The Institute of Chartered Financial Analysts of India University 2010 C.A Chartered Accountant Integrated Professional Competence (IPCC) Revision Test s- 3 (II)-Financial Management - Question P

May 2010: The Institute of Chartered Accountants of India - Revision Test ques. papers (RTPs) Integrated Professional Competence Course (IPCC) Examination: Paper three (II) Financial Management: May 2010 University ques. paper

PART II : FINANCIAL MANAGEMENT

1. Answer the following, supporting the same with reasoning/working notes:

(a) The demand for a commodity is 40,000 units a year, at a constant rate. It costs Rs. 20 to place an order, and 40 paise to hold a unit for a year. Find the order size to minimize stock costs, the number of orders placed each year, and the length of the stock cycle.

(b) Nalanda Limited's average inventory is Rs. 1,00,00,000 and annual sales are Rs.

4,00,00,000. You are required to calculate the inventory conversion period.

(c) You are required to calculate the cost of equity of Alpha Limited whose risk-free interest rate equals to 5%, the expected market rate of interest equals to 10%, and the firm's beta coefficient is equal to 0.9.

(d) Discuss the features of Trade Credit.

(e) Discuss the advantages of raising finance by issue of debentures.

Working Capital Management

2. (a) Sakya Limited has the following data for your consideration:

(i) The minimum cash balance is Rs. 8,000.

(ii) The variance of daily cash flows is 40,00,000, equivalent to a standard deviation of Rs. 2,000 per day.

(iii) The transaction cost for buying or selling securities is Rs. 50.

(iv) The interest rate is 0.025 percent per day.

You are required to formulate a decision rule using the Miller- Orr model for cash management.

(b) Indian Metals Limited is considering a change of credit policy which will result in slowing down in the average collection period from one to two months. The relaxation in credit standards is expected to produce an increase in sales in each year amounting to 25% of the current sales volume.

Sales Price per unit Rs. 10.00

Profit per unit (before interest) Rs. 1.50

Current Sales Revenue per annum Rs. 24,00,000

Required Rate of Return on Investment 20%

Assume that the 25% increase in sales would result in additional stocks of Rs.

1,00,000 and additional creditors of Rs. 20,000. You are to advise the company on whether or not it should extend the credit period offered to customers, in the following circumstances:

(i) If all customers take the longer credit of two months.

(ii) If existing customers do not change their payment habits, and only the new customers take a full two months' credit.

Investment Decisions

3. You are required to compute the internal rate of return (IRR) of the project given below and advise whether the project should be accepted if the company requires a minimum return of 17%.

|

Time |

Rs. |

|

0 |

(4,000) |

|

1 |

1,200 |

|

2 |

1,410 |

|

3 |

1,875 |

|

4 |

1,150 |

Financing Decisions

4. The data relating to Company Alpha and Company Beta are given for your consideration:

| ||||||||||||||||||||||||

|

You are required to calculate the operating leverage, financial leverage and combined leverage of Alpha and Beta Companies. |

Financial Analysis and Planning

5. The following are the summarised Balance Sheets of Zeta Limited as on 31st March,

2008 and 2009:

|

(Rs. in 000) | ||||||||||||||||||||||||||||||||||||

|

195 Prepaid Selling Expenses Cash at Bank _ Cash in Hand

26

494

26

7,098 10,582 Profit & Loss Account for the year ended 31st March, 2009

7,098 10,582

|

To Opening stock To Purchases To Wages To Gross Profit c/d To Depreciation To Office Expenses To Rent To Selling & Distribution Expenses To Income Tax To Net Profit c/d To Dividend To Balance c/d |

Rs. (Rs. in 000) Rs. 6,331 1,105 7,436 260 4,290 806 By Sales 2,080 By Closing Stock 650 3,900 7,436 390 By Gross Profit b/d 390 By Discount 130 By Commission 780 By Dividend 1,040 1,560 4,290 650 By Balance b/d 2,600 By Net Profit b/d 3,250 |

You are required to prepare a Cash flow statement as per AS 3 (revised).

Investment Decisions

6. Given below are the data on a capital project X' for Theta Limited for your consideration:

Annual Cost Saving Rs. 60,000

Useful Life 4 years

Internal Rate of Return 15 %

Profitability Index 1.064

Salvage Value 0 You are required to calculate for the Project X:

(i) Cost of Project

(ii) Payback Period

(iii) Cost of Capital

(iv) Net Present Value.

|

The following discount factor table is given for your use: | ||||||||||||||||||||||||||||||

|

Financing Decisions

7. The capital structure of Shahuji Limited as on 31st March, 2009 is as follows:

Rs.

Equity capital : 6,00,000 equity shares of Rs. 100 each 6 crore

Reserve and surplus 1.20 crore

12% debenture of Rs. 100 each 1.80 crore

For the year ended 31st March, 2009 Shahuji Limited has paid equity dividend @ 24%. Dividend is likely to grow by 5% every year. The market price of equity share is Rs. 600 per share. Income-tax rate applicable to Shahuji Limited is 30%.

