Institute of Chartered Financial Analysts of India (ICFAI) University 2009 C.A Chartered Accountant Integrated Professional Competence (IPCC) - Business Law, Ethics & Communition Revision Test s (emb

Download the subsequent attachment:

PAPER - 2 : BUSINESS LAWS, ETHICS AND COMMUNICATION

QUESTIONS

The Indian Contract Act, 1872

1. (a) Ram and Rahim are close friends. Rahim treats Ram during his illness. Rahim does

not accept payment from Ram for the treatment and Ram promises Rahim's son, Abdul that he will pay him Rs.1000. Ram being in poor circumstances ,is unable to pay .Abdul sues Ram for the money .Can Abdul recover the money?

(b) A agrees to sell his swift car to B a month after the date of the contract. But just after the 20 days of the contract he sells the swift car to C. Thereupon B sues A for the breach of the contract. A contends that he could still perform the contract by repurchasing the swift car from C .Decide the suit.

2. (a) How it can be determined whether a person is an agent of another? When an agent

is personally liable to a third party ? Suppose B, an agent signs a negotiable instrument in his own name. Explain whether an agent incurs the personal liability to a third person.

(b) Mark the correct answer justifying with reason in the following:

(i) A contracts to indemnify B against the consequences of any proceedings which C may take against B in respect of a certain sum of money. This is a-

(a) contract of indemnity.

(b) contract of guarantee.

(c) quasi contract.

(d) illegal contract.

(ii) A, in consideration that B will employ C in collecting the rents of B's house .promises B to be responsible to an amount of RS. 1,000 for due collection and payment by C of those rents.This is termed as-

(a) Contract of indemnity.

(b) Specific guarantee

(c) Retrospective guarantee.

(d) Continuing guarantee

(iii) In bailment-

(a) both custody and possession must change but not the ownership.

(b) custody and possession must not change.

(c) ownership must change.

(d) both the custody and possession must not change but only the ownership.

(iv) A' owns a shop. B' manages the shop. A' as owner orders purchases. B' also as the agent orders purchases. Can he do so?

(a) yes

(b) no

(v) J employed a goldsmith for converting her old jewellery and making new one. Every evening she received the unfinished jewellery and put it in a box at the house of the goldsmith. She, however ,kept the key of the box with herself. One night the jewellery was stolen from the box. Is the goldsmith liable as the bailee?

(a) no

(b) yes

3. (a) State the conditions when a surety would be discharged?

(b) Plaintiff X' sued the Principal debtor Y' and the surety Z' for arrears of rent. On account of death of the principal debtor the debt is barred by limitation. State the liability of the Surety .

(c) Certain shares in a limited company were pledged by the debtor with a bank as a security for loan advanced by the bank to him. Subsequently, the company declared dividend on the shares and also issued bonus shares. The bank claimed that it was entitled to retain the amount of the dividend as also the bonus shares issued by the company. Discuss the claim of the bank.

The Negotiable Instruments Act,1881

4. (a) "Once a bearer instrument always a bearer instrument. Explain with reference to

the relevant provisions of the Negotiable Instrument Act, 1881.

(b) A drawer of a cheque after having issued the cheque, informs the drawee not to present the cheque as well as informs the bank to stop the payment. Does it constitute an offence under the Act ?

(c) What is the rule of compensation in case of dishonour of negotiable instruments?

5. (a) Whether the payee or the holder of a cheque can initiate prosecution for an offence

under the N.I. Act, for its dishonour for the second time if he had not initiated prosecution on the first occasion?

(b) State the validity of the following statements with appropriate reason:

(i) A bill drawn in favour of a minor is valid.

(ii) A bill drawn in Calcutta on a merchant in Mumbai but endorsed in Paris is a foreign bill.

(iii) Special indorsement should be made by an indorser by signing his name and also by writing the name of the indorsee.

(iv) Acceptance is required in case of promissory note.

(v) Negotiable Instruments Act ordinarily is not applicable to Hundis..

6. (a) Elucidate the term "Salary or Wage under the Payment of Bonus Act, 1965.

(b) Who among the following are entitled to bonus:

(i) An employee employed through contractors on building operation.

(ii) A retrenched employee.

(iii) A temporary workman.

(iv) An employee of a seasonal factory.

(v) An employee who is dismissed from service on the ground of misconduct.

(c) State the categories of employees who are precluded from the purview of the Payment of Bonus Act, 1965.

7. (a) A ,in an establishment was a temporary employee drawing a salary of Rs.5,000.He

was prevented by the employers from working in the establishment for two months during the financial year 2008-2009, pending certain inquiry against him. Since on the lack of concrete findings A' was back in the service. However, the employers refuse to pay bonus to A' as he has worked for ten months in the year. In the light of the provisions of the Payment of Bonus Act, 1965 examine the validity of the employer's refusal to pay bonus to A.

(b) Is there any time limit for bonus payment?

The Employees Provident Funds And Miscellaneous Provisions Act,1952

8. Explain the provisions of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 relating to:

(i) Transfer of accounts of an employee in case of his leaving the employment and taking up employment in another establishment.

(ii) Liability of a transferee employer in case of transfer of establishment by an employer.

9. (a) Who may determine the moneys due from employers under the provisions of

Employees' Provident Funds and Miscellaneous Provisions Act, 1952?

(b) Mark true or false with reason:

(i) The liability for employer to contribute under the Employees' Provident Fund etc Act, 1952 is 10% of the employees' emoluments.

(ii) Employer of any establishment to which any scheme applies may reduce directly or indirectly the wages of any employee or the benefits as old age pension, gratuity fund to which an employee is entitled.

(iii) Basic wages means all the emoluments, dearness allowance, bonus, house rent allowance, and any other similar allowance payable to the employee.

(iv) Generally the Employees Provident Funds and Miscellaneous Provisions Act,

1952 applies to entities employing more than 10 persons.

(v) The Central Government may apply the provisions of this Act even if it employs less than required number of persons.

The Payment of Gratuity Act,1972

10. (a) When, to whom and how gratuity shall be payable?

(b) Mark the statements correct/incorrect with appropriate reasons :

(i) Gratuity shall be paid to an employee after he has surrendered continuous service for not less than five years

(ii) For calculation of gratuity under the Payment of Gratuity Act, 1972 the actual number of days of employment is to be taken .

(iii) Gratuity can be attached in execution of decree or order of any court.

(iv) An employee resigning from service is not entitled to gratuity.

(v) Right to gratuity is a statutory right .

11. (a) An employee was terminated for disorderly conduct during the course of his

employment .To what extent gratuity shall be forfeited?

(b) What is the procedure for the recovery of the gratuity?

The Companies Act,1956

12. State whether a minor can become a member of a company under the Companies Act, 1956?

13. What do you understand by corporate veil' theory ?Examine the circumstances under which the Courts may lift the corporate veil.

14. Promoters of Ahuja & sons Co. Ltd signed an agreement during incorporation process of the company , for the purchase of certain raw material for the company and the payment to be made to the supplier after the incorporation of the company. The company was incorporated and the material was also consumed. Soon, the company became insolvent and the debt became due. As a result supplier sued the promoters of the company for the recovery of money.

Examine the position of the promoters under the following situations:

(i) When the company has already adopted the contract after incorporation?'

(ii) When the company makes a fresh contract with the suppliers in terms of preincorporation contract?

15. What do you understand by doctrines of constructive notice and indoor management? State the conditions under which the doctrine of indoor management is inapplicable.

16. What are preliminary contracts? State the rules in respect of preliminary contracts.

17. (a) What are the liabilities and duties of a member in a company?

(b) X purchased 100 equity shares of ABC Ltd. from Y. Though the amount of transaction was paid to the seller, the transferee name is not appearing in the list of members. Subsequently, the company declared dividend. Referring to the provisions of the Companies Act, 1956 state to whom the company will be paying the dividend.

