The Institute of Chartered Financial Analysts of India University 2010 C.A Chartered Accountant Integrated Professional Competence (IPCC) Revision Test s- 2– Business Law and Ethics - Question Pa

May 2010: The Institute of Chartered Accountants of India - Revision Test ques. papers (RTPs) Integrated Professional Competence Course (IPCC) Examination: Paper two Business legal regulations and Ethics: May 2010 University ques. paper

PAPER - 2 : BUSINESS LAWS, ETHICS & COMMUNICATION

QUESTIONS

The Indian Contract Act, 1872

1. (a) Examine what is the legal position, as to the following :

(i) X offered to sell his land to N for Rs. 28,000/-. N replied purporting to accept the offer and enclosed a cheque for Rs. 8,000/-. He also promised to pay the balance of Rs. 20,000/- in monthly installments of Rs. 5,000/- each.

(ii) A offered to sell his house to B for Rs. 10000/-. B replied that he can accept the house for only Rs. 8,000/-. A rejected B's counter offer to buy the house for Rs. 8,000/-. B later changed his mind and is now willing to buy the house for Rs. 10,000/-.

(b) What are the circumstances under which an offer gets revoked or lapses?

2. (a) Do the following statements amount to involvement of fraud?

(i) Where the vendor of a piece of land told a prospective purchaser that, in his opinion, the land can support 2000 heads of sheep whereas, in truth, the land could support only 1500 sheep.

(ii) X bought shares in a company on the faith of a prospectus which contained an untrue statement that one Z was a director of the company. X had never heard of Z and the untrue statement of Z being a director was immaterial from his point of view. Can X claim damages on grounds of fraud?

(b) Does the right of lien exist in the following cases?

(i) A company agreed to garage the motor-car of H for three years, for an annual charge. H was entitled to take the car out of the company's garage as and when she liked. The annual payment being in arrear the company detained the car at the garage and claimed a lien.

(ii) A, a watch-repairer, repaired B's watch for a total charge of Rs. 20. Before B took delivery of the watch, the shop caught fire through no fault of A, and B's watch was destroyed.

The Negotiable Instruments Act, 1881

3. (a) Examine the validity of the following instruments.

(i) W drew a cheque crossed not negotiable in blank and handed it to his clerk to fill in the amount and the name of the payee. The clerk inserted a sum in excess of her authority and delivered the cheque to P in payment of a debt of her own.

(ii) An instrument that reads: "I of my own free will and accord approached B and borrowed from him the sum of Rs. 100 bearing interest at the rate of 2 per cent per mensem. I have therefore executed these few presents by way of a

promissory note so that it may serve as evidence and be of use when needed.

(iii) An instrument that reads: "I promise to pay Rs. 1,000 to B, 30 days after his marriage with C.

(b) Discuss the rules relating to the calculation of maturity of Negotiable Instruments.

4. (i) A bill of exchange purports to be drawn by A on B and is accepted by B. The bill is

payable to C or order. C negotiates it to D who takes it as a holder in due course. In a suit by D on the bill, can B disclaim liability on the ground that A's signature is forged?

(ii) B obtains A's acceptance to a bill by fraud. B indorses it to C who takes it as a holder in due course. C indorses the bill to D who knows of the fraud. Can D recover from A?

(iii) A draws on B a bill payable three months after sight. It passes through several hands before X becomes its holder. On presentation by X, B refuses to pay. Discuss the rights of X on the bill.

The EPF & MP Act, 1952

5. (a) An establishment consists of different factories situated in two different states & the

Union Territory of Pondicherry. Shall the different factories be treated as part of one establishment under the EPF & MP Act, 1952?

(b). A company XYZ Ltd. had mortgaged its property to a Bank. The company went into liquidation. Shall the dues to the Bank have priority over PF dues payable in respect of the employees?

6. Company ABC Ltd. and company JKF Ltd., had delayed payments of contributions under the EPF & MP Act, 1952 for periods of 3 months & 8 months respectively. Will penalty be imposed at the same rate in both the cases? Can such penalty be waived and if so, under what circumstances?

The Payment of Bonus Act, 1965

7. (a) Raj, an employee of Troy Ltd. has been suspended for insubordination. During his

suspension he is paid a subsistence allowance. Would this subsistence allowance be treated as wages for payment of bonus? Explain with relevant case-laws.

(b). Will the following employees be entitled to bonus under the Payment of Bonus Act, 1965?

(i) An employee who has worked for only 20 days and had been laid off for 45 days under a standing order.

(ii) A dismissed employee reinstated with back wages.

(iii) A part time employee employed as a sweeper & engaged on a regular basis.

(iv) A retrenched employee who had worked only 45 days in an accounting year.

8. State whether the following statements are true or false and give reasons with reference to the Payment of Bonus Act, 1965.

(a) The minimum bonus payable to an employee who has not completed 15 years of age is either 8.33% or Rs. 100, whichever is higher.

(b) In a non-banking company, allocable surplus is equal to 66% of the available surplus.

(c) Attendance bonus is not customary bonus and need not be adjusted against the bonus payable under the Payment of Bonus Act, 1965.

(d) Since bonus is payable on the basis of gross profit, there is a general presumption under the Payment of Bonus Act, 1965 that the balance sheet & profit & loss A/c of a company are accurate.

The Payment of Gratuity Act, 1972

9. XYZ Ltd. was amalgamated with ABC Corporation in the year 2007. Mr. ST who had rendered continuous service from the year 1990, first in XYZ and later in the amalgamated company retired in 2008. ABC Corporation ( the amalgamated Company ) declined to pay gratuity claiming that Mr. ST has worked for only one year in their company. Examine their contention with reference to the Payment of Gratuity Act, 1972.

