Institute of Chartered Financial Analysts of India (ICFAI) University 2009 C.A Chartered Accountant Solved IPCC COST-FM II. - Question Paper

Solved IPCC COST-FM ques. Paper Nov 2009

PAPER - 3 : COST ACCOUNTING AND FINANCIAL MANAGEMENT

All questions are compulsory Working notes should form part of the answer

Question 1

Answer any five of the following:

(i) Define the following:

(a) Imputed cost

(b) Capitalised cost

(ii) Calculate efficiency and activity ratio from the following data:

Capacity ratio = 75%

Budgeted output = 6,000 units

Actual output = 5,000 units

Standard Time per unit = 4 hours

(iii) List the Financial expenses which are not included in cost.

(iv) Mention the main advantage of cost plus contracts.

(v) A Company sells two products, J and K. The sales mix is 4 units of J and 3 units of K. The contribution margins per unit are Rs.40 for J and Rs.20 for K. Fixed costs are Rs. 6,16,000 per month. Compute the break-even point.

(vi) When is the reconciliation statement of Cost and Financial accounts not required?

(5*2=10 Marks)

Answer

(i) (a) Imputed Cost: These costs are notional costs which do not involve any cash outlay.

Interest on capital, the payment for which is not actually made, is an example of Imputed Cost. These costs are similar to opportunity costs.

(b) Captialised Cost: These are costs which are initially recorded as assets and subsequently treated as expenses.

.... _ n Actual Hours

(ii) Capacity Ratio =-x100

Budgeted Hours

_AH_

6000 Units x 4 hour per unit

.75 =--

24000 Hours

AH = 18000 Hours

Actual Output in term of Standard Hours

Efficiency Ratio =---x 100

Actual Working Hours

5000 units x 4 hours per unit

=---x100

18000 Hours

20000 Hours

x 100= 111.11%

18000 Hours

. Actual Output in term of Standard Hours

Activity Ratio =---x100

Budgeted Output in term of S tan dard Hours

20000 Units

-x 100

6000 Units x 4 hour per unit 20000 Units

-x100 = 83.33%

24000 Units

(iii) Financial expenses which are not included in cost accounting are as follows:

Interest on debentures and deposit

Gratuity

Pension

Bonus of Employee,

Income Tax,

Preliminary Expenses

Discount on issue of Share

Underwriting Commissions.

(iv) Main advantages of cost plus contracts are:

Contractor is protected from risk of fluctuation in market price of material, labour and services.

Contractee can insure a fair price of the market.

It is useful specially when the work to be done is not definitely fixed at the time of making the estimate.

Contractee can ensure himself about the cost of the contract', as he is empowered to examine the books and documents of the contractor to ascertain the veracity of the cost of the cotract.

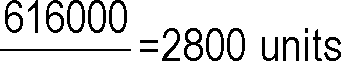

(v) Let 4x = No. of units of J Then 3x = No. of units of K

Fixed Cost

Rs.616000

Contribution

4(40) + 3(20)

BEP in x units

|

|

220 |

Or

Break even point of Product J = 4 x 2800 = 11200 units

Break even point of Product K = 3 x 2800 = 8400 units

(vi) Circumstances where reconciliation statement can be avoided

When the Cost and Financial Accounts are integrated - there is no need to have a separate reconciliation statement between the two sets of accounts. Integration means that the same set of accounts fulfill the requirement of both i.e., Cost and Financial Accounts.

Question 2

Mega Company has just completed its first year of operations. The unit costs on a normal costing basis are as under:

Rs.

Direct material 4 kg @ Rs.4 Direct labour 3 hrs @ Rs.18

16.00

54.00

Variable overhead 3 hrs @ Rs.4 Fixed overhead 3 hrs @ Rs. 6

12.00

18.00

100.00

Selling and administrative costs:

Variable

Rs.20 per unit Rs.7,60,000

Fixed

During the year the company has the following activity:

Units produced Units sold Unit selling price Direct labour hours worked

24.000 21,500 Rs. 168

72.000

Actual fixed overhead was Rs.48,000 less than the budgeted fixed overhead. Budgeted variable overhead was Rs.20,000 less than the actual variable overhead. The company used an expected actual activity level of 72,000 direct labour hours to compute the predetermine overhead rates.

Required :

(i) Compute the unit cost and total income under:

(a) Absorption costing

(b) Marginal costing

(ii) Under or over absorption of overhead.

(iii) Reconcile the difference between the total income under absorption and marginal costing. (15 Marks)

|

Answer (i) Computation of Unit Cost & Total Income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Marginal Costing | ||

|

Sales |

36,12,000 | |

|

Less: Cost of goods sold (21500x82) |

17,63,000 | |

|

Add: Under Absorption |

20,000 |

17.83.000 18.29.000 |

|

Less: Selling & Distribution Expenses |

4,30,000 | |

|

Contribution |

13,99,000 | |

|

Less: Fixed Factory and Selling & Distribution Overhead (38,400 + 7,60,000) |

11,44,000 | |

|

Profit |

2,55,000 |

(ii) Under or over absorption of overhead:

Budgeted Fixed Overhead Rs.

72.000 Hrs. x Rs.6 4,32,000 Less: Actual Overhead was less than Budgeted Fixed Overhead 48,000 Actual Fixed Overhead 3,84,000 Budgeted Variable Overhead

72.000 Hrs. x Rs.4 2,88,000 Add: Actual Overhead was higher than Budgeted 20,000 Budgeted 3,08,000 Both Fixed & Variable Overhead applied

72.000 Hrs x Rs,10 7,20,000 Actual Overhead (3,84,000 + 3,08,000) 6,92,000 Over Absorption 28,000

(iii) Reconciliation of Profit

Difference in Profit: Rs.3,00,000 - 2,55,000 = Rs.45,000

Due to Fixed Factory Overhead being included in Closing Stock in Absorption Costing not in Marginal Costing.

Therefore,

Difference in Profit = Fixed Overhead Rate (Production - Sale)

18 (24,000- 21,500) = Rs.45,000 Question 3

(a) XP Ltd. furnishes you the following information relating to process II.

(i) Opening work-in-progress - NIL

(ii) Units introduced 42,000 units @ Rs.12

(iii) Expenses debited to the process:

Rs.

Direct material = 61,530

Labour = 88,820

Overhead = 1,76,400

(iv) Normal loss in the process = 2 % of input.

(v) Closing work-in-progress - 1200 units Degree of completion - Materials 100%

Labour 50%

Overhead 40%

(vi) Finished output - 39,500 units

(vii) Degree of completion of abnormal loss:

Material 100%

Labour 80%

Overhead 60%

(viii) Units scraped as normal loss were sold at Rs.4.50 per unit.

(ix) All the units of abnormal loss were sold at Rs.9 per unit.

Prepare:

(i) Statement of equivalent production:

(ii) Statement showing the cost of finished goods, abnormal loss and closing work-in-progress.