18. The Articles of Associations of X Ltd. require the personal presence of six members to constitute quorum of General Meeting. The following persons were present at the time of commencement of an Extraordinary General Meeting to consider the appointment of Managing Director:

(i) Mr. G. the representative of Governor of Gujarat

(ii) Mr. A and Mr. B, shareholders of Preference Shares.

(iii) Mr. L. representing M Ltd., N Ltd. and X Ltd.

(iv) Mr. P, Mr. Q, Mr. R and Mr. S who were proxies of Shareholders.

Can it be said that quorum was present? Discuss.

19. P transfers his share to Q and applies to a company to register transfer of share by P to Q. The company refuses to register such transfer of shares and even not sends notice of refusal to P or Q within the prescribed period. What are the rights available to the aggrieved party against the company for such refusal?

ETHICS

Principles of Business Ethics and Workplace Ethics

20. (a) List the benefits of ethical business practices.

(b) What are the various factors that influence ethical behaviour of an employee? Corporate Governance and Corporate Social Responsibility

21. (a) What are the measures required for the corporate governance in a Business ?

(b) Define corporate social responsibility .Trace the key developments made in the CSR domain?

Ethics in Marketing and Consumer Protection, Environment & Ethics and Ethics in Accounting & Finance

22. (a) What is competition? What law has been enacted in order to prevent malpractices

having adverse effect on competition in market?

(b) Co-relate Business and Environmental Ethics?

(c) Discuss briefly "Ethical Conflict Resolution".

Interdepartmental Communication and Principles of Interpersonal Communication

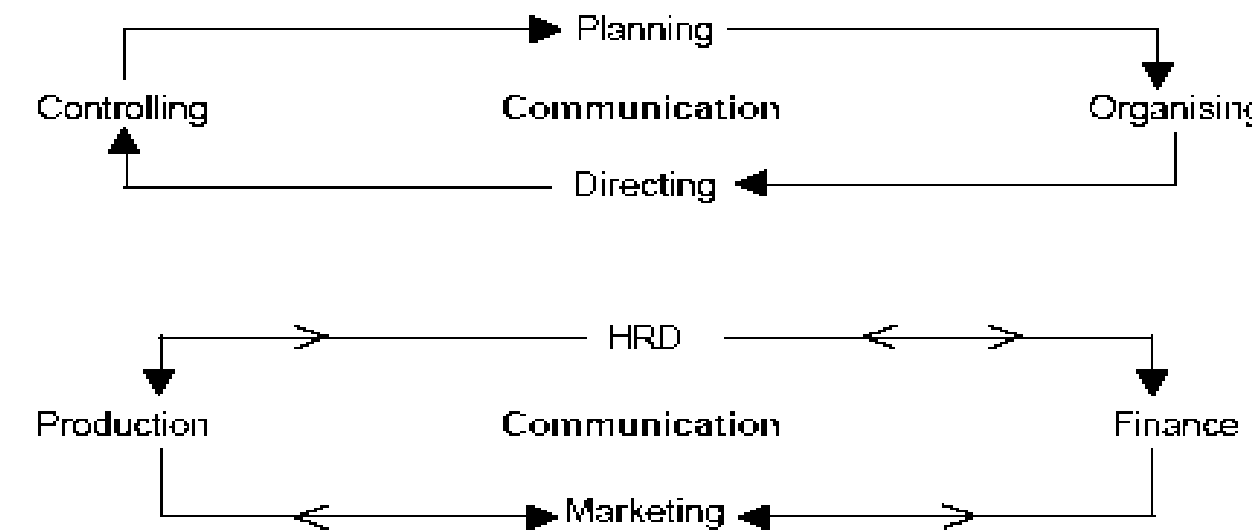

23. (a) Define the term Interdepartmental Communication.

(b) Describe the principles of Interpersonal Communication.

Characteristics of Group Personality, Ethical Communication and Press Release

24. fa) Elaborate characteristics of Group Personality.

(b) Write short notes on :

(i) Ethical communication

(ii) Press release Organizational Change and Affidavit

25. (a) Explain the term Corporate Culture'.

(b) What is an Affidavit? Supply its format.

SUGGESTED ANSWER/HINTS

1. (a) Problem on Consideration:

No, Abdul cannot recover the money from Ram. The arrangement between Abdul and Ram is not a contract in the absence of the consideration. In this case Abdul's father, Rahim voluntarily treats Ram during the illness. Apparently it is not a valid consideration because it is voluntary act whereas consideration to be valid must be given at the desire of the promisor given under section 2(d).Even it is not covered under the exception where the contract is valid without the consideration given under Section 25(2) which provides that "if it is promise to compensate a person who has already voluntarily done something for the promisor...Thus as per the exception the promise must be to compensate a person who has himself done something for the promisor and not to a person who has done nothing for the promisor. As Rahim's son, Abdul, to whom the promise was made, did nothing for Ram. So Ram's promise is not enforceable even under the exception.

(b) Anticipatory Breach of Contract:

As per the provision given under the Indian Contract Act, 1872 that where the promisor refuses to perform his obligation even before the specified time for performance and signifies his unwillingness, then there is an anticipatory breach of contract.

Thus according to above provision, in the given problem there is anticipatory breach of contract by conduct from A's side and therefore his contention will not be upheld.

B is entitled to elect to treat the contract as rescinded and sue A for the breach of contract immediately.

2. (a) Determining Agency & Agent:

The test for determining whether a person is or is not an agent is whether that person has the capacity to bind the principal and make him answerable to a third person by bringing him (the principal) into legal relations with a third person and thus establish a privity of contract between the party and the principal. If yes, he is agent, otherwise not. This relationship of agency may be created either by express agreement or by implication:

Under the following circumstances an agent is personally liable.

1. When he represents that he has authority to act on behalf of his principal, but who does not actually posses such authority or who has exceeded that authority and the alleged employer does not ratify his acts. Any loss sustained by a third party by the acts of such a person (agent) and who relies upon the representation is to be made good by such an agent.

2. Where a contract is entered into by a person apparently in the character of agent, but in reality on his own account, he is not entitled to require performance of it.

3. Where the contract expressly provides for the personal liability of the agent.

4. When the agent signs a negotiable instrument in his own name without making it clear that he is signing as an agent.

5. Where the agent acts for a principal who cannot be sued on account of his being a foreign Sovereign, Ambassador, etc.

6. Where the agent works for a foreign principal.

7. Where a Government Servant enters into a contract on behalf of the Union of India in disregard of Article 299 (1) of the Constitution of India. In such a case the suit against the agent can be instituted by the third party only and not by the principal (Chatturbhuj v. Moheshwar).

8. Where according to the usage of trade in certain kinds of business, agents are personally liable.

In case B signs a negotiable instrument without making it clear that he is signing it as an agent only, he may be held personally liable on the same. He would be personally liable as the maker of the note, even though he may be described in the body of the note as the agent. Here B is personally liable to third party.

(b) (i) This is a Contract of Indemnity as per the provision given under Section 124 of the Indian Contract Act, 1872.Accordingly, here A contracts to indemnify B from the loss to be caused against that of a proceeding, initiated by C against him.

(ii) It is a continuing guarantee as it extend to a series of transactions as per Section 129 of the Indian Contract Act, 1872.

(iii) As per provision given under Section 148 of the Indian Contract Act, 1872 bailment is the delivery of goods by one person to another for some purpose on a contract ,upon the condition that the goods shall be returned or otherwise disposed when the purpose is fulfilled. Here the word delivery' means giving up the custody or the possession of the goods but not the ownership.

