Liabilities Rs. Assets

Share Capital Fixed Assets

Authorised Gross Block

Liabilities Capital Accounts :

A 48,000

B 64,000

C 48,000

Reserve Creditors

10,000 10% Redeemable Preference Shares of Rs. 10 each

Rs.

Assets Fixed Assets Current Assets : Stock Debtors Cash and Bank

Rs.

1,00,000

30.000

60.000 30,000

1,60,000

20,000

40,000

2,20,000

1,20,000

Rs.

3.00.000

1.00.000

1,00,000 Less : Depreciation

|

90.000 Equity Shares of Rs.10 each Issued, Subscribed and Paid-up Capital 10,00,000 10.000 10% Redeemable Preference Shares of Rs. 10 each 1,00,000 1,00,000 10.000 Equity Shares of Rs.10 each (A) Reserves and Surplus General Reserve |

9.00.000 Investments Current Assets and Loans and Advances Inventory Debtors _ Cash and Bank Balances 25.000 25.000 50.000 20.000 2.00.000 Misc. Expenditure to the extent not written of 1,20,000 |

70,000

18.500

2,08,500

11.500 4,20,000 Total

(B)

Provisions

(C)

4,20,000

Securities Premium Profit and Loss A/c

Current Liabilities and Total (A + B + C)

For the year ended 31.3.2009, the company made a net profit of Rs. 15,000 after

providing Rs. 20,000 depreciation and writing off the miscellaneous expenditure of Rs.

20,000.

The following additional information is available with regard to company's operation :

1. The preference dividend for the year ended 31.3.2009 was paid before 31.3.2009.

2. Except cash and bank balances other current assets and current liabilities as on

31.3.2009, was the same as on 31.3.2009.

3. The company redeemed the preference shares at a premium of 10%.

4. The company issued bonus shares in the ratio of one share for every equity share held as on 31.3.2009.

5. To meet the cash requirements of redemption, the company sold a portion of the investments, so as to leave a minimum balance of Rs. 30,000 after such redemption.

6. Investments were sold at 90% of cost on 31.3.2009.

You are required to

(a) Prepare necessary journal entries to record redemption and issue of bonus shares.

(b) Prepare the cash and bank account.

(c) Prepare the Balance Sheet as at 31st March, 2009 incorporating the above transactions.

Accounting in Computerised Environment

17. Write short note on Pre-packaged Accounting Software.

Short Notes

18. Write short notes on the following:

(a) Debtors Method for accounting of Hire Purchase Transactions.

(b) Profit and Loss Appropriation Account.

(c) Accounting Standards

(d) Debtors and Creditors Suspense account

19. Write short notes on the following:

(a) Purchase consideration

(b) Advantages of self balancing ledgers

(c) Features of Hire Purchase Instalment system

(d) Provisions of Section 37 of the Indian Partnership Act

(e) What is Account current?

Short reasoning based questions

20. (a) If both the sides of a cash book are not tallied i.e. debit side exceeds credit side

then what are the possible items for recording the difference?

(b) The hire purchase price was payable Rs. 19,152 on 1.1.20X1 and Rs.15,000 at the end of three successive years. Given the present value of an annuity of Re.1 p.a. @ 5% interest is Rs.2.7232. Calculate the cash price with the help of annuity factor.

(c) X, Y and Z were partners sharing profits and losses in the ratio of 3:2:1 respectively. X died on 31st March, 2009. Calculate his share of profit during the accounting year 2009, when the partnership deed provided that the share of profit till the date of death be estimated at the sum calculated on the sales till the date of death by applying the ratio of Net Profit to Sales for the last accounting year. Sales from

1.1.2009 to 31.3.2009 amounted to Rs.30,000. Sales and Net Profit for the year

2008 amounted to Rs.3,60,000 and Rs.54,000 respectively.

(d) Calculate the amount of Insurance claim to be lodged, based on the following information:

Value of stock destroyed by fire Rs.90,000

Insurance policy amount (subject to average clause) Rs.65,000

Value of stock salvaged from fire Rs.40,000

21. (a) Find out the profit of Mr. A from the following information: Capital at the beginning of the year Drawings made by Mr. A Capital at the end of the year Additional capital introduced during the year

(b) A trader purchased goods for Rs.1,70,000. The opening stock of inventory prior to the said purchase was Rs.30,000. His sales was Rs.2,10,000. Find out the closing stock of inventory if the Gross profit margin is 25% on cost.

Rs.20,00,000 Rs. 2,00,000 Rs.25,00,000 Rs. 1,00,000

(c) X Co. Ltd. having share capital of Rs.50 lakhs divided into equity shares of Rs.10 each was taken over by Y Co. Ltd. X Co. Ltd. has General Reserve of Rs.10,00,000 and Profit and Loss account Cr. Rs.5,00,000. Y Co. Ltd. issued 11 equity shares of Rs.10 each for every 10 shares of X Co. Ltd.

How the Journal entry would be passed in the books of Y Co. Ltd. for the shares issued under the Pooling of interests method' of amalgamation.

(d) P, N and T are equal partners. The decided to change their profit sharing ratio into 5:4:3. The goodwill is calculated to the extent of Rs.2,40,000. Show Journal entries with narration to give effect for the same.

(e) Give the journal entry to be passed for accounting unrealized profit on stock, under amalgamation.

Accounting Standards

22. (a) Is any specific disclosure under AS 1 required for a company in liquidation?

(b) Inventories are usually written down to NRV on an item-by-item basis. Comment.

(c) Discuss the accounting treatment when the depreciable assets are revalued. The Notes on Accounts of Devi Ltd. reveals that "No depreciation has been provided during the year on fixed asset pursuant to an upward revaluation of fixed assets carried out in the current year. State whether the above viewpoint is correct.

(d) What is the basis for recognition of revenue by way of Interest, Royalties and Dividends?

23. (a) What is meant by accounting estimate? Give two examples for accounting

estimate.

(b) Provisions contained in the Accounting Standard in respect of Revaluation of fixed assets.

(c) Briefly explain the methods of accounting for amalgamation as per Accounting Standard-14.

(d) What are the disclosure requirements of AS-7 (Revised)?

Practical Questions Based on Accounting Standards

24. (a) In order to value the inventory of finished goods, HR Ltd. has adopted the standard cost of raw material, labour and overheads. Income tax officer wants to know the method, as per AS-2, for the valuation of raw material.