(iii) Process II account and abnormal loss account. (8 Marks)

(b) The following information is available from the cost records of Vatika & Co. For the month of August, 2009:

Material purchased 24,000 kg Rs. 1,05,600 Material consumed 22,800 kg Actual wages paid for 5,940 hours Rs.29,700 Unit produced 2160 units.

Standard rates and prices are:

Direct material rate is Rs.4.00 per unit.

Direct labour rate is Rs. 4.00 per hour Standard input is 10 kg. for one unit Standard requirement is 2.5 hours per unit.

Calculate all material and labour variances for the month of August, 2009. Answer

(8 Marks)

(a) Statement of Equivalent Production

|

Particulars |

Output |

Material Units % |

Labour Units |

% |

Overhead Units % | ||

|

Finished Output |

39,500 |

39,500 |

100% |

39,500 |

100% |

39.500 |

100% |

|

Normal Loss 2% of 42,000 units |

840 |

- |

- |

- |

- |

- |

- |

|

Abnormal Loss (42,000 - 39,500 -840- 1200) |

460 |

460 |

100% |

368 |

80% |

276 |

60% |

|

Closing W.I.P. |

1,200 42,000 |

1,200 41,160 |

100% |

600 40,468 |

50% |

480 40256 |

40% |

Units Introduced 42,000@12 Add: Material

Statement of Cost

Rs.

5,04,000

Less: Value of Normal Loss

5,61,750

Cost per Unit

Material

5,61,750 41,160 '

88,820

40,468

1,76,400

40,256

Rs.13.648

Rs.2.195

Rs.4.382

20.225

6,278.08

807.76

Labour

Overhead

Abnormal Loss:

Material

Labour

460 x 13.648 368 x 2.195

Overheads

276 x 4.382

1,209.42

8,295.26

16,377.60

1,317.00

2,103.36

19,797.96

Rs.7,98,887.50

Closing W.I.P.

Material

Labour

Overheads

1,200 x 13.648 600 x 2.195 480 x 4.382

39,500 x 20.225

Finished Goods

|

Process II Account | ||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||

|

Abnormal Loss Account | ||||||||||||||||||||||||||||

|

(b) Material Variances:

(i) Material Cost Variance = (SQ * SP) - (AQ * AP)

= (2,160* 4 * 10)- (22,800 * 4.40)

= Rs.86,400- Rs. 1,00,320 = 13,920 (A)

(ii) Material Price Variance = AQ (SP - AP)

= 22,800 Kg (4- 4.40) = 9,120 (A)

(iii) Material Usage Variance = SP (SQ - AQ)

= 4 (21,600 - 22,800) = 4,800 (A)

Note : unit basis for direct material has been taken as kg. hence, direct material rate is Rs. 4 per kg.

Verification:-

MCV = MPV + MUV

13,920 (A) = 9,120 (A) + 4,800 (A)

Labour Variances:

(i) Labour Cost Variance

= (SH x SR) - (AH x AR)

= (2,160 x 2.50 x 4)- (29,700)

= 21,600- 29,700 = 8,100 (A)

(ii) Labour Rate Variance = AH (SR - AR)

= 5,940 (4- 5) = 5,940 (A)

(iii) Labour Efficiency Variance = SR (SH- AH)

= 4 (5,400 - 5,940) = 2,160 (A)

Verification:-

LCV = LRV + LEV

8,100 (A) = 5,940 (A) + 2,160 (A)

SH = 2,160 Units x 2.50 Hours = 5,400 Hrs.

Question 4

Answer any three of the following:

(i) Standard Time for a job is 90 hours. The hourly rate of Guaranteed wages is Rs.50. Because of the saving in time a worker a gets an effective hourly rate of wages of Rs. 60 under Rowan premium bonus system. For the same saving in time, calculate the hourly rate of wages a worker B will get under Halsey premium bonus system assuring 40% to worker.

(ii) Explain briefly, what do you understand by Operating Costing. How are composite units computed?

(iii) The following information relating to a type of Raw material is available:

Annual demand 2000 units

Unit price Rs.20.00

Ordering cost per order Rs.20.00

Storage cost 2% p.a.

Interest rate 8% p.a.

Lead time Half-month

Calculate economic order quantity and total annual inventory cost of the raw material.

(iv) List the eight functional budgets prepared by a business. (3*3=9 Marks) Answer

(i) Increase in Hourly Rate of Wages (Rowan Plan) is (Rs.60 - Rs.50) = Rs.10 This is Equal to Time Saved

- x Hourly rate

Standard Time

Time Saved

Or 10 =-x 50

S tan dard Time

_ Time Saved

Or-x 50 = 10

90

Time Saved = -900 = 18 Hours

50

Time Taken = (90- 18) = 72 Hours

Effective Hourly Rate under Halsey System Time Saved = 18 Hours

Bonus @ 40% = 18 x 40% x 50 = Rs.360

Total Wages = (50 x 72 + 360) = 3,960

Effective Hourly Rate = 3,960 - 72 Hours = Rs.55

(ii) Operating Costing: It is method of ascertaining costs of providing or operating a service. This method of costing is applied by those undertakings which provide services rather

than production of commodities. This method of costing is used by transport companies, gas and water works departments, electricity supply companies, canteens, hospitals, theatres, schools etc.

Composite units may be computed in two ways:

(a) Absolute (weighted average) tones kms, quintal kms etc.

(b) Commercial (simple average) tones kms, quintal kms etc.

Absolute tonnes-kms are the sum total of tonnes kms arrived at by multiplying various distances by respective load quantities carried.

Commercial tonnes-kms, are arrived at by multiplying total distance kms, by average load quantity.

2 x Annual Consumption x Buying Cost per Order

(iii) EOQ

Storage Cost per unit

2 x 2,000 x 20

80,000

2

Rs.20 x

= 200 Units

Total Annual Inventory Cost

Cost of 2,000 Units @ Rs.20 (2,000 x 20)

= Rs.40,000 = Rs.10 = Rs.200

M 2000

No. of Order-

200

Ordering Cost 10 x 20

200

10

Carrying cost of Average Inventory x 20 x = Rs.200

= Rs.40,400

(iv) The various commonly used Functional budgets are:

Sales Budget

Production Budget

Plant Utilisation Budget

Direct Material Usage Budget

Direct Material Purchase Budget

Direct Labour (Personnel) Budget

Factory Overhead Budget

Production Cost Budget

Note: In addition to above, there are many more functional budgets which the student can write alternatively.

Question 5

Answer any five of the following:

(i) Explain briefly the limitations of Financial ratios.

(ii) What do you understand by Business Risk and Financial Risk?

(iii) Differentiate between Factoring and Bills discounting.

(iv) Differentiate between Financial Management and Financial Accounting.

