The Institute of Chartered Financial Analysts of India University 2010 C.A Chartered Accountant Professional Edution II (PE-II) Revision Test s- 4B- Financial Management - Question Paper

May 2010: The Institute of Chartered Accountants of India - Revision Test ques. papers (RTPs) Professional Education II Course (PE-II) Examination: Paper 4B- Financial Management: May 2010 University ques. paper

SECTION - 4B : FINANCIAL MANAGEMENT

Financial Management: An Overview

1. (a) Mr. Rohan invested Rs. 2,000 for four years. Calculate at what annual rate of

compound interest the invested amount grows to Rs. 2,721 after four years.

(b) Maha Bank adds interest monthly to investors' accounts even though interest rates are expressed in annual terms. The current rate of interest is 12%. Ram deposited Rs. 2,000 on 1st July, 2009. You are required to calculate the amount of interest he will have earned by 31st December, 2009?

2. (a) Ganpati Limited faces a fixed cost of Rs. 4,000 to obtain new funds. There is a

requirement for Rs. 24,000 of cash over each period of one year for the foreseeable future. The interest cost of new funds is 12% per annum and the interest rate earned on short-term securities is 9% per annum. You are required to calculate the amount of finance Ganpati Limited should raise at a time.

(b) Asin Limited is proposing to increase the credit period that it gives to its customers from one month to one and a half months in order to raise turnover from the present annual figure of Rs. 2.4 crores representing 40 lakhs of units per annum. The price of the product is Rs. 6 and it costs Rs. 5.40 to make it. The increase in the credit period is likely to generate an extra 1,50,000 unit sales. Advise whether this is enough to justify the extra costs given that Asin Limited's required rate of return is 20%? Assume no changes to stock levels, as Asin Limited is increasing its operating efficiency. Also assume that the existing debtors will take advantage of the new terms.

|

3. The details regarding the fixed assets and equities of Sona Limited are supplied for your consideration both at the beginning and at the end of the year 2008-2009: | ||||||||||||||||||

|

You are not in a position to have the complete Balance Sheet data or an income statement for the year in spite of the fact that you have obtained the following information:

(a) Dividend of Rs. 37,500 was paid.

(b) The net income included Rs. 13,000 as profit on sale of equipment. There has been an increase of Rs. 93,000 in the value of gross plant assets even though equipments worth Rs. 29,000 with a net book value of Rs. 19,000 were disposed off.

You are required to prepare a statement of sources and uses of net working capital.

Tools of Financial Analysis and Planning

4. Sandblast Limited is a manufacturer of products for the construction industry and its accounts are given for your consideration. You are required to calculate the liquidity and working capital ratios from the accounts and comment on the ratios.

2009 2008

Rs. (in lakhs) Rs. (in lakhs)

Turnover 2,065.0 1,788.7

Cost of Sales 1,478.6 1,304.0

Gross Profit 586.4 484.7

2009 2008 Rs. (in lakhs) Rs. (in lakhs)

Current Assets

Stocks 119.0 109.0

Debtors (Refer Note A) 400.9 347.4

Short-term Investments 4.2 18.8

Cash at bank and in hand 48.2 48.0

572.3 523.2

Current Liabilities

Loans and Overdrafts 49.1 35.3

Taxes 62.0 46.7

Dividend 19.2 14.3

Creditors (Refer to Note B) 370.7 324.0

501.0 420.3

Net Working Capital 71.3 102.9

2009 2008

Rs. Rs.

