The Institute of Chartered Financial Analysts of India University 2010 C.A Chartered Accountant Professional Edution II (PE-II) Revision Test s- 4A- Cost Accounting - Question Paper

May 2010: The Institute of Chartered Accountants of India - Revision Test ques. papers (RTPs) Professional Education II Course (PE-II) Examination: Paper 4A- Cost Accounting: May 2010 University ques. paper

PAPER - 4 : COST ACCOUNTING AND FINANCIAL MANAGEMENT

SECTION - A : COST ACCOUNTING QUESTIONS

Basic Concepts and Product Cost Sheet

1. (i) Discuss the four different methods of costing along with their applicability to

concerned industry?

(ii) Name the various reports that may be provided by the Cost Accounting Department of a big manufacturing company for the use of its executives.

Materials

2. (i) The Shreya Nath Company uses about 75,000 valves per year and the usage is

fairly constant at 6,250 per month

When bought in quantities, the valves cost Rs. 1.50 per unit and the carrying cost is estimated at 20% of average inventory investment on the annual basis. The cost to place an order and process the delivery is Rs. 18.

It takes 45 days to receive delivery from the date of and order and a safety stock of 3,250 valves is desired.

You are required to determine:

(a) the most economic order quantity and frequency of orders in a year ; (b) the order point ; and (c) the most economic order quantity, if the valves cost Rs. 4.50 each instead of Rs. 1.50 each.

(ii) Explain the advantages that would accrue in using the LIFO method of pricing for the valuation of raw material stock

Materials

3. Mehrotra Ltd. distributes wide range of Water purifier systems. One of its best selling items is a standard water purifier. The management of Mehrotra Ltd. uses the EOQ decision model to determine optimal number of standard water purifiers to order. Management now wants to determine how much safety stock to hold.

Mehrotra Ltd. estimates annual demand (360 working days) to be 36,000 standard water purifiers. Using the EOQ decision model, the company orders 3,600 standard water purifiers at a time. The lead-time for an order is 6 days. The annual carrying cost of one standard purifier is Rs. 450. Management has also estimated the additional stock out costs would be Rs. 900 for shortage of each standard water purifier.

Demand during lead time Number of times _quantity was demanded_

540

560

580

600

620

640

660

16

130

20

10

6

200

Mehrotra Ltd. has analysed the demand during 200 past re-order periods. The records indicate the following patterns:

(i) Determine the level of safety stock for standard water purifier that the Mehrotra Ltd. should maintain in order to minimize expected stock out costs and carrying 'costs. When computing carrying costs, assume that the safety stock is on hand at all times and that there is no overstocking caused by decrease in expected demand (consider safety stock levels of 0, 20, 40 and 60 units).

(ii) What would be the Mehrotra Ltd.'s new re-order point?

(iii) What factors Mehrotra Ltd. should have considered in estimating stock out costs?

Labour

4. (i) Under the Rowan Premium system a less efficient worker can obtain the same bonus as high efficient worker. Discuss.

(ii) Assuming a man day of 8 hours, you are required to calculate the labour cost per man day. The following data has been provided.

|

a) Basic Salary b) Dearness Allowance c) Leave Salary d) Employer's contribution to Provident |

Rs 2 per day 25 paise per every point over 100 cost of living index for working class. Current cost of living index is 700 points. 10% of (a) and (b) 8% of (a), (b) and (c) |

Fund

e) Employer's contribution to State

2.5% of (a), (b) and (c)

Rs. 20 per head per mensem

Insurance

f) Expenditure on amenities to labour

g) Number of working days in a month 25 days of 8 hours each

Overheads

|

Anisha Ltd. has two production departments and two service departments. The data relating to a period are as under: | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

|

The power requirement of these departments are met by a power generation plant. The said plant incurred an expenditure, which is not included above, of Rs. 1,21,875 out of which a sum of Rs. 84,375 was variable and the rest fixed,. After apportionment of power generation plant costs to the four departments, the service department overheads are to be redistributed on the following basis: | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||

|

You are required to: |

(i) Apportion the power generation plant costs to the four departments.

5

(ii) Re-apportion service department costs to production departments.

(iii) Calculate the overhead rates per direct labour hour of production departments, given that the direct wage rates of PD1 and PD2 are Rs. 5 and Rs. 4 per hour respectively.

Non-Integrated Accounting

6. Rohan Ltd operates a historical job costing system, which is not integrated with financial accounts. The company manufactures engines, the technology of which is frequently bought from inventors to whom royalty is needed to be paid. The following are details of the opening balances in the Cost Ledger for the month of May 2009 ,

Rs

Stores ledger control account 85,400

Work in progress control account 1,67,350

Finished goods control account 49,250

Cost ledger control account 3,02,000

Rs

Material:

Purchases 42,700

Issues to production 63,400

Issues to general maintenance 1,450

Issues to construction of manufacturing equipment 7,650

Factory wages

Total gross wages paid 1,24,000

Rs 75,750 of the above wages are direct wages while Rs 12,500 has been expended on the construction of manufacturing equipment; the balance being the amount paid as indirect wages.