(v) Y Ltd. retains Rs. 7,50,000 out of its current earnings. The expected rate of return to the

shareholders, if they had invested the funds elsewhere is 10%. The brokerage is 3% and

the shareholders come in 30% tax bracket. Calculate the cost of retained earnings.

(vi) From the information given below calculate the amount of Fixed assets and Proprietors

fund.

Ratio of fixed assets to proprietors fund = 0.75

Net Working Capital = Rs. 6,00,000 (5 x 2=10 Marks)

Answer

(i) Limitations of Financial Ratios

The limitations of financial ratios are listed below:

(a) Diversified product lines: Many businesses operate a large number of divisions in quite different industries. In such cases, ratios calculated on the basis of aggregate data cannot be used for inter-firm comparisons.

(b) Financial data are badly distorted by inflation: Historical cost values may be substantially different from true values. Such distortions of financial data are also carried in the financial ratios.

(c) Seasonal factors may also influence financial data.

(d) To give a good shape to the popularly used financial ratios (like current ratio, debt-equity ratios, etc.): The business may make some year-end adjustments. Such window dressing can change the character of financial ratios which would be different had there been no such change.

(e) Differences in accounting policies and accounting period: It can make the accounting data of two firms non-comparable as also the accounting ratios.

(f) There is no standard set of ratios against which a firms ratios can be compared: Sometimes a firm's ratios are compared with the industry average. But if a firm desires to be above the average, then industry average becomes a low standard.

On the other hand, for a below average firm, industry averages become too high a standard to achieve.

(g) It is very difficult to generalise whether a particular ratio is good or bad: For example, a low current ratio may be said bad' from the point of view of low liquidity, but a high current ratio may not be good' as this may result from inefficient working capital management.

(h) Financial ratios are inter-related, not independent. Viewed in isolation one ratio may highlight efficiency. But when considered as a set of ratios they may speak differently. Such interdependence among the ratios can be taken care of through multivariate analysis.

(Note: Students to write any four limitations)

(ii) Business Risk and Financial Risk

Business Risk: It is an unavoidable risk because of the environment in which the firm has to operate and the business risk is represented by the variability of earnings before interest and tax (EBIT). The variability in turn is influenced by revenues and expenses. Revenues and expenses are affected by demand of firm's products, variations in prices and proportion of fixed cost in total cost.

Financial Risk: It is the risk borne by a shareholder when a firm uses debt in addition to equity financing in its capital structure. Generally, a firm should neither be exposed to high degree of business risk and low degree of financial risk or vice-versa, so that shareholders do not bear a higher risk.

(iii) Differentiation between Factoring and Bills Discounting

The differences between Factoring and Bills discounting are:

(a) Factoring is called as "Invoice Factoring' whereas Bills discounting is known as Invoice discounting.

(b) In Factoring, the parties are known as the client, factor and debtor whereas in Bills discounting, they are known as drawer, drawee and payee.

(c) Factoring is a sort of management of book debts whereas bills discounting is a sort of borrowing from commercial banks.

(d) For factoring there is no specific Act, whereas in the case of bills discounting, the Negotiable Instruments Act is applicable.

(iv) Differentiation between Financial Management and Financial Accounting

Though financial management and financial accounting are closely related, still they differ in the treatment of funds and also with regards to decision - making.

Treatment of Funds: In accounting, the measurement of funds is based on the accrual principle. The accrual based accounting data do not reflect fully the financial conditions of the

organisation. An organisation which has earned profit (sales less expenses) may said to be profitable in the accounting sense but it may not be able to meet its current obligations due to shortage of liquidity as a result of say, uncollectible receivables. Whereas, the treatment of funds, in financial management is based on cash flows. The revenues are recognised only when cash is actually received (i.e. cash inflow) and expenses are recognised on actual payment (i.e. cash outflow). Thus, cash flow based returns help financial managers to avoid insolvency and achieve desired financial goals.

Decision-making: The chief focus of an accountant is to collect data and present the data while the financial manager's primary responsibility relates to financial planning, controlling and decision-making. Thus, in a way it can be stated that financial management begins where financial accounting ends.

(v) Computation of Cost of Retained Earnings (Kr)

|

Kr = k (1-Tp) (1-B) | |

|

Kr = 0.10 (1- 0.30) (1- 0.03) | |

|

= 0.10 (0.70) x (0.97) | |

|

= 0.0679 or 6.79% | |

|

Cost of Retained Earnings = 6.79% | |

|

Calculation of Fixed Assets and Proprietors Fund | |

|

Since Ratio of Fixed Assets to Proprietor's Fund |

= 0.75 |

|

Therefore, Fixed Assets |

= 0.75 Proprietor's Fund |

|

Net Working Capital |

= 0.25 Proprietor's Fund |

|

6,00,000 |

= 0.25 Proprietor's Fund |

|

Therefore, Proprietor's Fund |

_ Rs.6,00,000 0.25 |

= Rs. 24,00,000

Proprietors Fund = Rs. 24,00,000

Since, Fixed Assets = 0.75 Proprietor's Fund

Therefore, Fixed Assets = 0.75 x 24,00,000

= Rs.18,00,000

|

Question 6 The Balance Sheets of a Company as on 31st March, 2008 and 2009 are given below: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Additional information:

During the year ended 31st March, 2009 the company:

(i) Sold a machine for Rs.1,20,000; the cost of machine was Rs. 2,40,000 and depreciation provided on it was Rs. 84,000.

(ii) Provided Rs. 4,20,000 as depreciation on fixed assets.

(iii) Sold some investment and profit credited to capital reserve.

(iv) Redeemed 30% of the debentures @ 105.

(v) Decided to write off fixed assets costing Rs. 60,000 on which depreciation amounting to Rs.

48,000 has been provided.

You are required to prepare Cash Flow Statement as per AS 3. (15 Marks)

Answer

Cash Flow Statement for the year ending 31st March, 2009

(A) Cash Flows from Operating Activities

Profit and Loss A/c (3,60,000 - 2,88,000)

Rs.

72,000

Adjustments:

Increase in General Reserve

1.44.000

4.20.000

4.08.000

36.000 14,400

1,72,800

48.000

12.000 60,480

40.000 8,000

48.000 (2,00,000)

(44,000)

Depreciation

Provision for Tax

Loss on Sale of Machine

Premium on Redemption

of

Debentures

Proposed Dividend Preliminary Expenses written off Fixed Assets written off Interest on Debentures*

13.15.680

13.87.680

Funds from Operations Increase in Sundry Creditors Increase in Bills Payable

Increase in Sundry Debtors Increase in Stock Cash before Tax Less: Tax paid

(1,96,000)

11,91,680

4,32,000

7,59,680

Cash flows from Operating Activities

(B) Cash Flows from Investing Activities

Purchase of Fixed Assets Sale of Investment Sale of Fixed Assets

(C) Cash Flows from Financing Activities

Issue of Share Capital 4,80,000

Redemption of Debentures (3,02,400)

Dividend Paid (1,44,000 - 19,200) (1,24,800)

Interest on Debentures (60,480) (7,680)

Net increase in Cash and Cash (4,000)

Equivalents

Cash and Cash Equivalents at the 4,000

beginning of the year

Cash and Cash Equivalents at the end of NIL

the year

* It is assumed that the 30 percent debentures have been redeemed at the beginning of the year.