(iv) Yes,B can order purchases. As per the provision given under Section 188 of the Indian Contract Act, 1872 an agent has an authority to carry on a business and has authority to do every lawful thing necessary for the purpose, usually done in the course of conducting such business.

(v) No, J keeps the keys with herself and therefore she did not hand over the possession and in bailment possession of goods must change.

Sections 133 to 139 of the Act lay down the provisions as to when a surety would be discharged. These are as follows:

(a) where there is any variance in the terms of the contract between the principal debtor and the creditor without surety's consent .

(b) The surety is discharged if the principal debtor is discharged

(i) by a contract or

(ii) any act or

(iii) any omission the result of which is the discharge of the principal debtor. However, there are certain exceptions to the above rules.

(b) Problem on the Indian Contract Act,1872:

In the given problem, if the debt is barred by the limitation on account of the death of the principal debtor, the surety is still liable for the payment of arrears of rent to the plaintiff X' [Krishto Kishore vs. Radha Romun i.l.r.12 Cal.330] The same view was confirmed by Privy Council in Mahant Singh vs U Bai A.I.R 1939 P.C 110 where it was held that omission of the creditor to sue within the period of limitation does not discharge the surety.

(c) Problem on the Indian Contract Act,1872:

The given problem is based on the provisions of the Sec.163 of the Indian Contract Act,1872.It provides that, in the absence of a contract to the contrary, the bailee is bound to deliver to the bailor, or to any other person in accordance with his direction, any increase or profit which may have accrued from the goods bailed. Since the pledge of goods that is shares as security is a form of bailment and the bank is not authorized to retain any increase or profit. Hence bank shall not be justified in its claim.

A bearer instrument is one, which can change hands by mere delivery of the instrument. The instrument may be a promissory note or a bill of exchange, or a cheque. It should be expressed to be so payable or on which the last endorsement is in blank. (Explanation 2 to Section 13 of the Negotiable Instrument Act, 1881).

Under Section 46 where an instrument is made payable to bearer, it is transferable merely by delivery, i.e. without any further endorsement thereon. But this character of the instrument can be subsequently altered. Section 49 provides that a holder of negotiable instrument endorsed in blank (i.e. bearer) may, without signing his own name, by writing above the endorser's signature, direct that the payment of the instrument be made to another person. Thus the character of the instrument is changed and the instrument cannot be negotiated by mere delivery.

But in the case of a Cheque, however, the law is a little different from the one stated above. According to the provisions of Section 85 (2) where a cheque is originally expressed to be payable to bearer, the drawee is discharged by payment in due course to the bearer thereof, despite any endorsement whether in blank or full appearing thereon not with standing that any such instrument purported to restrict or exclude further negotiation. In other words, the original character of the cheque is not altered so far as the paying bank is concerned, provided the payment is made in due course. Hence the proposition that once a bearer instrument always a bearer instrument.

(b) Problem on the Negotiable Instrument Act,1881:

The Supreme Court in Modi Cements Ltd. vs. Kuchil Kumar Nandi [1998] 2 CLJ 8 held that once a cheque is issued by the drawer, a presumption under Section 139 follows and merely because the drawer issues a notice thereafter to the drawee or to the bank for stoppage of payment, it will not preclude an action under Section 138. The object of Sections 138 to 142 of the Act is to promote the efficacy of the banking operations and to ensure credibility in transacting business through cheques. Section 138 is a penal provision in the sense that once a cheque is drawn on an account maintained by the drawer with his banker for payment of any amount of money to another person from out of that account for the discharge in whole or in part of any debt or other liability, is informed by the bank unpaid either because of insufficiency of amount to honour the cheques or the amount exceeding the arrangement made with the bank, such a person shall be deemed to have committed an offence

Under Section 17 of the Act, the compensation payable in case of dishonour of a promissory note, bill of exchange, or cheque, by any party liable to the holder or any endorse, shall be determined by the following rules :

(a) The holder is entitled to the amount due upon the instrument, together with the expenses incurred in presenting, noting and protesting it.

(b) When the person charged resides at a place different from that at which the instrument was payable, the holder is entitled to receive such sum at the current rate of exchange between the two places.

(c) When the person charged and such endorser reside at different places, the endorser is entitled to receive such sum at the current rate of exchange between the two places.

(d) An endorser, who has paid the amount due under the instrument, is entitled to the amount so paid with interest at 6% per annum from the date of payment until tender or realisation together with all expenses caused by the dishonour and non-payment.

(e) The party entitled to compensation may draw a bill upon the party liable to compensate him, payable at sight or on demand, for the amount due to him, together with all expenses properly incurred by him.

5. (a) Problem on Dishonour of cheque:

The following facts are required to be proved to successfully prosecute the drawer for an offence under Section 138:-

(i) that cheque was drawn for payment of an amount of money for discharge of a debt/liability and the cheque was dishonored;

(ii) that the cheque was presented within the prescribed period;

(iii) that the payee made demand for the payment of the money by giving a notice in writing to the drawer within the stipulated period;

(iv) that the drawer failed to make the payment within 30 days(as per Negotiable Instruments Amendments and Miscellaneous Provisions Act,2002)of the receipt of the notice.

However,Clause (b) of Section 142 gives a restrictive meaning in that it refers to only one fact which will give rise to the cause of action and that is failure to make the payment within 30 days from the the date of receipt of the offence.

Besides the language of sections 138-142 which clearly postulates only one cause of action,there are other formidable impediments which negates the concept of successive cause of action.The combined reading of the Sections 138 and 142 leave no room for the doubt that cause of action within the meaning of section 142(c) arises and can arise only once.

Thus the apparently conflicting provisions of the act, one enabling the payee to repeatedly present the cheque and the other giving him only one opportunity to file a complaint for its dishonour and that to within one month from the date of cause of action arises can be reconciled, the court held that the two provisions can be harmonized with the interpretation that on each presentation of the cheque and its dishonour, a fresh right and not cause of action accrues in his favour.

Therefore, the holder/payee of a cheque cannot initiate prosecution for an offence under Section138 for its dishonour for the second time, if he had not initiated such prosecution on the earlier cause of action.

(b) (i) Valid. Any bill drawn in favour of a minor is not void and can be sued upon by him, because he though incompetent to contract, may yet accept a benefit.

(ii) Invalid. As per section 11 of the Negotiable Instruments Act, 1881 any negotiable instrument drawn or made in India and made payable in or drawn upon any person resident in India shall be deemed to be an inland instrument.

(iii) Valid. As per section 15 of the Negotiable Instrument Act, 1881 the endorsement which includes in addition to the signature of the endorser the person to whom or to whose order the instrument is payable is specified is called as special endorsement.

(iv) Invalid as acceptance is required only in case of Bill of Exchange and not in the case of a promissory note and a cheque.

(v) Valid. The Negotiable Instrument,Act1881 ordinarily is not applicable to hundis but, the parties to the Hundis may agree to be governed by the Negotiable Instrument Act.

6. (a) Meaning of Salary or Wages:

According to Section 2(21) of the Payment of Bonus Act, 1965, the term salary or wage' means all remuneration other than remuneration in respect of overtime work, capable of being expressed in terms of money, which would, if the terms of employment, express or implied, were fulfilled, be payable to an employee in respect of his employment or of work done in such employment and includes dearness allowance; i.e. all cash payments by whatever name called, paid to an employee on account of a rise in the cost of living. But the term excludes:

(i) any other allowance which the employee is for the time being entitled to;

(ii) the value of any house accommodation or of supply of light, water, medical attendance or other amenities or of any service or of any concessional supply of foodgrains or other articles;

(iii) any travelling concession;

(iv) any bonus including incentive, production and attendance bonus;

(v) any contribution paid or payable by the employer to any pension fund or provident fund or for the benefit of the employee under any law for the time being in force;

(vi) any retrenchment compensation or any gratuity or other retirement benefit payable to the-employee or any ex-gratia payment made to him;

(vii) any commission payable to the employee.