The actual amount of production overhead incurred excluding the items shown above amounted to Rs 1,52,350 out of which Rs 30,000 was absorbed by the manufacturing equipment under construction and Rs 7,550 was under absorbed. As per the policy of Rohan Ltd, the under absorbed overhead needed to be written off at the month end. The company shall also pay Rs 2,150 as royalty for the relevant months production to an inventor from whom technology had been bought.

Selling overheads : Rs. 22,000

Sales : Rs. 4,10,000

The company's gross profit margin is 25% on factory cost.

At the end of the month stocks of work in progress had increased by Rs 12,000. The manufacturing equipment under construction was completed within the month , and transferred out of the cost ledger at the end of the month.

You are required to prepare the relevant control accounts, costing profit and loss account and any other accounts you consider necessary to record the above transactions in the cost ledger for the concerned month.

Joint Products and By- Products

7. In an Oil Mill four products emerge from a refining process. The total cost of input during the quarter ending March 2010 is Rs. 1,48,000. The output, sales and additional processing costs are as under:

|

Products |

Output in Litres |

Additional processing cost after split off |

Sales value |

|

ACH |

8,000 |

43,000 |

1,72,500 |

|

BCH |

4,000 |

9,000 |

15,000 |

|

CSH |

2,000 |

- |

6,000 |

|

DSH |

4,000 |

1,500 |

45,000 |

In case these products wee disposed off at the split off point that is before further processing, the selling price would have been:

ACH

15.00

BCH

6.00

CSH

3.00

DSH

7.50

Prepare a statement of profitability based on:

(i) If the products are sold after further processing is carried out in the mill.

(ii) If they are sold at the split off point.

Process Costing

8. The following data are available in respect of Process A for February, 2010 of Ishan Ltd: Opening work-in-progress Degree of completion of opening work-in-progress:

Materials 100%

Labour 60%

Overhead 60%

Input of materials 9,200 units at a total cost of Rs. 36,800

Direct wages incurred Rs. 16,740

Production overhead Rs. 8,370

Units scrapped in the process 1,200. The stage of completion of these units was: Materials 100%

Labour 80%

Overhead 80%

Closing work-in-progress 900 units. The stage of completion of these units was: Materials 100%

Labour 70%

Overheads 70%

Units completed and transferred to the next process 7,900.

Normal process loss is 8% of the total input (opening stock plus units put in).

Scrap value is Rs. 4 per unit.

You are required to:

(a) compute equivalent production ;

(b) calculate the cost per equivalent units for each element ;

(c) calculate the cost of abnormal loss (or gain), closing work-in-progress and the units transferred to the next process using the FIFO method ;

(d) Prepare the process and other accounts.

Operating Costing

9. The Unique Transport Company has been given a twenty kilometer long route to play a bus. The bus costs the company Rs. 1,00,000. It has been insured at 3% per annum. The annual road tax amounts to Rs. 2,000. Garage rent is Rs. 400 per month. Annual repair is estimated to cost Rs. 2,360 and the bus is likely to last for five years.

The salary of the driver and the conductor is Rs.600 and Rs. 200 per month respectively in addition to 10% of takings as commission to be shared equally by them. The manager's salary is Rs.1,400 per month and stationery will cost Rs. 100 per month. Petrol and oil cost Rs. 50 per 100 kilometers. The bus will make three round trips per day carrying on an average 40 passengers in each trip. Assuming 15% profit on takings and that the bus will ply on an average 25 days in a month, prepare operating cost statement on a full year basis and also calculate the bus fare to be charged from each passenger per kilometer.

Contract Costing

10. Girish Construction Company with a paid-up share capital of Rs. 25 lakhs undertook a contract to construct STC houses. The contract work commenced on 1.1.09 and the contract price was Rs. 25 lakhs. Cash received on account of contract on 31.12.09 was Rs. 9 lakhs (90% of the work certified). Work completed but not certified was estimated at Rs. 50,000. As on 31.12.09 material at site was estimated at Rs. 15,000 and machinery at site costing Rs. 1,00,000 was returned to the stores. Plant and machinery at site is to be depreciated at 5%. Wages outstanding on 31.12.09 was Rs. 2,500.

Land and Buildings

25,000

5,000

7,00,000

62,500

Rates and taxes 7,500

Cash at bank 66,500

Wages 1,25,000

Prepare the Contract Account to ascertain the profit from the contract and show the WIP in the Balance sheet .