Fixed Assets Account

|

Particulars |

Rs. |

Particulars |

Rs. | ||

|

To |

Balance b/d |

27,36,000 |

By |

Cash |

1,20,000 |

|

To |

Purchases (Balance) |

10,20,000 |

By |

Loss on Sales |

36,000 |

|

By |

Depreciation |

4,20,000 | |||

|

By |

Assets written off |

12,000 | |||

|

By |

Balance c/d |

31,68,000 | |||

|

37,56,000 |

37,56,000 |

Question 7

(a) From the following financial data of Company A and Company B: Prepare their Income Statements.

Variable Cost Fixed Cost Interest Expenses Financial Leverage Operating Leverage Income Tax Rate Sales

Company A Rs.

20.000 12,000

5: 1

30%

Company B Rs.

60% of sales

9,000

4 : 1 30% 1,05,000

(b) A hospital is considering to purchase a diagnostic machine costing Rs. 80,000. The projected life of the machine is 8 years and has an expected salvage value of Rs. 6,000 at the end of 8 years. The annual operating cost of the machine is Rs. 7,500. It is expected to generate revenues of Rs. 40,000 per year for eight years. Presently, the hospital is outsourcing the diagnostic work and is earning commission income of Rs.12,000 per annum; net of taxes.

Required:

Whether it would be profitable for the hospital to purchase the machine? Give your recommendation under:

(i) Net Present Value method

(ii) Profitability Index method.

PV factors at 10% are given below:

Answer

(a)

| ||||||||||||||||

|

(8 + 8 = 16 Marks) |

|

Income Statements of Company A and Company B | |||||||||||||||||||||||||||||||||

|

Working Notes: Company A

EBIT

(i) Financial Leverage =

EBIT

5 =

EBIT -12,000 5 (EBIT- 12,000) = EBIT 4 EBIT = 60,000 EBIT = Rs.15,000

(ii) Contribution = EBIT + Fixed Cost

= 15,000 + 20,000 = Rs. 35,000

(iii) Sales = Contribution + Variable cost

= 35,000 + 56,000 = Rs. 91,000

Company B

(i) Contribution = 40% of Sales (as Variable Cost is 60% of Sales) = 40% of 1,05,000 = Rs. 42,000

Contribution

(ii) Financial Leverage = 4=

EBIT 42,000

EBIT

EBIT = Rs.10,500

4

(iii) Fixed Cost = Contribution - EBIT

= 42,000- 10,500 = Rs. 31,500

(b) Advise to the Hospital Management Determination of Cash inflows

Cash inflow after tax per annum 25,525

Less: Loss of Commission Income 12,000

Net Cash inflow after tax per annum 13,525 In 8th Year:

New Cash inflow after tax 13,525

Add: Salvage Value of Machine 6,000

Net Cash inflow in year 8 19,525

Calculation of Net Present Value (NPV)

|

Year |

CFAT |

PV Factor @10% |

|

1 to 7 |

13,525 |

4.867 |

|

8 |

19,525 |

0.467 |

|

Less: Cash Outflows |

Present Value of Cash inflows

65,826.18

9,118.18

74,944.36

80,000.00

NPV (5,055.64)

Sum of discounted cash inflows Present value of cash outflows

Profitability Index =

= =0.937

80,000

Advise: Since the net present value is negative and profitability index is also less than 1, therefore, the hospital should not purchase the diagnostic machine.

Note: Since the tax rate is not mentioned in the question, therefore, it is assumed to be 30 percent in the given solution.

Question 8

Answer any three of the following:

(i) Explain the two basic functions of Financial Management.

(ii) Explain the following terms:

(a) Ploughing back of profits

(b) Desirability factor.

(iii) What do you understand by Weighted Average Cost of Capital?

(iv) There are two firms P and Q which are identical except P does not use any debt in its capital structure while Q has Rs. 8,00,000, 9% debentures in its capital structure. Both the firms have earning before interest and tax of Rs. 2,60,000 p.a. and the capitalization rate is 10%.

Assuming the corporate tax of 30%, calculate the value of these firms according to MM Hypothesis. (3 *3 = 9 Marks)

Answer (i) Two Basic Functions of Financial Management

Procurement of Funds: Funds can be obtained from different sources having different characteristics in terms of risk, cost and control. The funds raised from the issue of equity shares are the best from the risk point of view since repayment is required only at the time of liquidation. However, it is also the most costly source of finance due to dividend expectations of shareholders. On the other hand, debentures are cheaper than equity shares due to their tax advantage. However, they are usually riskier than equity shares. There are thus risk, cost and control considerations which a finance manager must consider while procuring funds. The cost of funds should be at the minimum level for that a proper balancing of risk and control factors must be carried out.

Effective Utilization of Funds: The Finance Manager has to ensure that funds are not kept idle or there is no improper use of funds. The funds are to be invested in a manner such that they generate returns higher than the cost of capital to the firm. Besides this, decisions to invest in fixed assets are to be taken only after sound analysis using capital budgeting techniques. Similarly, adequate working capital should be maintained so as to avoid the risk of insolvency.

(ii) (a) Ploughing Back of Profits: Long term funds may also be provided by accumulating the

profits of the company and by ploughing them back into business. Such funds belong to the ordinary shareholders and increase the net worth of the company. A public limited company must plough back a reasonable amount of its profits each year keeping in view the legal requirements in this regard and its own expansion plans. Such funds also entail almost no risk. Further, control of present owners is also not diluted by retaining profits.

(b) Desirability Factor. In certain cases we have to compare a number of proposals each involving different amount of cash inflows. One of the methods of comparing such proposals is to work out, what is known as the Desirability Factor' or Profitability Index'. In general terms, a project is acceptable if the Profitability Index is greater than 1.

Mathematically,

. , Sum of DiscountedCashinflows

Desirability Factor =-

Initial Cash Outlay or Total Discounted Cash outflows

(iii) Weighted Average Cost of Capital

The composite or overall cost of capital of a firm is the weighted average of the costs of various sources of funds. Weights are taken in proportion of each source of funds in capital structure while making financial decisions. The weighted average cost of capital is calculated by calculating the cost of specific source of fund and multiplying the cost of each source by its proportion in capital structure. Thus, weighted average cost of capital is the weighted average after tax costs of the individual components of firm's capital structure. That is, the after tax cost of each debt and equity is calculated separately and added together to a single overall cost of capital.

