Veer Narmad South Gujarat University 2011-1st Year B.Com Financial Accounting, ,- , Veer Narmad South University - Question Paper

Get previous year ques. papers for 1st Year B.Com exam You can download from here.

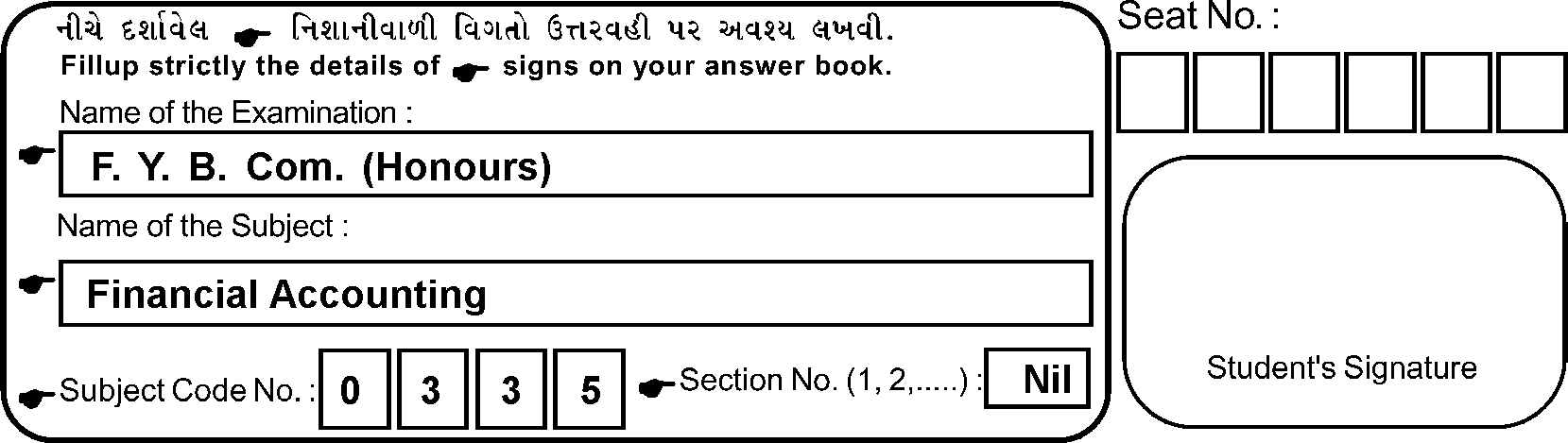

University: Veer Narmad South Gujarat University

Program Name :Second Year B.Com

Course Name: SB:0335 - Financial Accounting, 1st Year B.Com Examination, March-2011, Veer Narmad South Gujarat University.

examination Month and Year: March-2011.

Duration : three hours

Maximum marks:- 70

Attachment :- PDF file containing SB:0335 - Financial Accounting, March-2011.

SB-0335

First Year B. Com. (Honours) Examination March / April - 2011 Financial Accounting

Time : 3 Hours] [Total Marks : 70

Instructions :

(2) Each question carries equal marks.

(3) Calculation is a part of your answer.

1 Write the answer as per instruction :

(a) Jivraj has sent goods 10000 kg on consignment at 3 Rs. 200 per kg. He has paid Rs. 30,000 as expenses and consignee paid Rs. 10,000 as octroi. 1000 kg destroyed

in fire in the godown of consignee. The insurance co. accepted the claim of Rs. 1,00,000. Find out abnormal loss and pas the journal entry in the books of consignor.

(b) A and B are partners of joint venture shoring profit 3 and losses in the ratio of 3:2 respectively. A supplied goods of Rs. 30,000 for joint venture and paid Rs. 600

as expenses. B sold all goods at Rs. 36000. B paid the amount due to A and settled the account. Write journal entries in the books of B.

(c) X, Y and Z are partners sharing profits and losses in 4 the ratio of 3:4:5. Z retires and X and Y decided to share equally in futures profit. There was no goodwill shown

in the firm's book, but now it is valued at Rs. 2,40,000.

Pass journal entries for goodwill of retired share in the books of the firm.