Required:

(i) Compute the current weighted average cost of capital.

(ii) The company has planned to raise a further Rs. 3 crore by way of long-term loan at 18% interest. If loan is raised, the market price of equity share is expected to fall to Rs. 500 per share. What will be the new weighted average cost of capital of Shahuji Limited?

Financial Analysis and Planning

8. Soft Toys Limited is a toy manufacturing company. It manufactures purple teddy bears, which is the latest craze among kids and teenagers. The company is now at full production of the teddy bears. The final accounts for the year 2008 and 2009 have been given for your consideration:

|

Profit and Loss Account for the year ending 31st |

December | |

|

2009 |

2008 | |

|

000 |

000 | |

|

Sales |

30,000 |

20,000 |

|

Cost of Sales |

20,000 |

11,000 |

10,000

450

9.550 2,000

7.550 2,500 5,050

9,000

400

8,600

1,200

7.400 2,500 4,900

2008

000

1.400

'000

'000

'000

7,350

10,000

2,500

3.000

6.000 4,500

19,850

13,500

2,000

2,500

4,200

2.500

2.500

(8,700)

(5,000)

11,150

(1,200)

11.450 5,000 6,450

11.450

8,500

(3,500)

6.400 5,000

1.400

6.400

Fixed Assets Current Assets Stock Debtors Cash

Current Liabilities Overdraft Dividends Payable Trade Creditors

Net Current Assets 8% Debentures Net Assets Equity Shares (25p) Profit and Loss a/c

Balance Sheet as on 31st December

2009

Operating Profit Interest

Profit before tax Tax

Profit after tax Dividends Retained Profit

000

1,500

000

You are required to identify the main problems faced by Soft Toys Limited using ratio analysis and provide possible solutions to the problems.

Financial Analysis and Planning

9. White Ash Limited is a manufacturer of products for the construction industry and its accounts are given for your consideration. You are required to calculate the liquidity and working capital ratios from the accounts and comment on the ratios.

2009 2008

Rs. (in lakhs) Rs. (in lakhs)

Turnover 2,065.0 1,788.7

Cost of Sales 1,478.6 1,304.0

Gross Profit 586.4 484.7

2009 2008 Rs. (in lakhs) Rs. (in lakhs)

Current Assets

Stocks 119.0 109.0

Debtors (Refer Note A) 400.9 347.4

Short-term Investments 4.2 18.8

Cash at bank and in hand 48.2 48.0

572.3 523.2

Current Liabilities

Loans and Overdrafts 49.1 35.3

Taxes 62.0 46.7

Dividend 19.2 14.3

Creditors (Refer to Note B) 370.7 324.0

501.0 420.3

Net Working Capital 71.3 102.9

Notes:

2009 2008

Rs. Rs.

A Trade Debtors 329.8 285.4

B Trade Creditors 236.2 210.8

Time Value of Money

10. You are required to calculate:

(a) The cost of a new mobile phone is Rs. 10,000. If the interest rate is 5 percent, how much would you have to set aside now to provide this sum in five years?

(b) You have to pay tuition fees amounting to Rs. 12,000 a year at the end of each of the next six years. If the interest rate is 8 percent, how much do you need to set aside today to cover these fees?

(c) You have invested Rs. 60,476 at 8 percent. After paying the above tution fees, how much would remain at the end of the six years?

|

11. The fixed assets and equities of Alpha Limited are supplied to you both at the beginning and at the end of the year 2008-2009: | ||||||||||||||||||

| ||||||||||||||||||

|

You are not in a position to have complete Balance Sheet data or an income statement for the year in spite of the fact that you have obtained the following information: |

(a) Dividend of Rs. 37,500 was paid.

(b) The net income included Rs. 13,000 as profit on sale of equipment. There has been an increase of Rs. 93,000 in the value of gross plant assets even though equipments worth Rs. 29,000 with a net book value of Rs. 19,000 were disposed off.

You are required to prepare a statement of sources and uses of net working capital.

12. Differentiate between the following:

(a) William J. Baumal and Miller- Orr Cash Management Model

(b) Global Depository Receipts and American Depository Receipts

(c) Profit maximization and Wealth maximization

(d) Operating Leverage and Financial Leverage.

13. Write short notes on the following:

(a) Debt Securitisation

(b) Venture Capital Financing

(c) Factoring

(d) Merits of Payback Period.

SUGGESTED ANSWERS/HINTS

EOQ = J 2 x 200<440,000

1600000

0.4

= 2,000 units

This means that there will be 1 = 20 orders placed each year, so that the

2,000

stock cycle is once every 52 + 20 = 2.6 weeks.

Total costs = (20 x Rs. 20) + x 0.40j = Rs. 800 a year.

(b) Calculation of Inventory Conversion Period

AverageInventory

Inventory Conversion Period = -

Sales per day Rs. 1,00,00,000

Inventory Conversion Period = -

Rs. 4,00,00,000 / 365 days

= 91 days

(c) Computation of Cost of Equity based on CAPM

Ke = Rf + b (Rm - Rf)

Ke = 5% + (10%- 5%) (0.9)

= 5% + (5%) (0.9)

= 5% + 4.5%

= 9.5%

Cost of Equity = 9.5%.