Where an employee is given in lieu of the whole or part of the salary or wage payable to him, free food allowance or free food by his employer, such food allowance or the value of such food shall be deemed to form part of the salary or wage of such employee.

(b) (i) An employee employed through contractors on building operation is not

entitled to bonus. (Section 32).

(ii) A retrenched employee is eligible to get bonus provided he has worked for minimum qualifying period. [East Asiatic Co. (P.) Ltd. vs. Industrial Tribunal [1961] 1 LLJ 720].

(iii) A temporary workman is entitled to bonus on the basis of total number of days worked by him.

(iv) An employee of a seasonal factory is entitled to proportionate bonus and not the minimum bonus as prescribed under Section 10 of the Act.

(v) An employee who is dismissed from service on the ground of misconduct as mentioned in Section 9, is disqualified for any bonus and not merely for bonus of the accounting year in which he is dismissed (Pandian Roadways Corporation Ltd. vs. Presiding Officer [1996] 2 CLR 1175 (Mad.).

(c) Categories of employees not covered under the Payment of Bonus Act, 1965:

The Payment of Bonus Act, 1965 does not cover under its purview the following categories of employees (Section 32):

(i) Employees employed by the Life Insurance Corporation of India.

(ii) Seamen as defined under Section 3(42) of the Merchant Shipping Act, 1958.

(iii) Employees registered or listed under any scheme made under the Dock Workers (Regulation of Employment) Act, 1948 and employed by the registered or listed employers.

(iv) Employees employed by an establishment engaged in any industry carried on by or under the authority of any department of the Central Government or a State Government or a local authority.

(v) Employees employed by :

(a) the Indian Red Cross Society or any other institution of a like nature (including its branches),

(b) Universities and other educational institutions;

Institutions including hospitals, chambers of commerce and social welfare institutions established not for purposes of profit.

(vi) Employees employed through contractors on building-operations.

(i) Employees employed by Reserve Bank of India.

(a) The Industrial Finance Corporation of India;

(b) Any financial corporation established under section 3 or any joint financial corporation established under section 3A of the State Financial Corporation Act 1951;

(c) The Deposit insurance Corporation;

(d) The Agricultural Refinance Corporation;

(e) The Unit Trust of India;

(f) The Industrial Development Bank of India;

(g) Any other Financial Institution (other than a banking company) being an establishment in Public Sector, which the Central Government may be notification in the Official Gazette, specify; while so specifying the Central Government shall have regard to its capital structure, its objectives and the nature and extent of financial assistance or any concessions given to it by the Government and any other relevant factor.

(h) Employees employed by inland water transport establishment operating on routes passing through any other country.

Besides the above, if the appropriate government is of the opinion that it will be in the public interest, having regard to the financial position and other relevant circumstances of any establishment or class of establishment, it may, by notification in the Official Gazette, exempt for such periods as may be specified therein and subject to such conditions as it may think fit to impose, such establishments from all or any of the provisions of this Act.

7. (a) Entitlement for bonus under the Payment of Bonus Act, 1965:

Every employee of an establishment covered under the Act is entitled to bonus from his employer in an accounting year provided he has worked in that establishment for not less than 30 working days in the year on a salary less than Rs. 3,500 per month. [Section 2(13) read with Section 8] (This ceiling of Rs. 3,500 has been now revised to Rs. 10,000, with effect from Nov 2007).

If an employee is prevented from working and subsequently reinstated in service, employee's statutory liability for bonus cannot be said to have been lost and the employee concerned shall be entitled to the bonus. (ONGC v. Sham Kumar Sahegal).

Thus based on the above ruling and the provisions of the Act as contained in Section 8, the refusal by the employers to pay bonus to X is not valid and he (X) is entitled to get bonus in the given case for the reasons given above in the provisions,

i.e. he has worked for more than 30 days in a year, drawing salary of less than Rs.

10,000 and not disqualified for any other reason.

The employer is bound to pay his employee bonus within one month from the date on which the award becomes enforceable or the settlement comes into operation, if a dispute regarding payment of bonus is pending before any authority under Section 22. In other cases, however, the payment of the bonus is to be made within a period of 8 months from closing of the accounting year. But this period of 8 months may be extended up to a maximum of 2 years by the appropriate Government or by any authority specified by the appropriate Government. This extension is to be granted on the application of the employer and only for sufficient reasons.

8. Transfer of accounts of an employee and liability of transferee employer under employees Provident Funds and Misc. Provisions Act, 1952:

Transfer of Accounts: (Section 17-A)

Section I7A of the Act provides for the transfer of accounts of an employee in case if he is leaving the employment and taking up employment in another establishment and to deal with the case of an establishment to which the Act applies and also to which it does not apply. The option to get the amount transferred is that of the employee.

Where an employee of an establishment to which the Act applies leaves his employment and obtains re-employment in another establishment to which the Act does not apply, the amount of accumulations to the credit of such employee in the Fund or, as the case may be, in the provident fund of the establishment left by him shall be transferred to the credit of his account in the provident fund of the establishment in which he is reemployed. if the employee so desires and the rules in relation to that provident fund permit such transfer. This transfer has to be made with in such time as may be specified by the Central Government in this behalf.

Conversely, when an employee of an establishment to which this Act does not apply leaves his employment and obtains re-employment in another establishment to which this Act applies, the amount of accumulations to the credit of such employee in the provident fund of the establishment left by him, if the employee so desires that the rules in relation to such provident fund permit, may be transferred to the credit of his account in the fund or as the case may be, in the provident fund of the establishment in which he is re-employed.

Liability of a transferee employer in case of transfer of establishment by the employer (Section 17-B).

Where an employer in relation to an establishment, transfers that establishment in whole or in part by sale, gift, lease or licence or in any other manner whatsoever, the employer and the person to whom the establishment is so transferred shall Jointly or severally be liable to pay the contribution and other sums due from the employer under any provisions of the Act of the Scheme or the Pension Scheme, as the case may be, in respect of the period up to the date of such transfer. It is provided that the liability of the transferee shall be limited to the value of the assets obtained by him by such transfer.

Section 17-B deals with the liability of transferor and transferee in regard to the money due under-

(a) the Act: or

(b) the Scheme;

(c) Pension Scheme.

in the case of transfer of the establishment brought in by sale, gift, lease, or any other manner whatsoever, the liability of the transferor and the transferee is joint and several, but is limited with respect to the period upto the date of the transferor. Also the liability of the transferee is further limited to the assets obtained by him from the transfer of the establishment.

9. (a) Determination of moneys due from employer (Section 7A, E.P.F. & M.P Act, 1952):

Authorities empowered to determine the amount due from an employer under the provisions of the Act and the scheme include Central P.F. Commissioner, Deputy P.F. Commissioner, Assistant P.F. Commissioner & Regional P.F. Commissioner.

They involves decisions on:

(i) amount due as contribution

(ii) date from which same is due

(iii) administration charges

(iv) amount to be transferred under Section 15 or 17 of Act.

(v) any other charges payable by employer,

The authorities may conduct such inquiries as necessary and have powers such as are vested in Court.

Employer must be given a reasonable opportunity of representing his case.

Where any party fails to appear etc., the officer may decide on basis of evidence and documents put before him.

An ex parte order against employer may be set aside on application within 3 months of receiving order by him by showing sufficient cause. A fresh date shall be given for proceeding with inquiry.

As the above "proceedings are of quasi-judicial in nature and vitally affect the rights of parties, the principles of natural justice must be strictly followed in deciding the dispute.

(b) (i) True. As per Section 6 of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952,the contribution paid to the fund by the employer shall be 10% of the employees emoluments.