A Trade Debtors 329.8 285.4

B Trade Creditors 236.2 210.8

Tools of Financial Analysis and Planning

5. Mahalaxmi Limited's balance sheets as on 31st March, 2008 and 2009 were as follows:

|

Liabilities |

31.3.08 |

31.3.09 |

Assets |

31.3.08 |

31.3.09 |

|

Rs. |

Rs. |

Rs. |

Rs. | ||

|

Equity Share Capital |

10,00,000 |

10,00,000 |

Goodwill |

1,00,000 |

80,000 |

|

8% P.S. Capital |

2,00,000 |

3,00,000 |

Land and Building |

7,00,000 |

6,50,000 |

|

General Reserve |

1,20,000 |

1,45,000 |

Plant and Machinery |

6,00,000 |

6,60,000 |

|

Securities Premium |

- |

25,000 | |||

|

Profit and Loss A/c |

2,10,000 |

3,00,000 |

Investments | ||

|

11% Debentures |

5,00,000 |

3,00,000 |

(non-trading) |

2,40,000 |

2,20,000 |

|

Creditors |

1,85,000 |

2,15,000 |

Stock |

4,00,000 |

3,85,000 |

|

Provision for tax |

80,000 |

1,05,000 |

Debtors |

2,88,000 |

4,15,000 |

|

Proposed Dividend |

1,36,000 |

1,44,000 |

Cash and Bank Prepaid Expenses Premium on Redemption of Debentures |

88,000 15,000 |

93.000 11.000 20,000 |

|

24,31,000 |

25,34,000 |

24,31,000 |

25,34,000 |

Additional Information:

(a) Investments were sold during the year at a profit of Rs. 15,000.

(b) During the year an old machine costing Rs. 80,000 was sold for Rs. 36,000. Its written down value was Rs. 45,000.

(c) Depreciation charged on Plants and Machinery @ 20 per cent on the opening balance.

(d) There was no purchase or sale of Land and Building.

(e) Provision for tax made during the year was Rs. 96,000.

(f) Preference shares were issued for consideration of cash during the year.

(g) Debentures are redeemed at the beginning of the year.

You are required to prepare Cash flow statement as per Accounting Standard 3 (revised).

Capital Budgeting and Project Planning

6. (a) Felco Limited manufactures a product which it sells for Rs. 5 per unit. Variable costs of production are currently Rs. 3 per unit, and fixed costs 50 paise per unit. A new machine is available which would cost Rs. 90,000 but which could be used to make the product for a variable cost of only Rs. 2.50 per unit. Fixed costs, however, would increase by Rs. 7,500 per annum as a direct result of purchasing the machine. The machine would have an expected life of 4 years and a resale value after that time of Rs. 10,000. Sales of the product are estimated to be 75,000 units per annum. Felco Limited expects to earn at least 12% per annum from its investments. Ignore taxation. You are required to advise whether Felco Limited should purchase the machine.

(b) You are required to compute the internal rate of return (IRR) of the project given below and advise whether the project should be accepted if the company requires a minimum return of 17%.

|

Time |

Rs. |

|

0 |

(4,000) |

|

1 |

1,200 |

|

2 |

1,410 |

|

3 |

1,875 |

|

4 |

1,150 |

Leverage

7. Satvik Limited has sales of Rs. 40 lakhs; variable cost of Rs. 25 lakhs; fixed cost of Rs. 6 lakhs; 10% debt of Rs. 30 lakhs; and equity capital of Rs. 45 lakhs. You are required to calculate the operating, financial and combined leverage of Satvik Limited.

8. Goodbuy Company's capital structure is given as under: 9% Debentures 11% Preference Shares Equity Shares (face value : Rs. 10 per share)

Additional information:

Rs. 2,75,000 Rs. 2,25,000 Rs. 5,00,000 Rs. 10,00,000

(i) Rs. 100 per debenture redeemable at par has 2% floatation cost and 10 years of maturity. The market price per debenture is Rs. 105.

(ii) Rs. 100 per preference share redeemable at par has 3% floatation cost and 10 years of maturity. The market price per preference share is Rs. 106.

(iii) Equity share has Rs. 4 floatation cost and market price per share of Rs. 24. The next year expected dividend is Rs. 2 per share with annual growth of 5%. The firm has a practice of paying all earnings in the form of dividends.

(iv) Corporate Income-tax rate is 35%.

You are required to calculate Weighted Average Cost of Capital (WACC) using market value weights.

9. Differentiate between the following:

(a) Traditional Phase and Modern Phase of Financial Management

(b) Debt Financing and Equity Financing

(c) Investment Decisions and Dividend Decisions

(d) Funds Flow Analysis and Cash Flow Analysis.

10. Write short notes on the following:

(a) Composition of ROE using Du Pont

(b) Trading on Equity

(c) Seed Capital Assistance

(d) Capital Budgeting Process.