10. (a) Mr. Kumar, an employee of Costa Nostra Corporation had his services terminated

for negligence leading to losses for the Company. Is he eligible for payment of any gratuity under the Payment of Gratuity Act, 1972?

(b) State whether the following statements are true or false and give reasons therefore, with reference to the Payment of Gratuity Act, 1972.

(i) Where an employee becomes disabled due to an accident or disease and is not in a position to do the same work and is reemployed on reduced wages on some other work, the gratuity will be calculated in two parts.

(ii) The power to exempt any establishment from the operation of the Payment of Gratuity Act, 1972 rests with the Controlling Authority.

(iii) Under the Payment of Gratuity Act, 1972, "retirement means termination of the service of an employee otherwise than on superannuation.

(iv) Where an employee dies without making a nomination, his legal heir shall apply on form "F.

The Companies Act, 1956

11. Mr. Jain, a director in Syslnfo Ltd has been empowered by the Board to make calls on shares of the company. Is this delegation of power to make calls, legal? Also advise him and the Board on the rules relating to making of calls.

12. Softmicro Ltd was allotted shares of LCH Ltd. But Softmicro Ltd claimed that it had not been issued a share certificate despite repeated requests for the same. But LCH Ltd contended that a director of Softmicro Ltd had taken personal delivery of the certificate. How can this matter be resolved ? Discuss with reference to case laws, if any.

13. Mrs. & Mr. Premchand are joint-shareholders in XYZ Ltd. They wish to appoint their minor son Ajay as the nominee. Is such nomination, subsequent to purchase of shares, feasible? Can joint-holders appoint a single nominee? If so, can the proposed nominee be a minor? Explain with reference to the statutory provisions.

14. The secretary of X Ltd., convened a general meeting for the purpose of making a call. Only one shareholder attended the meeting. The business of the company was carried through including a call on the shareholders. D, a shareholder was sued for the call he had failed to pay. In his defence, D argued that the call had not been validly made at a general meeting. Is the meeting where only one member had attended, valid? Are all such meetings invalid? Substantiate your answer with relevant case law.

15. Beena Ltd company wants to buy back its shares. Advise the company as to the rules it has to comply with in this regard.

16. Examine the objectives and the parameters of Competition Law in India.

17. Examine the concept of stakeholders and enumerate a few examples.

18. How does a commitment to Corporate Social Responsibilities become an imperative for Corporations? Give any five reasons.

19. State whether the following statements are true or false and give reasons.

(a) The concept of sustainable development was first elaborately dealt with by Brundtland Report.

(b) The Indian Competition Act, 2002 is confined to control of abuse of dominant position.

(c) One of Gandhiji's seven social sins is commerce without character.

(d) The Cadbury Report was a seminal development in the field of corporate governance.

(e) An employer is not responsible for any sexual harassment that may be perpetrated by one employee on another.

20. Discuss ways to create an ethical environment.

BUSINESS COMMUNICATION

Oral Communication

21. Elaborate merits and limitations of oral communication.

Emotional Intelligence

22. Discuss the competencies that are associated with emotional intelligence.

Types of Groups in Organization

23. Describe types of groups in organization.

Negotiation, Resistance to change and Legal Deeds

24. Write short notes on:

(a) Negotiation

(b) Resistance to change

(c) Gift deed

Notice of Annual General Meeting

25. Draft a Power of Attorney' by subscribers of Memorandum of Association of the Company authorizing a Chartered Accountant to appear before the Registrar of Companies for the purpose of incorporation of the company.

SUGGESTED ANSWERS/HINTS

1. (a) To conclude a contract between the parties, the acceptance must be communicated in some perceptible form. Any conditional acceptance or acceptance with varying or too deviant conditions is no acceptance. Such conditional acceptance is a counter proposal and has to be accepted by the proposer, if the original proposal has to materialize into a contract. Further when a proposal is accepted, the offeree must have the knowledge of the offer made to him. If he does not have the knowledge, there can be no acceptance. The acceptance must relate specifically to the offer made. Then only it can materialize into a contract. With the above rules in mind, we may note that the following is the solution to the given problems:

(i) It is not a valid acceptance and no contract can come into being. In fact this problem is similar to the facts of Neale vs. Merret [1930] W.N 189, where M offered to sell his land to N for 280. N replied purporting to accept the offer but enclosed a cheque for 80 only. He promised to pay the balance of 200 by monthly installments of 50. It was held that N could not enforce his acceptance because it was not an unqualified one.

(ii) This problem is similar to the facts of Union of India v. Bahulal (AIR 1968

Bombay 294) case, wherein A offered to sell his house to B for Rs. 1000/-, to which B replied that, "I can pay Rs.800 for it. Consequently, the offer of A' is rejected by B' as the aceptance is not unqualified. But when B later changes his mind and is prepared to pay Rs. 1000/-, it becomes a counter offer and it is up to A whether to accept it or not.

(b) An offer may come to an end by revocation or lapse, or rejection.

Revocation or lapse of offer. Section 6 deals with various modes of revocation of

offer. According to it, an offer is revoked-

(i) By communication of notice of revocation by the offeror at any time before its acceptance is complete as against him [Section 6(1)].

(ii) By lapse of time if it is not accepted within the prescribed time. If however, no time is prescribed, it lapses by the expiry of a reasonable time [Section 6(2)].

(iii) By non-fulfillment by the offeree of a condition precedent to acceptance [Section6 (3)1].

(iv) By death or insanity of the offeror provided the offeree comes to know of it before acceptance [Section 6(4)]. If he accepts an offer in ignorance of the death or insanity of the offeror, the acceptance is valid.