(b) X Co. Ltd. charged depreciation on its asset on SLM basis. For the year ended

31.3.2009 it changed to WDV basis. The impact of the change, when computed from the date of the asset coming to use, amounts to Rs. 20 lakhs being additional charge.

Decide how it must be disclosed in Profit and loss account. Also, discuss, when such changes in method of depreciation can be adopted by an enterprise as per

AS 6.

(c) X Limited has recognized Rs. 10 lakhs on accrual basis income from dividend on units of mutual funds of the face value of Rs. 50 lakhs held by it as at the end of the financial year 31st March, 2009. The dividends on mutual funds were declared at the rate of 20% on 15th June, 2009. The dividend was proposed on 10th April,

2009 by the declaring company. Whether the treatment is as per the relevant Accounting Standard? You are asked to answer with reference to provisions of Accounting Standard.

(d) Soft and Hardwares Ltd. are finalizing their annual accounts as on 31st March. A few elements in their Profit and loss Account are furnished below:

Amount (Rs. in lakhs) 2,740 200 300

(a) Cost of goods sold (includes loss on sale of assets)

(b) Profit on sale of property

(c) PBT

Some of the assets, revalued in earlier years, have been sold by the company now, for Rs. 100 lacs (WDV Rs. 250 lacs). Revaluation reserve corresponding to these assets stood at Rs. 200 lacs, now brought to Profit and Loss Account.

Comment on this treatment, and advise action, if any, with reference to relevant accounting standard.

25. (a) Bharat Ltd. wants to re-classify its investments in accordance with AS 13. Decide on the amount of transfer, based on the following information:

1. A portion of Current Investments purchased for Rs. 20 lakhs, to be reclassified as Long Term Investments, as the Company has decided to retain them. The market value as on the date of Balance Sheet was Rs. 25 lakhs.

2. Another portion of current investments purchased for Rs. 15 lakhs, to be reclassified as long term investments. The market value of these investments as on the date of balance sheet was Rs. 6.5 lakhs.

3. Certain long term investments no longer considered for holding purposes, to be reclassified as current investments. The original cost of these were Rs. 18 lakhs but had been written down to Rs. 12 lakhs to recognise permanent decline, as per AS 13.

(b) Garden Ltd. acquired fixed assets viz. plant and machinery for Rs.20 lakhs. During the same year it sold its furniture and fixtures for Rs.5 lakhs. Can the company disclose, net cash outflow towards purchase of fixed assets in the cash flow statement as per AS-3?

(c) A company took a construction contract for Rs.100 lakhs in January, 2006. It was found that 80% of the contract was completed at a cost of Rs.92 lakhs on the closing date i.e. on 31.3.2007. The company estimates further expenditure of Rs.23 lakhs for completing the contract. The expected loss would be Rs.15 lakhs. Can the company recognise the loss in the financial statements prepared for the year ended 31.3.2007?

SUGGESTED ANSWERS/HINTS

Profit and Loss Account for 9 months ended on 30th September, 2009

Particulars W.N.

Total Pre-(Rs.) incorporation

Post-

incor

poration

Particulars W.N.

Total

Rs.

Pre- Post-incorpor-- incoration poration

1.1.2009 1.5.2009

to to

30.4.2009 30.9.2009

1.1.2009 1.5.2009 to to

30.4.2009 30.9.2009

To General expenses

To Directors fees

To Forrmation exp.

To Rent

To Managers salary

To Net profit-Capital Reserve

2 14,220

3 5,000

4 1,500

5 1,350

6 2,000

31,930

6,320

7,900 By Gross profit

5,000

56,000 16,000

40,000

1,500

400

2,000

7,280

950

-P&L

Appropriation

56,000

16,000

40,000

40,000

56,000 16,000

Working Notes:

(1) Let the average monthly sales of first four months be Rs.100. Then the average monthly sales of next five months will be Rs.200.

Total sales of first four months = Rs.100 x 4 = Rs.400 and that of next five months = Rs.200 x 5 = Rs.1,000. The ratio of sales = 400:1000 or 2:5

The gross profit is apportioned on the basis of sales, i.e., 2:5. Therefore, the gross profit is apportioned as:

|

Pre _ Rs'56,000 x2=Rs.16,000; 7 |

Post _ Rs'56,000 x5=Rs.40,000. 7 |

(2) General expenses accrue evenly throughout the period and are, therefore, divided on the basis of time.

|

Pre _ Rs'14,220 x 4 = Rs.6,320; 9 |

Post _ Rs'14,220 x5=Rs.7,900. 9 |

(3) Directors' fees payable @ Rs.1,000 per month. It is to be found in company only. So Rs.5,000 (5 x Rs.1,000) must naturally be shown in post-period incorporation period.

(4) Formation expenses though incurred in point of time, before the company was in incorporated, are charge against the post incorporation profit.

(5) Rent for first four months = Rs.100 x 4 = Rs.400. For next five months = (Rs.100 x 2) + (Rs.250 x 3) = Rs.950.

(6) Salary to manager is related to pre-incorporation period only. Salary to be charged = Rs.500 x 4 = Rs.2,000.

Investment Account [Equity Shares in A Ltd.] for the year ending on 31st December 2009

2.

|

Dr. Cr. | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||

|

(dividend on shares acquired on 2nd June) |

|

16.08.09 To Bonus 30.09.09 To Bank 1,000 15,000 31.12.09 By Balance c/d (Rights shares) 15.11.09 To P&L A/c profit on sale of shares 5,000 |

15.11.09 By Bank (Sale 2,500 37,500 of shares 2,000 26,000 |

4,500 65,500

4,500

65,500

2,500+500' 6

=500shares.

2,500+500+500 7

x 3

= 1,500 shares

Working Notes:

(i) Bonus Shares

(ii) Rights shares

(iii) Rights shares renounced = [1,500 x ] = 500 shares

(iv) Dividend received [2,500x10x 20%]= Rs.5,000.

Dividend on share purchased on 20th June = 500 x 10 x 20% = Rs.1,000 is adjusted to Investment Account.

(v) Cost of Shares on 31st December

(37,500+8,000 +15,000 -1,000 -1,000)

=Rs.13per share

4,500

2,000 share x Rs.13 = Rs.26,000

(vi) Profit on sale of shares = 37,500 - (2,500 x 13) = Rs.5,000.

Perfect Investment Pvt. Ltd.

3.