(iv) Calculation of Value of Firms P and Q according to MM Hypothesis

Market Value of Firm P (Unlevered)

V = EBIT (1-t)

u_ Ke

_ 2,60,000 (1-0.30)

_ 10%

10%

Market Value of Firm Q (Levered)

Ve _ Vu + DT

_ Rs.18,20,000 + (8,00,000 x 0.30)

_ Rs.18,20,000 + 2,40,000 _ Rs. 20,60,000

60

PAPER - 3 : COST ACCOUNTING AND FINANCIAL MANAGEMENT

All questions are compulsory Working notes should form part of the answer

Question 1

Answer any five of the following:

(i) Define the following:

(a) Imputed cost

(b) Capitalised cost

(ii) Calculate efficiency and activity ratio from the following data:

Capacity ratio = 75%

Budgeted output = 6,000 units

Actual output = 5,000 units

Standard Time per unit = 4 hours

(iii) List the Financial expenses which are not included in cost.

(iv) Mention the main advantage of cost plus contracts.

(v) A Company sells two products, J and K. The sales mix is 4 units of J and 3 units of K. The contribution margins per unit are Rs.40 for J and Rs.20 for K. Fixed costs are Rs. 6,16,000 per month. Compute the break-even point.

(vi) When is the reconciliation statement of Cost and Financial accounts not required?

(5*2=10 Marks)

Answer

(i) (a) Imputed Cost: These costs are notional costs which do not involve any cash outlay.

Interest on capital, the payment for which is not actually made, is an example of Imputed Cost. These costs are similar to opportunity costs.

(b) Captialised Cost: These are costs which are initially recorded as assets and subsequently treated as expenses.

.... _ n Actual Hours

(ii) Capacity Ratio =-x100

Budgeted Hours

6000 Units x 4 hour per unit

.75 =

24000 Hours

AH = 18000 Hours

Actual Output in term of Standard Hours

Efficiency Ratio =---x 100

Actual Working Hours

5000 units x 4 hours per unit

=---x100

18000 Hours

20000 Hours

x 100= 111.11%

18000 Hours

. Actual Output in term of Standard Hours

Activity Ratio =---x100

Budgeted Output in term of S tan dard Hours

20000 Units

-x 100

6000 Units x 4 hour per unit 20000 Units

-x100 = 83.33%

24000 Units

(iii) Financial expenses which are not included in cost accounting are as follows:

Interest on debentures and deposit

Gratuity

Pension

Bonus of Employee,

Income Tax,

Preliminary Expenses

Discount on issue of Share

Underwriting Commissions.

(iv) Main advantages of cost plus contracts are:

Contractor is protected from risk of fluctuation in market price of material, labour and services.

Contractee can insure a fair price of the market.

It is useful specially when the work to be done is not definitely fixed at the time of making the estimate.

Contractee can ensure himself about the cost of the contract', as he is empowered to examine the books and documents of the contractor to ascertain the veracity of the cost of the cotract.

(v) Let 4x = No. of units of J Then 3x = No. of units of K

Fixed Cost

Rs.616000

Contribution

4(40) + 3(20)

BEP in x units

|

|

220 |

Or

Break even point of Product J = 4 x 2800 = 11200 units

Break even point of Product K = 3 x 2800 = 8400 units

(vi) Circumstances where reconciliation statement can be avoided

When the Cost and Financial Accounts are integrated - there is no need to have a separate reconciliation statement between the two sets of accounts. Integration means that the same set of accounts fulfill the requirement of both i.e., Cost and Financial Accounts.

Question 2

Mega Company has just completed its first year of operations. The unit costs on a normal costing basis are as under:

Rs.

Direct material 4 kg @ Rs.4 Direct labour 3 hrs @ Rs.18

16.00

54.00

Variable overhead 3 hrs @ Rs.4 Fixed overhead 3 hrs @ Rs. 6

12.00

18.00

100.00

Selling and administrative costs:

Variable

Rs.20 per unit Rs.7,60,000

Fixed

During the year the company has the following activity:

Units produced Units sold Unit selling price Direct labour hours worked

24.000 21,500 Rs. 168

72.000

Actual fixed overhead was Rs.48,000 less than the budgeted fixed overhead. Budgeted variable overhead was Rs.20,000 less than the actual variable overhead. The company used an expected actual activity level of 72,000 direct labour hours to compute the predetermine overhead rates.

Required :

(i) Compute the unit cost and total income under:

(a) Absorption costing

(b) Marginal costing

(ii) Under or over absorption of overhead.

(iii) Reconcile the difference between the total income under absorption and marginal costing. (15 Marks)

|

Answer (i) Computation of Unit Cost & Total Income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Marginal Costing | ||

|

Sales |

36,12,000 | |

|

Less: Cost of goods sold (21500x82) |

17,63,000 | |

|

Add: Under Absorption |

20,000 |

17.83.000 18.29.000 |

|

Less: Selling & Distribution Expenses |

4,30,000 | |

|

Contribution |

13,99,000 | |

|

Less: Fixed Factory and Selling & Distribution Overhead (38,400 + 7,60,000) |

11,44,000 | |

|

Profit |

2,55,000 |

(ii) Under or over absorption of overhead:

Budgeted Fixed Overhead Rs.

72.000 Hrs. x Rs.6 4,32,000 Less: Actual Overhead was less than Budgeted Fixed Overhead 48,000 Actual Fixed Overhead 3,84,000 Budgeted Variable Overhead

72.000 Hrs. x Rs.4 2,88,000 Add: Actual Overhead was higher than Budgeted 20,000 Budgeted 3,08,000 Both Fixed & Variable Overhead applied

72.000 Hrs x Rs,10 7,20,000 Actual Overhead (3,84,000 + 3,08,000) 6,92,000 Over Absorption 28,000

(iii) Reconciliation of Profit

Difference in Profit: Rs.3,00,000 - 2,55,000 _ Rs.45,000

Due to Fixed Factory Overhead being included in Closing Stock in Absorption Costing not in Marginal Costing.

Therefore,

Difference in Profit _ Fixed Overhead Rate (Production - Sale)

18 (24,000- 21,500) _ Rs.45,000 Question 3

(a) XP Ltd. furnishes you the following information relating to process II.

(i) Opening work-in-progress - NIL

(ii) Units introduced 42,000 units @ Rs.12

(iii) Expenses debited to the process:

Rs.

Direct material = 61,530

Labour = 88,820

Overhead = 1,76,400

(iv) Normal loss in the process = 2 % of input.

(v) Closing work-in-progress - 1200 units Degree of completion - Materials 100%

Labour 50%

Overhead 40%

(vi) Finished output - 39,500 units

(vii) Degree of completion of abnormal loss:

Material 100%

Labour 80%

Overhead 60%

(viii) Units scraped as normal loss were sold at Rs.4.50 per unit.

(ix) All the units of abnormal loss were sold at Rs.9 per unit.