Trade Credit represents credit granted by suppliers of goods, etc., as an incident of sale. The usual duration of such credit is 15 to 90 days. It generates automatically in the course of business and is common to almost all business operations. It can be in the form of an 'open account' or 'bills payable'. Trade credit is preferred as a source of finance because it is without any explicit cost and till a business is a going

concern it keeps on rotating. Another very important characteristic of trade credit is that it enhances automatically with the increase in the volume of business.

(e) Advantages of Raising Finance by Issue of Debentures

(i) The cost of debentures is much lower than the cost of preference or equity capital as the interest is tax-deductible. Also, investors consider debenture investment safer than equity or preferred investment and, hence, may require a lower return on debenture investment.

(ii) Debenture financing does not result in dilution of control.

(iii) In a period of rising prices, debenture issue is advantageous. The fixed monetary outgo decreases in real terms as the price level increases.

2. (a) Computation using Miller Orr Cash Management Model

The spread between the upper and the lower cash balance limits is calculated as follows:

, /3 Transactioncost x Variance of cashflows3

Spread = 3 \ x-

I 4 Interest rate

3 = Rs. 25,303

1

3 50 x 40,00,000"

=3

x-

4 0.00025 = Rs. 25,300 approx.

The upper limit and return point are now calculated as:

Upper Limit = Lower Limit + Rs. 25,300 = Rs. 8,000 + Rs. 25,300 = Rs. 33,300 Return Point = Lower limit + /3 x spread

= Rs. 8,000 + X x Rs. 25,300 = Rs. 16,433 or Rs. 16,400 approx.

Decision Rule: If the cash balance reaches Rs. 33,300, buy Rs. 16,900 (= 33,30016,400) in marketable securities. If the cash balance falls to Rs. 8,000, sell Rs. 8,400 of marketable securities for cash.

(b) Change in Credit Policy

The change in credit policy would be justifiable, if the rate of return on the additional investment in working capital exceeds 20%.

Extra Profit

Profit Margin s.1.5Rs 10) 15%

Increase in Sales Revenue (Rs. 24,00,000 x 25%) Rs. 6,00,000

Increase in Profit (15% x Rs. 6,00,000) Rs. 90,000

Total Sales Revenue (Rs. 24,00,000 + Rs. 6,00,000) Rs. 30,00,000

(i) Extra Investment, if All Debtors take Two Months Credit

Average Debtors after the Sales Increase (2/12 x Rs.

5.00.000

2.00.000

3.00.000

1.00.000 4,00,000 (20,000) 3,80,000

30,00,000)

Current Average Debtors (1/12 x Rs. 24,00,000)

Increase in Debtors Increase in Stocks

Increase in Creditors Net Increase in Working Capital

Return on Extra Investment = Rs.90,000 _ 23.7%

Rs. 3,80,000

(ii) Extra Investment, if only the New Debtors take Two Months Credit

Rs.

Increase in Debtors (2/12 x Rs. 6,00,000) 1,00,000

Increase in Stocks 1,00,000

2,00,000

Increase in Creditors (20,000)

Net Increase in Working Capital Investment 1,80,000

Return on Extra Investment = Rs.90,000 _ 50%

Rs.1,80,000

Advise: In both the cases (i) and (ii), the new credit policy appears to be worthwhile. Furthermore, the cost profile of the product can also support extra sales. If the firm has high fixed costs but low variable costs, the extra production and sales could provide a substantial contribution at little extra cost.

3. Calculation of Internal Rate of Return (IRR)

Total receipts are Rs. 5,635 giving a total profit of Rs. 1,635 and average profit of Rs. 409. The average investment is Rs. 2,000. The ARR is Rs. 409 Rs. 2,000 = 20%. Two thirds of the ARR is approximately 14%. The initial estimate of the IRR that we will take is 14%.

|

Time |

Cash flow |

Discount factor at 14% |

PV |

Discount factor at 16% |

PV |

|

Rs. |

Rs. |

Rs. | |||

|

0 |

(4,000) |

1.000 |

(4,000) |

1.000 |

(4,000) |

|

1 |

1,200 |

0.877 |

1,052 |

0.862 |

1,034 |

|

2 |

1,410 |

0.769 |

1,084 |

0.743 |

1,048 |

3

4

0.675

0.592

NPV

1,266

681

83

0.641 1,202 0.552 635 NPV {81)

The IRR must be less than 16%, but higher than 14%. The NPVs at these two costs of capital will be used to estimate the IRR.

Using interpolation, we calculate IRR :

83

x (16% -14%)

IRR = 14% +

(83 + 81) 83 x 2%

= 14% +

164

= 14% +1.01% = 15.01%

Advise: The IRR is 15%. The project should be rejected as the IRR is less than the minimum return required by the company.

