Veer Narmad South Gujarat University 2010 M.Com Commerce Texation : - III , ( Part -1 ) - - Question Paper

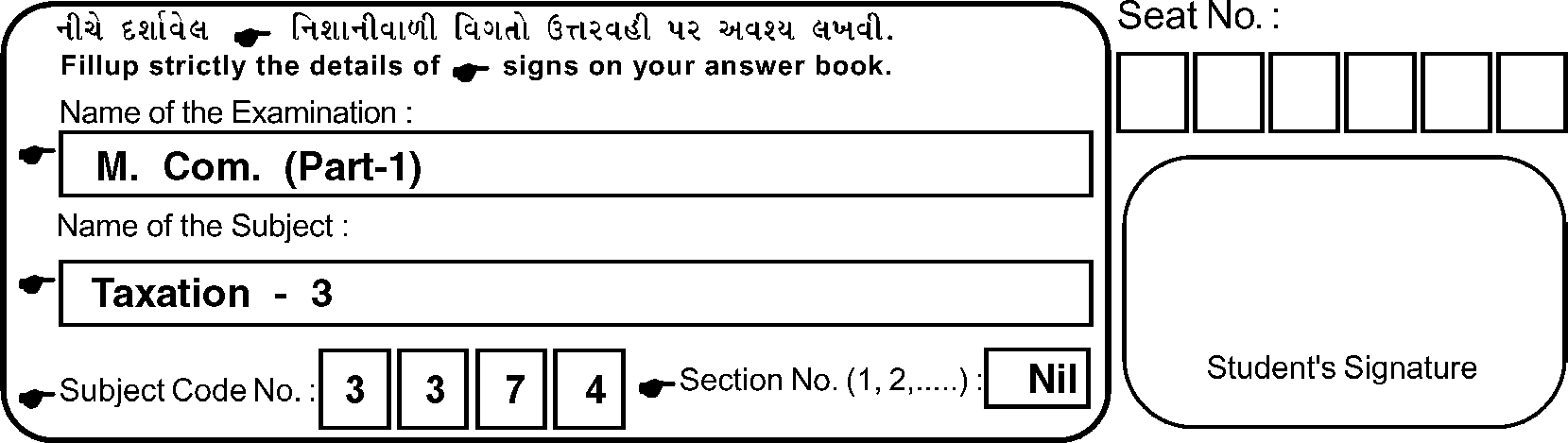

RF-3374

M. Com. (Part-I) Examination

April/May - 2010 Taxation : Paper - III

(Gujarat Value Added Tax Act,

Central Sales Tax Act & Gujarat Professional Tax Act)

Time : 3 Hours] [Total Marks : 70

|

: |

|

00

*1 ojLd mil *003 fo'l (Value Added

Tax) (H*clL'r0. ML ML SwMhL SMI *UH

d d WLLcfl.

WU

*1 ojLd MHfcl *003 [&HLHI *< ill'll ?Hd HLfecft *1*

Hjfl HLq.L-0. WHL*M &fed* aiail *l.

* ojLd MHfcl *003 -MdL-ft <.LCLLS:HL WLL4 : *1*

(*l) dlM

(h) dlMd *e.<HLdC-t i*ql (Suspension)

H*l<U

* 3J.*Ld =1*1 MHfcl *003 aiLSL H* 1*1 (*11(32 a*0 *1*

?Hd HM H* q.*l (da a*l) 5HM %i:HciL&>M aiail *l.

3 oySRld kii MHfcl 003 *j<H WltfMM *U

(*l) M<3.

(0 foftad

M [d<3. Md ipHlddl *MlMl.

M*l<U

3 ojld =1*1 -i OO3HI K4H ('H Ud<Wl WltfMM *U

awl #t.

Y (m) aj.'SRld 'ife =1*1 *003 <H Md H* cHI'YHI 6

fcPlcil&Ml WWl.

(<h) UIR&R HiadL al *l. 6

M*l<U

Y (m) aj.'SRld 'ife =1*1 *003 HRdl Uldl Ml *l : 6

(*l) M50US-S oj3i (0

(H) <*l<ttllHteldl tt&oWl fcSd $1&H S*q.Hl Md MliRStl *<U 6

MM IcU&mM aiail *l.

M fcum*l (*[V*g*ld Md SdMA=R) 3<3l HCjMO HRdl *lO

OHHHM H'gdl MLHl :

(m) 1*51 HLHd

(H) ii HlHd

U) ttH'&fl. ii (OHHH- Md IY Mfcl %ll*t)

(i) *Rd<Hl'rG. HLHd

(&) Sidl cRjC-Ud <HL<Hd.

M*l<U

H fcllSltel MHfcl, *lCjMe MH dM, HRL Md % *=Udl *lO

fcPlcil&Ml WWl.

6 fcu>2W*l lfcMe dlAdl HfcWl IU tt*m<il : *1*

(*l) Hl<3.

(0 (3l<Hl

(y) Hhl W*l.

M*l<U

e (m) HL<L-Cl hM tolSl *m-(l H61* 5HI* l <klH ? 6

(H) tolSltel <Ul Md tt*m<il. 6

RF-3374] 2 [Contd...

Instructions : (1) As per the instruction No. 1 of Page No. 1.

(2) Figures to the right indicate full marks of the question.

1 "When and under which circumstances the liability for 12 value added tax arises as per provisions of Gujarat Value Added Tax Act 2003?

OR

1 Discuss the liability to produce accounts and supply 12 information as per Gujarat VAT Act 2003.

2 Discuss the provisions for following matters as per 12 Gujarat VAT Act 2003 :

(a) Voluntary Registration

(b) Suspension of Registration Certificate

(c) Audit Assessment

OR

2 Explain the provisions of Tax on Sales (output tax) and 12 Tax on purchases (Input tax) as per Gujarat VAT Act 2003.

3 Discuss the provisions for following matters as per 12 Gujarat VAT Act 2003 :

(a) Appeal

(b) Revision

(c) Appeal in High Court

(d) Powers of Tribunal and Commissioner.

OR

3 Discuss the penalty provisions as per Gujarat VAT Act 12 2003.

4 (a) Explain the provisions of Refund and Interest on 6

Refund as per Gujarat VAT Act 2003.

salaried persons.

OR

4 (a) Explain the following terms as per Gujarat VAT 6

Act 2003.

(i) Exempted Goods

(ii) Capital Goods

(iii) Prohibited Goods

provisions for filing return and assessment.

5 Give the explanation of the following as per Central 10

Sales Tax (Registration and Turnover) Rules 1957.

(a) Regarding reliable reason

(b) Regarding recovery of tax

(c) Regarding breach of condition

(d) Regarding Penalties

(e) Regarding Explanation Note (Rule 13 and 14 with decision)

OR

5 State the provisions of Registration amendement and 10 its cancellation under Central Sales Tax Act 1956.

6 Explain the following terms as per Central Sales Tax 12 Act 1956.

(1) Goods

(2) Turnover

(3) Dealer

(4) Place of Business

OR

6 (a) When is sales or purchase of goods considered to 12 take place outside the state?

(b) Explain the importance of Form C and D under Central Sales Tax Act 1956.

RF-3374] 4 [ 200 ]

|

Attachment: |

| Earning: Approval pending. |