SUGGESTED ANSWERS/HINTS

1. (a) Calculation of Annual Rate of Compound Interest

Using the formula for compound interest, we get 2,721 = 2,000 x (1 +r)4 (1+r)4 = 2,721/2,000 = 1.3605 1+r = 4/1.3605 = 1.08 r = 0.08 = 8%

The nominal rate of interest is 12% per annum payable monthly

.. The effective rate =-

= 1% compound monthly.

12months

In the six months from July to December, the interest earned is: [Rs. 2,000 x (1.01)6] - Rs. 2,000 2,123.04- 2,000 = Rs. 123.04

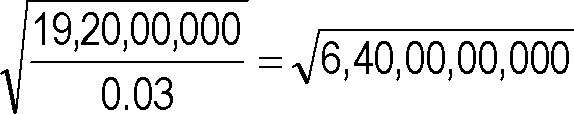

2. (a) Calculation of Amount of Finance to be Raised

Cost of holding cash = 12% - 9% = 3%

Optimum level of the re-order quantity is:

12 x 4,000 x 24,000 V 003

= 80,000

The optimum amount of new funds to be raised = Rs. 80,000 This amount is raised every 80,000 24,000 = 3 /3 years.

(b) Advise to the Management Existing value of debtors is:

Rs 2,40,00,000 = Rs.20,00,000 12months

If sales increased by 1,50,000 units, the value of debtors would be:

[Rs. 2,40,00,000 + (1,50,000 x Rs. 6)]

12months

3 [Rs. 2,40,00,000 + 9,00,000]

2 12months

3 Rs. 2,49,00,000

Rs. 31,12,500

x-

2 12 months

2

The debtors have to be financed somehow, and the additional Rs. 11,12,500 (i.e.

31,12,500 - 20,00,000) will cost Rs. 11,12,500 x 20% = Rs. 2,22,500 in financing costs.

The profit on the extra sales is:

1,50,000 units x (Rs. 6 - Rs. 5.40) = Rs. 90,000

Advise: The new credit policy is not worthwhile, mainly because existing customers would also take advantage of it.

Net increase in Gross Value 93,000

Add: Gross Value of Plant Sold 29,000

1,22,000

(ii) Depreciation on Plant and Machinery

Plant and Machinery Account

Rs.

Rs.

19.000

_____ By Balance c/d

1,85,500

Rs.

1,72,500

37,500

Increase in Retained Earnings [4,10,500 - 2,38,000]

Add: Dividend Paid Add: Depreciation on Plant

Less: Gain on Sale of Equipment

|

Sources Funds from Operation Sale of Equipment Decrease in Net Working Capital (Balancing figure) |

Rs. Uses 2,21,000 Purchase of plant 32,000 Purchase of Investments (2,90,000 - 1,32,000) 1.58.000 1.80.000 37,500 4,97,500 2,44,500 Payment of Bonds Dividends 4,97,500 |

|

Computation of Liquidity and Working Capital Ratios for Sandblast Limited | ||||||||||||||||||

|

Analysis: Sandblast Limited is a manufacturing group serving the construction industry, and so would be expected to have comparatively lengthy debtors' turnover period, because of the relatively poor cash flow in the construction industry. It is clear that the company compensates for this by ensuring that they do not pay for raw materials and other costs before they have sold their stocks of finished goods (hence the similarity of debtors' and creditors' turnover periods.)

4.

Sandblast Limited's current ratio is a little lower than average but its quick ratio is better than average and very little less than the current ratio. This suggests that the stock levels are strictly controlled, which is reinforced by the low stock turnover period. It would seem

that working capital is tightly managed, to avoid the poor liquidity which could be caused by a high debtors' turnover period and comparatively high creditors.

5. Cash Flow Statement

for the year ending 31st March, 2009

Rs. Rs.