(ii) False. As per Section 12 ,no employer in relation to any establishment to which scheme applies shall by reason only of his liability for the payment of any contribution to the funds or any charge under this act or the scheme, reduce directly or indirectly the wages of any employee or the benefits in the nature of oldage pension, gratuity fund to which the employee is entitled.

(iii) False. As per provision given under Section 2(b) of the Employees' Provident Funds and Miscellaneous Provisions Act,1952,basic wages means all emoluments which are earned by an employer while on duty or on leave or on holidays with wages excluding the cash value, D.A, HRA, Bonus, overtime allowance ,any present etc.

(iv) False. As per Section 16 of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952,This Act is generally applied to the entities employing 20 or more persons.

(v) True. As per section 16 of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, the Central Government may, after giving not less than 2 months' notice of its intension to do so ,apply the provisions of this Act to any establishment with less than 20 persons in the employment.

10. (a) Payability of Gratuity [Section 4(1)]

Gratuity shall be payable to an employee' on the termination of his employment after he has rendered continuous service for not less than five years-

On his superannuation, or

On his retirement or resignation, or

On his death or disablement due to accident or disease

The condition of the completion of five years continuous service is not essential in case of the termination of the employment of any employee due to death or disablement. Generally, it is payable to the employee himself. However ,in case of death of the employee it shall be paid to his Nominee.

In the establishments other than seasonal establishments, the employer shall pay the gratuity to an employee at the rate of 15 days wages leased on the rate of wages last drawn by the employee concerned for every completed year of service or part therof in excess of 6 months.

In case of piece rated employee, daily wages, shall be computed on the average of the total wages received by him for a period of 3 months immediately preceding the termination of his employment.

In seasonal establishment employee may be categorized under two groups-

Those who work throughout the year &

Who work only in the season.

The former are entitled to get the gratuity at the rate of 15 days wages for every completed year of service or part thereof in excess of six months. The later are, however, entitled to receive gratuity at the rate of seven days for each seasons.

(b) (i) The given statement is correct as per Section 4(1) of the Payment of Gratuity Act, 1972. Therefore Gratuity shall be payable to an employee' after he has rendered continuous services for not less than five years on his superannuation, retirement or resignation, or on the death or disablement.

(ii) The given statement is incorrect. As per the provision under the Payment of Gratuity Act, 1972, for calculation of gratuity the number of days in a month is to be taken as 26 days.

(iii) The statement is incorrect as per the provision given under Section 13 of the Payment of Gratuity Act, 1972. Gratuity cannot be attached in execution of any decree or order of any civil, revenue or criminal court.

(iv) The given statement is incorrect. As per the provision given under the Payment of Gratuity Act, 1972 ,an employee resigning or leaving the establishment is entitled to gratuity which is paid by the employer to his employee for his past services.

(v) The statement is correct making gratuity a statutory right of the employees as per the provision given under the Payment of Gratuity Act, 1972.

11. (a) Forfeiture of gratuity: Section 4(6)]

If the services of an employee have been terminated for any act, willful omission,or negligence causing any damage or loss to, or destruction of, property belonging to the employer the gratuity shall be forfeited to the extent of the damages or loss so caused.

If the services of such an employee have been terminated for his disorderly conduct or any other act of violence on his part, or if the services of such employees have been terminated for any act which constitutes offence involving moral turpitude, provided that such offence is committed by him in the course of his employment ,the gratuity payable to the employee may be wholly or partially forfeited.

If the gratuity payable under the Act is not paid by the employer within the prescribed time, to the person entitled thereto. The controlling authority shall issue a certificate for the amount to the collector to recover the same alongwith the compound interest at such rate as prescribed by the Central Government from the date of expiry of the prescribed time as land revenue arrears to enable the person entitled to get the amount after receiving the application from the aggrieved person. [Section. 8]

Before issuing the certificate for such recovery the controlling authority shall give the employer a reasonable opportunity of showing cause against the issue of such certificate.

The amount of interest payable under this Section shall not exceed the amount of gratuity payable under this Act in no case [Section 8].

12. Minor as a member of a company:

The Company Law Board has laid down in Nandita Jain v. Bennet Coleman & Co. Ltd. that a minor can become a member provided four conditions are fulfilled:

(a) Company must be a Company Limited by shares.

(b) Shares are fully paid up.

(c) Application for transfer is made on behalf of minor by lawful guardian.

(d) The transfer is manifestly for the benefit of the minor.

This was also confirmed in S.L. Bagree v. Britannia Industries.

In also Diwan Singh v. Minerva Films Ltd. [(3958) 28 Comp. Cases 191 (Punj.), (1959) 29 Comp. Cases 263 (Punj.)], the Punjab High Court held that there is no legal bar to minor becoming a member of a company by acquiring shares (by way of transfer) provided the shares are fully paid and no further obligation or liability is attached to them. Minor can become member by transfer or transmission, but a company may not allow a minor to be a member by allotment.

A company is a legal person distinct from its members (Salomon v. Salomon & Co.). It has its own corporate personality. This principle may be referred to as the veil of incorporation. The Courts in general consider themselves bound by this principle. The effect of this principle is that there is a fictional veil between the company and its members. That is, the company has a corporate personality which is distinct from its members.

The human ingenuity, however, started using this veil of corporate personality blatantly as a cloak for fraud or improper conduct.Thus, it became necessary for the Courts to break through or lift the corporate veil or crack the shell of corporate personality or disregard the corporate personality of the company. Thus while by fiction of law a corporation is a distinct entity, yet, in reality it is an association of persons who are in fact the beneficial owners of all the corporate property (Gallaghar v. Germania Brewing Co.).

The circumstances or the cases in which the Courts have disregarded the corporate personality of the company are:

1. Protection of revenue: The Courts may ignore the corporate entity of a company where it is used for tax evasion. (Juggilal v. Commissioner of Income-tax).

2. Prevention of fraud or improper conduct: The legal personality of a company may also be disregarded in the interest of Justice where the machinery of incorporation has been used for some fraudulent purpose like defrauding creditors or defeating or circumventing law. Thus where a company was incorporated as a device to conceal the identity of the perpetrator of the fraud, the Court disregarded the corporate personality. (Jones v. Lipman).

3. Determination of character of a company whether it is enemy company: A company may assume an enemy character when persons in de facto control of its affairs are residents in an enemy country. In such a case, the court may examine the character of persons in real control of the company and declare the company to be an enemy company. (Daimler Co. Ltd. V. Continental Tyre &. Rubber Co. Ltd).

4. Where the company is a sham: The Courts also lift the veil or disregard the corporate personality of a company where a company is a mere cloak or sham [hoax]. (Gilford Motor Co. Ltd. V. Horne).

5. Company avoiding legal obligations: Where the use of an incorporated company is being made to avoid legal obligations, the Court may disregard the legal personality of the company and proceed on the assumption as if no company existed.

6. Company acting as agent or trustee of the shareholders: Where the Company is acting as agent for its shareholders, the shareholders will be liable for the acts of the company. (F.G. Films Ltd. In re).

7. Avoidance of welfare legislation: Where the Courts find that there is avoidance of welfare legislation, it will be free to lift the corporate veil. [Workmen of Associated Rubber Industry Ltd. V. Associated Rubber Industry Ltd.].

8. Protecting Public Policy: The Courts invariably lift the corporate veil or disregard the corporate personality of a company to protect the public policy and prevent transactions contrary to public policy, (Connors v. Connors Ltd.).

The promoters remain personally liable on a contract made on behalf of a company which is not yet in existence. Such a contract is deemed to have been entered into personally by the promoters and they are liable to pay damages for failure to perform the promises made in the company's name (Scot v. Lord Ebury), even though the contract expressly provided that only the company shall be answerable for performance.

