Institute of Chartered Financial Analysts of India (ICFAI) University 2009 C.A Chartered Accountant Integrated Professional Competence (IPCC) - Cost Accounting Revision Test s (ember ) - Question Pap

Download the subsequent attachment:

1. (i)

PAPER - 3 : COST ACCOUNTING AND FINANCIAL MANAGEMENT PART - I : COST ACCOUNTING QUESTIONS

The following data are available in respect of material X for the year ended 31st March, 2008:

Opening Stock Rs. 90,000

Purchases during the year Rs. 2,70,000

Closing stock Rs. 1,10,000

Calculate:

a. Inventory turnover ratio

b. The number of days for which the average inventory held.

Aries Co. has recorded the following data in the two most recent periods:

(ii)

Total cost of production Volume of Production

Rs. (Units)

14,600 800

19,400 1200

What is the best estimate of the firm's fixed costs per period?

X Ltd. has earned a contribution of Rs.2,00,000 and net profit of Rs.1,50,000 of sales of Rs.8,00,000. What is its margin of safety?

(iii)

(iv)

(v)

The cost accountant of Y Ltd. has computed labour turnover rates for the quarter ended 31st March, 2002 as 10%, 5% and 3% respectively under Flux method'. Replacement method' and Separation method'.

If the number of workers replaced during that quarter is 30, find out the number of

(i) workers recruited and joined, and (ii) workers left and discharged.

The standard and actual figures of product Z' are as under:

Material quantity Material price per unit Calculate material price variance.

Standard 50 units

Actual 45 units

2. (a) Given below is a list of ten industries. Give the method of costing and the unit of cost against each industry.

| ||||||||||||||

|

(viii) Advertising |

(ix) Furniture

(x) Sugar company having its own sugarcane fields.

(b) Name the various reports (Elaboration not needed) that may be provided by the Cost Accounting Department of a big manufacturing company for the use of its executives.

3. (a) What is Just in Time (JIT) purchases? What are the advantages of such purchases?

(b) The Stock Control Policy of a company is that, each stock is ordered twice a year. The quantum of each order being one-half of the year's forecast demand

The materials manager, however, wishes to introduce a policy in which for each item of stock, reorder levels and EOQ is calculated

For one of the items X; the following information is available:

Forecast annual demand 3,600 units

Cost / unit Rs. 100

Cost of placing an order Rs.40

Stock holding cost 20% of average stock value

Lead time 1 month

It is estimated by the materials manager that for item X, a buffer stock of additional 100 Units should be provided to cover fluctuations in demand.

If the new policy is adopted, calculate for stock item X:

(i) the reorder level that should be set by the material manager;

(ii) the anticipated reduction in the value of the average stock investment;

(iii) the anticipated reduction in total inventory costs in the first and subsequent years.

Labour

4. Both direct and indirect labor of a department in a factory are entitled to production bonus in accordance with a Group Incentive Scheme, the outlines of which are as follows:

(a) For any production in excess of the standard rate fixed at 10,000 tons per month (of 25 days) a general incentive of Rs.10 per ton is paid in aggregate. The total amount payable to each separate group is determined on the basis of an assumed percentage of such excess production being contributed by it, namely @ 70% by direct labor,@ 10% by inspection staff, @ 12% by maintenance staff and @ 8% by supervisory staff.

(b) Moreover, if the excess production is more than 20% above the standard, direct labor also get a special bonus @ Rs.5 per ton for all production in excess of 120% of standard.

(c) Inspection staff are penalized @ Rs.20 per ton for rejection by customer in excess of 10% of production.

(d) Maintenance staff are also penalized @ Rs.20 per hour of breakdown.

From the following particulars for a month, work out the production bonus earned by each group:

(a) Actual working days: 20

(b) Production: 11,000 tons

(c) Rejection by customer: 200 tons

(d) Machine breakdown: 40 hours

Overheads

5. (a) Discuss briefly the Step method and Reciprocal Service method of secondary

distribution of overheads.