Computation of Degree of Operating Leverage, Financial Leverage and Combined Leverage of Companies Alpha and Beta

4

|

Company Alpha |

Company Beta | |

|

Output Units per annum |

60,000 |

15,000 |

|

Rs. |

Rs. | |

|

Selling Price / Unit |

30 |

250 |

|

Sales Revenue |

18,00,000 |

37,50,000 |

|

(60,000 units x Rs. |

(15,000 units x Rs. | |

|

30) |

250) | |

|

Less: Variable Costs |

6,00,000 |

11,25,000 |

|

(60,000 units x Rs.10) |

(15,000 units x Rs. 75) | |

|

Contribution (C) |

12,00,000 |

26,25,000 |

|

Less: Fixed Costs |

7,00,000 |

14,00,000 |

|

EBIT |

5,00,000 |

12,25,000 |

|

Less: Interest @ 12% on Debentures |

48,000 |

78,000 |

|

Earnings before taxes (EBT) |

4,52,000 |

11,47,000 |

Calculation of Degree of Operating Leverage (DOL)

2.4 2.14

DOL = (Rs.12,00,000 / (Rs.26,25,000 / Rs.12,25,000)

EBIT Rs.5,00,000)

Calculation of Degree of Financial Leverage (DFL)

DFL = EBIT 1.11 1.07

EBT (Rs.5,00,000 / Rs.4,52,000) (Rs.12,25,000 / Rs.11,47,000)

Calculation of Degree of Combined Leverage (DCL)

2.66 2.29

DCL = DOL x DFL (2.4 x 1.11) (2.14 x 1.07)

5. Cash Flow Statement for the year ending 31st March, 2009

[as per AS 3 (revised)]

(Rs. in 000)

6,019

(A) Cash flow from Operating Activities

Cash from Sales 5,928

Commission Received _91

Cash Payments

Cash Purchases 1,755

Wages 650

Office Expenses 390

Rent 117

Selling and Distribution Expenses 806

3,718

2,301

1,365

936

Less : Tax paid

Cash flow from Operating Activities (a)

(B) Cash flow from Investing Activities

Purchase of Plant & Machinery Dividend Received

(1,937)

260

Net Cash used in Investing Activities (b)

(C) Cash flow from Financing Activities

Issue of Shares Issue of 12% Debentures Dividend Paid

1.300

1.300 (650)

Net Cash flow from Financing Activities (c)

Net Increase in Cash and Cash Equivalents during the year (a+b+c)

Add: Cash and Cash Equivalents at 1-4-2008 Cash and Cash Equivalents at 31-3-2009 Working Notes:

520

1,729

1. Cash Sales

Cash Sales = Total Sales - Increase in Debtors = 6,331 - (1,131 - 728)

= 6,331 - 403 = Rs. 5,928

2. Cash Purchases

Cash Purchases = Total Purchases - Increase in Creditors = 2,080- (1,222+39- 936)

= 2,080- 325= Rs. 1,755

3. Rent

Rs.

130

182

117

Rent

Add: Rent Outstanding as on 31-3-2008 Less: Rent Outstanding as on 31-3-2009

4. Tax Payable

|

To Tax Paid To Balance c/d |

Tax Payable A/c Rs. Rs. 520 1,040 1,560 1,365 By Balance b/d 195 By Profit and Loss A/c 1,560 |

5. Selling and Distribution Expenses

Rs.

780

52

Selling and Distribution Expenses

Add: Prepaid Selling Expenses on 31-3-2009

Less: Prepaid Selling Expenses on 31-3-2008 _26

At 15% internal rate of return (IRR), the Sum of total cash inflows = Cost of the project i.e Initial cash outlay

Annual Cost Savings = Rs. 60,000

Useful life = 4 years

Considering the discount factor table @ 15%, cumulative present value of cash inflows for 4 years is 2.855

Hence, Total Cash inflows for 4 years for Project X is

60,000 x 2.855 = Rs. 1,71, 300

Hence, Cost of the Project = Rs. 1,71,300

Cost of the Project

Pay back period =

Annual Cost Savings Rs. 1,71,300

60,000

Payback Period = 2.855 years

Profitability index = 1.064 =

1,71,300

Sum of Discounted Cash inflows = Rs. 1,82,263.20 Since, Annual Cost Saving = Rs. 60,000

Hence, cumulative discount factor for 4 years = Rs.1,82'263.20

60,000

From the discount factor table, at discount rate of 12%, the cumulative discount factor for 4 years is 3.038

Hence, Cost of Capital = 12%

NPV = Sum of Present Values of Cash inflows - Cost of the Project

= Rs. 1,82,263.20- 1,71,300

= Rs. 10,963.20

Net Present Value = Rs. 10,963.20

7. (i) Computation of Current Weighted Average Cost of Capital

Cost of Debentures (kd)

I 12

kd = (1 -1) = (1- 0.30)