Hire Purchase Trading Account

|

Dr. To Opening Balance: H.P. Stock H.P. Debtors To Trucks send on H.P. |

Rs. By Bank 2,40,000 By Stock reserve 60,000 3,00,000 By Trucks send on H.P. By Closing Balance: |

Purchased during the year

Less: Other sales Less: Closing Stock

80,00,000

8,00,000

72,00,000

1,60,000

70,40,000

H.P. Debtors

1,00,000

Add: Loading To Body Building Charges To Bank (Interest paid)

To Stock reserve (20% on cost) To Profit and Loss A/c

14,08,000

84.48.000

4.00.000 80,000

2.00.000

13.20.000 1,07,48,000

1,07,48,000

|

Opening stock Purchase Gross profit Working Notes: Value of H.P. Stock: (1) Cost of trucks in respect of H.P. agreement subsisting as on 31.3.2009 (2) H.P. price in respect thereof (3) Instalments not due (48 lakhs less 36 lakhs) 4. Trading Account for the year ended 31st March, 2009 |

Rs. 9,62,200 By 45,25,000 BY 10,40,000 65,27,200 |

Sales Closing stock |

40.00.000 48.00.000 12.00.000 Cr. Dr. To To To Rs. 52,00,000 13,27,200 65,27,200 |

Rate of gross profit to sales = (10,40,000 / 52,00,000) x 100 = 20% Period from 1st April 2009 to 18th August 2009 has 140 days or 20 weeks. Hence, amount of defalcation = Rs. 2,000 x 20 = Rs. 40,000

Memorandum Trading Account from 1st April, 2009 to 22nd January, 2010

Dr.

To

To

To

Cr.

Rs.

49,17,000

40,000

7,44,300

57,01,300

Rs.

13,27,200 By Sales

Opening stock Purchase

Less: Cost of goods used for advertising

Gross profit - 20% of recorded as well as unrecorded sales

34,82,700

1,00,000 33,82,700

9,91,400

57,01,300

By Unrecorded cash sales - Defalcation

By Stock on 22nd January, 2010 (Bal. Fig.)

Stock in hand on the date of fire = Rs. 7,44,300

For calculating managerial remuneration, first of all, the profit as per Section 349 have to be calculated in the following manner:

5

Calculation of Profits for the Purpose of Managerial Remuneration

Particulars Rs. Net Profit

Rs.

2,00,000

Add: Depreciation (to be treated separately) 40,000

Preliminary expenses 10,000

Tax provision 3,10,000

Bonus (to be treated separately) 15,000

Provision for doubtful debts 9,000

Scientific research expenditure (W.N.1) 20,000

Managing Director's remuneration 30,000

4.34.000

6.34.000

59,500

5,74,500

Rs.

28,725

Less: Depreciation allowable under Schedule XIV to the 35,000 Companies Act

Capital profit on sale of fixed assets (W.N.2) 6,500 Profit under section 349

Calculation of Managerial Remuneration

Particulars

Remuneration payable to Managing Director @ 5% of Rs.5,74,500 Remuneration already paid to Managing Director Excess amount paid

Cost of setting up new machinery for scientific research is a capital expenditure. Therefore, it will not be treated as allowable expenses for computing managerial remuneration. At the time of calculation of profit, it was deducted from Net Profit. So, it is to be added back.

(1)

(2)

Rs.

26,500

20,000

6,500

6.

Calculation of Capital Profit on Sale of Fixed Assets

Particulars

Sale Price (W.D.V. + Profit on sale, i.e., Rs.11,000 + Rs.15,500) Less:Cost price (original)

Capital Profit

Total Debtors Accounts

|

Dr. |

Cr. | ||||

|

2009 |

Rs. |

2009 |

Rs. | ||

|

Apr. 1 |

To Balance b/d |

41,000 |

Apr. 1 |

By Balance b/d |

2,000 |

|

" 30 |

To Credit Sales |

44,100 |

" 30 |

By Cash |

39,300 |

|

" 30 |

To Bills Receivable A/c |

1,000 |

" 30 |

By Discount Account |

950 |

|

" 30 |

To Cash (Noting |

10 |

" 30 |

By Bad Debts Account |

1,650 |

|

Charges) | |||||

|

" 30 |

To Balance c/d (G) |

1,800 |

" 30 |

By Returns Inwards |

500 |

|

A/c | |||||

|

" 30 |

By Bills Receivable A/c |

1,000 | |||

|

" 30 |

By Total Creditor A/c | ||||

|

(Transfer) |

1,800 | ||||

|

" 30 |

By Balance c/d |

40,710 | |||

|

87,910 |

87,910 | ||||

|

2009 |

2009 | ||||

|

May 1 |

To Balance b/d |

40,710 |

May 1 |

To Balance b/d |

1,800 |

Working Notes:

(i) Cash Received:

Rs.

450

1,800

2,250

From B From G

Rs.

27,300

Ex sales before April 1

Ex sales during April

9,750

37,050

39,300

Discount: Rs.37,050 x 21/2 / 971/2 = Rs.950

(iii) The creation of the Provision for Doubtful Debts will not affect the Total Debtors Account.

Trading and Profit and Loss A/c for the year ended 30th September, 2009

|

Sales Less: Cost of goods sold: Opening Stock Purchase Closing stock Less: Wages Less: Gross Profit Gross profit allocated on time basis Less: Expenses Salaries Trade expenses Rent and rates Bad debts Provision for doubtful debts Depreciation: Plant and machinery Motor vehicles Interest on loan |

Half year to 31st March 2009 Rs. Rs. 10,600 3,450 765 500 600 700 775 |

Rs. Rs. 96,000 12.400 62,000 74.400 14,200 60,200 14.600 21,200 Half year to 30th September 2009 Rs. Rs. 10.600 2,250 1,015 500 230 700 600 540 |