(b) In a factory, overheads of a particular department are recovered on the basis of Rs. 5 per machine hour. The total expenses incurred and the actual machine hours for the department for month of August were Rs. 80,000 and 10,000 hours respectively. Of the amount of Rs. 80,000, Rs. 15,000 became payable due to an award of the Labour Court and Rs. 5,000 was in respect of expenses of the previous year booked in the current month (August). Actual production was 40,000 units, of which 30,000 units were sold. On analysing the reason, it was found that, 60% of the underabsorbed overhead was due to defective planning and the rest was attributed to normal cost increase. How would you treat the under-absorbed overhead in the cost accounts?

6. (a) "The profits of cost accounts may be different from those projected by financial

accounts and in such cases a memorandum reconciliation statement is needed" In the context of this statement, discuss the possible reasons of differences between the two sets of accounts and the need of reconciliation.

(b) The following figures are extracted from the Financial Accounts of Anishka Ltd. For the year ended 30-04-2009:

Rs. Rs.

Sales (20,000 units) 50,00,000

Materials 20,00,000

Wages 10,00,000

Factory Overheads 9,00,000

Administrative Overheads 5,20,000

Selling and Distribution Overheads 3,60,000

Finished Goods (1,230 units) 3,00,000

Work-in-progress:

Materials 60,000

Labour 40,000

Factory Overheads 40,000

1,40,000

Goodwill Written off 4,00,000

Interest paid on capital 40,000

In the costing records, Factory Overhead is charged at 100% of Wages, Administration Overhead 10% of factory cost and Selling and Distribution Overhead at the rate of Rs. 20 per unit sold.

Prepare a statement reconciling the profit as per Cost Records with the profit as per Financial Records.

Contract Costing

7. Nilcom Construction Company commenced a contract on 1.7.08. The contract price is Rs. 9,00,000. Actual expenditure till 31.1.08 and estimated expenditure in 2009 are given below:

Actual Estimated for

Till 31.12.08 2009

Rs. Rs.

Purchase of materials 1,50,000 2,60,000

|

Labour |

1,10,000 |

1,20,000 |

|

Purchase of plant (original cost) |

80,000 | |

|

Miscellaneous expenses |

40,000 |

71,000 |

|

Return of plant to stores | ||

|

on 31.12.08 (original cost) |

20,000 |

50,000 |

|

as at 31.12.08 |

as at 30.9.09 | |

|

Materials at site |

10,000 |

Nit |

|

Work certified |

4,00,000 |

Full |

|

Work uncertified |

15,000 |

Nil |

|

Cash received |

3,60,000 |

Full |

Depreciation is charged on plant @ 20% p.a. on original cost (calculation to be made on time basis). The contract is likely to be completed by 30.9.09.

You are required to prepare the contract account for the year ended 31.12.09. It has been decided to estimate the total profit on the contract and to take to the credit of profit and loss account that proportion of estimated profit on realized basis which the work actually certified bears to the total contract.

Operating Costing

8. KINGFISHER Airways owns a single jet aircraft and operates between Bombay and New Delhi. Flights leave Bombay on Mondays and Thursdays and depart from New Delhi on Wednesdays and Saturdays. KINGFISHER Airways cannot afford any more flights between Bombay and New Delhi. Only tourist class seats are available on its flights. An analyst has collected the following information:

Seating capacity per plane 360

Average Passengers per flight 100

Flights per week 4

Flights per year 208

Average one-way fare Rs. 10,000

Variable fuel costs Rs. 1,40,000 per flight

Food service to passengers (not charged to passengers) Rs. 400 per passenger

Commission paid to travel agents paid by KINGFISHER 8% of fare Airways on each ticket booked on KINGFISHER Airways (Assume that all KINGFISHER tickets are booked by travel agents)

Fixed annual lease costs allocated to each flight Rs. 5,30,000 per flight Fixed ground services (maintenance, check-in baggage

handling) costs allocated to each flight Rs. 70,000 per flight

Fixed salaries of flights crew allocated to each flight Rs. 40,000 per flight

For the sake of simplicity, assume that fuel costs are unaffected by the actual number of passengers on a flight.