A. Cash flow from Operating Activities

Profit and Loss A/c as on 31.3.2009 3,00,000

Less: Profit and Loss A/c as on 31.3.2008 2,10,000

90,000

Add: Transfer to General Reserve 25,000

Provision for Tax 96,000

Proposed Dividend 1,44,000 2,65,000

Profit before Tax 3,55,000

Adjustment for Depreciation:

Land and Building 50,000

Plant and Machinery 1,20,000 1,70,000

Profit on Sale of Investments (15,000)

Loss on Sale of Plant and Machinery 9,000

Goodwill written off 20,000

Interest Expenses 33,000

Operating Profit before Working Capital Changes 5,72,000 Adjustment for Working Capital Changes:

Decrease in Prepaid Expenses 4,000

Decrease in Stock 15,000

Increase in Debtors (1,27,000)

Increase in Creditors 30,000

Cash generated from Operations 4,94,000

Income tax paid (71,000)

Net Cash Inflow from Operating Activities (a) 4,23,000

B. Cash flow from Investing Activities

Sale of Investment 35,000

Purchase of Plant and Machinery (2,25,000)

Net Cash Outflow from Investing Activities (b) (1,54,000)

C. Cash Flow from Financing Activities

Issue of Preference Shares 1,00,000

Premium received on Issue of Securities 25,000

Redemption of Debentures at premium (2,20,000)

Dividend Paid (1,36,000)

Interest paid to Debenture holders (33,000)

Net Cash Outflow from Financing Activities (c) (2,64,000)

Net increase in Cash and Cash Equivalents during the year (a + b + c) 5,000

Cash and Cash Equivalents at the beginning of the year 88,000

Cash and Cash Equivalents at the end of the year 93,000

Working Notes:

1. Provision for the Tax Account

Rs. Rs.

To Bank (paid) 71,000 By Balance b/d 80,000

To Balance c/d 1,05,000 By Profit and Loss a/c 96,000

1,76,000 1,76,000

Rs. Rs.

To Balance b/d 2,40,000 By Bank a/c (b/f) 35,000

To Profit and Loss (profit on sale) 15,000 By Balance c/d 2,20,000

3. Plant and Machinery Account

Rs. Rs.

To Balance b/d 6,00,000 By Bank (sale) 36,000

To Bank a/c (Purchase b/f) 2,25,000 By Profit and Loss a/c 9,000

(Loss on sale)

Savings are 75,000 x (Rs. 3 - Rs. 2.50) = Rs. 37,500 per annum.

Additional costs are Rs. 7,500 per annum.

Net cash savings = 37,500 - 7,500 = Rs. 30,000 per annum.

The first step in calculating NPV is to establish the relevant costs year by year. All future cash flows arising as direct result of the decision should be taken into consideration. It is assumed that the machine will be sold for Rs. 10,000 at the end of fourth year.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

of capital will be used to estimate the IRR. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Using interpolation, we calculate IRR

83

_83

164

x 2%

= 14% +1.01% = 15.01%

Advise: The IRR is 15%. The project should be rejected as the IRR is less than the minimum return required by the company.

Calculation of Operating, Financial and Combined Leverage

7

Rs.

40.00.000

25.00.000

15.00.000 6,00,000

9.00.000

3.00.000

6.00.000

Sales

Less: Variable Cost Contribution (C)

Less: Fixed Cost EBIT

Less: Interest EBT

Operating leverage =

C 15,00,000

= 1.67

EBIT 9,00,000

EBIT 9,00,000

Financial leverage =

= 1.50

EBT 6,00,000 Combined leverage = Operating leverage x Financial leverage = 1.67 x 1.50 = 2.505 = 2.51

Computation of Weighted Average Cost of Capital using Market Value Weights Cost of Equity (ke)

8

D1

Ke

= + g Po

Rs.2

K _ I(1-T) + (RV-NP)/N d (RV + NP)/2

_ 9(1 - 0.35) + (100 - 98) /10 (100 + 98)/2

_ 585 + 0 20 _ 6.11%

99

Cost of Preference Shares (kp)

_ PD + (RV - NP)/N

Kp

(RV + NP)/2

= 11 + (100 - 97)/10 = 11.30 = 11 47%

(100 + 97)/2 98.5 . %

Calculation of WACC using Market Value Weights

|

Source of Capital |

Market Value (Rs.) |

Weights to Total Capital |

Specific Cost |

Total Cost |

|

Debentures (Rs. 105 per debenture) |

2,88,750 |

0.1672 |

0.0611 |

0.0102 |

|

Preference Shares (Rs. 106 per preference share) |

2,38,500 |

0.1381 |

0.1147 |

0.0158 |

|

Equity Shares (Rs. 24 per share) |

12,00,000 |

0.6947 |

0.1500 |

0.1042 |

|

17,27,250 |

1.00 |

0.1302 |

WACC using market value weights = 13.02%

9. (a) Traditional Phase and Modern Phase of Financial Management

During the Traditional Phase, financial management was considered necessary only during occasional events such as takeovers, mergers, expansion, liquidation, etc. Also, when taking financial decisions in the organisation, the needs of outsiders (investment bankers, people who lend money to the business and other such people) to the business was kept in mind.