6,790

3,810

5,835

4,765

Appropriation of profits: Interest on Capital:

|

Glad |

240 | ||||||

|

Happy |

180 |

84 | |||||

|

Joy |

420 |

96 |

180 | ||||

|

Remaining profits | |||||||

|

Glad |

2,260 | ||||||

|

Happy |

1,130 |

2,751 | |||||

|

Joy |

3,390 |

1,834 |

4,585 | ||||

|

3,810 |

4,765 | ||||||

|

Partners Capital Accounts | |||||||

|

Glad |

Happy |

Joy |

Glad |

Happy |

Joy | ||

|

Rs. |

Rs. |

Rs. |

Rs. |

Rs. |

Rs. | ||

|

To Glad |

3,200 |

4,800 |

By Balance b/d |

8,000 |

6,000 | ||

|

To Glads 16,000 Loan A/c |

By Cash |

3,000 | |||||

|

To Balance c/d |

2,800 |

3,200 |

By Happy By Joy By Cash |

3,200 4,800 |

5,000 | ||

|

16,000 |

6,000 |

8,000 |

16,000 |

6,000 |

8,000 | ||

|

Partners Current Accounts | |||||||

|

Glad |

Happy |

Joy |

Glad |

Happy |

Joy | ||

|

Rs. |

Rs. |

Rs. |

Rs. |

Rs. |

Rs. | ||

|

To Car taken over |

600 |

- |

- |

By Balance b/d |

2,400 |

1,600 | |

|

To Drawings |

1,800 |

2,400 |

900 |

By Interest on capital |

240 |

264 |

96 |

|

To Transfer to loan account |

2,500 |

By Profit |

2,260 |

3,881 |

1,834 | ||

|

To Balance c/d |

3,345 |

1,030 | |||||

|

4,900 |

5,745 |

1,930 |

4,900 |

5,745 |

1,930 | ||

|

Assets Balance Sheet as at 30th September 2009 Cost Depreciation Net Rs. Rs. Rs. Fixed assets: Plant and machinery Motor vehicles Current assets: Stock Debtors Prepaid Rent Balance at bank Less: Current liabilities Outstanding Trade expenses Creditors Net current assets Financed by Capital accounts Current accounts Loan - Glad Total as per trial balance Less: Partners' Drawings - Glad Happy Joy |

10,800 1,800 2,400 900 5,100 |

Allocation

Half-year to 31st March, 2009:

>2 x (Rs.5,700- Rs.1,200) + Joy's salary of Rs.1,200 Half-year to 30 September 2009:

2,250

5,700

1,600

180

1,780

765

1,015

1,780

1,400

400

1,000

>2 x (Rs.5,700- Rs.1,200)

Total as per trial balance Add: Accrual

Half-year to 31 March 2009:

>2 x (Rs.1,780 - Rs.250)

Half-year to 30th September 2009:

>2 x (Rs.1,780 - Rs.250) + professional charges of Rs.250

Total as per trial balance Less: Rent paid in advance Allocation: 50 : 50

4. Depreciation Plant and machinery:

10% per annum on Rs.14,000 - Rs.1,400;

Allocated 50:50

Motor vehicles:

Half-year to 31st March 2009: 25% per annum on Rs.6,200 = Rs.775 Half-year to 30th September 2009: 25% per annum on Rs.4,800 = Rs.600

Rs.

Rs.

16,000

2,500

To Cash from Joy 5,000 By Transfer from

capital account

To Balance c/d 14,040 By Transfer from

current account

By Profit and loss account:

Interest at 8%

p.a. on

Rs.13,500 for six months

19.040

14.040 Rs.

1,400

800

600

By Balance b/d

Rs.

625

175

6. Car taken over by Glad

Cost

Depreciation - to 30th September 2009 To 31st March, 2009

19,040

7. Motor vehicles

Cost Depreciation

Rs. Rs.

Per trial balance 6,200 3,400

Less: Vehicle sold 1,400 800

4,800 2,600

Charge for year to 30th September 2009 1,375

3,975

8. Debtors Rs.

Balance per trial balance 4,600

Less: Provision for bad debts 230

4,370

8. City Club

Receipts and Payments Account

|

for the year ended 31st March, 2009 | ||

|

Receipts |

Rs. Payments |

Rs. |

|

To Opening balance: |

By Premises |

30,000 |

|

Cash on hand |

450 By Rent |

2,400 |

|

Bank balance |

24,420 By Rates and taxes |

3,780 |

|

To Subscriptions |

62,130 By Printing and stationary |

1,410 |

To Fair receipts To Variety show receipts (net)

To Interest To Bar collections To Sale proceeds of old car

7,200 By Sundry expenses 12,810 By Wages 690 By Fair expenses 22,350 By Honorarium to secretary 9,000 By Bar purchases (payments)

46,800

Nil

By Repairs By New Car By Closing balance Cash in hand

_ Bank balance

1,39,050

Income and Expenditure Account for the year ended 31st March, 2009

|

Expenditure Rs. Rs. 2,400 3,780 1,410 2,520 To Rent To Rates and taxes To Printing and stationary To Wages To Honorarium to secretary To Sundry expenses To Repairs To Depreciation on Premises @ 5% Car @20% 3,030 9,360 12,390 To Excess of income over expenditure |

Income By Subscriptions Add: Due as on 31.3.09 Less: Due as on 31.3.08 12,000 By Surplus from fair: 5,350 Fair receipts 960 Less: Fair expenses By Surplus from variety show By Interest By Profit from bar (W.N.2) 43,490 By Profit from sale of car (W.N. 3) |

Rs. Rs. 62,130 2,940 65,070 3,600 61,470 7,200 7,170 30 12,810 690 6,000 3,300 |

84,300

84,300

Working Notes:

1. Calculation of bar purchases

Bar Creditors Account

3. Profit on sale of car:

Sale proceeds of old car

Less: W.D.V. of old car (Rs. 36,570-Rs. 30,870)

Trading and Profit and Loss Account of Mr. Shiv Kumar for the year ended 31st March, 2009

Dr.

To Bank A/c To Balance c/d

2. Profit from bar:

Bar collections Less: Bar stock consumed-Opening stock Add: Purchases

Less: Closing stock

Cr.

Rs.

1,770

16,830

18,600

Rs.

22,350

Rs.

17,310

1,290

18,600

By Balance b/d By Bar purchases

Rs.