Required:

(a) What is the operating income that KINGFISHER Airways makes on each one-way flight between Bombay and New Delhi?

(b) The market research department of KINGFISHER Airways indicates that lowering the average one-way fare to Rs. 9,600 will increase the average number of passengers per flight to 106. Should KINGFISHER Airways lower its fare?

(c) Travel India, a tour operator, approaches KINGFISHER Airways to charter its jet aircraft twice each month, first to take Travel India International tourists from Bombay to New Delhi and then bring the tourists back from New Delhi to Bombay. If KINGFISHER Airways accepts the offer, it will be able to offer only 184 (208 minus 24) of its own flights each year. The terms of the charter are:

(i) For each one-way flight Travel India will pay KINGFISHER Rs. 7,50,000 to charter the plane and to use its flight crew and ground service staff.

(ii) Travel India will pay for fuel costs.

(iii) Travel India will pay for all food costs.

On purely financial considerations, should KINGFISHER Airways accept the offer from Travel India Tours and Travel?

Process Costing

9. Prepare a process account from the following information.

|

Opening stock |

Nil |

|

Input units |

10,000 |

|

Input costs | |

|

Material |

Rs. 5,150 |

|

Labour |

Rs. 2, 700 |

|

Normal loss |

5% of input |

|

Scrap value of units of loss |

Re1 per unit |

|

Output to finished goods |

8,000 units |

|

Closing stock |

1000 units |

|

Completion of closing stock |

50% for labour |

|

80% for material |

Standard Costing

10. The following standards have been set to manufacture a product:

Direct materials:

2 units of P at Rs. 4 per unit

3 units of Q at Rs. 3 per unit 15 units of R at Re. 1 per unit

9.00

15.00

32.00

Direct labour 3 hours @ Rs. 8 per hour Total standard prime cost

24.00

56.00

The company manufactured and sold 6,000 units of the product during the year.

Direct material costs were as follows:

12.500 units of P at Rs. 4.40 per unit

18,000 units of Q at Rs. 2.80 per unit

88.500 units of R at Rs. 1.20 per unit

The company worked 17,500 direct labour hours during the year. For 2,500 of theses hours the company paid at Rs. 12 per hour while for the remaining the wages were paid at the standard rate.

Calculate material price, usage variances, labour rate, and efficiency variances.

Marginal Costing

11. RXG Ltd. reports the following results for year ended 31st March, 2007.

(Rs.)