In addition to the above cases dealt with in Section 6, an offer is also revoked:

(v) If a counter-offer is made to it [U.P State Electricity Board v. Goel Electric Stores., A.I.R (1977) All. 494, 497]. Where an offer is accepted with some modification in the terms of the offer or with some other condition not forming part of the offer, such qualified acceptance amounts to a counter-offer. An offeree agreed to accept half the quantity of goods offered by the offeror on the same terms and conditions as would have applied to the full contract. Held, there was no contract as there was counter-offer to the offer [Tinn v. Hoffman, (1873) 29 L.T. 71].

(vi) If an offer is not accepted according to the prescribed or usual mode, provided the offeror gives notice to the offeree within a reasonable time that the acceptance is not according to the prescribed or usual mode. If the offeror keeps quiet, he is deemed to have accepted the acceptance [Section7 (2)].

(vii) If the law is changed. An offer comes to an end if the law is changed so as to make the contract contemplated by the offer illegal or incapable of performance. An offer can however be revoked subject to the following rules:

(1) It can be revoked at any time before its acceptance is complete as against the offeror.

(2) Revocation takes effect only when it is communicated to the offeree.

(3) If the offeror has agreed to keep his offer open for a certain period, he can revoke it before the expiry of that period only-

(a) If the offer has in the meantime not been accepted, or

(b) If there is no consideration for keeping the offer open.

2. (a) (i) The problem is based on the facts of the case Bisset vs Wilkinson (1927). In

the given problem the vendor says that in his opinion the land could support 2000 heads of sheep. This statement is only an opinion and not a representation and hence cannot amount to fraud.

(ii) The problem is based on the facts of the case Smith vs Chadwick (1884). In the problem though the prospectus contains an untrue statement that untrue statement was not the one that induced X to purchase the shares. Hence X cannot claim damages.

(b) (i) In the given problem H was entitled to take the car away as and when she pleased. The possession by the garage was not continuous, and nor can we say that the possession at all vested in the company. Hence no right of lien exists [It was so held in a similar case of Hatton vs Car Maintenance Ltd (1915)].

(ii) In the given case, the issue relates not to existence of lien but a rule relating to particular lien. As a rule, if through no fault of the bailee, the goods are destroyed or stolen then the bailee is entitled to be paid for services performed on the goods before they were destroyed or stolen. In the given instance A' is entitled to get his repair charges for the work he performed prior to fire.

3. (a) (i) The given problem is based on the facts of Wilson & Meeson vs. Pickering

case. In that case, it was held that the clerk had no title to the cheque and as such P had no better title and therefore W was not liable.

(ii) The given problem is based on Bal Mukand Vs Lal Ramji Lal case. The position of law is that the instant instrument is not a promissory note as it does not contain an express undertaking to pay the amount mentioned in it.

(iii) This is not a promissory note as it is probable that B may marry somebody other than C or may not marry at all.

(b) Calculation of maturity: Where a bill is payable at a fixed period after sight, the time is to be calculated from the date of acceptance if the bill is accepted and from the date of noting or protest if the bill is noted or protested for non-acceptance.

In the case of a note, the expression after sight means after exhibition thereof to the maker for the purpose of founding a claim for payment.

In the case of a bill payable after a stipulated number of months after sight which has been accepted for honour the date of its maturity is calculated from the date of acceptance for honour.

In calculating the date at which a note or bill made payable a certain number of days after date or after sight or after a certain event is at maturity on the day or the date or the day of presentment for acceptance or sight or the day of protest for nonacceptance or the day on which the event happens shall be excluded (Section 24). When a note or bill is made payable a stated number of months after date, the period stated terminates on the day of the month which corresponds with the day on which the instrument is dated. When it is made payable after a stated number of months after sight the period terminates on the day of the month which corresponds with the day on which it is presented for acceptance or sight or noted for nonacceptance or protested for non-acceptance. When it is payable a stated number of months after a certain event the period terminates on the day of the month which corresponds with the day on which the event happens ( Section 23).

If the month in which the period would terminate has no corresponding day the period terminates on the last day of such month (Section 23). Three days of grace are allowed to these instruments after the day on which they are expressed to be payable ( Section 22).

When the last day of grace falls on a day which is public holiday the instrument is due and payable on the preceding business day ( Section 25).

4. (i) Section 120 of the Negotiable Instruments Act, 1882 states that no maker of a

promissory note, and no drawer of a bill of exchange or cheque and no acceptor of a bill of exchange for the honour of the drawer, is in a suit thereon by a holder in due course permitted to deny the validity of the instrument as originally made or drawn. Therefore in the given problem B being an acceptor of the bill for the honour of the drawn cannot deny the validity of the bill and is therefore liable to D.

(ii) Yes D can recover the amount from A as he derived his title from C who is a holder in due course. Moreover D is not a party to the fraud. Once the title has been cleansed of the defect notwithstanding notice of the fraud D gets a good title. It was also so held in Guildford Trust Vs Gloss.

(iii) X is entitled to recover money on the bill from all the prior parties. A the drawer of the bill and B the acceptor of the bill are liable to X as principal debtors whereas the intervening indorsers are liable as sureties.

5. (a) Section 2(A) of the EPF &MP Act, 1952 provides that "where an establishment

consists of different departments or has branches whether situate in the same place or in different places, all such departments or branches shall be treated as parts of the same establishment".

An establishment which consists of different departments or has branches in different places shall be treated as part of the same establishment even if the factories are situated in different states or Union Territory was the judgment in Eddy Current Controls (India) Ltd. V.RPFC (1993) 83 FJR 161=1993(2) KLT 573 and this is applicable in the given problem also. Therefore, the different departments spread over two States and a Union Territory comprise a single entity under the EPF & MP Act.