2,130

16,830

18,960

2,610

16,350

6,000

9,000

5,700

3,300

9.

|

Rs. |

Rs. | ||||

|

To |

Opening stock |

By |

Sales |

4,00,000 | |

|

(balancing figure) |

80,000 |

By |

Closing stock |

40,000 | |

|

To |

Purchases |

2,40,000 | |||

|

To |

Gross profit c/d | ||||

|

@ 30% on sales |

1,20,000 | ||||

|

4,40,000 |

4,40,000 | ||||

|

To |

Miscellaneous |

By |

Gross profit b/d |

1,20,000 | |

|

expenses (Rs.80,000 |

82,000 |

By |

Miscellaneous receipts |

20,000 | |

|

- Rs.8,000 + |

By |

Net loss transferred to |

25,840 | ||

|

Rs.10,000) |

Capital A/c |

To Depreciation:

Building Rs. 36,000 Furniture Rs. 7,800 (Rs.6,800 + Rs.1,000) Motor Car Rs. 16,000

To

To

To

11,000

8,000

5,040

1,65,840

1,65,840

Loss on sale of furniture

Bad debts

Provision for doubtful debts

Balance Sheet of Mr. Shivkumar as on 31st March, 2009

Rs.

|

61,200 64.000 40.000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bills receivable

Cash in hand and at bank

1,04,000

8,68,160

Rs.

2,00,000

20,000

8,000

2.52.000

4.80.000

Rs.

1,20,000

1,92,000

3,12,000

Rs.

24.000

28.000

52.000

Rs.

28.000 16,000

44,000

|

8,68,160 | |||

|

Working Notes: | |||

|

Sundry Debtors Account | |||

|

Rs. | |||

|

To |

Balance b/d |

1,60,000 By |

Cash/Bank A/c |

|

To |

Sales A/c |

3,20,000 By By |

Bills Receivable A/c Bad debts A/c |

|

By |

Balance c/d (balancing fig.) | ||

|

4,80,000 | |||

|

Sundry Creditors Account | |||

|

Rs. | |||

|

To |

Cash/Bank A/c |

1,84,000 By |

Balance b/d |

|

To |

Bills Payable A/c |

16,000 By |

Purchases A/c |

|

To |

Balance c/d (balancing figure) |

1,12,000 3,12,000 | |

|

Bills Receivable Account | |||

|

Rs. | |||

|

To |

Balance b/d |

32,000 By |

Cash/ Bank A/c |

|

To |

Sundry Debtors A/c |

20,000 By 52,000 |

(balancing figure) Balance c/d |

|

Bills Payable Account | |||

|

Rs. | |||

|

To |

Cash/Bank A/c |

28,000 By |

Balance b/d |

|

(balancing figure) |

By |

Sundry Creditors A/c | |

|

To |

Balance c/d |

16,000 44,000 | |

|

Furniture Account | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

|

Cash/Bank Account |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1st payment is made after 12 months from the date of loan. 2nd payment is made after 18 months from the date of loan. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3rd payment is made after 24 months from the date of loan. 4th payment is made after 30 months from the date of loan.

36

5th payment is made after months from the date of loan.

120

Average due date = Date of loan+ Sum f mths frm January, 2009 tothe ckte f eadi msteNm

Number of installments

\20months

=1st January, 2009

+

5

=1st January, 2009+ 24 months =1st January, 2011 = Rs. 25,000 x 10/100 x 2 years = Rs. 5,000

Interest

11.

(Rs. in thousand) -200 -250

3,400 _0

550

50

-50

-500

2,950

50

3,000

1,421

-402

90

110

-150

30

80

Cash flow from Operating Activities

Change in general reserve

Change in profit and loss account

Proposed dividend

Provision for tax

Profit before tax

Add: Depreciation

Add: Miscellaneous Expenses

Add/(Less): Profit /(loss) on sale of fixed assets

Add/(Less): Profit /(loss) on sale of investments

Funds flow from operations

Add: Interest paid

Less: Interest and Dividend Received

Add/(Less): Working Capital Adjustment

Inventories

Debtors

Creditors

Outstanding expenses

Cash flow from Operating Activities (before Tax)

Less: Advance tax for 2009-2010 _0

Cash flow from operating Activities (after tax) 4,099

Cash flow from Financing Activities

Issue of shares

Face value 1,500

Premium 750 2,250

Repayment of Secured Loans _200

Raising of Unsecured Loans 1,350

Net loan 1,150

Interest payment _1,421

Dividend payment for 2009 _2,800

_821

Cash flow from Investment Activities

Purchase of Fixed Assets _1,800

Sale of Fixed Assets 150

Capital WIP _1,860

Fixed Assets (Net) _3,510

Purchase of Investments _1,330

Sale Proceeds of Investments 2,500

Investments (Net) 1,170

Loans _1,500

Interest and Dividend Income 402

_3,438

Cash Flow Statement

Cash flow from Operating Activities (after tax) 4,099

Cash flow from Financing Activities _821

Cash flow from Investment Activities _3,438

Increase/decrease in Cash and Bank Balance (120 - 280) _160

12. In the Books of ABC Ltd.

Journal Entries

Particulars Rs. Rs.

8% Preference share capital A/c Dr. 6,00,000

To Preference shareholders A/c 4,20,000

[Being 30% reduction in liability of preference share capital]

Preference shareholders A/c Dr. 4,20,000

To 11% Debentures A/c

4,20,000

12,00,000

9.00.000

3.00.000

5,00,000

92,000

3,00,000

1,50,000

13,000

[Being the issue of debentures to preference shareholders]

9% Debentures A/c Dr. 12,00,000

To Debenture holders A/c

[Being transfer of 9% debentures to debenture holders A/c]

Debenture holders A/c Dr. 12,00,000

To Plant & machinery A/c

To Capital reduction A/c

[Settlement of debenture holders by allotment of plant & machinery]

Sundry creditors A/c Dr. 5,92,000

To Stock A/c To Capital reduction A/c [Being settlement of creditors by giving stocks]

Bank A/c Dr. 3,00,000

To 11% Debentures A/c [Being fresh issue of debentures]

Bank overdraft A/c Dr. 1,50,000

To Bank A/c [Being settlement of bank overdraft]

Capital reduction A/c Dr. 5,72,000

To Investment A/c

To Profit and loss A/c

To Capital reserve A/c

[Being decrease in investment and profit and loss account (Dr. bal.); and balance of capital reduction account transferred to capital reserve]

| ||||||||||||||||||||||||||||||||||||||||||||||||

|

28,74,000 28,74,000 | ||||||||||||||||||||||||||||||||||||||||||||||||

Working Note:

Cash at bank = Opening balance + 11% Debentures issued - Bank overdraft paid = Rs. 10,000 + Rs.3,00,000 - Rs. 1,50,000 = Rs.1,60,000

Statement showing calculation of purchase consideration

13. (i)

(Number of shares)

Existing shares Less:Shares held by A Ltd.

