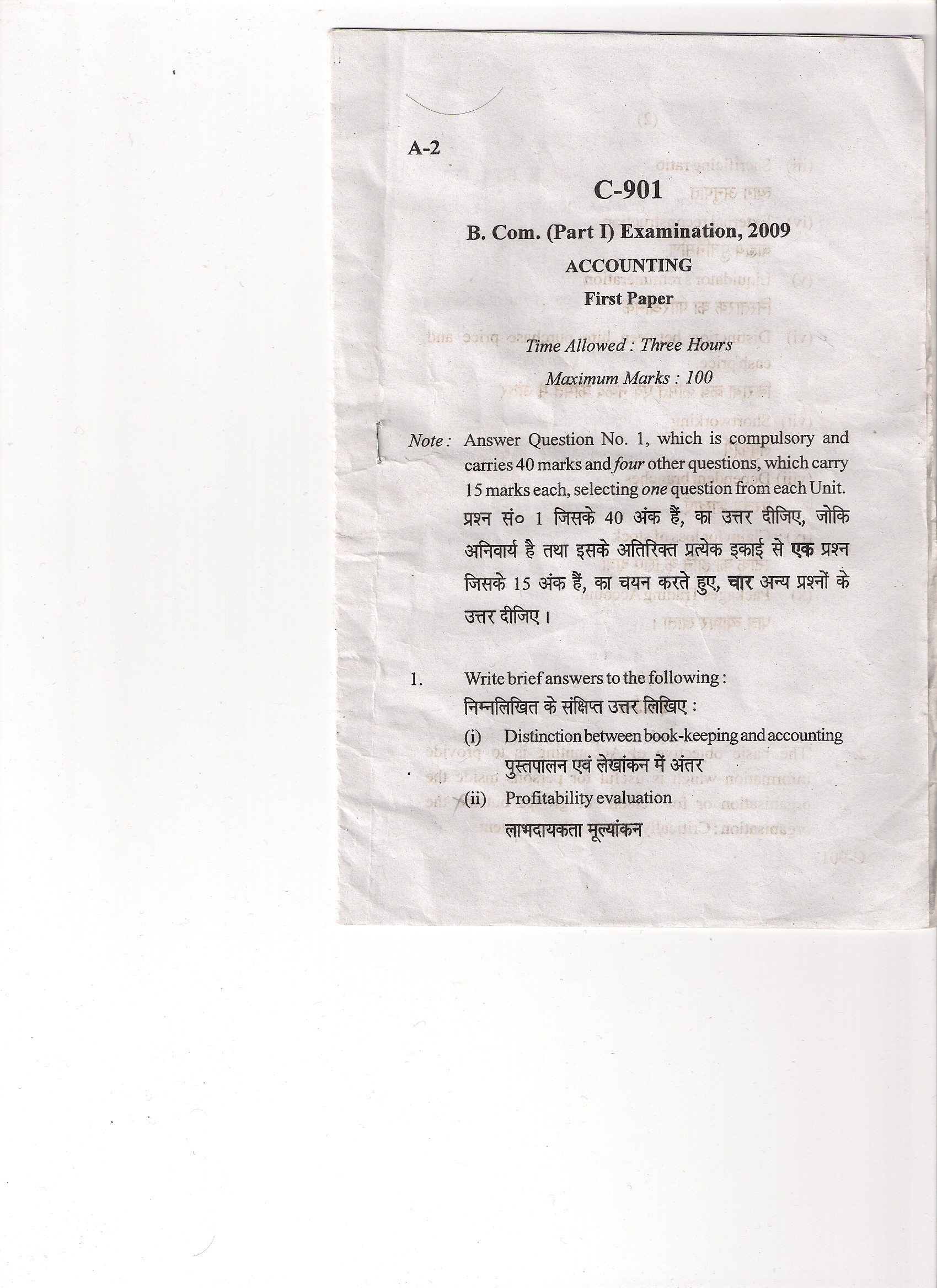

University of Lucknow 2009 B.Com Accounting - Question Paper

C-901

B.Com.(Part 1) Examindation,2009

Accounting

1st Paper

Time Allowed: 3 Hours

Maximum Marks: 100

C-901

B. Com. (Part I) Examination, 2009 ACCOUNTING First Paper

Time Allowed: Three Hours Maximum Marks: 100

Answer Question No. 1, which is compulsory and carries 40 marks andfour other questions, which carry 15 marks each, selecting one question from each Unit. Ho 1 40 '5R5 \3tH 'Jl][cb

15 I, m W f?, 3PT Smf % 3tTC I

Write brief answers to the following:

PlMfaRiM 3tR :

(i) Distinction between book-keeping and accounting

(ii) Profitability evaluation

(2)

(iii) Sacrificing ratio <*JFT3TgqRT | (iv) External reconstruction

(v) Liquidator's remuneration

i) Distinction between hire purchase price and cash price.

(vii) Shortworking

(viii) Dependent branches

(ix) Claim for loss of stock 5 eft

(x) Packages Trading Account.

*JT5f <NK WfR I

Unit-I

2y- 'The basic objective of Accounting is to provide information which is useful for persons inside the organisation or for persons or groups outside the organisation; Critically examine the statement.