NP 100

= 8.4%

Cost of Equity Share Capital (ke)

i D1

= P- + g P0

= 24(1+0.05) + 5%

600

25.2

+ 0.05 600

= 0.042 + 0.05 = 0.092 = 9.2%

Sources of Amount Weight Cost of Capital Weighted

Capital (Rs. in Cost of

crores) Capital

Equity 7.20 0.8 9.2% 7.36

Debentures 1.80 0.2 8.4% 1.68

Weighted Average Cost of Capital 9.04

Current Weighted Average Cost of Capital = 9.04 %

Computation of New Weighted Average Cost of Capital

Cost of Existing Debentures (kd)

Cost of existing debenture = 8.4%

Cost of Loan

18

Cost of Loan = -(1-0.30)

100

= 0.18 x 0.70 = 12.6%

k, = 24(105) + 5%

500

25.2

+ 0.05

500

= 0.0504 + 0.05 = 0.1004 = 10.04%

| |||||||||||||||||||||||||||||||||||

|

New Weighted Average Cost of Capital = 10.434% |

8. (i) Problems Faced by Soft Toys Limited

Soft Toys Limited has become significantly more reliant on short-term liabilities to finance its operations as shown by the following analysis:

2009 2008

000 000

Total Assets 21,350 14,900

|

Short-term Liabilities Long-term Funds and Debt) |

8,700 40.7% (Equity 12,650 59.3% 21,350 |

5,000 33.6% 9,900 66.4% 14,900 |

A major reason for this is overtrading. Sales increased by 50% in one year, but the operating profit margin fell from 9,000/20,000 = 45% in 2008 to 10,000/30,000 = 33% in 2009.

However, the effect is compounded by the repayment of Rs. 2.3 million (66%) of the 8% debentures and replacement with Rs. 2 million bank overdraft and increased trade creditor finance. Although this may be because the interest rate on the overdraft is cheaper than on the debentures. It is generally not advisable in the context of the risk of short-term debt.

However, if it is felt that the current sales volume is abnormal and that, when the Soft Toys Limited reaches the end of its product life cycle, sales will stabilise at a lower level, the use of shorter-term debt is justified.

As a result of overtrading, the company's current ratio has deteriorated from

13,500 / 5,000 = 2.7 in 2008 to 19,850 / 8,700 = 2.28 in 2009. The quick assets ratio (or acid test') has deteriorated from 10,500 / 5,000 = 2.1 to 12,500 / 8,700 =

1.44. However, these figures are acceptable and only if they continue to deteriorate, there is likely to be liquidity problem. In the year 2009, the company continues to have a healthy bank balance, although this has been achieved partly by halting dividend growth.

(d) Investment in Fixed Assets

Soft Toys Limited has not maintained an investment in fixed assets to match its sales growth. Sales/ fixed assets ratio has increased from 20,000 / 1,400 = 14.3 times to 30,000 / 1,500 = 20 times. This may be putting the quality of production at risk, but may be justified, however, if sales are expected to decline when the purple teddy bear loses its popularity.

An analysis of working capital ratios shows that:

(i) Stock turnover ratio has decreased from 20,000 / 3,000 = 6.67 times to

30,000 / 7,350 = 4.08 times. This indicates that there has been a large investment in stock. The question of whether this is justified again depends on expected future sales, but the strategy appears to be the opposite of that adopted for fixed assets.

(ii) The average debtors payment period has increased from 6,000 / 20,000 x 365 = 110 days to 10,000 / 30,000 x 365 = 122 days, indicating a lack of credit control. This has contributed to weakening of the cash position. There appears to be no evidence of prompt payment discounts to debtors.

(iii) The payment period to creditors (estimated roughly) has decreased from

2,500 / 11,000 x 365 = 83 days to 4,200 / 20,000 x 365 = 77 days. This result is unexpected, indicating that there has been no increase in delaying payment to creditors over the year. Creditors are being paid in a significantly shorter period than the period of credit taken by customers.

(f) Thus the main problem facing Soft Toys Limited is its increasing over dependence on short-term finance, caused mainly by:

(i) A major investment in stock to satisfy a rapid increase in sales volumes,

(ii) Deteriorating profit margins,

(iii) Poor credit control of debtors, and

(iv) Repayment of debenture capital.

(ii) Solutions Provided for Soft Toys Limited

Possible solutions to the above problems depend on future sales and product projections of Soft Toys Limited. If the rapid increase in sales has been a one-product phenomenon, there is little point in over-capitalizing by borrowing longterm and investing in a major expansion of fixed assets. If, however, sales of this and future products are expected to continue increasing, and further investment is needed, the company's growth should be underpinned by an addition of equity capital and an issue of longer-term debt.

(b) Better Working Capital Management

Regardless of the above, the working capital strategies followed by Soft Toys Limited could be improved. Debtors should be encouraged to pay more promptly. This is best done by instituting proper credit control procedures. Longer credit periods could probably be negotiated with creditors and quantity discounts should be considered.

|

9. Computation of Liquidity and Working Capital Ratios for White Ash Limited | ||||||||||||||||||

|

Analysis: White Ash Limited is a manufacturing group serving the construction industry, and so would be expected to have comparatively lengthy debtors' turnover period, because of the relatively poor cash flow in the construction industry. It is clear that the company compensates for this by ensuring that they do not pay for raw materials and other costs before they have sold their stocks of finished goods (hence the similarity of debtors' and creditors' turnover periods.)