Cost Audit & Cost Accounting (Records) Rules

11. State the areas of activity for which accounting records are to be maintained under Cost Accounting Record Rules.

Activity Based Costing

12. Ranbaxy Limited specializes in the distribution of pharmaceutical products. It buys from the pharmaceutical companies and resells to each of the three different markets.

(i) General Supermarket Chains

(ii) Drugstore Chains

(iii) Chemist Shops

|

The following data for the month of April, 2009 in respect of Ranbaxy Limited has been reported: | ||||||||||||||||

| ||||||||||||||||

|

In the past, Ranbaxy Limited has used gross margin percentage to evaluate the relative profitability of its distribution channels. |

The company plans to use activity -based costing for analysing the profitability of its distribution channels.

The activity analysis of Ranbaxy Limited is as under:

Activity Area

Cost Driver

|

Customer purchase order processing Line-item ordering Store delivery Cartons dispatched to stores Shelf-stocking at customer store |

Purchase orders by customers Line-items per purchase order Store deliveries Cartons dispatched to a store per delivery Hours of shelf-stocking |

The April, 2009 operating costs (other than cost of goods sold) of Ranbaxy Limited are Rs. 8,27,970. These operating costs are assigned to five activity areas. The cost in each area and the quantity of the cost allocation basis used in that area for April, 2009 are as follows:

| ||||||||||||||||||

|

Other data for April, 2009 include the following: |

| ||||||||||||||||||||||||

|

Required: (i) Compute for April, 2009 gross-margin percentage for each of its three distribution |

channels and compute RST Limited's operating income.

(ii) Compute the April, 2009 rate per unit of the cost-allocation base for each of the five activity areas.

(iii) Compute the operating income of each distribution channel in April, 2009 using the activity-based costing information. Comment on the results. What new insights are available with the activity-based cost information?

(iv) Describe four challenges one would face in assigning the total April,2009 operating costs of Rs. 8,27,970 to five activity areas.

13. B Electronics Ltd. furnishes the following information for 10,000 TV valves manufactured

during the year, 2009.

|

Rs. |

Rs. | ||

|

Materials |

90,000 |

Clerical Salaries and | |

|

Direct wages |

60,000 |

Management expenses |

33,500 |

|

Power and consumable stores |

12,000 |

Selling expenses |

5,500 |

|

Factory indirect wages |

15,000 |

Sale proceeds of scraps |

2,000 |

|

Lighting of factory |

5,500 |

Plant repairs, | |

|

Defective work |

Maintenance and depreciation |

11,500 | |

|

(cost of rectification) |

3,000 |

The net selling price was Rs. 31.60 per unit and all the units were sold.

As from 1st January, 2010 the selling price was reduced to Rs. 31.00 per unit. It was estimated mar production could be increased in 2010 by 50% utilising spare capacity. Rates for materials and direct wages will increase by 10%.

You are required to prepare:

(a) Cost sheet for the year, 2009, showing various elements of cost per unit, and

(b) Estimated cost profit for 2010 assuming that 15,000 units will be produced and sold during the year. Factory overheads are recovered as a percentage of direct wages and office and selling expenses as a percentage of works cost. (Apply the same respective percentages as in the previous year.)

Uniform Costing and Inter-Firm Comparison

14. What is meant by Inter-firm comparison'? Describe the requisites to be considered while installing a system of inter-firm comparison.

15. Explain the following:

(a) Sunk Costs

(b) Pre-production Costs

(c) Perpetual Inventory System

(d) continuous stock taking.

SUGGESTED ANSWERS/HINTS Basic Concepts and Product Cost Sheet

1. (i) Four different methods of costing along with their applicability to concerned industry have been discussed as below:

1. Job Costing: The objective under this method of costing is to ascertain the cost of each job order. A job card is prepared for each job to accumulate costs. The cost of the job is determined by adding all costs against the job it is incurred.

This method of costing is used in printing press, foundries and general engineering workshops, advertising etc.

2. Batch Costing: This system of costing is used where small components/parts of the same kind are required to be manufactured in large quantities. Here batch of similar products is treated as a job and cost of such a job is ascertained as discussed under 1, above. If in a cycle manufacturing unit, rims are produced in batches of 2,500 units each, then the cost will be determined in relation to a batch of 2,500 units.

3. Contract Costing: If a job is very big and takes a long time for its completion, then method used for costing is known as Contract Costing. Here the cost of each contract is ascertained separately. It is suitable for firms engaged in the construction of bridges, roads, buildings etc.

4. Operating Costing: The method of Costing used in service rendering undertakings is known as operating costing. This method of costing is used in undertakings like transport, supply of water, telephone services, hospitals, nursing homes etc.