STTSTRT % 3RT % afe

q<? W t 3t?T $ afffaft STWirfi 5f. vjqlil RT IMH ch<"ll % l 'ffl SdtfH-'tKW 'TftOTRl

Explain any three of the following:

(i) Management Accounting

(ii) Realisation concept 3ft3iww

(iii) Consistency Convention

(iv) Accounting standard for inventory valuation.

Unit-II

Write notes on the following:

(i) Memorandum Revaluation Account

901

(4)

(ii) Realisation Account

(iii) Liquidators Final Statement of Account Pitting 35T oifdH I

5. White Ltd. agreed to acquire the business of Green Ltd. as on 31 st March, 2008 on which date the Balance Sheet of Green Ltd. was summarized as follows:

White Ltd. % 3 2008 Green Ltd. =BT W s&t I Irlr Green Ltd. 3>T

feir flRifcRT W:_

Rs./.

|

Liabilities |

Rs.A>. |

Assets |

|

Share Capital |

Goodwill | |

|

teMlfrl | ||

|

(in fully paid shares |

Land& | |

|

ofRs. 10 each) |

6,00,000 |

Building |

|

(io s. e# fk-ti | ||

|

Plant & | ||

|

General Reserve |

1,70,000 |

Machinery |

|

tffcrfcT | ||

|

C-901 |

Stock 1,68,000

Profit & Loss

Account

Debtors 56,000

12% Debentures

1,00,000

Cash at Bank 36,000

12% stTTO

Creditors

10.00.000

The consideration payable by White Ltd. was:

White Ltd. 3TCF IlfcfW PlM IT:

(i) A cash payment of Rs. 2.50pershareinGreenLtd Green Ltd % OTST % 2.50 6. 35T T1CW

(ii) The issue of 90,000 shares of Rs. 10 each at an agreed value of Rs. 12.50 per shSre; and

10 S. 31% 90,000 STSfif 5151 12.50 S. jrfcl %

(iii) Issue of fully paid 15 % debentures in White Ltd. at 96% as is sufficient to discharge the 12% debentures in Green Ltd. at a premium of 20%.

C-901

(6)

White Ltd. STCT 15% ffef sETOf 96% qqkr fc'for Green Ltd. % 12% slt'TOf %

20% nr yrapr % f?m it i

The directors of White Ltd. valued land and building at Rs. 4,00,000 and created a provision of 5% on debtors against doubtful debts. The expenses of liquidation of Rs. 6,000 were paid by White Ltd.

White Ltd. % WT m pW

4,00,000 s. qrteir

5% 35T HOTH fell I White Ltd. 6,000 5. PWI,

Give journal entries to record the acquisition of business in the books of White Ltd.

White Ltd. if oqfqTC % Pt WfacT

Unit-Ill

i

6. On 1st January, 2006 X Ltd. purchased a machinery] from Y Ltd. on Hire-purchase system. 1/5 of cash price was payable down and the balance 3 equal annual instalments together with interest @ lOp.a. The amount of last instalment including interest was

Rs. 1,760,00. Depreciation was to be provided at 20% on the diminishing balances. At the end of 3 years of service X Ltd sold the machinery for Rs. 3,00,000 for cash.

Prepare necessary ledger accounts in the books of XLtd.

1 2006 X Ltd. Y Ltd. %

(T crai 3>T fiw #r SfW tetff 10%

eRTI% 1,760.00. sft I gq M qT20% IRT % !#? StmFT 11TI #T spfl 7 %

X Ltd. % 3,00,000 WT I XLtd. I

C-901

His capital was Rs. 1,750 and his drawings were Rs. 1,750. During business operation he suffered a loss of Rs. 1,950. His assets consisted of:

(8)

(a) Book defts Rs. 2,500 of which Rs. 2,000 was considered good and the balance estimated to produce Rs. 250.

(b) Stock (book value Rs. 3,750) estimated to produce Rs. 2,250.

(c) Machinery (book value Rs. 4,000) estimated to produce Rs. 2,750.

(d) Freehold house (private property) valued at Rs. 3,000, the deed of which was lodged with the bank as security for an overdraft on business amounting to Rs. 2,000.

(e) His life policy (surrender value s. 1,500) was given as part security for a private loan of Rs. 2,500. His unsecured creditors amounted to Rs. 10,000 and he owed Rs. 125 to his two clerks being salary for two months just preceding the date of his insolvency.

1920 % sfcFtcT Rcllfaill fIT W, m

1,750. 1,750. s?T I <W

% 1,950 $ Sift 3t I BqirRff

(or) 2,500 5. r 2,000 % m*i sir % 250 v. jtr $ 1

(*r) (gcRj 3,750 .) 3FJ#RT HR 71% 2,2505. I

(fl) rctat (m 4,000 s.) aHrPw Jtw TrfSr 2,750 5. I

(?) *PFT (ft# Nfrf) 35T 3,000 5.

'tawi 3 aim %

2,000 5. % srfSlteif sft ftmtM % 3 %R

gtcSf T|% I I

fa) vJBT Ff *ra (#J 1,500 T5.)

ifsw? wit wi i

6ftcT #T5K 10,000 5. % rWI 125

5. *Ef I I *t? cpf

l

8. (a) How would you ascertain the claim for loss of profit as a result of fire ?

C-901

|

Attachment: |

| Earning: Approval pending. |