Thapar University 2010 M.B.A Information Technology PIT 203 : Financial Management - Question Paper

Roll Number:

ThaparUniversity, Patiala LMTSchool of Management

MBA (IT) (II Semester) Mid Semester PIT-203: Financial Managemeni

March, 2010

Time: 2:00 Hrs. MM: 30 Name of Faculty: Dr. Jouni/ Dr. Shailendra Kumar

Note: There are two sections in the question paper i.e. Section A & B. Attempt all Questions.

1. Value creation

When companies create value, they attempt to do something for their shareholders that they cannot do themselves. In the lectures, we discussed four different ways how a business organization can create value for the shareholders(4 Marks)

However, these four ways are no longer that self evident ways to create value for shareholders. Discuss why that is so and what, perhaps, seems to be the most important way companies create value for their shareholders (i.e. what is often a company's most important asset in the eyes of the investors?) (2 Marks)

2. Financial Ratios

Companies have different stakeholders who use financial information to evaluate companies. Identify six groups of stakeholders and the reason why they are interested in the financial performance of companies (3 Marks)

There are different kinds of ratios for analyzing different things. What are the three main ways of using these ratios (i.e. what are the tree ways to apply these in practice?)(3 Marks)

3. Analyzing investments

A company is considering an investment option (new production line) resulting in the cash inflow and outflow stated below. The company usually accepts investment proposals providing positive NPV with 12 % interest. Do you think that, based on the NPV analysis, the company should proceed with the investment proposal (4 Marks)

|

! Sales 1 Costs | ||

|

Initial Investment |

600 000 | |

|

Cash flows year 1 |

350 000 |

300 000 |

|

year 2 |

550 000 |

400 000 |

|

year 3 |

750 000 |

550 000 |

|

year A |

900 000 |

650 000 |

|

year 5 |

750 000 |

550 000 |

Would the situation change if the company will be able sell part of the equipment in the production line to some smaller company with the estimated sales price of 100 000 (2 Marks)after the five years of use?

Profit and Cost Budget

Profit

Saies and Administration

52

350 000

Direct materia)

500 000

Sales Price

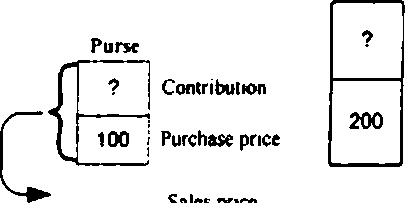

Dress

Contribution

Purchase price Sales price

Below you can see the cost budget of another company. Calculate the overhead burden rates and define sales price for the two products when the company wishes to make 15 % profit(4 Marks)?

Direct material 1000 000 Material overhead 90 000

Direct manufacturing 1 000 000

Manufacturing overhead 160 000

Sales and administration 675 000

|

Products |

A |

B |

|

Direct Material |

100 |

100 |

|

Material Overhead | ||

|

Direct Manufacturing |

100 |

200 |

|

Manufacturing Overhead | ||

|

Total | ||

|

Administration Overhead | ||

|

Total Costs | ||

|

Sales Price |

TABLE I

Present value interest factor for 1 Euro at \% for n periods

|

1% |

2% |

3% |

4 % |

S% |

6% |

7% |

8 % |

9% |

10 % |

11% |

12 % |

13% |

14% |

i9* |

16% |

17% |

16% |

19% |

20% | |

|

1 |

0.990 |

0.980 |

0.971 |

0362 |

0,952 |

0,943 |

0,935 |

0.926 |

0,917 |

0.909 |

0401 |

0493 |

0.885 |

0477 |

0470 |

0462 |

0455 |

0.847 |

0.840 |

0433 |

|

2 |

0.9*0 |

0.961 |

0.9*3 |

0525 |

0,907 |

0490 |

0473 |

0457 |

0.842 |

0426 |

0412 |

0,797 |

0.783 |

0.769 |

0.756 |

0.74J |

0.731 |

0.718 |

0.706 |

0.694 |

|

3 |

0.971 |

0,942 |

0,915 |

0489 |

0464 |

0440 |

0416 |

0.794 |

0.722 |

0.751 |

0,731 |

0.712 |

0.693 |

0.675 |

0458 |

0.64) |

0.624 |

0.609 |

0493 |

0479 |

|

4 |

0,961 |

0,924 |

0,888 |

0.855 |

0423 |

0.792 |

0,763 |

0.735 |

0.708 |

0.683 |

0.659 |

0.636 |

0.613 |

0492 |

0.572 |

0422 |

0.534 |

0416 |

0499 |

0,482 |

|

S |

0.951 |

0,906 |

0*63 |

0422 |

0.784 |

0.747 |

0.713 |

0.681 |

0.650 |

0.621 |

0493 |

0467 |

0443 |

0419 |

0.497 |

0.476 |

0.456 |

0437 |

0419 |

0402 |

|

6 |

0,924 |

0488 |

0,837 |

0,790 |

0,746 |

0,705 |

0.666 |

0.630 |

0496 |

0464 |

043S |

0407 |

0.490 |

0.456 |

0.432 |

0410 |

0490 |

0470 |

0452 |

0435 |

|

7 |

0.9)3 |

0,871 |

0413 |

0.760 |

0,711 |

0465 |

0,623 |

0.583 |

0447 |

0419 |

0,482 |

0,452 |

0/425 |

0400 |

0476 |

04S4 |

0433 |

0414 |

0496 |

0479 |

|

8 |

0,923 |

0453 |

0.789 |

0,731 |

0477 |

0427 |

0482 |

0440 |

0402 |

0,467 |

0434 |

0.404 |

0476 |

0.351 |

0427 |

0405 |

0,285 |

0.266 |

0,249 |

0.233 |

|

9 |

0414 |

0437 |

0,766 |

0,703 |

0,645 |

C492 |

0444 |

0400 |

0.460 |

0.424 |

0491 |

0.361 |

0433 |

0.308 |

0.284 |

0.263 |

0.243 |

0,225 |

0,209 |

0.194 |

|

10 |

0.905 |

0,820 |

0.744 |

0,676 |

0.614 |

C.SS8 |

0,508 |

0463 |

0,422 |

0486 |

0452 |

0422 |

0,295 |

0.270 |

0,247 |

0.227 |

0.208 |

0,191 |

0,176 |

0.162 |

Question No. 4

You are an avid investor in fixed income securities. Your portfolio of bond does not have bonds from AAA rated companies. You are considering purchase of an AAA rated bond. Two such bonds from AAA rated companies, Bond A and Bond B are available in the market that have following features:

(6 Marks)

|

Particulars |

Bond A |

Bond B |

|

Face Value |

Rs. 100.00 |

Rs. 120.00 |

|

Coupon Rate |

16% |

12% |

|

Periodicity of Coupon |

Semi-annual |

Semi-annual |

|

Time Remaining for Maturity |

3 years |

4 years |

|

Current Market Price |

Rs. 110.00 |

Rs. 130.00 |

Your expectation of return from the investment in AAA rated bond is 10%. Which of the bond should you buy and why? Assume that you are indifferent to the investment horizon of 3 or 4 years.

Question No. 5 {3+3= 6 Marks)

Write Short Notes on any Two of the following, with example:

(I) Over Capitalisation Vs. Under Capitalisation

(II) Trading on Equity

(III) Capital Market Vs. Money Market

5

|

Attachment: |

| Earning: Approval pending. |