In Kelner v. Baxter also it was held that the persons signing the contracts viz. Promoters were personally liable for the contract.

Further, a company cannot ratify a contract entered into by the promoters on its behalf before its incorporation. Therefore, it cannot by adoption or ratification obtain the benefit of the contract purported to have been made on its behalf before it came into existence as ratification by the company when formed is legally impossible. The doctrine of ratification applies only if an agent contracts for a principal who is in existence and who is competent to contract at the time of contract by the agent.

The company can, if it desires, enter into a new contract, after its incorporation with the other party. The contract may be on the same basis and terms as given in the preincorporation contract made by the promoters. The adoption of the pre-incorporation contract by the company will not create a contract between the company and the other parties even though the option of the contract is made as one of the objects of the company in its Memorandum of Association. It is, therefore, safer for the promoters acting on behalf of the company about to be formed to provide in the contract that: (a) if the company makes a fresh contract in terms of the pre-incorporation contract, the liability of the promoters shall come to an end; and (b) if the company does not make a fresh contract within a limited time, either of the parties may rescind the contract.

Thus applying the above principles, the answers to the questions as asked in the paper can be answered as under:

(i) the promoters in the first case will be liable to the suppliers of furniture. There was no fresh contract entered into with the suppliers by the company. Therefore, promoters continue to be held liable in this case for the reasons given above.

(ii) in the second case obviously the liability of promoters comes to an end provided the fresh contract was entered into on the same terms as that of pre-incorporation contract.

15. Doctrines of constructive notice and indoor management: In consequences of the registration of the memorandum and articles of association of the company with the Registrar of Companies, a person dealing with the company is deemed to have constructive notice of their contents. This is because these documents are construed as "public document under Section 610 of the Companies Act, 1956. Accordingly if a person deals with a company in a manner incompatible with the provisions of the aforesaid documents or enters into transaction, which is ultra vires, these documents, he must do so at his peril. However, the doctrine of constructive notice is not a positive one but a negative one like that of estoppel of which it forms parts. It operates only against the person who has been dealing with the company but not against the company itself; consequently he is prevented form alleging that he did not know that the constitution of the company rendered a particular act or a particular delegation of authority ultra vires. Thus, the doctrine is a "cloud for the strangers.

One limitation to the doctrine of constructive notice of the memorandum and articles of a company is the doctrine of indoor management. According to the doctrine of indoor management, the outsider, dealing with the company are entitled to assume that as far as the internal proceedings of the company are concerned, everything has been regularly done. They are bound to lend the registered documents and to see that the proposed dealing is not inconsistent therewith, but they are not bound to do more, they need not inquire into the regularity of the internal proceedings as required by the memorandum and Articles. This limitation of the doctrine of constructive notice is known as the Doctrine of Indoor Management', popularly known as rule in Royal British Bank v. Turquand. Thus the doctrine of indoor management aims to protect outsiders against the company.

The following are the circumstances in which doctrines of indoor management is inapplicable:

1. Knowledge of irregularity: Where a person dealing with a company has actual or constructive notice of the irregularity as regards internal management, he cannot claim the benefit under the rule of indoor management. (T.R. PRATT (Bombay) Ltd. v. E.D. Sassoon & Co. Ltd.).

2. Negligence: Where a person dealing with a company could discover the irregularity if he had made proper inquiries, he cannot claim the benefit of the rule of indoor management. The protection of the rule is also not available where the circumstances surrounding the contract are so suspicious as to invite inquiry, and the outsider dealing with the company does not make proper inquiry (Anand Bihari Lel v. Dinshaw & Co.) Also the case of Under Wood v. Bank of Liver Pool.

3. Act void ab initio and forgery: Where the acts done in the name of a company are void ab initio, the doctrine of indoor management does not apply. The doctrine applies only to irregularities that otherwise might affect a genuine transaction. It does not apply to a forgery. A Company can never he held liable for forgeries committed by its officers (Ruben v. Great Fingall Consolidated Co.).

4. Acts outside the scope of apparent authority: If an officer of a company enters into a contract with a third party and if the act of the officer is beyond the scope of his authority, the company is not bound. (Kreditbank Cassel v. Schenkers Ltd.).

5. A person having no knowledge of Articles cannot seek protection under Indoor Management.

16. Preliminary or pre-incorporation contracts: Pre-incorporation contracts are those contracts, which are entered into, by agents or trustees on behalf of a prospective company before it has come into existence. Since a company comes in to existence from the date of its incorporation, it follows that any act purporting to be performed by it prior to that date is of no effect so far as the company is concerned. It will very likely be the intention of the promoters or persons concerned in the company that the company should, on its formation acquire some property or takeover the existing business, and for this purpose, a preliminary contract for the acquisition may be entered into before the company is formed. But as the company is non-existent before incorporation it cannot be bound, by any purported ratification [Kelner vs. Baxter (1862) L.R. 2 C.P. 174].

The rules in respect of preliminary contracts may be summarised as follows:

(a) The vendor cannot sue, or be sued by the company thereof, after its incorporation;

(b) Person who acts for the intended company remains personally liable to the vendor even if the company purports to ratify the agreement, unless the agreement provides that :

(i) his liability shall cease if the company adopts the agreement; and

(ii) either party may rescind the agreement, if the company does not adopt it within a specified time;

(c) After incorporation, the company may adopt the preliminary agreement. But this must be by novation which may be implied from the circumstances. But in some cases, the memorandum directs the directors to execute such contracts. The company can enforce a pre-incorporation contract if it is warranted by the terms of incorporation and for purposes of company.

A pre-incorporation contact can be enforced against the company if it is warranted by the terms of incorporation and it is adopted by the company. [Sections 15 and 16 of the Specific Relief Act, 1963]. In such a case, the directors have no discretion in the matter.

17. (a) Liabilities and duties of a member[Section 45]

(i) To take shares, when they are allotted in due time and in compliance with the provisions of the Act, unless the refusal to accept the shares has been sent on the ground of non-compliance with the provisions of the Act as regards the issue of the prospectus or as regards allotment.

(ii) To pay for the shares allotted to him when the allotment is made and when calls have been made validly and in conformity with the provisions of the articles.

(iii) To abide by the doing of the majority of members unless the majority acts vindictively, oppressively, mala fide or fraudulently.

(iv) to contribute to the assets of the company in the case of winding up when the shares held are partly paid-up.

(v) Members are severally liable for debts of the company contracted, where its business is carried on beyond the expiry of six months from the date at which its membership is redeemed below the legal minimum (i.e., seven members in the case of public company and two members in the case of a private company). However, such members are not liable for debts contracted before the expiry of six months. No liability will accrue to those members who are not cognisant of the fact that the business of the company is being carried on with members fewer than the legal minimum .

(b) According to Section 206 of the Companies Act, 1956 dividend shall be paid only to the registered holder of shares or to his order or to his bankers or to the bearer of a share warrant. Where shares have been sold but not yet registered, the dividend shall be paid to the transferee only in case the transferor gives a mandate in writing

to that effect. Otherwise, the dividend in respect of such shares shall be transferred to the unpaid dividend account'.

18. Problem on Quorum:

Quorum means the minimum number of members that must be personally present in order to constitute a meeting and transact business thereat. Thus, quorum represents the number of members on whose presence the meeting of a company can commence its deliberations. According to Section 174, of the Companies Act, 1956, unless the Articles provide for larger number, five members, personally present in the case of a public company and two in the case of any other company form the quorum for a general meeting. In this case, the Articles provide for six.

The word personally present' excludes proxies. However, the representative of a body corporate appointed under Section 187 or the representative of the President or a Governor of State under Section 187A is a member personally present' for purpose of counting a quorum. In case two or more corporate bodies who are members of a company are represented by a single individual, each of the bodies corporate will be treated as personally present by the individual representing it. If, for instance, he represents three corporate bodies, his presence will be counted as three members being present in person for purposes of quorum.