A Ltd. 1,00,000

1,00,000

Rs.18

Rs.18,00,000

B. Ltd. 60,000 5,000 55,000 Rs.20 Rs.11,00,000

Value per share Total value

|

No. of shares to be issued at a premium of Rs.6 per share i.e. Rs.16 (10+6) Share capital 68,750 shares Rs. 4.12.500 11,00,000 Rs. 9.00.000 4.10.000 80,000 30,000 60,000 8,20,000 18,00,000 18,00,000 Add: Securities premium Total purchase consideration Journal Entries in the books Realisation A/c Dr. To Land & building A/c To Plant & machinery A/c To Stock A/c To Sundry debtors A/c To Investments A/c To Bank A/c (Being assets transferred to Realisation A/c) Profit and loss A/c Dr. To Creditors A/c (Being contingent liability treated as real liability) 10% Debentures A/c Dr. Creditors A/c Dr. To Realisation A/c (Being transfer of liabilities to Realisation A/c) AB Ltd. Dr To Realisation A/c (Being the purchase consideration accounted for) Share in AB Ltd. A/c Dr. To AB Ltd. (Being purchase consideration received) |

Rs. 11,25,000 6,75,000 18,00,000 of A Ltd. Rs. 24,40,000 60,000 5,00,000 3,20,000 18,00,000 18,00,000 |

|

Share Capital A/c |

Dr. |

10,00,000 |

|

Securities premium A/c |

Dr. |

2,00,000 |

|

General Reserve A/c |

Dr. |

3,00,000 |

|

Profit and Loss A/c |

Dr. |

1,20,000 |

|

Realisation A/c |

Dr. |

1,80,000 |

|

To Shareholders A/c | ||

|

(Being transfer of balances to |

shareholders' account) | |

|

Shareholders A/c |

Dr. |

18,00,000 |

To Shares in AB Ltd.

18,00,000

(Being closure of shareholders a/c)

(iii)

Rs.

3,00,000

1,70,000

11,00,000

|

Journal Entries in the Books of AB Ltd. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

5,00,000 3,20,000 18,00,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

To Secured loan A/c To Sundry creditors A/c To Liquidator of B Ltd. A/c (Being purchase consideration of B Ltd. accounted for) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Liquidator of A Ltd. A/c Dr.

To Equity share capital A/c To Securities premium A/c (Being shares issued to Liquidator of A Ltd.) Liquidator of B Ltd. A/c Dr.

11,00,000

To Equity share capital A/c To Securities premium A/c (Being shares issued to Liquidator of B Ltd.)

6.87.500

4.12.500

|

Liabilities Share capital: (iv) Balance Sheet of AB Ltd. (After amalgamation of A Ltd. & B Ltd.) Rs. Assets Rs. 3.50.000 6.70.000 70,000 1,81,250 Equity shares of Rs.10 each fully paid up (above shares have been issued for consideration other than cash) Securities premium 10,87,500 5.00.000 3.00.000 4,90,000 41,90,000 10% Debentures Secured loan Sundry creditors |

Goodwill (2,60,000 + 90,000) 18,12,500 Land & building Plant & machinery Stock Sundry debtors Cash at bank 41,90,000 |

14.

Rs.

10,00,000

To

To

To

To

To

Depreciation Provision for income tax Net profit c/d

10,00,000

1,77,760

2,75,450

10,00,000

80,000

8,88,800

By

By

preference (1,82,000 +

Reserve fund

Proposed dividend 93,450)

Profit and Loss Account-(below the line) for the year ended 2008

Rs.

31,200 By Profit 80,000 8,88,800

Balance b/f Net profit b/d

To Proposed equity dividend 3,26,900 (1,40,000 + 1,86,900)

To Bonus to employees 32,690 (14,000 + 18,690)

To Balance c/d 1,56,000

9,68,800

9.68.800 Rs.

9.68.800 6,69,760 2,99,040

1

= x 3

Working Note:

Balance of amount available for Preference and Equity shareholders and Bonus for Employees

Credit Side

Less: Dr. side [1,77,760 + 1,82,000+1,40,000+14,000 + 1,56,000]

Suppose remaining balance will be = x

1

Suppose preference shareholders will get share from remaining balance = x x

3

2 2

Equity shareholders will get share from remaining balance = x x-=- x

33

2 10 2 Bonus to Employees = x x=x 3 100 30

2 1 2 Now, - x + x + x=2,99,040 3 3 30

32 x = 89,71,200

x = 89,71,200/32 = Rs.2,80,350

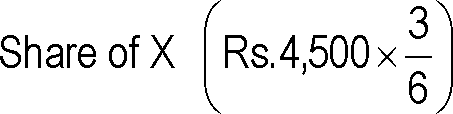

1

Share of preference shareholders - Rs. 2,80,350 x- = Rs.93,450

3

2

Share of equity shareholders- Rs.2,80,350 x- = Rs.1,86,900

3

2

Bonus to employees - Rs.2,80,350 x = Rs.18,690

15. Computation of entitlement of legal heirs of C

(1) Profits for the half year ended 31st March, 2009

Rs.

Profits for the year ended 31st March, 2009 (after depreciation) 48,000

Add: Depreciation 10,000

Profits before depreciation 58,000

Profits for the first half (assumed : evenly spread) 29,000

Less : Depreciation for the first half 6,000

Profits for the first half year (after depreciation) 23,000

Profits for the second half (i.e., 1st October, 2008 to 31st March, 2009) 29,000

Less : Depreciation for the second half 4,000

Profits for the second half year (after depreciation) 25,000

(2) Capital Accounts of Partners as on 30th September, 2008

Dr. Cr.

|

A |

B |

C |

A |

B |

C | ||||

|

Rs. |

Rs. |

Rs. |

Rs. |

Rs. |

Rs. | ||||

|

To |

Fixed Assets |

By |

Balance b/d |

48,000 |

64,000 |

48,000 | |||

|

(loss on |

By |

Reserve |

6,000 |

8,000 |

6,000 | ||||

|

revaluation) |

6,000 |

8,000 |

6,000 |

y B |

Goodwill |

18,000 |

24,000 |

18,000 | |

|

To |

Drawings |

9,000 |

12,000 |

20,000 |

By |

P & L Appro | |||

|

To |

C Executors A/c |

52,000 |

priation A/c | ||||||

|

To |

Balance c/d |

57,000 |

76,000 |

- |

(Interest on | ||||

|

Rs. 48,000 @ 25% | |||||||||

|

for 6 months) |

6,000 | ||||||||

|

72,000 |

96,000 |

78,000 |

72,000 |

96,000 |

78,000 | ||||

(3) Application of Section 37 of the Partnership Act

Legal heirs of C have not been paid anything other than the share in joint life policy. The amount due to the deceased partner carries interest at the mutually agreed upon rate. In the absence of any agreement, the representatives of the deceased partner can receive at their option interest at the rate of 6% per annum or the share of profit earned for the amount due to the deceased partner.