(b) If the employer is adjudged insolvent or in the case of company, an order of winding up is made, the amount due towards PF dues, insurance fund administration charges etc., will be deemed to be included among the debts which under Section 49 of Presidency Towns Insolvency Act or Section 61 of Provincial Insolvency Act or Section 530 of Companies Act are to be paid in priority to all other debts in the distribution of property of insolvent or assets of the company being wound up. [Section 11(1)]. The amount due from employer in respect of PF contribution deducted from salary of employees and also employer's contribution toward PF will be first charged over assets of the establishment and will be paid in priority to all debts. (Section 11(2).

In Union Bank of India v. Assistant PF Commissioner 2005 LLR 1018 (Kar HC), it was held that PF dues have priority over dues to Banks even if property has been mortgaged to Bank. Therefore in the given problem also, the PF dues shall priority over any dues to the Bank.

6. Under Para 32A of the EPF Scheme, rate of damages for delays in payment are - (a) Delay of less than two months: 17% p.a. (b) Two months and above but less than four months: 22% p.a. (c) Four months and above but less than six months: 27% p.a. (d) six months and above: 37% p.a.

Therefore ABC Ltd must pay damages at the rate of 22% p.a. for its delay of three months and JKF Ltd must pay at the rate of 37% p.a.for its delay of 8 months.

The damages can be also reduced by the Central Board in the following manner (a) Full waiver may be granted in case of merger/ amalgamation of sick company or change in management to Worker's Cooperative (b) Full waiver if BIFR recommends in a rehabilitation scheme (c) In other cases depending on merit reduction upto 5% may be allowed. (Para 32B of EPF Scheme).

The damages can be reduced or waived by Central Board in case of sick company for which a scheme for rehabilitation has been sanctioned by the BIFR.

7. (a) Subsistence allowance paid when employee is under suspension would not amount

to "wages' within meaning of 2(21) of the Act, as it is not paid for work done. It was so held in Motor Industries Co v. Popat Murlidhar 1997 ILLN 749 = 1997 (2) LLJ 1206 (Bom HC). Contrary view was expressed in Project Manager Oil and Natural

Gas Commission V. Sham Kumar 1995 LLR 619 (Guj HC) where it was held that suspended employee will be entitled to bonus on suspension allowance. But since the former judgment is later in date, we may safely conclude that subsistence allowance does not amount to wages and therefore Mr. Raj would not be paid bonus

(b) (i) Under Section 2(13) read with Section 8 every employee who has worked for 30 days in an accounting year on a salary of less than Rs. 10,000/- per month is eligible for bonus and under Section 14 the days when an employee who has been laid off under a standing order shall be treated as working days. Therefore the employee in the given problem is entitled to get bonus.

(ii) As per the decision in Gannon India Ltd Vs Niranjan Das (1984) a dismissed employee reinstated with back wages is entitled to bonus.

(iii) A part time employee employed as a sweeper and engaged on a regular basis is entitled to bonus as per the decision in Automobile Karmchari Sangh vs. Industrial Tribunal (1970) 38 FJR 268.

(iv) A retrenched employee is eligible to get bonus provided he has worked for the minimum qualifying period as per the decision in East Asiatic Co. (P) Ltd. vs Industrial Tribunal (1961) 1 LLJ 720.

8. (a) False:- The minimum bonus payable to an employee who has not completed 15

years of age is either 8.33% or Rs. 60/-.

(b) True:- Allocable surplus is 67% of available surplus.

(c) True:- As per the decision in Baidyanath Ayurveda Bhavan Mazdoor Sangh Vs. Management (1984) attendance bonus is not a customary bonus.

(d) True:- There is such a presumption in law and evidence need not be adduced unless the documents are disputed.

9. The payability of gratuity to the employee is his right as well as the obligation of the employer. Even on the change of ownership, the relationship of employer and employees subsists and the new employer cannot escape from the liability of payment of gratuity to the employees; it was so held in the case of Pattathurila K. Damodaran Vs M. Kassim Kanju (1993) ILLJ (1211 (Ker).

Hence, Mr. ST is eligible to receive gratuity from ABC Corporation.

10. (a) According to Section 4(6) of the Payment of Gratuity Act, 1972, "If the services of an

employee have been terminated for any act, willful omission, or negligence causing any damage or loss to or destruction of property belonging to the employer the gratuity shall be forfeited to the extent of the damage or loss so caused.

Therefore, the amount of loss Mr. Kumar caused to his employer will be deducted from his gratuity.

(b) (i) True: The reason being Section 4(4)) of the Payment of Gratuity Act, 1972 which stipulates when an employee becomes disabled due to any accident or disease and is not in a position to do the same work and is re-employed on reduced wages on some other job, the gratuity will be calculated in two parts-

For the period preceding the disablement : On the basis of wages last drawn by the employee at the time of his disablement.

For the period subsequent to the disablement - On the basis of the reduced wages as drawn by him at the time of the termination of services.

(ii) False: because the power to exempt rests with the the Appropriate Government.

(iii) True: because retirement means termination of the service of an employee otherwise than on Superannuation, according to Section 2 (q) of the Payment of Gratuity Act, 1972.

(iv) False: because, if an employee dies without making a nomination his legal heir, who is eligible for the payment of gratuity shall apply ordinarily within one year from the date of gratuity became payable to him on form K' to the employer.

11. The Board of Directors alone is empowered to make a call. The power cannot be delegated to a director or to a committee of directors or to any other officer of the company (Section 292). A call on the shares falling under the same class must be made on a uniform basis. Shares of the same nominal value, on which different amounts have been paid up, are not deemed to fall under the same class' (Section 91). The Board's resolution on making the call must specify the amount of call per share and the time allowed for its payment. The calls are made and are payable according to the conditions prescribed by the articles of the company. A call must not exceed 1/4th of the nominal value of the shares or be payable at less than one month from the date fixed for the payment of the last preceding call.