(ii) Various reports that may be provided by the Cost Accounting Department of a big

manufacturing Company for the use of its executives are as under:

(i) Cost Sheets

(ii) Statements of material consumption

(iii) Statements of labour utilisation

(iv) Overheads incurred compared with budgets

(v) Sales effected compared with budgets

(vi) Reconciliation of actual profit with estimated profit

(vii) The total cost of inventory carried

(viii) The total cost of abnormally spoiled work in factory and abnormal losses in stores

(ix) Labour turnover statements

(x) Expenses incurred on research and development compared with budgeted amounts.

|

Materials |

|

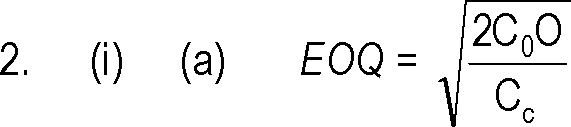

Where C0 = consumption per annum in units

Cc = carrying cost of one unit of stock for one year

= 3,000 units

Frequency of orders = 75,000 or 25 orders per year.

3,000

(b) Order point = Safety Stock + (Lead time x Average consumption).

= 3,250 + (1.5 months x 6,250 units p.m.)

= 3,250 + 9,375 = 12,625 units.

(c) EOQ, when cost per valve is Rs. 4.50.

cnn \2 x 75,000 x 18 1 )

EOQ = J-= 1,732 (approx).

V 20% x 4.50

(ii) LIFO- Last-in-first-out: A method of pricing for the valuation of raw material stock. It is based on the assumption that the items of the last batch(lot) purchased are the first to be issued. Therefore, under this method, the price of the last batch(lot) of raw material is used for pricing raw material issues until it is exhausted. If, however, the quantity of raw material issued is more than the quantity of the latest lot, the price of the last but one lot and so on will be taken for pricing the raw material issues.

The advantages that would accrue from the use of LIFO method of pricing the valuation of raw materials, are as follows:-

(i) The cost of materials used is nearer to the current market price. Thus the cost of goods produced depends upon the trend of the market price of materials. This enables the matching of cost of production with current sales revenues.

(ii) Use of LIFO during the period of rising prices does not depict unnecessarily high profit in the income statement; compared to the first-in-first-out or average methods. The profit shown by the use of LIFO is relatively lower, because the cost of production takes into account the rising trend of material prices.

(iii) When price of materials fall, the use of LIFO method accounts for rising the profits due to lower material cost. Inspite of this finished product appears to be more competitive and at market prices.

(iv) Over a period, the use of LIFO will iron out the fluctuations in profit.

(v) During inflationary period, the use of LIFO will show the correct profit and thus avoid paying unduly high taxes to some extent.

3. (i) Determination of the level of safety stock to minimize expected stock out costs and carrying costs

Average daily usage

_ Annualdemand No. of working days

36,000 units .nn ,

_!-= 100 units per day

360 days

Re-order point _ Average daily usage x Lead time

_ 100 units per day x 6 days _ 600 units Possible safety stock level _ Possible demand - Reorder point Probability of demand during lead-time is

|

Demand during |

No. of time quantity |

Probability |

|

lead time |

was demanded | |

|

540 |

6 |

0.03 |

|

560 |

12 |

0.06 |

|

580 |

16 |

0.08 |

|

600 |

130 |

0.65 |

|

620 |

20 |

0.10 |

|

640 |

10 |

0.05 |

|

660 |

6 |

0.03 |

1.00

200

|

Safety |

Demand |

Stock out |

-Q O ro |

Relevant |

No. of |

Expected |

Relevant |

Total |

|

Stock |

realizations |

in units |

stock out |

stock-out cost |

orders |

stock-out |

carrying cost |

Relevant |

|

level |

resulting |

(3)=(2) - |

(5)=(3)x 900 |

per year |

(7)= (4)x(5) x (6) |

(8) = (1) x |

costs | |

|

(units) |

in Stock-outs |

1 O O CO |

(Rs.) |

Rs.450 |

(9)=(7)+(8) | |||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(Rs.) |

(Rs.) |

(Rs.) |

|

0 |

620 |

20 |

0.10 |

18,000 |

10 |

18,000 | ||

|

640 |

40 |

0.05 |

36,000 |

10 |

18,000 | |||

|

660 |

60 |

0.03 |

54,000 |

10 |

16,200 | |||

|

- |

- |

- |

- |

52,200 |

0 |

52,200 | ||

|

20 |

640 |

20 |

0.05 |

18,000 |

10 |

9,000 | ||

|

660 |

40 |

0.03 |

36,000 |

10 |

10,800 19,800 |

9,000 |

28,000 | |

|

40 |

660 |

20 |

0.03 |

18,000 |

10 |

5,400 |

18,000 |

23,400 |

|

60 |

Nil |

Nil |

- |

- |

- |

0 |

27,000 |

27,000 |

Note: When there will safety stock level of zero then we can have three situation of stock out i.e. 620,640 and 660. Similarly when safety stock level will be 20 only two situation will result into stock out situation i.e. 640 and 660. The same rule will be applicable in the remaining two cases i.e. safety stock 40 and 60.