Thus, the representatives of C can opt for

Either,

(i) Interest on Rs. 52,000 for 6 months @ 6% p.a. = Rs. 1,560

Or

(ii) Profit earned out of unsettled capital (in the second half year ended 31st March, 2009)

Rs. 25,000 x-52000-= Rs. 7,027 (approx.)

57,000 + 76,000 + 52,000

In the above case, it would be rational to assume that the legal heirs would opt for Rs. 7,027.

(4) Amount due to legal heirs of C Rs.

Balance in C's Executor's account 52,000

Amount of profit earned out of unsettled capital [calculated in (3)] 7,027

Amount due 59,027

16. Journal Entries in the Books of Trinity Ltd.

Dr. Cr.

Rs. Rs.

Securities Premium A/c Dr. 10,000

To Premium on Redemption of Preference shares 10,000

(Being amount of premium payable on redemption of

preference shares)_

10% Redeemable Preference Capital Dr. 10,00,000

Premium on redemption of Preference Shares Dr. 10,000

To Preference Shareholders 1,10,000

(Being the amount payable to preference shareholders

on redemption)_

General Reserve A/c Dr. 1,00,000

To Capital Redemption Reserve 1,00,000

(Being transfer to the latter account on redemption

of shares)_

Bank A/c Dr. 45,000

Profit and Loss A/c Dr. 5,000

To Investments (Being amount realised on sale of Investments and loss

thereon adjusted)_

Preference shareholders A/c Dr. 1,10,000

To Bank

1,10,000

1,00,000

1,00,000

(Being payment made to preference shareholders)_

Capital Redemption Reserve A/c Dr. 1,00,000

To Bonus to Shareholders (Amount adjusted for issuing bonus share in the ratio of 1 : 1.)

Bonus to Shareholders A/c Dr. 1,00,000

To Equity Share Capital

(Balance on former account transferred to latter)_

Cash and Bank A/c

(b)

|

Dr. To Balance b/d To Cash from operations: Profit 15.000 20.000 20,000 Add : Depreciation Add : Miscellaneous Expenditure written off To Investments |

Rs. 50,000 By Preference Dividend By Preference shareholders By Balance c/d 55.000 45.000 |

1,50,000

1,50,000

Balance Sheet of Trinity Limited as at 31st March, 2009 (after redemption)

(c)

Rs. Assets

Liabilities

Rs.

Share Capital Authorised Capital

Fixed Assets

10,00,000 Gross Block

Issued, Subscribed and Paid-up

Less : Depreciation

Capital upto 31.3.2008 1,00,000

20,000 Equity Share

of Rs. 10 each fully paid 2,00,000 For the year 20,000 1,20,000 1,80,000 (10,000 shares have been

allotted as Bonus Shares Investments

by capitalising capital (Market Value Rs. 45,000) 50,000

Redemption Reserve) Current Assets, Loans and Advances

Reserves and Surplus

General Reserve 20,000 Inventory 25,000

Securities Premium 60,000 Debtors 25,000

Profit and Loss A/c 18,500 98,500 Cash and Bank Balance 30,000 80,000 Current Liabilities and Provisions

Sundry Creditors 11,500 _

3,10,000 3,10,000

Working Notes:

(i) Profit and Loss Account for the year ending 31st March, 2009 Rs. Balance as on 1.4.2008 18,500

Add : Profit for the year 15,000 33,500

Less: Preference Dividend 10,000

Loss on sale of investments 5,000 15,000

Balance as on 31.3.2009 18,500

(ii) General Reserve 1,20,000 Less: Transfer to Capital Redemption Reserve 1,00,000 Balance as on 31.3.2009 20,000

(iii) Securities Premium 70,000 Less: Premium on Redemption of Preference shares 10,000 Balance as on 31.3.2009 60,000

(iv) Capital Redemption Reserve 1,00,000 Less : Transfer for Bonus Shares 1,00,000 Balance as on 31.3.2009 NIL

|

Cost of Investments |

50,000 |

|

Less: Cash Received |

45,000 |

|

Loss on Sale of Investments |

5,000 |

|

Total Investments: |

1,00,000 |

|

Less: Cost of Investments sold |

50,000 |

|

Cost of Investments on hand |

50,000 |

|

Market value (90% of Rs. 50,000) |

45,000 |

17. Prepackaged accounting softwares are easy to use, relatively inexpensive and readily available. The installation of these softwares are very simple. An installation diskette or CD is provided with the software which can be used to install the software on a personal computer. A network version of this software is also generally available which needs to be installed on the server and work can be performed from the various workstations or nodes connected to the server. Along with the software an user manual is provided which guides the user on how to use the software. After installation of the software, the user should check the version of the software to ensure that they have been provided with the latest. The vendor normally provides regular updates to take care of the changes of law as well as add features to the existing software. These softwares normally have a section which provides for the creation of a company. The name, address, phone numbers and other details of the company like VAT registration number, PAN and TAN numbers are feeded into the system. The accounting period has to be set by inserting the first and the last day of the financial year. The next step in the use of this software could be the creation of accounts. This is done by adding the accounts along with their codes into the master file files. Each account has to be classified into whether it is an asset or liability or an income or expenditure account. Whether the account has other subsidiary ledgers under it needs to be indicated to the system. The opening balances are to be entered into the master file files. The company parameters need to be set at this point of time so that the accounts which are the cash, bank, sundry debtors, sundry creditors, etc are known to the system. The customers name, address and other basic details are also entered in the customer master file. Similarly, the creditors details are entered into the creditor master file files. Product details are entered through the product master file files. Here the unit of measurement and the opening stock quantities including the values are provided. The system of valuation of stock like the FIFO, LIFO, Weighted average, etc are defined in the product master file files.