Rules relating to payment of calls in advance:

But before we conclude our discussion on calls we have also to know how payment in advance of calls is treated by a company. A company may, if so authorised by the articles, accept from any member the whole or a part of the amount remaining unpaid of any shares by him although no part of that amount has been called up [Section 92(1)]. The amount so received or accepted is described as payment in advance of calls. When a company receives payment in advance of calls, the consequences will be as follows:

(i) The shareholder is not entitled to voting rights in respect of the moneys so paid by him until the same would, but for such payment, become presently payable [Section 92(2)].

(ii) The shareholder's liability to the company in respect of the call for which the amount is paid is extinguished.

(iii) The shareholder is entitled to claim interest on the amount of the call to the extent payable according to articles of association. If there are no profits, it must be paid out of capital, because shareholder becomes the creditor of the company in respect of this amount.

(iv) The amount received in advance of calls is not refundable.

(v) In the event of winding up the shareholder ranks after the creditors, but must be paid his amount with interest, if any before the other shareholders are paid off.

(vi) The power to receive the payment in advance of calls must be exercised in the general interest and for the benefit of the company (Syke's case (1872) L.R. 13 Eq. 255).

12. In Cardiff Chemicals Ltd. Vs. Fortune Bio-Tech Ltd. and another [2004] 414 CLB., the petitioner company was allotted some shares against application and the respondent company had failed to deliver the share certificates in spite of repeated demands. Hence, the petitioner company filed petition under section 113 of the Companies Act, 1956 before the Company Law Board seeking directions against the respondent company for delivery of share certificates. The respondent company challenged the petition on the ground that the director of the petitioner took physical delivery of share certificates from the company. However, the respondent company failed to produce conclusive proof that it had delivered the share certificates to the petitioner. It was held that, the burden of proving delivery of the share certificates is on the respondent; and on failure of proving it, then the company is not discharged of its obligations imposed under section 113(1). Hence, the Company Law Board upheld the default of company in delivering the share certificates and further directed the company to deliver share certificates to the petitioner.

Hence in the given problem, if LCH Ltd is unable to prove that a director of Softmicro Ltd had taken personal delivery of the share certificate, it must issue a fresh share certificate.

13. A new Section (109A) has been inserted by the Companies (Amendment) Act, 1999. Sub-section (1) of Section 109A provides that every holder of shares in, or holder of debentures of, a company may, at any time nominate, in the prescribed manner, a person to whom his shares in, or debentures of, the company shall vest in the event of his death.

Where the shares in, or debentures of, a company are held by more than one person jointly, the joint-holders may together nominate, in the prescribed manner, a person to whom all the rights in the shares or debentures of the company shall vest in the event of death of all the joint holders (Sub-section 2).

Notwithstanding anything contained in any other law for the time being in force or in any disposition, whether testamentary or otherwise, in respect of such shares in, or debentures of, the company, where a nomination made in the prescribed manner purports to confer on any person the right to vest the shares in, or debentures of, the company, the nominee shall, on the death of the shareholder or holder of debentures of, the company or, as the case may be, on the death of the joint holders become entitled to all the rights in the shares or debentures of the company or, as the case may be, all the joint holders, in relation to such shares in, or debentures of the company to the exclusion of all other persons, unless the nomination is varied or cancelled in the prescribed manner (Sub-section 3).

Where the nominee is a minor, it shall be lawful for the holder of the shares, or holder of debentures, to make the nomination to appoint in the prescribed manner any person to become entitled to shares in or debentures of, the company, in the event of his death, during the minority. (Sub-section 4).

Therefore, in the given problem, Mrs. & Mr. Premchand can nominate their minor son Ajay at any time and even if they are joint shareholders.

14. The problem is based on the facts of Sharp v. Dawes, (1876) 2 Q.B.D. 26. In that case a general meeting of a company was called for the purpose of making a call. Only one shareholder attended the meeting. The business of the company was carried through including a call on the shareholders. D was sued for the call he had failed to pay. In his defence, D argued that the call had not been validly made at a general meeting. The Court held that one person could not constitute a meeting, in the given circumstances.

Exceptions: In the following cases, one person may constitute a meeting:

1. Where there is a class meeting of shareholders and all the shares of that class (e.g., preference shares) are held by one person, he alone can constitute a meeting of the class and can pass a class resolution by signing it.

2. Where the Tribunal calls or directs the calling of an annual general meeting under Sec.167, it has the power to direct that one member present in person or by proxy shall be deemed to constitute a meeting.

3. Where the Tribunal orders a meeting of a company (other than the annual general meeting) under Sec.186 to be held, it may direct that even one member of the company present in person or by proxy shall be deemed to constitute a meeting.

4. Where the Board of directors delegates, subject to the provisions of the Act, any of the powers to a committee, the committee may consist of any one person (Article 77, Table A). In such a case, the only member of the committee shall constitute the quorum.

5. Where a quorum is not present at a general meeting within half an hour of the meeting, the meeting shall stand adjourned to the same day in the next week at the same time and place. If at the adjourned meeting also a quorum is not present within half an hour of the time of the meeting, the members present are the quorum. In such a case even one member may constitute the meeting (Sec.174).

15. Sections 77-A and 77-AA permit a company to purchase its own shares or other specified securities (referred to as buy-back subject to certain conditions).

Section 77- B prohibits buy-back in certain circumstances.

Power of company to purchase its own shares (Sec.77-A)

Buy-back

Notwithstanding anything contained in the Companies Act, 1956, a company may purchase its own shares or other specified securities (hereinafter referred to as buyback). This is, however, subject to provisions as contained in Sec.77-A (2) and Sec.77-B.