2 On 1.4.2004, a firm purchased machinery for Rs. 2,00,000. 10 On 1.10.04 additional machinery costing Rs. 1,00,000 was purchased. On 1.10.05, the machinery purchased on 1.4.04 having become obsolete, was sold off for Rs. 90,000. On 1.10.2006 new machine was purchased for Rs. 2,50,000 while

the machine purchased on 1.10.04 was sold for Rs. 85,000 on the same day.

The firm provide depreciation on its machine at 10% per annum on original cost on 31st March every year.

Show machinery account and provision for depreciation account for the period of three accounting years ending on 31.3.2007.

3 A, B and C were partners sharing profits and losses in the ratio of 1/2, 3/8 and 1/8. They decided to sell their business to x Ltd. on 31.3.2006. On that day their position was as follows :

|

Balance Sheet on 31.3.2006 | |||||||||||

|

X Ltd. took over the entire business including cash and the purchase price was payable in fully paid 8000 shares of Rs. 10 each issued at Rs. 12 each, debentures of Rs. 20,000 and Rs. 6,000 in cash. The expenses of realization amounted to Rs. 2,000.

There is no agreement between the partners as regards the proportion in which shares and debentures are to be divided among them.

You are required to prepare necessary accounts to close the books of the firm.

4 X, Y and Z are sharing profits and losses in the ratio of 4:5:1 respectively. Their balance sheet is as under :

| ||||||||||||||||||||||||||||||||||||||||

|

The partnership is dissolved and the assets realized as |

follows :

First instalment.....................................Rs. 20,000

Second instalment.................................Rs. 40,000

Third instalment....................................Rs. 34,000

On the date of the dissolution there was a contingent liability of Rs. 2,000 against the firm which was settled at Rs. 1400 at the time of second instalment. Realization expenses were estimated at Rs. 4000 but these actually amounted to Rs. 3000. Mr. Z took stock in Rs. 1000 at the time of third instalment. The firm was forced to pay Rs. 600 out of third instalment for which no provision was made in the books.

Prepare statement showing piecemeal distribution of cash according to Maximum Loss Method.

5 A and B entered into Joint Venture. They decided to share profits and losses in the ratio of 4:5 and 10% interest on any cash investment they make in the venture.

They purchased a five acre plot costing Rs. 6,00,000. They took 80% loan to pay the cost and remaining 20% and registration expenses Rs. 48,000 paid by A. B met the cost as under :

(a) Levelling cost Rs. 2500 per subplot, municipal fee Rs. 4000 per subplot.

(b) Advertisement expenses Rs. 1,75,000.

The entire area of five acre was dealt with as under

(i) 15% area was left for roads.

(ii) Remaining 85% area divided in nine sub plots equally and sold it for Rs. 1,20,000 each.

(iii) B is to receive 5% of sale proceeds as fee.

SB-0335] 3 [Contd...

Prepare joint venture account and partners account in the books of A. Bank loan interest paid Rs. 5,000 by A. They closed the business with in six months and settled the accounts.

6 Head office supplied goods to its branch at invoice price, which is decided cost plus 50%. Cash received by branch is remitted to

H.O. and all expenses of branch are paid by the H.O. From the following particulars prepare branch stock account, branch debtors account, branch profit account and branch adjustment account in the books of Head Office.

|

Particulars |

Rs. |

Particulars |

Rs. |

|

Opening stock with branch |

Opening Debtors |

60,000 | |

|

(invoice price) |

3,00,000 |

Opening petty cash |

500 |

|

Goods received from |

Credit sales (net) |

4,30,000 | |

|

H.O (Invoice price) |

9,30,000 |

Discount allowed | |

|

Goods returned to |

to debtors |

12,000 | |

|

H.O (Invoice price) |

60,000 |

Cash Sales |

5,20,000 |

|

Cash received from |

Closing stock with | ||

|

debtors |

4,50,000 |

Branch (invoice price) |

2,70,000 |

|

Expenses paid by H.O. |

Closing petty cash |

500 | |

|

Rent : 12,000 | |||

|

Salary : 1,20,000 | |||

|

Petty Cash : 5,000 |

1,37,000 |

7 Write short note : (any three)

(i) Errors affecting Trial Balance

(ii) Goodwill on admission of a partner

(iii) Decision of Garner V/s Murray

(iv) The difference between receipts and payment account and income and expenditure account.

SB-0335] 4 [ 200 ]

|

Attachment: |

| Earning: Approval pending. |