White Ash Limited's current ratio is a little lower than average but its quick ratio is better than average and very little less than the current ratio. This suggests that the stock levels are strictly controlled, which is reinforced by the low stock turnover period. It would seem

that working capital is tightly managed, to avoid the poor liquidity which could be caused by a high debtors' turnover period and comparatively high creditors.

10. You are required to use the Appendix tables given at the end of the study material.

(a) 1+ (1.05)5 = 0.784. Therefore, you need to set aside 10,000 x 0.784 = Rs. 7,840.

(b) The present value of Re.1 a year for 6 years at 8% is 4.623. Therefore, you need to set aside 12,000 x 4.623 = Rs. 55,476.

(c) 1.086 = 1.587. Therefore, at the end of 6 years you would have 1.587 x (60,476 -55,476) = Rs. 7,935.

Net increase in Gross Value 93,000

Add: Gross Value of Plant Sold 29,000

1,22,000

(ii) Depreciation on Plant and Machinery

Plant and Machinery Account

Rs.

Rs.

19.000

To Balance b/d 63,500 By Sale of Plant & Machinery A/c

To Purchases 1,22,000 By Depreciation (balancing figure)

_____ By Balance c/d

1,85,500

Rs.

1,72,500

37,500

Increase in Retained Earnings [4,10,500 - 2,38,000]

Add: Dividend Paid Add: Depreciation on Plant

Less: Gain on Sale of Equipment

Statement of Sources and Uses of Fund

|

Sources Funds from Operation Sale of Equipment |

Rs. Uses 2,21,000 Purchase of plant Rs. 1,22,000 of 1,58,000 32,000 Purchase Investments |

37,500

4,97,500

|

|

4,97,500 |

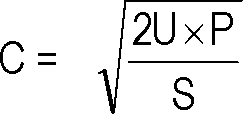

12. (a) William J. Baumal and Miller- Orr Cash Management Model

According to William J. Baumal's Economic order quantity model optimum cash level is that level of cash where the carrying costs and transaction costs are the minimum. The carrying costs refer to the cost of holding cash, namely, the interest foregone on marketable securities. The transaction cost refers to the cost involved in getting the marketable securities converted into cash. This happens when the firm falls short of cash and has to sell the securities resulting in clerical, brokerage, registration and other costs.

The optimim cash balance according to this model will be that point where these two costs are equal. The formula for determining optimum cash balance is:

Where,

C = Optimum cash balance

U = Annual (monthly) cash disbursements

P = Fixed cost per transaction

S = Opportunity cost of one rupee p.a. (or p.m.)