Thus a company may purchase its own shares or other specified securities from -

(i) out of its a free reserves; or

(ii) out of the securities premium account ; or

(iii) out of the proceeds of an earlier issue other than fresh issue of shares made specifically for buy-back purposes (Sec.77-A(1)).

Conditions for buy-back

No company shall purchase its own shares or other specified securities as referred to above unless-

(a) the buy-back is authorised by its Articles;

(b) a special resolution has been passed in general meeting of the company authorising the buy-back;

However, the said special resolution shall not be required to be passed if the following conditions are satisfied:

(a) the bay-back is for less than 10 per cent of the total paid-up equity capital and the free reserves of the company, and

(b) such buy-back has been authorised by the Board of Directors by means of a resolution passed at its meeting;

Provided no company can come out with a fresh proposal to buy back its shares if within a period of 365 days from the date of preceding offer of buy back.

(c) the buy-back is off less than 25 per cent of the total paid-up capital and free reserves of the company purchasing its own shares or other specified securities;

(d) the ratio of the debt owed by the company is not more than twice the capital and its free reserves after such buy-back;

(e) all the shares or other specified securities are fully paid-up;

(f) the buy-back of shares or other specified securities listed on a stock exchange is in accordance with the regulations made by the Securities Exchange Board of India (SEBI) in this behalf;

(g) the buy-back in respect of unlisted shares or other specified securities is in accordance with the guidelines as may be prescribed (Sec.77-A(2)).

Notice of the meeting

The notice of the meeting at which special resolution is proposed to be passed shall be accompanied by an explanatory statement stating -

(a) a full and complete disclosure of all material facts;

(b) the necessity for the buy-back;

(c) the class of security intended to be purchased under the buy-back;

(d) the amount to be invested under the buy-back; and

(e) the time limit for completion of buy-back (Sec.77-A(3)).

Period for completion of buy-back

Every buy-back shall be completed within 12 months from the date of passing the special resolution (Sec.77-A (4)).

Modes of buy-back

The buy-back referred to above may be -

(a) from the existing security holders on a proportionate basis; or

(b) from the open market; or

(c) from odd lots, that is to say, where the lot of securities in a listed public company is smaller than such market lot as may be specified by the stock exchange; or

(d) by purchasing the securities issued to employees of the company pursuant to a scheme of stock option or sweat equity (Sec.77-A(5)).

Filing of declaration of solvency:

Where a company has passed a special resolution to buy-back its own shares or other securities, it shall, before making such purchases, file with the Registrar of Companies and Securities and Exchange Board of India a declaration of solvency in the form prescribed. The declaration shall be verified by an affidavit to the effect that the Board of directors has made a full inquiry into the affairs of the company as a result of which it is capable of meeting its liabilities and will not be rendered insolvent within a period of one year of the date of declaration adopted by the Board. The declaration shall be signed by at least two directors of the company, one of whom shall be the managing director, if any.

The declaration of solvency is not required to be filed by an unlisted company (Sec. 77-A(6)).

Extinguishment and physical destruction of securities

Where a company buys back its own securities, it shall extinguish and physically destroy the securities so bought within 7 days of the last date of completion of the buy-back (Sec.77-A(7)).

Restriction on further issue of securities within 6 months

Where a company completes a buy-back of its securities, it shall not make further issue of securities within a period of 6 months. It may however issue bonus shares. It may also discharge its subsisting obligations such as conversion of preference shares or debentures into equity shares (Sec.77-A(8)).

Maintenance of register and filing of return

Where a company buys back its securities, it shall maintain a register of the securities so bought, the consideration paid for the securities bought back, the date of cancellation of securities, the date of extinguishing and physical destruction of securities and such other particulars as may be prescribed (Sec.77-A(9)).

A company shall, after the completion of the buy-back, file with the Registrar of Companies and the Securities and Exchange Board of India, a return containing such particulars relating to the buy-back within 30 days of such completion, as may be prescribed (Sec.77-A(10).

Transfer of certain sum (Sec.77-A). Where a company purchases its own shares out of free reserves, a sum equal to the nominal value of share so purchased shall be transferred to capital redemption reserve account and details of such transfer shall be disclosed in the balance sheet.

Prohibition for buy-back in certain circumstances (Sec.77-B)

No company shall purchase its own shares or other specified securities -

(a) through any subsidiary company including its own subsidiary companies, or

(b) through any investment company or group of investment companies; or

(c) if a default, in repayment of deposit or interest thereon, redemption of debentures or preference shares or repayment of a term loan or interest thereon to any financial institutions or bank, is subsisting.

16. The Competition Act, 2002 intends to provide, keeping in view of the economic development of the country, for the establishment of a Commission to prevent practices having adverse effect on competition, to promote and sustain competition in markets, to protect the interests of consumers and to ensure freedom of trade carried on by other participants in markets, in India, and for matters connected therewith or incidental thereto. The renewed efforts of the Government in implementing a Competition Act, 2002 is a laudable step in the right direction and a new beginning in the frontiers of India's Competition Policy towards harmonizing international trade and policy.

Parameters of Competition Law

> Prohibition of certain agreements, which are considered to be anti-competitive in nature. Such agreements [namely tie in arrangements, exclusive dealings (supply and distribution), refusal to deal and resale price maintenance] shall be presumed as anti-competitive if they cause or likely to cause an appreciable adverse effect on competition within India.

> Abuse of dominant position by imposing unfair or discriminatory conditions or limiting and restricting production of goods or services or indulging in practices resulting in denial of market excess or through in any other mode are prohibited.