Decision:

Safety stock of 40 units would minimize ABC Ltd's total expected stock-out and carrying cost.

New Re-order Point = ROL + Safety Stock = 600 units + 40 units = 640 units Factors to consider in estimating stock-out cost

(iii)

> expediting an order from supplier (additional. ordering cost plus any associated transportation cost).

> loss of sales due to stock out (opportunity cost in terms of lost contribution margin on the sales not made due to item not being in stock plus any contribution margin lost on future sales due to customer will be caused by the stock out.)

Labour 4. (i)

Under the rowan premium system, a less efficient worker can obtain the same bonus as high efficient worker. This is because of the design of the incentive plan.

Bonus under Rowan premium system =

Time taken Time allowed

x Time saved x Hourly rate

V J

Consider the following example for proving the statement, given in the question. Example

Time allowed for a job = 20 hrs.

Hourly rate = Rs. 7.50

Time taken Worker A =8 hrs.

Worker B = 12 hrs.

Bonus of Worker A: [ x 12 x Rs. 7.50/hr. | = Rs.36

V 20

Bonus of Worker B: fx8xRs.7.50/hr. |= Rs.36

V 20

The bonus amount is same for both efficient and inefficient worker, as apparent from the above calculation . The bonus comes out to Rs. 36/- because of the design of the incentive plan. In fact the Rowan premium system discourages a worker to save more time.

Statement of Labour Cost (per man-day of 8 hours)

Rs.

2.00

6.00

0.80

0.70

0.22

(a)

(b)

600 x 25 100

25

(c)

(d)

(e)

(f)

0.80

Basic Salary

Dearness Allowance @ 25 paise per every point over 100

Amenities to labour @ Rs. 20 per head per month of 25

20

cost of living index for a month of 25 days

8 x 10

Employer's contribution to State Insurance

8.80 x 2.5

Employer's contribution to Provident Fund

8.80 x 8

Leave Salary -10% of (a) and (b)

2.5% of (a), (b) and (c) =

8% of (a), (b) and (c) -

working days = =

100

100

100

x

10.52

Total

|

Overheads 5. (i) Apportionment of Power Generation Plant Costs | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

|

(ii) Overhead Distribution Summary and Re-apportionment _or Service Department Costs_ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(iii) Calculation of Overhead Rates | ||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||

|

Stores ledger control account |

|

Rs |

Rs | ||

|

1.5.09 Balance b/f |

85,400 |

WIP A/c |

63,400 |

|

Cost ledger control A/c- |

42,700 |

Production overhead control A/c |

1,450 |

|

Purchases | |||

|

Capital a/c |

7,650 | ||

|

31.5.09 Balance |

55,600 | ||

|

1,28,100 |

1,28,100 |

|

Wages control A/c | ||||||||||||||||||||

|

|

Production overhead control account | ||||||||||||||||

|

|

Rs |

Rs | ||

|

1.5.09 Balance b/f |

1,67,350 |

Finished goods control A/c(balancing figure) |

2,81,300 |

|

Stores ledger A/c -issues |

63,400 |

31.5.09 Balance c/f |

1,79,350 |

|

Wages control A/c |

75,750 | ||

|

Production overhead absorbed |

1,52,000 | ||

|

Cost ledger control A/c- | |||

|

Royalty |

2,150 | ||

|

4,60,650 |

4,60,650 |

|

Finished goods control account | ||||||||||||||||

|

|

Capital under construction account | ||||||||||||||||||||

|

|

Sales account | |||

|

Costing P/L A/c |

Rs 4,10,000 |

Cost ledger control a/c |

Rs 4,10,000 |

|

Cost of sales A/c | |||

|

Finished goods A/c |

Rs 3,28,000 |

Costing P/L A/c |

Rs 3,28,000 |

|

Selling overhead account | |||

|

Rs Cost ledger control A/c 22,000 |

Costing P/L A/c |

Rs 22,000 | |

|

Costing profit and loss account | ||||||||

|

| |||||||||||||||

|

Notes : |

1.

Closing balance of work in Rs 1,67,350(opening balance) progress

Rs 12,000 (increase as per question)

Rs 1,79,350

2. Transfer from finished goods stock to cost of sales account : Rs 4,10,000 sales multiplied by 100/125 = Rs. 3,28,000

Joint and By-Products

7. (i) Statement of profitability of an Oil Mill (after carrying out further processing) for the quarter ending 31st March 2010.