18. (a) In the Debtors method, Hire purchase Trading account is prepared. The objective of

preparing Hire Purchase Trading Account is to measure the profitability of the Hire Purchase division separately. The following are the steps to be followed while preparing a Hire Purchase Trading Account:

(1) Credit all down payments and instalments falling due to hire purchase sales account. Transfer balance in Hire Purchase Sales Account to Hire Purchase

Trading Account.

(2) Transfer cost of all transactions to Hire Purchase Trading Account.

Hire Purchase Trading A/c Dr.

To Shop Stock A/c

(3) Charge any special expenses to Hire Purchase Trading Account.

(4) Treat instalments not yet due as stock lying with customers and transfer to Hire Purchase Trading Account.

(5) Charge appropriate stock reserve.

(b) Profit and Loss Appropriation Account: Profit and Loss Appropriation Account is prepared by a partnership firm to distribute the net profit among the partners in accordance with the partnership deed. Any interest on drawing is added to the net profit and thereafter out of such total profit, interest on partners' capital, salaries, commission, rent etc. are distributed as per agreement. Lastly, the balance of profit is distributed among the partners at the profit sharing ratio.

(c) Accounting Standards (ASs) are written policy documents issued by expert accounting body or by government or other regulatory body covering the aspects of recognition, measurement, presentation and disclosure of accounting transactions in the financial statements. The ostensible purpose of the standard setting bodies is to promote the dissemination of timely and useful financial information to investors and certain other parties having an interest in the company's economic performance. Accounting Standards reduce the accounting alternatives in the preparation of financial statements within the bounds of rationality, thereby ensuring comparability of financial statements of different enterprises.

Accounting Standards deal with the issues of

(i) recognition of events and transactions in the financial statements,

(ii) measurement of these transactions and events,

(iii) presentation of these transactions and events in the financial statements in a manner that is meaningful and understandable to the reader, and

(iv) the disclosure requirements which should be there to enable the public at large and the stakeholders and the potential investors in particular, to get an insight into what these financial statements are trying to reflect and thereby facilitating them to take prudent and informed business decisions.

Accounting Standards standardize diverse accounting policies with a view to eliminate, to the maximum possible extent,

(i) the non-comparability of financial statements and thereby improving the reliability of financial statements, and

(ii) to provide a set of standard accounting policies, valuation norms and disclosure requirements.

(d) A company taking over a running business may also agree to collect its debts as an agent for the vendors and may further undertake to pay the creditor on behalf of the vendors. In such a case, the debtors and creditors of the vendors will be included in the accounts for the company by debit or credit to separate Total Accounts in the General Ledger to distinguish them from the debtors and creditors of the business and contra entries will be made in corresponding Suspense Accounts. Also details of debtors' and creditors' balance will be kept in separate ledgers. In order that the collections from debtors and payments of creditors of vendors may not get mixed up with those of the company, it is a desirable procedure further to distinguish them by having separate columns for them in the Cash Book.

19. (a) AS-14 Accounting for Amalgamations'. Para 3(g) of AS-14 defines the term purchase consideration as the "aggregate of the shares and other securities issued and the payment made in the form of cash or other assets by the transferee company to the shareholders of the transferor company. Therefore purchase consideration does not include the sum which the transferee company will directly pay to the creditors of the transferor company. The purchase consideration essentially depends upon the fair value of its elements. For example, when the consideration includes securities, the value fixed by the statutory authority may be taken as the fair value. In case of other assets, the fair value may be determined by reference to the market value of the assets given up or in the absence of market value, book value of the assets are considered.

Sometimes adjustments may have to be made in the purchase consideration in the light of one or more future events. When the additional payment is probable and can be reasonably estimated it is to be included in the calculation of purchase consideration.

(b) The advantages of this system are:

(i) It fixes the responsibility of the ledger keeper, as to the balancing of the ledger or ledger under his/her charge and the person responsible for the mistake can be called upon to work overtime to locate it. Errors are localised.

(ii) It enables preparation of interim accounts without personal ledgers having to be balanced.

(iii) The figures of total debtors or creditors is readily available.

(c) Features of Hire Purchase Instalment system

1. Possession: The hire vendor transfers only possession of the goods to the hire purchaser immediately after the contract for hire purchase is made.

2. Instalments: The goods is delivered by the hire vendor on the condition that a hire purchaser should pay the amount in periodical instalments.

3. Down Payment: The hire purchaser generally makes a down payment on signing the agreement.

4. Constituents of Hire purchase instalments: Each instalment consists partly of a finance charge (interest) and partly of a capital payment.

5. Ownership: The property in goods is to pass to the hire purchaser on the payment of the last instalment and exercising the option conferred upon him under the agreement.

6. Repossession: In case of default in respect of payment of even the last instalment, the hire vendor has the right to take the goods back without making any compensation.

(d) Where any member of a firm has died or otherwise ceased to be a partner, and the surviving or continuing partners carry on the business of the firm with the property of the firm without any final settlement of accounts as between them and the outgoing partner or his estate, then, in the absence of a contract to the contrary, the outgoing partner or his estate is entitled at the option of himself or his representatives to such share of the profits made since he ceased to be a partner as may be attributable to the use of his share of the property of the firm or to interest at the rate of six per cent per annum on the amount of his share in the property of the firm :

Provided that where by contract between the partners an option is given to surviving or continuing partners to purchase the interest of a deceased or outgoing partner, and that option is duly exercised, the estate of the deceased partner, or the outgoing partner or his estate, as the case may be, is not entitled to any further or other share of profits; but if any partner assuming to act in exercise of the option does not in all material respects comply with the terms thereof, he is liable to account under the foregoing provisions of this section. This way, the outgoing partner has the option to receive, interest at the rate of 6% p.a. or the share of profit earned on the unsettled amounts for the period till his dues are settled by the firm in the absence of any contract made to the contrary.

It may be noted that the outgoing partner is not bound to make election until the share of the profit that would be payable to him has been ascertained.

(e) Account current is a running statement of transactions between parties, maintained in the form of a ledger account, for a given period of time and includes interest allowed or charged on various items. It is prepared when transactions regularly take place between two parties. An account current has two parties - one who renders the account and the other to whom the account is rendered.

20. (a) If debit side exceeds credit side then the difference may be any of the following item:

(i) Closing cash balance or bank balance; or

(ii) Opening bank overdraft;

(iii) Cash purchase; or

(iv) Payment to creditors; or

(v) Bills Payable discharged; or

(vi) Drawings; or

(vii) Purchase of fixed assets; or