> Regulation of combinations which cause or likely to cause an appreciable adverse affect on competition within the relevant market in India is also considered to be void.

17. Stakeholders: The traditional governance model positions management as accountable solely to investors (shareholders). But a growing number of corporations accept that constituents other than shareholders are affected by corporate activity, and that the corporation must therefore be answerable to them. Coined only in the late part of the 20th century, this word "stakeholders describes such constituents of an organisation -the individuals, groups or other organizations which are affected by, or can affect the organisation in pursuit of its goals. A typical list of stakeholders of a company would be

Employees

Trade Unions

Customers

Shareholders and investors

Suppliers

Local communities

Government

Competitors.

18. 1. The Iron Law of Responsibility

The institution of business exists only because it performs invaluable services for society. Society gives business its charter to exist and that charter can be amended or revoked at any time if it fails to live up to society's expectations. Therefore, if a business intends to retain its existing social role and social power, it must respond to society's needs constructively. This is called the Iron Law of Responsibility. In the long-run those who do not use power in a manner that society considers responsible, will tend to lose it. And CSR policies help corporations to continue to fulfill the expectations the wider society places on them.

2. To Fulfill Long term Self-interest

A business organisation, sensitive to community needs would, in its own selfinterest, like to have a better community in which to conduct its business. To achieve that, it would implement special programmes for social welfare. As a result of this,

crime would decrease and less money required to protect property.

Labour recruitment would be easier.

Turnover and absenteeism would also be substantially reduced.

A better society would produce a better environment in which the business may gain long-term profit maximisation.

3. To Establish a Better Public Image

Each business organisation must enhance its public image to secure more customers, better employees and higher profit.. According to this line of argument, social goals are now a top priority with members of the public. So, if the firm wants to capture a favourable public image, it will have to show that it also supports these social goals.

4. To Avoid Government Regulation or Control

Regulation and control are costly to business, both in terms of energy and money and restrict its flexibility of decision-making, as failure of businessmen to assume social responsibilities invites government to intervene and regulate or control their activities.. Businessmen have learnt that once a government control is established, it is seldom removed even though the warranting conditions change. If these are the facts, then the prudent course for business is to understand the limit of its power and to use that power responsibly, giving government no opportunity to intervene. By their own socially responsible behaviour, they can prevent government intervention

5. To Avoid Misuse of National Resources and Economic Power

Businessmen command considerable power over the productive resources of a community. They are obliged to use those resources for the common good of society. They should not forget that the power to command national resources has been delegated to them by the society to generate more wealth for its betterment. They must honour social obligations while exercising the delegated economic power. Otherwise, society will not indefinitely tolerate their misdeeds in wasting away these resources.

19. (a) True: The report of the Brundtland Commission of 1987 title Our Common Future'

was one of the earliest documents to highlight and bring into international focus the concept of sustainable development.

(b) False: The Indian Competition Act, 2002 in addition to control of abuse of dominant position, deals with regulation of combinations, prohibition of monopolistic agreements and advocacy of fair competition.

(c) False: Two of Gandhiji's social sins are "commerce without morality' and knowledge without character'.

(d) True : The Adrian Cadbury Report of 1992 was a pioneering study of corporate governance issues and many other international studies were modeled on this.

(e) False: An employer is invariably held responsible for any sexual harassment that may go on in the workplace. The Supreme Court of India in the Vishaka vs. State of Rajasthan (1997) Case had placed entire onus on the employer to prevent sexual harassment in the workplace and part culpability on the employer in case of occurrences of sexual harassment offences.

20. Creating an Ethical Environment

The following three points need to be addressed for creating a sound ethical environment

in any company. They are:

1. Ensuring that employees are aware of their legal and ethical responsibilities.

Ethical organisations would have policies to train and motivate employees toward ethical behaviour. This would require initiation from the top. A number of companies, both in the West and in India have been known for their quality and soundness of their Ethics programmes. Companies like Raytheon make ethics training compulsory for everyone. Similarly Texas Instruments has a well drafted Ethics programme from as long as 1961. In India Wipro was amongst the pioneers to establish an organised set of beliefs which would guide business conduct. This was done as early as 1970s. In the process the company has established an Integrity manual which helps employees take ethical decisions when faced with choices.

2. Providing a communication system between the management and the employees so that any one in the company can report about fraud and mismanagement without the fear of being reprimanded.

Ethical organisations need to provide facilities for employees through which they could communicate with responsible higher-ups for reporting frauds, mismanagement or any other form of non routine detrimental behaviour. In India Wipro has introduced a helpline comprising of senior members of the company who are available for guidance on any moral, legal or ethical issues that an employee of the company may face.

3. Ensuring fair treatment to those who act as whistle blowers.

This is perhaps the most important and sensitive issue. When Sherron Watkins had raised questions at Enron, she was demoted. Similar fate would have met all those who had followed Sherron. Fair treatment to whistle blowers is a basic necessity to check fraud. It is reassuring that two of the three "persons of the year, selected by the popular Time magazine in that year were accountants from Enron and World Com who had dared to blow the whistle. However, needless to say, that the appreciation is much more needed from within the company rather than outside.