| ||||||||||||||||||||||||||||||||||||||||||||||||

|

(ii) Statement of profitability at the split off point |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

off point. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Details |

Input Units |

Output Units |

Materials |

Labour and Overhead | ||

|

% Completion |

Equivalent Units |

% Completion |

Equivalent Units | |||

|

Opening Work-in-Progress |

800 |

800 |

40% |

320 | ||

|

Introduced and Finished in | ||||||

|

the period |

9,200 |

7,100 |

100% |

7,100 |

100% |

7,100 |

|

Transferred to next process |

7,900 | |||||

|

Normal Loss | ||||||

|

(8% of 10,000) |

800 | |||||

|

Abnormal Loss | ||||||

|

(balancing figure) |

400 |

100% |

400 |

80% |

320 | |

|

Closing Work-in-Progress |

900 |

100% |

900 |

70% |

630 | |

|

10,000 |

10,000 |

8,400 |

8,370 | |||

Statement of cost

|

Cost Elements |

Period Cost Rs. |

Equivalent Units |

Cost per unit Rs. |

|

Materials |

36,800 | ||

|

Less : Scrap realization from Normal Loss |

-- | ||

|

800 units @ Rs.4 |

3,200 | ||

|

33,600 |

8,400 |

4.00 | |

|

Labour |

16,740 |

8,370 |

2.00 |

|

Overhead |

8,370 |

8,370 |

1.00 |

|

58,710 |

7.00 |

Statement showing value of Finished Goods and Closing Work-in-Progress

|

Rs. |

Rs. | |

|

Value of opening Work-in-Progress 800 units |

4,000 | |

|

Costs incurred on Opening Work-in-Progress: | ||

|

Material |

Nil | |

|

Labour 320 equivalent units @ Rs. 2 |

640 | |

|

Overhead 320 equivalent units @ Rs. 1 |

320 |

960 4,960 |

|

Value of units introduced and completed | ||

|

7,100 units @ Rs. 7 |

49,700 | |

|

Value of Finished Goods (7,900 units) |

54,660 | |

|

Value of Abnormal Loss (400 units) |

|

Materials 400 equivalent units @ Rs. 4 |

1,600 | |

|

Labour 320 equivalent units @ Rs. 2 |

640 | |

|

Overhead 320 equivalent units @ Re. 1 |

320 |

2,560 |

|

Value of Closing Work-in-Progress (900 units): | ||

|

Materials 900 equivalent units @ Rs. 4 |

3,600 | |

|

Labour 630 equivalent units @ Rs. 2 |

1,260 | |

|

Overhead 630 equivalent units @ Re. 1 |

630 |

5,490 62,710 |

|

Process A Account | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Dr. Abnormal Loss Account Cr. | ||||||||||||||||||

|

Operating Costing

9. Unique Transport Company

Statement showing Operating Cost of the bus per annum

A. Fixed Charges

Rs.

Manager's Salary 16,800

(Rs. 1,400 x 12)

Driver's Salary 7,200

(Rs. 600 x 12)

Conductor's Salary (Rs.200 x 12)

Road Tax Insurance

2,000

3,000

4,800

1,200

20,000

57,400

2,360

18,000

77,760

25,920

1,03,680

14,40,000

7.2 Paise

(3% of Rs. 1,00,000)

Garage rent (Rs. 400 x 12)

Stationery (Rs. 100 x 12)

Depreciation

(Rs. 1,00,000/5 years)

B. Maintenance Costs

Repairs C: Running Charges

Petrol and Oil (36,000 Km* x Rs. 50)/100 Total Cost (A + B + C):

Add: 10 percent of takings for commission of Driver and Conductor and 15 percent for desired profit i.e.

25 percent of takings or 331 percent on Total Cost

Calculation of distance covered (20 Km x 2 x 3 x 25 x 12 ) = 36,000 Km per annum Calculation of bus fare to be charged

Effective Passenger Kilometers: =

(2 x 20 Km x 3 trips x 40 passengers x 25 days x 12 months)

Rate to be charged per kilometer from each passenger (Rs. 1,03,680/14,40,000)

|

Rs. |

Rs. |

Rs. | ||

|

To Material sent to site |

7,00,000 |

By work certified (9,00,000 x 100/90) |

10,00,000 | |

|

Less : Material al site |

15,000 |

6,85,000 |

By work not certified |

50,000 |

|

To wages |

1,25,000 | |||

|

Add : Outstanding |

2,500 |

1,27,500 | ||

|

To Site Expenses |

2,500 | |||

|

To Postage and Telegram |

2,000 | |||

|

To Fuel and Power |

62,500 | |||

|

To Office Expenses |

4,000 | |||

|

To Rates and Taxes |

7,500 | |||

|

To Depreciation (1,25,000 x 0.60 x 0.05) |

37,500 | |||

|

To balance c/d |

1,21,500 |

- | ||

|

10,50,000 |

10,50,000 | |||

|

To P & L A/c. (1/3 x 90/100 x 1,21,500) |

36,450 |

By Balance b/d |

1,21,500 | |

|

To WIP A/c. (Reserve for unrealized profit) |

85,050 1,21,500 |

1,21,500 |

|

Work-in-progress A/c |

Rs. |

|

Work certified Less : Cash received Less : Reserve for unrealized profit |

10,00,000 9.00.000 1.00.000 85,050 14,950 |

Balance Sheet as on 31.12.2009

|

Liabilities |

Rs. |

Assets |

Rs. |

Rs. |

|

Paid-up Capital |

25,00,000 |

Land and Buildings |

7,50,000 | |

|

Wages outstanding |

2,500 |

Lorries and Vehicles |

4,00,000 | |

|

Profit & Loss A/c |

36,450 |

Furniture Office Equipment Machinery : At site Less: Depreciation Less : Returned to |