Sales

Variable cost Fixed cost Net profit

20,00,000

12,00,000

5.00.000

3.00.000

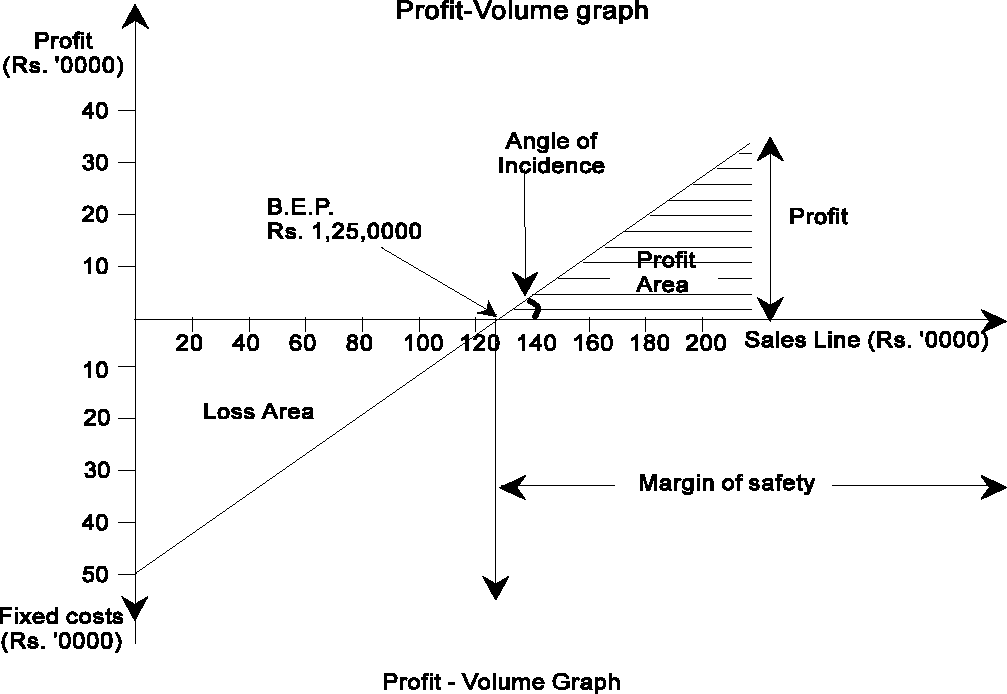

Construct a Profit-Volume graph and also calculate (i) P / V ratio (ii) Break-even Point (iii) Margin of safety.

Budgetary Control

12. The cost accountant of manufacturing company provides you the following details for year 2008 :

Rs.

Direct materials Direct Wages

1,00,000 Other fixed costs

Fixed factory overheads 1,00,000 Profit

Variable factory overheads 1,00,000 Sales

1.15.000

7.50.000

During the year, the company manufactured two products A and B and the output and costs were :

A B

| ||||||||||||

|

Variable factory overhead are absorbed as a percentage of direct wages. Other variable costs have been computed as : Product A Re.0.25 per unit; and B Re.0.30 per unit. |

During 2009, it is expected that the demand for product A will fall by 25 % and for B by 50%. It is decided to manufacture a further product C, the cost for which are estimated as follows :

Product C

Output (units) 2,00,000

Selling price per unit Rs.1.75

Direct materials per unit Re.0.40

Direct wages per unit Re 0.25

It is anticipated that the other variable costs per unit will be the same as for product A.

Prepare a budget to present to the management, showing the current position and the position for 2009. Comment on the comparative results.

13. (a) Define Joint Products and By-Products .

(b) Define Differential Cost and Incremental Cost..

1. (i) (a) Inventory Turnover Ratio = Raw Material Consumed / Average Inventory

= 2,50,000/1,00,000 = 2.5 Times

(b) No. of days for which Average inventory is held =

Days in a year/ITR = 360/2.5 = 144 Days

Working Notes:

1. Raw material consumed = Opening Stock + Purchases - Closing Stock

= 90,000 + 2,70,000 - 1,10,000 = Rs. 2,50,000

2. Average Inventory = (Opening Stock + Closing Stock) / 2

= (90,000 + 1,10,000) / 2 = Rs. 1,00,000

(ii) Variable Cost per unit = Change in Total Cost / Change in Production

= (Rs. 19,400 - Rs. 14,600)/(1200 units - 800 units) = 4800/400 = Rs. 12 per unit

Total variable cost for 1200 units = 1200 units x Rs. 12 = Rs. 14,400

= Total cost - Total Variable Cost

Total fixed cost

= 19400- 14400 = Rs. 5000

-= = 25%

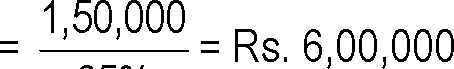

(iii) P/V ratio

S 8,00,000

Margin of safety

P/V ratio 25%

Alternatively:

Fixed cost = Contribution - Profit

=Rs. 2,00,000 - Rs.1,50,000 = Rs. 50,000

B.E. Point = Rs. 50,000 - 25% = Rs. 2,00,000

Margin of Safety = Actual sales - B.E. sales

= 8,00,000- 2,00,000 = 6,00,000

(iv) Average number of workers on payroll:

Number or workers replaced

100

Labour turnover rate (Replacement method)=

Average number on pay roll

5

30

or,

100 Average number onpay roll

or, Average number of workers on payroll = 30 x 100 600.

|

Number of workers left and discharged: Labour turnover rate (Separation method) = -x 100 |

3 Number separated or, 600 100 or, Number of workers separated (i.e., left and discharged) = 3 x 600 = 18. 100 Number of workers recruited and joined: _ Number separated+Number recruitedand joined Labour turnover rate (Flux method) x100 Average number on payroll 10 18+Number recruitedand joined or, 600 100 or, Number of workers recruited and joined _ 600 x10 -18 = 42. 100 (v) Price variance _ Actual qty (Std. price - Actual price) _ 45 units (Re. 1.00 - Re. 0.80) _ Rs.9 (F) Basic Concepts 2. (a)

Various reports that may be provided by the Cost Accounting Department of a big manufacturing Company for the use of its executives are as under: (i) Cost Sheets (ii) Statements of material consumption (iii) Statements of labour utilisation (iv) Overheads incurred compared with budgets (v) Sales effected compared with budgets (vi) Reconciliation of actual profit with estimated profit (vii) The total cost of inventory carried (viii) The total cost of abnormally spoiled work in factory and abnormal losses in stores (ix) Labour turnover statements (x) Expenses incurred on research and development compared with budgeted amounts. Material 3. (a) Just in time (JIT) purchases means the purchase of goods or materials such that delivery immediately precedes their use. Advantages of JIT purchases: Main advantages of JIT purchases are as follows: 1. The suppliers of goods or materials cooperates with the company and supply requisite quantity of goods or materials for which order is placed before the start of production. 2. JIT purchases results in cost savings for example, the costs of stock out, inventory carrying, materials handling and breakage are reduced. 3. Due to frequent purchases of raw materials, its issue price is likely to be very close to the replacement price. Consequently the method of pricing to be followed for valuing material issues becomes less important for companies using JIT purchasing. 4. JIT purchasing are now attempting to extend daily deliveries to as many areas as possible so that the goods spend less time in warehouses or on store shelves before they are exhausted. (b) (i) Reorder level (to be set by the material manager) = Safety stock + lead time consumption = 100 units + 3,600 units /12 = 400 units 2x3,600 unitsxRs.40 EOQ =!- = 120 units \ 0.2xRs.100 (ii) Anticipated reduction in the value of average stock investment The average of total stock held under new system: = Safety stock + EOQ/2= 100 units + 60 units = 160 units The average stock investment under new system = 160 units x Rs.I00 = Rs. 16,000 The average of total stock held under old system Previously, 1,800 units were ordered at a time and so the average stock held was 900 units. The average stock investment under old system Rs. 90,000 (900 units x Rs.100). Therefore, anticipated reduction in the value of the average stock investment = Rs. (90,000 - 16,000) =Rs. 74,000 (iii) Anticipated reduction in total inventory costs (in the first and subsequent years) Under new system: Rs. Annual ordering cost (3, 600 units x Rs.40 / 120units) 1,200 Stock holding cost (0.20 x Rs.16,000) 3,200 Total inventory cost 4,400 Under old system: Annual ordering cost (2 orders x Rs. 40) 80 Stock holding cost (0.20 x Rs. 90, 000) 18,000 Total inventory cost 18,080 Thus, anticipated reduction in total inventory costs is Rs. 13,680 (Rs.18,080 -Rs.4,400) However, in the first year, the safety stock of 100 units is to be purchased at a cost of Rs. 10,000 (100 units x Rs.100). Therefore, while the saving would be of Rs. 13,680, the cost reduction in the system would be only Rs.3,680. In subsequent years, however, the cost reduction will be of Rs. 13,680. 4. (i) No. of working days during month: 20 (ii) Standard production for 20 days @ 10,000 tons per month of 25 days 10,000 x 20 (iii) Actual production during month _ 11,000 tons (iv) Excess production during month _ 11,000 - 8,000 _ 3,000 tons (v) Excess production above 20% of standard _ 3,000 - 20% of 8,000 _ 3,000 - 1,600 _ 1,400 tons