Prepare:

(i) Statement of equivalent production:

(ii) Statement showing the cost of finished goods, abnormal loss and closing work-in-progress.

(iii) Process II account and abnormal loss account. (8 Marks)

(b) The following information is available from the cost records of Vatika & Co. For the month of August, 2009:

Material purchased 24,000 kg Rs. 1,05,600 Material consumed 22,800 kg Actual wages paid for 5,940 hours Rs.29,700 Unit produced 2160 units.

Standard rates and prices are:

Direct material rate is Rs.4.00 per unit.

Direct labour rate is Rs. 4.00 per hour Standard input is 10 kg. for one unit Standard requirement is 2.5 hours per unit.

Calculate all material and labour variances for the month of August, 2009. Answer

(a) Statement of Equivalent Production

| ||||||||||||||||||||||||||||||||||||||||

|

Statement of Cost | ||||||||||||||||||||||||||||||||||||||||

Units Introduced 42,000@12 Add: Material

Rs.

5,04,000

61,530

5,65,530

3,780

Less: Value of Normal Loss

5,61,750

Cost per Unit

Material

5,61,750 41,160 '

88,820

40,468

1,76,400

40,256

Rs.13.648

Rs.2.195

Rs.4.382

20.225

6,278.08

807.76

Labour

Overhead

Abnormal Loss:

Material

Labour

460 x 13.648 368 x 2.195

276 x 4.382

Overheads

1,209.42

8,295.26

16,377.60

1,317.00

2,103.36

19,797.96

Rs.7,98,887.50

Closing W.I.P.

Material

Labour

Overheads

1,200 x 13.648 600 x 2.195 480 x 4.382

39,500 x 20.225

Finished Goods

|

Process II Account | ||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||

|

Abnormal Loss Account | ||||||||||||||||||||||||||||

|

(b) Material Variances:

(i) Material Cost Variance = (SQ * SP) - (AQ * AP)

= (2,160* 4 * 10)- (22,800 * 4.40)

= Rs.86,400- Rs. 1,00,320 = 13,920 (A)

(ii) Material Price Variance = AQ (SP - AP)

= 22,800 Kg (4- 4.40) = 9,120 (A)

(iii) Material Usage Variance = SP (SQ - AQ)

= 4 (21,600 - 22,800) = 4,800 (A)

Note : unit basis for direct material has been taken as kg. hence, direct material rate is Rs. 4 per kg.

Verification:-

MCV = MPV + MUV

13,920 (A) = 9,120 (A) + 4,800 (A)

Labour Variances:

(i) Labour Cost Variance

= (SH x SR) - (AH x AR)

= (2,160 x 2.50 x 4)- (29,700)

= 21,600- 29,700 = 8,100 (A)

(ii) Labour Rate Variance = AH (SR - AR)

= 5,940 (4- 5) = 5,940 (A)

(iii) Labour Efficiency Variance = SR (SH- AH)

= 4 (5,400 - 5,940) = 2,160 (A)

Verification:-

LCV = LRV + LEV

8,100 (A) = 5,940 (A) + 2,160 (A)

SH = 2,160 Units x 2.50 Hours = 5,400 Hrs.

Question 4

Answer any three of the following:

(i) Standard Time for a job is 90 hours. The hourly rate of Guaranteed wages is Rs.50. Because of the saving in time a worker a gets an effective hourly rate of wages of Rs. 60 under Rowan premium bonus system. For the same saving in time, calculate the hourly rate of wages a worker B will get under Halsey premium bonus system assuring 40% to worker.

(ii) Explain briefly, what do you understand by Operating Costing. How are composite units computed?

(iii) The following information relating to a type of Raw material is available:

Annual demand 2000 units

Unit price Rs.20.00

Ordering cost per order Rs.20.00

Storage cost 2% p.a.

Interest rate 8% p.a.

Lead time Half-month

Calculate economic order quantity and total annual inventory cost of the raw material.

(iv) List the eight functional budgets prepared by a business. (3*3=9 Marks) Answer

(i) Increase in Hourly Rate of Wages (Rowan Plan) is (Rs.60 - Rs.50) = Rs.10 This is Equal to Time Saved

x Hourly rate

Standard Time

Time Saved

Or 10 =-x 50

S tan dard Time

_ Time Saved

Or-x 50 = 10

90

Time Saved = -900 = 18 Hours

50

Time Taken = (90- 18) = 72 Hours

Effective Hourly Rate under Halsey System Time Saved = 18 Hours

Bonus @ 40% = 18 x 40% x 50 = Rs.360

Total Wages = (50 x 72 + 360) = 3,960

Effective Hourly Rate = 3,960 - 72 Hours = Rs.55

(ii) Operating Costing: It is method of ascertaining costs of providing or operating a service. This method of costing is applied by those undertakings which provide services rather

than production of commodities. This method of costing is used by transport companies, gas and water works departments, electricity supply companies, canteens, hospitals, theatres, schools etc.

Composite units may be computed in two ways:

(a) Absolute (weighted average) tones kms, quintal kms etc.

(b) Commercial (simple average) tones kms, quintal kms etc.

Absolute tonnes-kms are the sum total of tonnes kms arrived at by multiplying various distances by respective load quantities carried.

Commercial tonnes-kms, are arrived at by multiplying total distance kms, by average load quantity.

2 x Annual Consumption x Buying Cost per Order

(iii) EOQ

Storage Cost per unit

80,000

= 200 Units

2

2 x 2,000 x 20

Rs.20 x

Total Annual Inventory Cost Cost of 2,000 Units @ Rs.20 (2,000 x 20) 2000

= Rs.40,000 = Rs.10 = Rs.200

No. of Order-

200

Ordering Cost 10 x 20

200

10

Carrying cost of Average Inventory x 20 x = Rs.200

= Rs.40,400

(iv) The various commonly used Functional budgets are:

Sales Budget

Production Budget

Plant Utilisation Budget

Direct Material Usage Budget

Direct Material Purchase Budget

Direct Labour (Personnel) Budget

Factory Overhead Budget

Production Cost Budget

Note: In addition to above, there are many more functional budgets which the student can write alternatively.

Question 5

Answer any five of the following:

(i) Explain briefly the limitations of Financial ratios.

(ii) What do you understand by Business Risk and Financial Risk?

(iii) Differentiate between Factoring and Bills discounting.

(iv) Differentiate between Financial Management and Financial Accounting.

(v) Y Ltd. retains Rs. 7,50,000 out of its current earnings. The expected rate of return to the

shareholders, if they had invested the funds elsewhere is 10%. The brokerage is 3% and

the shareholders come in 30% tax bracket. Calculate the cost of retained earnings.

(vi) From the information given below calculate the amount of Fixed assets and Proprietors

fund.