7,50,000 37,500 7,12,500 |

25,000 5,000 |

|

stores(1,00,000- |

95,000 |

6,17,500 | ||

|

5,000) | ||||

|

At office |

5,00,000 | |||

|

Add : From store |

95,000 |

5,95,000 | ||

|

Material at site |

15,000 | |||

|

Work-in-progress |

64,950 | |||

|

Cash at Bank |

66,500 | |||

|

25,38,950 |

25,38,950 |

Cost Audit & Cost Accounting (Records) Rules

11. Areas of activity for which accounting records are to be maintained under Cost Accounting Record Rules

Costing Accounting Record Rules: The Government of India had issued Cost Accounting Record Rules, in respect of number of products industries (as listed under section 209( I) (d) of Companies Act). Before the imposition of Statutory Cost Audit it was expected from all such concerns to observe these rules. Such an audit is imposed in respect of those products, industries which are consumer oriented and earners of high profit margin. According to these rules, all companies engaged in activities of production or manufacturing, etc. (for which cost accounts records have been prescribed) should maintain accounting records relating to the utilisation of materials, labour and other items of cost. Such books of account should facilitate the calculation and disclosure or cost of

production and cost or sales of the products at a periodical intervals. Each books of account and the proforma prescribed by the rules should be completed within the prescribed time limit after the end of the relevant financial year of the company. Following records are to be maintained under Cost Accounting (Record) Rules generally applicable to various industries in India.

1. Records for raw materials, components. stores & spare parts.

2. Records for labour.

3. Records for overheads.

4. Records for utilities / services.

5. Records for fixed assets.

6. Records for packing

7. Records for research mid development expenses.

8. Records for conversion cost.

9. Records for by-products.

10. Records for work-in-progress and finished goods.

11. Records for cost of production and marketing.

12. Reconciliation of cost records with financial books.

13. Computation of variances.

14. Physical verification.

15. Statistical data.

12. Activity Based Costing

(i) Ranbaxy Limiteds

Statement of operating income and gross margin percentage for each of its three

distribution channel

|

General Super Market Chains |

Drugstore Chains |

Chemist Shops |

Total | |

|

Revenues: (Rs.) |

2,80,41,750 |

2,38,21,875 |

1,49,73,750 |

6,68,37,375 |

|

(330 x Rs. |

(825 x Rs. 28,875) |

(2,750 x Rs. | ||

|

84,975) |

5,445) | |||

|

Less: Cost of goods |

2,72,25,000 |

2,26,87,500 |

1,36,12,500 |

635,25,000 |

|

sold: (Rs.) |

(330 x Rs 82,500) |

(825 x Rs 27,500) |

(2,750 x Rs | |

|

4,950) | ||||

|

Gross Margin: (Rs.) |

8,16,750 |

11,34,375 |

13,61,250 |

33,12,375 |

|

Less: Other | ||||

|

operating costs: (Rs) |

8,27,970 | |||

|

Operating income: (Rs.) |

24,84,405 | |||

|

Gross Margin |

2.91% |

4.76 % |

9.09% |

4.96% |

|

Operating income % |

3.72 | |||

|

(ii) Computation of rate per unit of the cost allocation base for each of the five activity areas for April 2009 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Comments and new insights: The activity-based cost information highlights, how the Chemist Shops' uses a larger amount of Ranbaxy Ltd's resources per revenue than do the other two distribution channels. Ratio of operating costs to revenues, across these markets is:

General supermarket chains 0.58%

(Rs. 1,62,910/Rs. 2,80,00,750) x 100

Drug store chains 0.80%

(Rs. 1,90,410/Rs. 2,38,21,875) x 100 Chemist shops 3.17%

(Rs. 4,74,650/Rs. 1,49,73,750) x 100

|

Working note: Computation of operating cost of each distribution channel: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(iv) Challenges faced in assigning total operating cost of Rs. 8,27,970 :

- Choosing an appropriate cost driver for activity area.

- Developing a reliable data base for the chosen cost driver.

- Deciding, how to handle costs that may be common across several activities.

- Choice of the time period to compute cost rates per cost driver.