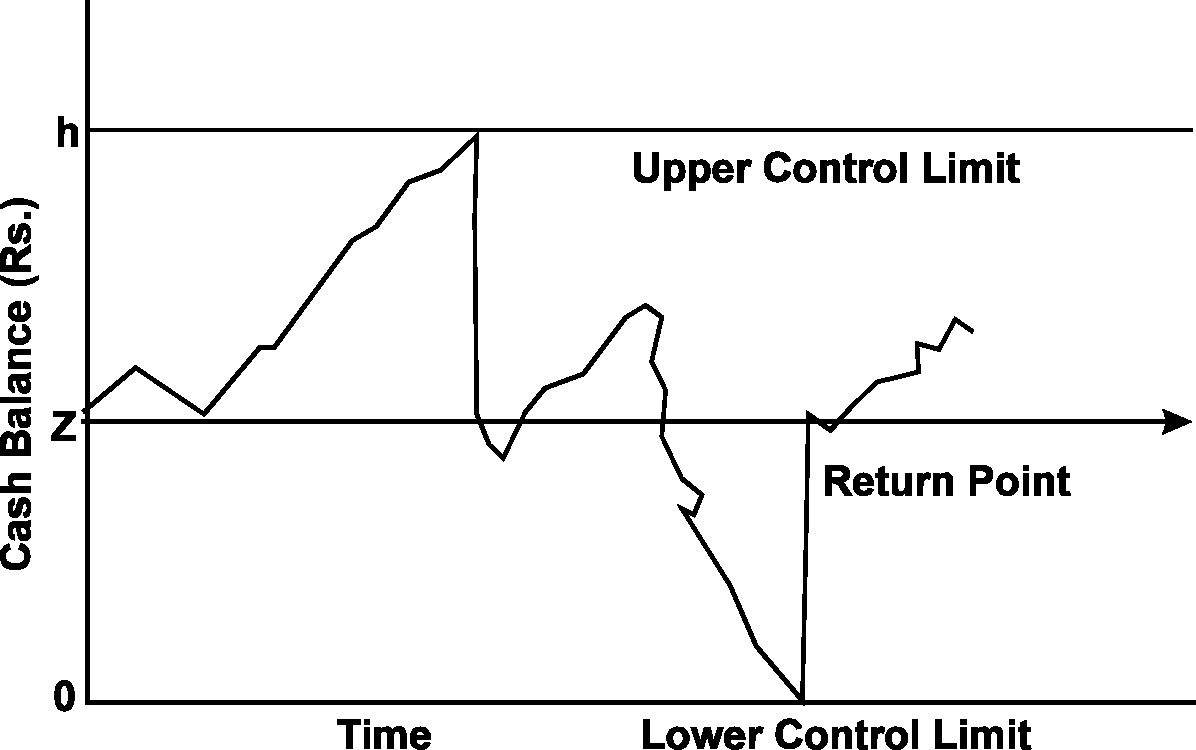

Miller-Orr cash management model is a net cash flow stochastic model. This model is designed to determine the time and size of transfers between an investment account and cash account. In this model control limits are set for cash balances. These limits may consist of h as upper limit, z as the return point, and zero as the lower limit.

When the cash balances reaches the upper limit, the transfer of cash equal to h-z is invested in marketable securities account. When it touches the lower limit, a transfer from marketable securities account to cash account is made. During the period when cash balance stays between (h, z) and (z, o ) i.e high and low limits no transactions between cash and marketable securities account is made. The high and low limits of cash balance are set up on the basis of fixed cost associated with the securities transactions, the opportunity cost of holding cash and the degree of likely fluctuations in cash balances. These limits satisfy the demands for cash at the lowest possible total costs. The diagram given below illustrates the Miller- Orr model.

MILLER-ORR CASH MANAGEMENT MODEL

(b) Global Depository Receipts (GDRs) and American Depository Receipts (ADRs)

Global Depository Receipt is a negotiable certificate denominated in US dollars, which represents a non-US company's publicly, traded local currency equity.

GDRs are created when the local currency shares of an Indian company are delivered to the depository's local custodian bank, against which depository bank issues depository receipts in US dollar.

The GDRs may be freely traded in the overseas market like any other dollar denominated security either on a foreign stock exchange or in the over-the-counter market of qualified institutional buyers (QIBs). By issue of GDRs, Indian companies are able to tap global equity market to raise foreign currency funds by way of equity. It has distinct advantage over debt as there is no repayment of the principal and service costs are lower. Rule 144A of SEC of USA permits companies from outside USA to offer their GDRs to QIBs.

Whereas, American Depository Receipts (ADRs) are depository receipts issued by a company in the USA and are governed by the provisions of Security and Exchange Commission of USA. As the regulations are severe, Indian Companies tap the American market through private debt placements of GDRs listed in London Luxemburg Stock Exchanges.

Apart from legal impediments, ADRs are costlier than GDRs. Legal fees are considerably high for US listing. Registration fee in USA is also substantial. Hence, ADRs are less popular than GDR's.

The two most important objectives of financial management are as follows:

1. Profit maximization

2. Value maximization

Objective of profit maximization: Under this objective the financial manager's sole objective is to maximize profits. The objective could be short-term or longterm. Under the short-term objective the manager would intend to show profitability in a short run say one year. When profit maximization becomes a long-term objective the concern of the financial manager is to manage finances in such a way so as to maximize the EPS of the company.

Objective of value maximization: Under this objective the financial manager strives to manage finances in such a way so as to continuously increase the market price of the company's shares.

Under the short-term profit maximization objective a manager could continue to show profit increased by merely issuing stock and using the proceeds to invest in risk-free or near to risk-free securities. He may also opt for increasing profit through other non-operational activities like disposal of fixed assets etc. This would result in a consistent decrease in the shareholders profit - that is earning per share would fall. Hence it is commonly thought that maximizing profits in the long run is a better objective. This would increase the Earning Per Share on a consistent basis. However, even this objective has its own shortcomings, which are as follows:

It does not specify the timing of duration of expected returns, hence one cannot be sure whether an investment fetching a Rs. 10 lakhs return after a period of five years is more or less valuable than an investment fetching a return of Rs. 1.5 lakhs per year for the next five years.

It does not consider the risk factor of projects to be undertaken; in many cases a highly levered firm may have the same earning per share as a firm having a lesser percentage of debt in the capital structure. In spite of the EPS being the same the market price per share of the two companies shall be different.

This objective does not allow the effect of dividend policy on the market price per share; in order to maximize the earning per share the companies may not pay any dividend. In such cases the earning per share shall certainly increase, however the market price per share could as well go down.

For the reasons just given, an objective of maximizing profits may not be the same as maximizing the market price of share and hence the firm's value. The market price of a firm's share represents the focal judgment of all market participants as to the value of the particular firm. It takes into account present

as well as futuristic earnings per share; the timing, duration and risk of these earnings; the dividend policy of the firm; and other factors that bear upon the market price of the share. The market price serves as a barometer of the company's performance; it indicates how well management is doing on behalf of its shareholders. Management is under continuous watch. Shareholders who are not satisfied may sell their shares and invest in some other company. This action, if taken, will put downward pressure on the market price per share and hence reduce the company's value.