**Penalty for machine breakdown for 40 hours @ Rs.20 per hour. Overheads 5. (a) Step method: This method gives cognizance to the service rendered by service department to another service deptt, thus sequence of apportionments has to be selected. The sequence here begins with the deptt that renders service to the max number of other service deptt. After this, the cost of service deptt serving the next largest number of deptt is apportioned. Reciprocal service method: This method recognizes the fact that where there are two or more service deptt they may render service to each other and, therefore, these inter deptt services are to be given due weight while re-distributing the expense of service deptt. The methods available for dealing with reciprocal equation method are: Simultaneous equation method Repeated distribution method Trial and error method (b) Rs. Total expenses incurred during the month 80,000 Less: Amount paid due to an award of the Labour Court 15,000 Expenses of previous year 5,000 20,000 Net Overhead Expenses for the month 60,000 Overheads recovered:10,000 hours@ Rs. 5 per hour 50,000 Under-absorbed Overhead 10,000 Treatment in Cost Accounts: 60% of the under-absorbed overheads (Rs. 6,000) which is due to defective planning should be written off to Costing Profit and Loss Account, because it is abnormal in nature. The balance 40% of the under-absorbed overheads (Rs. 4,000) should be recovered from the current month's production (40,000 units) by means of a supplementary rate and adjusted to the values of Finished Goods Stock and Cost of Goods Sold as shown under: _ , , .x, . Under - absorbedOverheads Supplementary rate on per unit basis =- Units Produced Rs.4,000 _ aha <. = -1 = Re.0.10per unit. 40,000 Amount of under-absorbed overheads to be charged to: Rs. Finished Goods Stock 10,000 units x Re. 0.10 1,000 Cost of Goods Sold 30,000 units x Re. 0.10 3,000 Non - Integrated accounts 6. (a) Differences between the two sets of accounts arises when separate books are maintained for both cost accounts and financial accounts. The various reasons for disagreement of profits may be listed as below: 1. Items appearing only in financial accounts The following items of income and expenditure are normally included in financial accounts and not in cost accounts. Their inclusion in cost accounts might lead to unwise managerial decisions. These items are: (i) Income: (a) Profit on sale of assets (b) Interest received (c) Dividend received (d) Rent receivable (e) Share transfer fees

There are some items which are included in cost accounts but not in financial accounts. These are: (a) Notional interest on capital; (b) Notional rent on premises owned 3. Under or over-absorption of overhead In cost accounts overheads are charged to production at pre-determined rates whereas in financial accounts actual amount of overhead is charged, the difference gives rise to under-or over-absorption; causing a difference in profits. When such under absorption or over absorption is charged or credited respectively to the Costing Profit and Loss Account, there shall be no need of reconciliation. 4. Different bases of stock valuation In financial books, stocks are valued at cost or market price, whichever is lower. In cost books, however, stock of materials may be valued on FIFO or LIFO basis and work-in-progress may be valued at prime cost or works cost. Differences in stock valuation may thus cause a difference between the two profits. 5. Depreciation The amount of depreciation charged may be different in the two sets of books either because of the different methods of calculating depreciation or the rates adopted. In cost accounts, for instance, the straight line method may be adopted whereas in financial accounts it may be the diminishing balance method. Anishka Ltd. Profit & Loss Account (For the year ended 30th April, 2009)