- Behavioural factors.

|

Product Cost Sheet 13. Cost sheet Period year ended 31st December, 2009 Output 10,000 Units | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Note: The cost of rectification of defective works has been included in factory overheads on the assumption that the defectives are normal. Where, however, the defective work is due to abnormal causes, the cost of rectification should be charged to the costing profit and loss account. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

_Estimated output 15,000 units

|

Total |

Per unit | |

|

Rs. |

Rs. | |

|

Materials : 15,000 x Rs. 9.90 |

1,48,500 |

9.90 |

|

99,000 |

6.60 |

| |||||||||||||||||||||||||||

|

Working Notes: |

(1) Percentage of factory overhead on wages in 2009 = Rs45,000 x 100 = 75%

Rs.60,000

(2) Percentage of office and selling expenses on works cost in 2009

Rs'.39-000 x 100 = 20%

Rs. 1,95,000 Uniform Costing and Inter-Firm Comparison

14. It is the technique of evaluating the performance efficiency, costs and profits of firms in an industry. It consists of voluntary exchange of information/data concerning costs, prices, profits, productivity and overall efficiency among firms engaged in similar type of operations for the purpose of bringing improvement in efficiency and indicating the weaknesses. Such a comparison will be possible where uniform costing is in operation.

An inter-firm comparison indicates the efficiency of production and selling, adequacy of profits, weak spots in the organisation, etc and thus demands from the firm's management an immediate suitable action. Inter-firm comparison may enable the management to challenge the standards which it has set for itself and to improve upon them in the light of the current information gathered from more efficient units. Such a comparison may be pharmaceuticals, cycle manufacturing, etc.

Requisites of Inter-firm comparison scheme:

The following requisites should be considered while installing a system of inter-firm comparison:

1. Centre for Inter-firm Comparison:

For collection and analysing data received from member units for doing a comparative study and for dissemination of the results of study a Central body is necessary. The functions of such a body may be:

(a) Collection of data and information from its members:

(b) Dissemination of results to its members:

(c) Undertaking research and development for common and individual benefit of its members;

(d) Organising training programmes and publishing magazines.

Another requirement for the success of inter-firm comparison is that firms of different sizes should become members of the Centre entrusted with the task of carrying out inter-firm comparison.

3. Nature of information to be collected

Although there is no limit to information, yet the following information, useful to the management is in general collected by the center for inter firm comparison.

|

(a) |

Information regarding costs and cost structures. |

|

(b) |

Raw material consumption |

|

(c) |

Stock of raw material, wastage of materials etc. |

|

(d) |

Labour efficiency and labour utilisation. |

|

(e) |

Machine utilisation and machine efficiency. |

|

(f) |

Capital employed and return on capital |

|

(g) |

Liquidity of the organisation. |

|

(h) |

Reserve and appropriation of profit. |

|

(i) |

Creditors and debtors. |

|

(j) |

Methods of production and technical aspects. |

4. Method of Collection and presentation of information:

The centre collects information at fixed intervals in a prescribed form from its members. Sometimes a questionnaire is sent to each member, the replies of the questionnaire received by the Centre constitute the information/data. The information is generally collected at the end of the year as it is mostly related with final accounts and Balance Sheet. The information supplied by firms is generally in the form of ratios and not in absolute figures. The information collected as above is stored and presented to its members in the form of a report. Such reports are not made available to non-members.

15. (i) (a) Sunk Costs: These are historical costs which are incurred in the past. These costs were incurred for a decision made in the past and cannot be changed by any decision that will be made in future. In other words, these costs plays no role in decision making, in the current period. While considering the replacement of a plant, the depreciated book value of the old plant is irrelevant, as the amount is a sunk cost which is to be written off at the time of replacement.

(b) Pre-production Costs: These costs forms the part of development cost, incurred in making a trial production run, preliminary to formal production. These costs are incurred when a new factory is in the process of establishment or a new project is undertaken or a new product line or product is taken up, but there is no established or formal production to which such costs may be charged. These costs are normally treated as deferred revenue expenditure (except the portion which has been capitalised) and charged to the costs of future production.

(c) Perpetual Inventory System: It is a system of stock control followed by the stores department. Under this system, a continuous record of receipt and issue of material is maintained by the stores department. In other words, in this system, stock control cards or bin cards and the stores ledger show clearly the receipts, issues and balance of all items in stock at all times. This system facilitates planning of production and ensures that production is not interrupted for want of materials and stores.

(d) Continuous Stock taking: It means physical verification of stores items on a continuous basis to reveal the position of actual balances. Such a verification is conducted round the year, thus covering each item of store twice or thrice. Any discrepancies, irregularities or shortages brought to the notice, as a result of continuous stock verification are reported to the appropriate authorities for initiating necessary rectification measures. This system works as a moral check as stores staff and acts as a deterrent to dishonesty.

30

|

Attachment: |

| Earning: Approval pending. |