Ratio of fixed assets to proprietors fund = 0.75

Net Working Capital = Rs. 6,00,000 (5 x 2=10 Marks)

Answer

(i) Limitations of Financial Ratios

The limitations of financial ratios are listed below:

(a) Diversified product lines: Many businesses operate a large number of divisions in quite different industries. In such cases, ratios calculated on the basis of aggregate data cannot be used for inter-firm comparisons.

(b) Financial data are badly distorted by inflation: Historical cost values may be substantially different from true values. Such distortions of financial data are also carried in the financial ratios.

(c) Seasonal factors may also influence financial data.

(d) To give a good shape to the popularly used financial ratios (like current ratio, debt-equity ratios, etc.): The business may make some year-end adjustments. Such window dressing can change the character of financial ratios which would be different had there been no such change.

(e) Differences in accounting policies and accounting period: It can make the accounting data of two firms non-comparable as also the accounting ratios.

(f) There is no standard set of ratios against which a firms ratios can be compared: Sometimes a firm's ratios are compared with the industry average. But if a firm desires to be above the average, then industry average becomes a low standard.

On the other hand, for a below average firm, industry averages become too high a standard to achieve.

(g) It is very difficult to generalise whether a particular ratio is good or bad: For example, a low current ratio may be said bad' from the point of view of low liquidity, but a high current ratio may not be good' as this may result from inefficient working capital management.

(h) Financial ratios are inter-related, not independent. Viewed in isolation one ratio may highlight efficiency. But when considered as a set of ratios they may speak differently. Such interdependence among the ratios can be taken care of through multivariate analysis.

(Note: Students to write any four limitations)

(ii) Business Risk and Financial Risk

Business Risk: It is an unavoidable risk because of the environment in which the firm has to operate and the business risk is represented by the variability of earnings before interest and tax (EBIT). The variability in turn is influenced by revenues and expenses. Revenues and expenses are affected by demand of firm's products, variations in prices and proportion of fixed cost in total cost.

Financial Risk: It is the risk borne by a shareholder when a firm uses debt in addition to equity financing in its capital structure. Generally, a firm should neither be exposed to high degree of business risk and low degree of financial risk or vice-versa, so that shareholders do not bear a higher risk.

(iii) Differentiation between Factoring and Bills Discounting

The differences between Factoring and Bills discounting are:

(a) Factoring is called as "Invoice Factoring' whereas Bills discounting is known as Invoice discounting.

(b) In Factoring, the parties are known as the client, factor and debtor whereas in Bills discounting, they are known as drawer, drawee and payee.

(c) Factoring is a sort of management of book debts whereas bills discounting is a sort of borrowing from commercial banks.

(d) For factoring there is no specific Act, whereas in the case of bills discounting, the Negotiable Instruments Act is applicable.

(iv) Differentiation between Financial Management and Financial Accounting

Though financial management and financial accounting are closely related, still they differ in the treatment of funds and also with regards to decision - making.

Treatment of Funds: In accounting, the measurement of funds is based on the accrual principle. The accrual based accounting data do not reflect fully the financial conditions of the

organisation. An organisation which has earned profit (sales less expenses) may said to be profitable in the accounting sense but it may not be able to meet its current obligations due to shortage of liquidity as a result of say, uncollectible receivables. Whereas, the treatment of funds, in financial management is based on cash flows. The revenues are recognised only when cash is actually received (i.e. cash inflow) and expenses are recognised on actual payment (i.e. cash outflow). Thus, cash flow based returns help financial managers to avoid insolvency and achieve desired financial goals.

Decision-making: The chief focus of an accountant is to collect data and present the data while the financial manager's primary responsibility relates to financial planning, controlling and decision-making. Thus, in a way it can be stated that financial management begins where financial accounting ends.

(v) Computation of Cost of Retained Earnings (Kr)

|

Kr = k (1-Tp) (1-B) | |

|

Kr = 0.10 (1- 0.30) (1- 0.03) | |

|

= 0.10 (0.70) x (0.97) | |

|

= 0.0679 or 6.79% | |

|

Cost of Retained Earnings = 6.79% | |

|

Calculation of Fixed Assets and Proprietors Fund | |

|

Since Ratio of Fixed Assets to Proprietor's Fund |

= 0.75 |

|

Therefore, Fixed Assets |

= 0.75 Proprietor's Fund |

|

Net Working Capital |

= 0.25 Proprietor's Fund |

|

6,00,000 |

= 0.25 Proprietor's Fund |

|

Therefore, Proprietor's Fund |

= Rs.6,00,000 0.25 |

= Rs. 24,00,000

Proprietors Fund = Rs. 24,00,000

Since, Fixed Assets = 0.75 Proprietor's Fund

Therefore, Fixed Assets = 0.75 x 24,00,000

= Rs.18,00,000

|

Question 6 The Balance Sheets of a Company as on 31st March, 2008 and 2009 are given below: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Additional information:

During the year ended 31st March, 2009 the company:

(i) Sold a machine for Rs.1,20,000; the cost of machine was Rs. 2,40,000 and depreciation provided on it was Rs. 84,000.

(ii) Provided Rs. 4,20,000 as depreciation on fixed assets.

(iii) Sold some investment and profit credited to capital reserve.

(iv) Redeemed 30% of the debentures @ 105.

(v) Decided to write off fixed assets costing Rs. 60,000 on which depreciation amounting to Rs.

48,000 has been provided.

You are required to prepare Cash Flow Statement as per AS 3. (15 Marks)

Answer

Cash Flow Statement for the year ending 31st March, 2009

(A) Cash Flows from Operating Activities

Profit and Loss A/c (3,60,000 - 2,88,000)

Rs.

72,000

Adjustments:

Increase in General Reserve

1.44.000

4.20.000

4.08.000

36.000 14,400

1,72,800

48.000

12.000 60,480

40.000 8,000

48.000 (2,00,000)

(44,000)

Depreciation

Provision for Tax

Loss on Sale of Machine

Premium on Redemption

of

Debentures

Proposed Dividend Preliminary Expenses written off Fixed Assets written off Interest on Debentures*

13.15.680

13.87.680

Funds from Operations Increase in Sundry Creditors Increase in Bills Payable

Increase in Sundry Debtors Increase in Stock Cash before Tax Less: Tax paid

(1,96,000)

11,91,680

4,32,000

7,59,680

Cash flows from Operating Activities

(B) Cash Flows from Investing Activities

Purchase of Fixed Assets Sale of Investment Sale of Fixed Assets

(C) Cash Flows from Financing Activities

Issue of Share Capital 4,80,000

Redemption of Debentures (3,02,400)

Dividend Paid (1,44,000 - 19,200) (1,24,800)

Interest on Debentures (60,480) (7,680)

Net increase in Cash and Cash (4,000)

Equivalents

Cash and Cash Equivalents at the 4,000

beginning of the year

Cash and Cash Equivalents at the end of NIL

the year

* It is assumed that the 30 percent debentures have been redeemed at the beginning of the year.