Whereas, on the other hand, the Modern Phase is still going on. The scope of financial management has greatly increased now. It is important to carry out financial analysis for a company. This analysis helps in decision-making. During this phase, many theories have been developed regarding efficient markets, capital

budgeting, option pricing, valuation models and also in several other important fields in financial management.

(b) Debt Financing and Equity Financing

Financing a business through borrowing is cheaper than using equity. This is because:

Lenders require a lower rate of return than ordinary shareholders. Debt financial securities present a lower risk than shares for the finance providers because they have prior claims on annual income and liquidation.

A profitable business effectively pays less for debt capital than equity for another reason: the debt interest can be offset against pre-tax profits before the calculation of the corporate tax, thus reducing the tax paid.

Issuing and transaction costs associated with raising and servicing debt are generally less than for ordinary shares.

(c) Investment Decisions and Dividend Decisions

Investment decisions are those decisions that determine how scarce resources in terms of funds available are committed to projects which can range from acquiring a piece of plant to the acquisition of another company. Funds procured from different sources have to be invested in various kinds of assets. Long-term funds are used in a project for various fixed assets and also for current assets. The investment of funds in a project has to be made after careful assessment of the various projects through capital budgeting. A part of long-term funds is also to be kept for financing the working capital requirements. Asset management policies are to be laid down regarding various items of current assets. The inventory policy would be determined by the production manager and the finance manager keeping in view the requirement of production and the future price estimates of raw materials and the availability of funds.

Whereas, on the other hand, Dividend decisions are those decisions that relate to the determination as to how much and how frequently cash can be paid out of the profits of an organisation as income for its owners/shareholders. The owner of any profit-making organization looks for reward for his investment in two ways, the growth of the capital invested and the cash paid out as income; for a sole trader this income would be termed as drawings and for a limited liability company the term is dividends.

The dividend decisions thus have two elements - the amount to be paid out and the amount to be retained to support the growth of the organisation, the latter being also a financing decision; the level and regular growth of dividends represent a significant factor in determining a profit-making company's market value, i.e. the value placed on its shares by the stock market.

(i) Funds flow statement is based on the accrual accounting system. In case of preparation of cash flow statements all transactions effecting the cash or cash equivalents only is taken into consideration.

(ii) Funds flow statement analyses the sources and application of funds of longterm nature and the net increase or decrease in long-term funds will be reflected on the working capital of the firm. The cash flow statement will only consider the increase or decrease in current assets and current liabilities in calculating the cash flow of funds from operations.

(iii) Funds Flow analysis is more useful for long range financial planning. Cash flow analysis is more useful for identifying and correcting the current liquidity problems of the firm.

(iv) Funds flow statement tallies the funds generated from various sources with various uses to which they are put. Cash flow statement starts with the opening balance of cash and reaches to the closing balance of cash by proceeding through sources and uses.

10. (a) Composition of ROE using DuPont

There are three components in the calculation of return on equity using the

traditional DuPont model- the net profit margin, asset turnover, and the equity

multiplier. By examining each input individually, the sources of a company's return

on equity can be discovered and compared to its competitors.

(i) Net Profit Margin: The net profit margin is simply the after-tax profit a company generates for each rupee of revenue.

Net profit margin = Net Income + Revenue

Net profit margin is a safety cushion; the lower the margin, lesser the room for error.

(ii) Asset Turnover: The asset turnover ratio is a measure of how effectively a company converts its assets into sales. It is calculated as follows:

Asset Turnover = Revenue + Assets

The asset turnover ratio tends to be inversely related to the net profit margin;

i.e., the higher the net profit margin, the lower the asset turnover.