(d) Operating Leverage and Financial Leverage

Operating leverage is defined as the "firm's ability to use fixed operating costs to magnify effects of changes in sales on its earnings before interest and taxes. When there is an increase or decrease in sales level the EBIT also changes. The effect of change in sales on the level of EBIT is measured by operating leverage. Operating leverage occurs when a firm has fixed costs which must be met regardless of volume of sales. When the firm has fixed costs, the percentage change in profits due to change in sales level is greater than the percentage change in sales.

Whereas, Financial leverage is defined as "the ability of a firm to use fixed financial charges to magnify the effects of changes in EBIT/Operating profits, on the firm's earnings per share. The financial leverage occurs when a firm's capital structure contains obligation of fixed financial charges e.g. interest on debentures, dividend on preference shares etc. along with owner's equity to enhance earnings of equity shareholders. The fixed financial charges do not vary with the operating profits or EBIT. They are fixed and are to be paid irrespective of level of operating profits or EBIT.

It is a method of recycling of funds. It is especially beneficial to financial intermediaries to support the lending volumes. Assets generating steady cash flows are packaged together and against this asset pool, market securities can be issued, e.g. housing finance, auto loans, and credit card receivables.

Process of Debt Securitisation

(i) The origination function - A borrower seeks a loan from a finance company or a bank. The credit worthiness of borrower is evaluated and contract is entered into with repayment schedule structured over the life of the loan.

(ii) The pooling function - Similar loans on receivables are clubbed together to create an underlying pool of assets. The pool is transferred in favour of Special Purpose Vehicle (SPV), which acts as a trustee for investors.

(iii) The securitisation function - SPV will structure and issue securities on the basis of asset pool. The securities carry a coupon and expected maturity which can be asset-based/mortgage-based. These are generally sold to investors through merchant bankers. Investors are - pension funds, mutual funds, insurance funds.

The process of securitisation is without recourse i.e. investor bears the credit risk or risk of default. Credit enhancement facilities like insurance, letter of credit (LOC) and guarantees are also provided.

It refers to financing of new high risky venture promoted by qualified entrepreneurs who lack experience and funds, to give shape to their ideas. In other words, under venture capital financing venture capitalist make investment to purchase equity or debt securities from inexperienced entrepreneurs who undertake highly risky ventures with a potential of success.

Some common methods of venture capital financing are as follows:

(i) Equity financing: When funds are required for a longer period but the firm fails to provide returns to the investors during the initial stages, the venture capital finance is provided by way of equity share capital.

(ii) Conditional loan: A conditional loan is repayable in the form of a royalty after the venture is able to generate sales'. Here royalty ranges between 2 to 15 per cent. No interest is paid on such loans.

(iii) Income note: It combines the features of both conventional and conditional loans. The concern has to pay viz., interest and royalty on sales but at substantially low rates.

(iv) Participating debenture: Such a security carries charges in three phases - in the start - up phase no interest is charged, next stage a low rate of interest is charged up to a particular level of operation, after that, a high rate of interest is required to be paid.

It is a new financial service that is presently being developed in India. It is not just a single service, rather a portfolio of complimentary financial services available to clients i.e., sellers. The sellers are free to avail of any combination of services offered by the factoring organizations according to their individual requirements.

Factoring involves provision of specialized services relating to credit investigation, sales ledger management, purchase and collection of debts, credit protection as well as provisions of finance against receivables and risk-bearing. In factoring, accounts receivables are generally sold to a financial institution (a subsidiary of commercial bank called "Factor) that charges commission and bears the credit risks associated with the accounts receivable purchased by it.

Its operation is very simple. Clients enter into an agreement with the "Factor working out a factoring arrangement according to his requirements. The Factor then takes the responsibility of monitoring; follow - up, collection and risk - taking and provision of advance. The factor generally fixes up a limit customer-wise for the client (seller).

The seller selects various combinations of these functions by changing provision in the factoring agreements. The seller may utilize the factor to perform the credit checking and risk-taking functions but not the lending functions. Under this arrangement the factor checks and approves the invoices.

(i) This method of evaluating proposals for capital budgeting is quite simple and easy to understand. It has the advantage of making it clear that there is no profit on any project unless the payback period is over. Further, when funds are limited, they may be made to do more by selecting projects having shorter payback periods. This method is particularly suitable in the case of industries where the risk of technological obsolescence is very high. In such industries, only those projects which have a shorter payback period should be financed since the change in technology would make the projects totally obsolete before their costs are recovered.

(ii) In the case of routine projects also use of payback period method favours projects which generate cash inflows in earlier years, thereby eliminating projects bringing cash inflows in later years which generally are conceived to be risky as risk tends to increase with futurity.

(iii) By stressing earlier cash inflows, liquidity dimension is also considered in the selection criterion. This is important in situations of liquidity crunch and high cost of capital.

(iv) The pay back period can be compared to a break-even point, the point at which the costs are fully recovered but profits are yet to commence.

(v) The risk associated with a project arises due to uncertainty associated with the cash inflows. A shorter payback period means that the uncertainty with respect to the project is resolved faster.

127

|

Attachment: |

| Earning: Approval pending. |