Fixed Assets Account

|

Particulars |

Rs. |

Particulars |

Rs. | ||

|

To |

Balance b/d |

27,36,000 |

By |

Cash |

1,20,000 |

|

To |

Purchases (Balance) |

10,20,000 |

By |

Loss on Sales |

36,000 |

|

By |

Depreciation |

4,20,000 | |||

|

By |

Assets written off |

12,000 | |||

|

By |

Balance c/d |

31,68,000 | |||

|

37,56,000 |

37,56,000 |

Question 7

(a) From the following financial data of Company A and Company B: Prepare their Income Statements.

Variable Cost Fixed Cost Interest Expenses Financial Leverage Operating Leverage Income Tax Rate Sales

Company A Rs.

20.000 12,000

5: 1

30%

Company B Rs.

60% of sales

9,000

4 : 1 30% 1,05,000

(b) A hospital is considering to purchase a diagnostic machine costing Rs. 80,000. The projected life of the machine is 8 years and has an expected salvage value of Rs. 6,000 at the end of 8 years. The annual operating cost of the machine is Rs. 7,500. It is expected to generate revenues of Rs. 40,000 per year for eight years. Presently, the hospital is outsourcing the diagnostic work and is earning commission income of Rs.12,000 per annum; net of taxes.

Required:

Whether it would be profitable for the hospital to purchase the machine? Give your recommendation under:

(i) Net Present Value method

(ii) Profitability Index method.

PV factors at 10% are given below:

Answer

(a)

| ||||||||||||||||

|

(8 + 8 = 16 Marks) |

|

Income Statements of Company A and Company B | |||||||||||||||||||||||||||||||||

|

Working Notes: Company A

EBIT

(i) Financial Leverage =

EBIT

5 _

EBIT -12,000 5 (EBIT- 12,000) _ EBIT 4 EBIT _ 60,000 EBIT _ Rs.15,000

(ii) Contribution _ EBIT + Fixed Cost

_ 15,000 + 20,000 _ Rs. 35,000

(iii) Sales _ Contribution + Variable cost

_ 35,000 + 56,000 _ Rs. 91,000

Company B

(i) Contribution _ 40% of Sales (as Variable Cost is 60% of Sales) _ 40% of 1,05,000 _ Rs. 42,000

Contribution

(ii) Financial Leverage _ 4_

EBIT 42,000

EBIT

EBIT _ Rs.10,500

4

(iii) Fixed Cost _ Contribution - EBIT

_ 42,000- 10,500 _ Rs. 31,500

(b) Advise to the Hospital Management Determination of Cash inflows

Cash inflow after tax per annum 25,525

Less: Loss of Commission Income 12,000

Net Cash inflow after tax per annum 13,525 In 8th Year:

New Cash inflow after tax 13,525

Add: Salvage Value of Machine 6,000

Net Cash inflow in year 8 19,525

Calculation of Net Present Value (NPV)

|

Year |

CFAT |

PV Factor @10% |

|

1 to 7 |

13,525 |

4.867 |

|

8 |

19,525 |

0.467 |

|

Less: Cash Outflows |

Present Value of Cash inflows

65,826.18

9,118.18

74,944.36

80,000.00

NPV (5,055.64)

Sum of discounted cash inflows Present value of cash outflows

Profitability Index =

= =0.937

80,000

Advise: Since the net present value is negative and profitability index is also less than 1, therefore, the hospital should not purchase the diagnostic machine.

Note: Since the tax rate is not mentioned in the question, therefore, it is assumed to be 30 percent in the given solution.

Question 8

Answer any three of the following:

(i) Explain the two basic functions of Financial Management.

(ii) Explain the following terms:

(a) Ploughing back of profits

(b) Desirability factor.

(iii) What do you understand by Weighted Average Cost of Capital?

(iv) There are two firms P and Q which are identical except P does not use any debt in its capital structure while Q has Rs. 8,00,000, 9% debentures in its capital structure. Both the firms have earning before interest and tax of Rs. 2,60,000 p.a. and the capitalization rate is 10%.

Assuming the corporate tax of 30%, calculate the value of these firms according to MM Hypothesis. (3 *3 = 9 Marks)

Answer (i) Two Basic Functions of Financial Management

Procurement of Funds: Funds can be obtained from different sources having different characteristics in terms of risk, cost and control. The funds raised from the issue of equity shares are the best from the risk point of view since repayment is required only at the time of liquidation. However, it is also the most costly source of finance due to dividend expectations of shareholders. On the other hand, debentures are cheaper than equity shares due to their tax advantage. However, they are usually riskier than equity shares. There are thus risk, cost and control considerations which a finance manager must consider while procuring funds. The cost of funds should be at the minimum level for that a proper balancing of risk and control factors must be carried out.

Effective Utilization of Funds: The Finance Manager has to ensure that funds are not kept idle or there is no improper use of funds. The funds are to be invested in a manner such that they generate returns higher than the cost of capital to the firm. Besides this, decisions to invest in fixed assets are to be taken only after sound analysis using capital budgeting techniques. Similarly, adequate working capital should be maintained so as to avoid the risk of insolvency.

(ii) (a) Ploughing Back of Profits: Long term funds may also be provided by accumulating the

profits of the company and by ploughing them back into business. Such funds belong to the ordinary shareholders and increase the net worth of the company. A public limited company must plough back a reasonable amount of its profits each year keeping in view the legal requirements in this regard and its own expansion plans. Such funds also entail almost no risk. Further, control of present owners is also not diluted by retaining profits.

(b) Desirability Factor. In certain cases we have to compare a number of proposals each involving different amount of cash inflows. One of the methods of comparing such proposals is to work out, what is known as the Desirability Factor' or Profitability Index'. In general terms, a project is acceptable if the Profitability Index is greater than 1.

Mathematically,

. , Sum of DiscountedCashinflows

Desirability Factor =-

Initial Cash Outlay or Total Discounted Cash outflows

(iii) Weighted Average Cost of Capital

The composite or overall cost of capital of a firm is the weighted average of the costs of various sources of funds. Weights are taken in proportion of each source of funds in capital structure while making financial decisions. The weighted average cost of capital is calculated by calculating the cost of specific source of fund and multiplying the cost of each source by its proportion in capital structure. Thus, weighted average cost of capital is the weighted average after tax costs of the individual components of firm's capital structure. That is, the after tax cost of each debt and equity is calculated separately and added together to a single overall cost of capital.

(iv) Calculation of Value of Firms P and Q according to MM Hypothesis

Market Value of Firm P (Unlevered)

V = EBIT(1-t)

u_ Ke

= 2,60,000 (1-0.30)

= 10%

10%

Market Value of Firm Q (Levered)

Ve = Vu + DT

= Rs.18,20,000 + (8,00,000 x 0.30)

= Rs.18,20,000 + 2,40,000 = Rs. 20,60,000

60

|

Attachment: |

| Earning: Approval pending. |