(iii) Equity Multiplier: It is possible for a company with bad sales and margins to take on excessive debt and artificially increase its return on equity. The equity multiplier, a measure of financial leverage, allows the investor to see what portion of the return on equity is the result of debt. The equity multiplier is

Calculation of Return on Equity

To calculate the return on equity using the DuPont model, simply multiply the three components (net profit margin, asset turnover, and equity multiplier.)

Return on Equity = Net profit marginx Asset turnover x Equity multiplier

(b) Trading on Equity

The term trading on equity' is derived from the fact that debts are contracted and loans are raised mainly on the basis of equity capital. Those who provide debt have a limited share in the firm's earnings and hence want to be protected in terms of earnings and values represented by equity capital. Since fixed charges do not vary with the firm's earnings before interest and tax, a magnified effect is produced on earnings per share. Whether the leverage is favourable in the sense increase in earnings per share more proportionately to the increased earnings before interest and tax depends on the profitability of investment proposals. If the rate of return on investment exceeds their explicit cost financial leverage is said to be positive.

In other words, it can be stated that trading on equity means using borrowed funds to generate returns in anticipation that the return would be more than the interest paid on those funds. Therefore, trading on equity occurs when a company uses bonds, preference shares or any other type of debt to increase its earnings on equity shares. For example, a company may use long-term debt to purchase assets that are expected to generate earnings more than the interest on the debt. The earnings in excess of the interest on the debt will increase the earnings of the company's equity shareholders. This increase in earnings indicates that the company was successful in trading on equity.

(c) Seed Capital Assistance

The Seed capital assistance scheme is designed by IDBI for professionally or technically qualified entrepreneurs and/or persons possessing relevant experience, skills and entrepreneurial traits. All the projects eligible for financial assistance from IDBI, directly or indirectly through refinance are eligible under the scheme. The project cost should not exceed Rs. 2 crores and the maximum assistance under the project will be restricted to 50% of the required promoter's contribution or Rs. 15 lacs whichever is lower.

The Seed Capital Assistance is interest-free but carries a service charge of one per cent per annum for the first five years and at increasing rate thereafter. However, IDBI will have the option to charge interest at such rate as may be determined by IDBI on the loan if the financial position and profitability of the company so permits

during the currency of the loan. The repayment schedule is fixed depending upon the repaying capacity of the unit with an initial moratorium upto five years.

For projects with a project cost exceeding Rs. 200 lacs, seed capital may be obtained from the Risk Capital and Technology Corporation Ltd. (RCTC). For small projects costing upto Rs. 5 lacs, assistance under the National Equity Fund of the SIDBI may be availed.

The extent to which the capital budgeting process needs to be formalised and systematic procedures established depends on the size of the organisation; number of projects to be considered; direct financial benefit of each project considered by itself; the composition of the firm's existing assets and management's desire to change that composition; timing of expenditures associated with the projects that are finally accepted.

(i) Planning: The capital budgeting process begins with the identification of potential investment opportunities. The opportunity then enters the planning phase when the potential effect on the firm's fortunes is assessed and the ability of the management of the firm to exploit the opportunity is determined. Opportunities having little merit are rejected and promising opportunities are advanced in the form of a proposal to enter the evaluation phase.

(ii) Evaluation: This phase involves the determination of proposal and its investments, inflows and outflows. Investment appraisal techniques, ranging from the simple payback method and accounting rate of return to the more sophisticated discounted cash flow techniques, are used to appraise the proposals. The technique selected should be the one that enables the manager to make the best decision in the light of prevailing circumstances.

(iii) Selection: Considering the returns and risks associated with the individual projects as well as the cost of capital to the organisation, the organisation will choose among projects so as to maximise shareholders' wealth.

(iv) Implementation: When the final selection has been made, the firm must acquire the necessary funds, purchase the assets, and begin the implementation of the project.

(v) Control: The progress of the project is monitored with the aid of feedback reports. These reports will include capital expenditure progress reports, performance reports comparing actual performance against plans set and post completion audits.

(vi) Review: When a project terminates, or even before, the organisation should review the entire project to explain its success or failure. This phase may have implication for firms planning and evaluation procedures. Further, the review may produce ideas for new proposals to be undertaken in the future.

48

|

Attachment: |

| Earning: Approval pending. |