The quorum of members, personally present means the presence of the members who are called to vote in the meeting. Preference shareholders can vote only in relation to the matters affecting the rights of preference shares. In the extra ordinary general meeting in question, only the appointment of the managing director has to be considered. It is not a matter affecting the right of preference shares and the preference shareholders are not entitled to vote and hence, they cannot be considered as "members personally present for the purpose of quorum.

Thus, the number of persons being personally present would be as follows:

Present personally Number

Mr. G 1

Mr. A and Mr. B Nil

Mr. L 3

Proxies Nil

Total 4

It can therefore be said that quorum was not present.

19. Refusal to register transfer and appeal against refusal:

The problem as asked in the question is based upon Section 111 of the Companies Act dealing with the refusal to register transfer and appeal against refusal.

On refusal to register a transfer or transmission by operation of law, of the right to any shares in, or debentures thereof, the company has to send notice of refusal giving reasons to the transferee or the transferor or to the person giving intimation of such transmission, or on delivery of transfer deed to the company, as the case may be within a period of 2 months from the date of the intimation or delivery of the transfer deed to the company. In the given case the company has failed to give such notice of refusal to the aggrieved parties within the stipulated time of 2 months. Failure to give notice of refusal gives a right/remedies to the aggrieved parties.

Rights/remedies to aggrieved parties:

The aggrieved parties may apply to the Company Law Board (Tribunal) under subsection (2) or (4) of Section 111 against refusal or for rectification of the register of members, if his name is entered in the register without sufficient cause, or for omission of his name from the register or default in making an entry of his name in the register. The time of filing such appeal is 4 months from the date of lodgement of transfer application. There is no limitation period provided for making an application for rectification of register of members, under subsection (4). The company is also punishable under sub-section

(12) with a fine upto Rs.500 per day.

20. (a) Benefits of business ethics: There are many benefits of paying attention to

business ethics :

1. Improved society

A few decades ago, children and workers were ruthlessly exploited. Trusts controlled some markets to the extent that prices were fixed and small businesses stifled. Influence was applied through intimidation and harassment. Then society reacted and demanded that businesses place high value on ethics, fairness and equal rights resulting in framing of anti-trust laws, establishment of Government agencies and recognition of labour unions

2. Easier change management

Attention to business ethics is critical during times of fundamental change -times like those faced presently by businesses, whether non profit or for-profit. During times of change, there is often no clear moral compass to guide leaders through complex conflicts about what is right or wrong. Continuing attention to ethics in the workplace sensitizes leaders and staff for maintaining consistency in their actions.

3. Strong teamwork and greater productivity

Ongoing attention and dialogue regarding values in the workplace builds openness, integrity and community, all critical ingredients of strong teams in the workplace. Employees feel a strong alignment between their values and those of the organization resulting in strong motivation and better performance.

4. Enhanced employee growth.

Attention to ethics in the workplace helps employees face the reality, both good and bad in the organization and gain the confidence of dealing with complex work situations.

5. Ethics programs help guarantee that personnel policies are legal.

A major objective of personnel policies is to ensure ethical treatment of employees , For example, in matters of hiring, evaluating, disciplining, firing, etc., an employer can be sued for breach of contract for failure to comply with any promise it made, so the gap between stated corporate culture and actual practice has significant legal, as well as ethical implications. Attention to ethics ensures highly ethical policies and procedures in the workplace. Ethics management programs are also useful in managing diversity. Diversity programs require recognizing and applying diverse values and perspectives which are the basis of a sound ethics management program.Most organisations feel that it is far better to incur the cost of mechanisms to ensure ethical practices than to incur costs of litigation later.

6. Ethics programs help to avoid criminal acts "of omission and can lower fines.

Ethics programs help to detect ethical issues and violations early, so that they can be reported or addressed.

7. Ethics programs help to manage values associated with quality management, strategic planning and diversity management .

Ethics programs help identifying preferred values and ensuring that organizational behaviors are aligned with those values. This includes recording the values, developing policies and procedures to align behaviours with preferred values, and then training all personnel about the policies and procedures. This overall effort is very useful for several other programs in the workplace that require behaviors to be aligned with values, including quality management, strategic planning and diversity management. For example, Total Quality Management initiatives include high priority on certain operating values, e.g., trust among stakeholders, performance, reliability, measurement, and feedback.

8. Ethics helps to promote a strong public image

An organization that pays attention to its ethics can portray a strong and positive image to the public. People see such organizations as valuing people more than profit and striving to operate with the integrity and honour.

Thus managing ethical values in businesses besides optimizing profit generation in the long term, legitimizes managerial actions, strengthens the coherence and balance of the organization's culture, improves trust in relationships between individuals and groups, supports greater consistency in standards and qualities of products, and cultivates greater sensitivity to the

impact of the enterprise's values and messages. Finally and most essentially, proper attention to business ethics is the right thing to do.

(b) Factors influencing ethical behaviour at work

Ethical decisions in an organization are influenced by three key factors: individual moral standards, the influence of managers and co-workers, and the opportunity to engage in misconduct. While one may have great control over personal ethics outside the workplace, co-workers and management through authority for example, exerts significant control on ones choices at work. In fact, the activities and examples set by co-workers, along with rules and policies established by the firm, are critical in gaining consistent ethical compliance in an organization. If a company fails to provide good examples and direction for appropriate conduct; confusion and conflict will develop and result in the opportunity for unethical behaviour. For example if the boss or co-workers leave work early, one may be tempted to do so as well. If one sees co-workers making personal long-distance phone calls at work and charging them to the company, then one may be more likely to do so also. In addition, having sound personal values contributes to an ethical workplace.

| ||||||||||||||||||||||||||||

|

21. (a) Corporate Governance measures |

In general, corporate governance measures include appointing non-executive directors, placing constraints on management power and ownership concentration, as well as ensuring proper disclosure of financial information and executive compensation. Many companies have established ethics and /or social responsibility committees on their Boards to review strategic plans, assess progress and offer guidance on social responsibilities of their business. In addition to having committees and boards, some companies have adopted guidelines governing their own policies and practices around such issues like board diversity, independence, and compensation.

Indian Companies are required to comply with Clause 49 of the listing agreement primarily focusing on following areas:

Board composition and procedure

Audit Committee responsibilities

Subsidiary companies

Risk management

CEO/CFO certification of financial statements and internal controls

Legal compliance

Other disclosures

(b) Definition of Corporate Social Responsibility:

"Corporate Social Responsibility is the continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as of the local community and society at large".

"Corporate Social Responsibility is achieving commercial success in ways that honour ethical values and respect people, communities, and the natural environment.

Key developments

Several factors have converged over the last decade to shape the direction of the CSR domain:

Increased Stakeholder Activism: Corporate accounting scandals have focused attention more than ever on companies' commitment to ethical and socially responsible behaviour. The public and various stakeholders are increasingly seeking assistance of the private sector to help with myriad complex and pressing social and economic issues. There is a growing ability and sophistication of activist groups to target corporations they perceive as not being socially responsible, through actions such as public demonstrations, public exposes, boycotts, shareholders' resolutions, and even "denial of service attacks on company websites. Companies are therefore focusing on meaningfully engaging with their various stakeholders. Companies and stakeholders have, in many cases, progressed beyond "dialogue for dialogue's sake, and are looking to rationalize the process.

Proliferation of Codes, Standards, Indicators and Guidelines: The recent accounting scandals, such as, Enron, Worldcome, Parmalat, AIR, LLP and Author Andersen have created another surge of reforms and new voluntary CSR standards and performance measurement tools continue to proliferate.