Cost Profit & Loss Statement (For the year ended 30th April, 2009) Rs. 20,00,000 10,00,000 30.00.000 10.00.000 40,00,000 1.40.000 38.60.000 3.86.000 42.46.000 2.46.000 Materials Wages Prime Cost Add: Factory Overhead @ 100% of wages Less: Closing Work-in-progress Factory Cost (20,000 + 1,230) units Administrative Overheads @ 10% of Factory Cost Less: Closing Stock of Finished Goods 1,230 units (See Note) Cost of Production (20,000 units) 40.00.000 4.00.000 44.00.000 50.00.000 6.00.000 Selling & Distribution Overhead @ Rs. 20 per unit Cost of Sales (20,000 units) Sales Revenue (20,000 units) Profit Note: Cost of 21,230 units is Rs. 42,46,000. Therefore, the cost of one unit is Rs. 200. Hence the cost of 1,230 units is Rs. 2,46,000. Alternatively : Administrative overheads could be excluded from the cost of production. Reconciliation Statement Rs. Rs. Profit as per Cost Records 6,00,000 Add: Factory Overheads over-absorbed (Rs. 10,00,000- Rs. 9,00,000) 1,00,000 Selling & Distribution Overhead Over-absorbed - (Rs. 4,00,000 - Rs. 3,60,000) 40,000 Difference in the valuation of closing stock of finished goods (Rs. 3,00,000 - Rs. 2,46,000) 54,000 1,94,000 7,94,000 Less: Administrative Overhead Underabsorbed (Rs. 5,20,000 - Rs. 3,86,000) 1,34,000 Goodwill written off relates to Financial Accounts 4,00,000 Interest on Capital 40,000 5,74,000 Profit as per Financial Accounts 2,20,000 Contract Costing 7. Dr. Contract Account Cr

4,00,000 (1) (i) Plant returned to store on 31.12.08: Original cost Less: Depreciation for 6 months @ 20%

54,000 37,500 7,500 2,98,000 4.70.000 7.68.000 9,00,000 1.32.000 Profit to be credited to profit and loss account: Work certified Cash received x Estimated total profit Contract price Work certified Rs. 4,00,000 Rs. 3,60,000 Rs. 9,00,000 Rs. 4,00,000 x Rs.1,32,000 = Rs.52,800 Operating Costing 8. (a) Statement of Operating Income of KINGFISHER Airways operating between Bombay and New Delhi (on each one way flight) Rs. 10,00,000 80,000 2.60.000 7.40.000 5.30.000 70.000 6.40.000 1,00,000 Rs. 10,17,600 81,408 42,400 Fare received (per flight): (A) 100 passengers x Rs. 10,000 Variable costs (per flight): Commission paid Rs. 10,00,000 x 8% Food Services 100 passengers x Rs. 400 Fuel costs Total variable costs: (B) Contribution (per flight): (C): [(A) - B)] Fixed costs (per flight): Fixed annual lease costs Fixed ground services (maintenance, check-in baggage handling) costs Fixed salaries of flight crew Total fixed costs: (D) Operating income (per flight): [(C) -(D) (b) Fare received (per flight): (X) 106 passengers x Rs. 9,600 Variable costs: Commission paid Rs. 10,17,600x8% Food service 106 passengers xRs. 400 Fuel costs Total variable costs: (Y) 1,40,000 2,63,808 7,53,792 13,792 Contribution per flight: (Z): [(X) -(Y)] Excess contribution due to lowering of fare: [(Z) -(C)] [Refer to (a) part] (Rs. 7,53,792 - Rs. 7,40,000) KINGFISHER Airways should lower its fare as it would increase its contribution towards profit by Rs. 13,792 per flight. (c) Financial consideration of KINGFISHER Airways to charter its plane to Travel India should use option (b) and not (a) Rs. Under option (b) KINGFISHER Airway receives contribution (per flight) 7,53,792 KINGFISHER Airway would get (per flight) if it charters the plane 7,50,000 A comparison of the above data clearly shows that the KINGFISHER Airways would be financially better off by not chartering the plane. Process Costing 9.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||