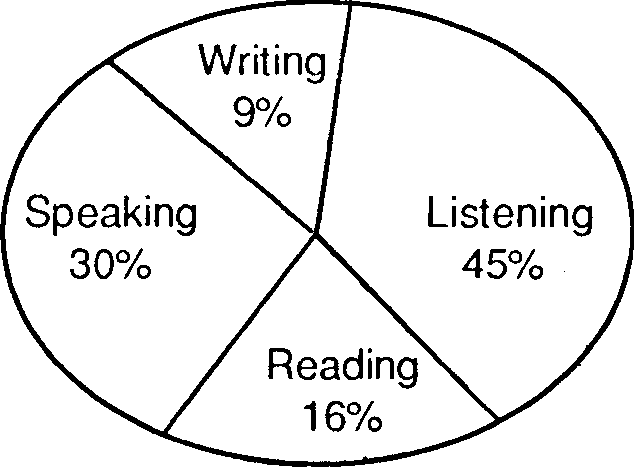

21. Oral Communication: According to a research, an average manager in general spends only 9% of his/her time in writing, 16% in reading, 30% in speaking and 45% in listening, as shown in the following figure

Oral communication is characterized by seven Cs - Candidness, Clarity, Completeness, Conciseness, Concreteness, Correctness, and Courtesy. These act as principles for choosing the form (style) and content (matter) of oral communication. Oral communication should provide a platform for fair and candid exchange of ideas.

Oral communication, which is face-to-face communication with others, has its own benefits. When people communicate orally, they are able to interact; they can ask questions and even test their understanding of the message. In addition, people can also relate and comprehend the non-verbal, which serves far more than words. By observing facial expressions, eye contact, tone of voice, gestures, postures, etc., one can understand the message better.

The only shortcoming of oral communication is that more often than not it is spontaneous and if one communicates incorrectly, the message will not get understood. It is primarily due to this reason, one need to develop effective oral communication skills as a message; if not understood at appropriate time, can lead to disaster.

22. Competencies Associated with Emotional Intelligence:

I - Personal Competence - How You Manage Yourself

Self-Awareness

> Emotional self-awareness: Reading your own emotions and recognizing their impact; using gut sense' to guide decisions

> Accurate self-assessment. Knowing your strengths and weaknesses

> Self-confidence: A sound sense of your self-worth and capabilities

> Self-Management

> Emotional self-control: Keeping disruptive emotions and impulses under control

> Transparency: Displaying honesty and integrity; trustworthiness

> Adaptability: Flexibility in adapting to changing situations or overcoming obstacles

> Achievement: The drive to improve performance to meet inner standards of excellence

> Initiative: Readiness to act and seize opportunities

> Optimism: Seeing the upside in events

II - Social Competence - How You Manage Relationships

Social Awareness

> Empathy: Sensing other's emotions, understanding their perspective and taking active interest in their concerns

> Organizational awareness: Reading the currents, decision networks, and politics at the organizational level

> Service: Recognizing and meeting follower, client, or customer needs

23. Types of Groups in Organization:

1. Self directed teams - autonomous and self regulated groups of employees empowered to make decisions.

2. Quality Circles - is a recent group dynamics technique representing a significant development in the fields of human relations and organizational behavior to improve productivity and work life in organizational settings. Quality Circle has been defined "as a group of workers from the same area who usually meet for an hour each week to discuss their quality problems, investigate causes, recommend solutions and take corrective actions when authority is in their purview. In other words, Quality Circle is a small group to perform voluntarily quality control activities within their work area.

3. Committees - are of various types (a) Standing Committee which are permanent in nature and highly empowered. (b) An advisory Committee comprises of experts in particular fields (c) An adhoc committee is setup for a particular purpose and after the goal is achieved, it is dissolved

4. Task Force - Task force is like Committee but it is usually temporary. Task force has wide power to take action and properly fix responsibility for investigation, results and proper implementation of decisions. Task force groups are very important in govt. organization to tackle specific administrative problems.

(a) Negotiation: Negotiation occurs when two or more parties-either individuals or groups discuss specific proposals in order to find a mutually acceptable agreement. Whether it is with an employer, family member or business associate, we all negotiate for things each day like higher salary, better service or solving a dispute with a co worker or family member. Negotiation is a common way of settling conflicts in business. When handled skillfully, negotiation can improve the position of one or even both but when poorly handled; it can leave a problem still unsolved and perhaps worse than before.

(b) Resistance to change: No matter whether a change is of major proportions or is objectively rather small, the change manager must anticipate that people in the organization are going to find reasons to resist changes. It is a basic tenet of human behaviour that any belief or value that has been previously successful in meeting needs will resist change.

(c) Gift deed: The law relating to gifts is provided for in the Transfer OF Property Act, 1882 and Indian Succession Act, 1925. Gift is defined as the transfer of certain movable or immovable property made voluntarily and without consideration by one person called the donor to another called the donee and accepted by or on behalf of the donee. A gift to be valid must be accepted by the donee during the life time of the donor. Registration of a gift often immovable property is must and that of movable property is optional.

25. Power of Attorney Before Registrar of Companies

We the subscribers to the Memorandum and Articles of Association of the proposed Company, hereby authorize to present the Memorandum of Articles of Association and other connected documents for the registration of the said company before the Registrar of Companies, Karnataka, Bangalore and to make such corrections / alternations / deletions / additions as may be required to be done by the Registrar in the documents and also to receive the certificate of incorporation.

General Power of Attorney

Know we all men by their presents that we--do hereby appoint and

constitute--son of---(hereinafter called ""Chartered Accountant who has

subscribed his signature hereunder in token of identification) presently residing at-

-------to be my lawful Chartered Accountant in our

name and on our behalf to do it any one or all of the following acts, deeds and things, namely:

1. to give all the particulars necessary for incorporation of company.

2. to give affidavit to the Registrar of Company for the purpose of incorporation.

3. to do needful acts necessary for the incorporation of the company.

4. to authorize include promissory notes, letter of declaration and indemnity for the purpose of incorporation.

5. to receive documents on behalf of one of the members of the company.

6. to sign forms, documents and papers required for the purpose of incorporation of the company.

Dated..........at this day..........of

(Address)

Specimen Signature of the Chartered Accountant above named Notary Public.

78

|

Attachment: |

| Earning: Approval pending. |