Accountability Throughout the Value Chain: Over the past several years, the CSR agenda has been characterized by the expansion of boundaries of corporate accountability. Stakeholders increasingly hold companies accountable for the practices of their business partners throughout the entire value chain with special focus on suppliers, environmental, labour, and human rights practices.

Transparency and Reporting: Companies are facing increased demands for transparency and growing expectations that they measure, report, and continuously improve their social, environmental and economic performance. Many companies are also instituting various types of audit and verification as further means of increasing the credibility of their transparency and reporting efforts. Increasingly,

demands for greater transparency also encompass public policy - stakeholders want to know that the way companies use their ability to influence public policy is consistent with stated social and environmental goals. As part of this move toward greater disclosure, many companies are displaying detailed information about their social and environmental performance on their publicly accessible websites - even when it may be negative.

Convergence of CSR and Governance Agenda: In the past several years, there has been a growing convergence of corporate governance and CSR agenda. In the 1990s, the overlap was seen most clearly on issues such as board diversity, director independence, and executive compensation. The need for having on the board of directors, directors who are non-executive and who are independent i.e., directors who are not involved in the day-to-day administration of the company but who would bring a non-partisan and unbiased approach to a company's policies is emphasized by both CSR and Corporate Governance dictates. More recently, an increasing number of corporate governance advocates have begun to view companies' management of a broad range of CSR issues as a fiduciary responsibility alongside traditional risk management. In addition, more and more CSR activists have begun to stress the importance of board and management accountability, governance, and decision-making structures as imperative to the effective institutionalisation of CSR.

Growing Investor Pressure and Market-Based Incentives: CSR is now more and more part of the mainstream investment scene. The last few years have seen the launch of several high-profile socially and/or environmentally screened market instruments (e.g., indexes like the Dow Jones Sustainability Indexes), This activity is a testament to the fact that mainstream investors increasingly view CSR as a strategic business issue. Many socially responsible investors are using the shareholder resolution process to pressure companies to change policies and increase disclosure on a wide range of CSR issues, including environmental responsibility, workplace policies, community involvement, human rights practices, ethical decision-making and corporate governance. Activist groups are also buying shares in targeted companies to give them access to annual meetings and the shareholder resolution process.

Advances in Information Technology: The rapid growth of information technology has also served to sharpen the focus on the link between business and corporate social responsibility. Just as email, mobile phones and the Internet speed the pace of change and facilitate the growth of business, they also speed the flow of information about a company's CSR record.

Pressure to Quantify CSR Return on Investment: Ten years after companies began to think about CSR in its current form, companies, their employees and customers, NGOs, and public institutions increasingly expect returns on CSR investments, both for business and society. This is leading to questions about how meaningful present CSR practice is, and the answers to those questions would determine both the breadth and depth of CSR practice for the next decade.

Companies want to determine what their CSR initiatives have accomplished so that they can focus on scarce resources more effectively.

22. (a) Definition of Competition: A broad definition of Competition is "a situation in a market in which firms or sellers independently strike for the buyers' patronage in order to achieve a particular business objective, for example profit, sales or market share (World Bank, 1999). A pre-requisite for a good competition is trade, trade is the unrestricted liberty of every man to buy, sell and barter, when, where and how, of whom and to whom he pleases.

Competition Act, 2002

The Competition Act, 2002 is the relevant law laid down with an intend to provide, keeping in view of the economic development of the country, for the establishment of a Commission to prevent practices having adverse effect on competition, to promote and sustain competition in markets, to protect the interests of consumers and to ensure freedom of trade carried on by other participants in markets, in India, and for matters connected therewith or incidental thereto. The renewed efforts of the Government in implementing a Competition Act, 2002 is a laudable step in the right direction and a new beginning in the frontiers of India's Competition Policy towards harmonizing international trade and policy.

(b) Business and Environmental Ethics

Few decades ago, the corporate world, the industry or others engaged in the use of natural resources or environmental services were mainly concerned with good business in economic sense. Concern for environment and resource depletion was not on their agenda; if conservation of resources was required it was with a motive of mere economic gains or profits.

Not only in India but all over the world, there is now a growing concern for Social responsibility and ethical norms in all spheres of human activities; be it public behaviour, business or environment and there are ethical concerns to look after not only the interest of stakeholders but also that of community; as the regulatory / mandatory requirements have also become more stringent. This translates into providing safety for the workers at workplace, concern for their health, reducing pollution and incorporating environmental values in governance.

Environmental ethics is a larger issue that concerns ethical behaviour of all types of organisations ranging from International bodies, national governments, opinion makers, media, intelligentsia, public and private enterprises and NGOs. In India many companies have come to realize that ethical practices make good business sense especially the organisations engaged in exports as these organisations have to satisfy the importer in regard to the quality, ethics and environmental standards.

(c) Ethical Conflict Resolution

While evaluating compliance with the fundamental principles, a finance and accounting professional may be required to resolve a conflict in the application of fundamental principles. The following needs to be considered, either individually or together with others, during a conflict resolution process,

(a) Relevant facts;

(b) Ethical issues involved;

(c) Fundamental principles related to the matter in question;

(d) Established internal procedures; and

(e) Alternative courses of action.

Having considered these issues, a finance and accounting professional should determine the appropriate course of action that is consistent with the fundamental principles identified. The professional should also weigh the consequences of each possible course of action. If the matter remains unresolved, the professional should consult with other appropriate persons within the firm or employing organization for help in obtaining resolution. During times where a matter involves a conflict with, or within, an organization, finance and accounting professional should also consider consulting with those charged with governance of the organisation, such as the board of directors.

If a significant conflict cannot be resolved, a professional may wish to obtain professional advice from the relevant professional body or legal advisors, and thereby obtain guidance on ethical issues without breaching confidentiality. For example, a professional accountant may have encountered a fraud, the reporting of which could breach the professional accountant's responsibility to respect confidentiality. The professional accountant should consider obtaining legal advice to determine whether there is a requirement to report.

If, after exhausting all relevant possibilities, the ethical conflict remains unresolved, a professional should, where possible, refuse to remain associated with the matter creating the conflict. The professional may determine that, in the circumstances, it is appropriate to withdraw from the engagement team or specific assignment, or to resign altogether from the engagement, the firm or the employing organization.

23. (a) Interdepartmental Communication:

The word department comes from the French word departir which means "to separate. Communication between departments is essential to collaborate and achieve the objectives of the organisation. Departments in an organization are like rooms in a house. Departments divide and create barriers; but without their cooperation, it would be virtually impossible for an organisation to function.

Importance of Interdepartmental Communication

Most organizations, to some degree, have difficulties with interdepartmental communication. Unfortunately, the problem is frequently overlooked and, even when recognized, often the symptoms are treated instead of the causes.

Avoiding unnecessary conflict, poor performance, time delays, and decisions that work at cross purposes are compelling reasons for taking active measures to improve interdepartmental communication. Major causes of interdepartmental communication problems are:

Departments Are Physically Separated: Office design may create barriers to effective interdepartmental relationships, because it subconsciously restricts natural communication impulses. To a great extent, office design determines who has access to whom by creating barriers to some departments and bridges to others. Because each office is unique, special factors have to be considered in each organization to make changes that will facilitate more effective communication between departments.

Departments Perform Separate Functions: Barriers are also caused by different priorities. What may be the first priority for department X may be the last priority for department Y. Ordinarily this may not be a problem, except when department X is dependent on department Y, a destructive sequence of impatience, tension, and distrust may prevail. Territory battles usually occur because departments fight over scarce resources, prestige, or such other factors. But who really wins? Who loses? Even though a particular department may "win," the customer usually loses. The competitor may even win. Customer service or a competitive threat should inspire and bridge the gaps between departments.

(b) Principles of Interpersonal Communication:

The following principles are basic to interpersonal communication: