Bharathiar University 2010 B.Com Computer Applications Statistic for business - Question Paper

D 1561 Q.P. Code : [07 DC 01/

07 DCCA 0*]

(For the candidates admitted during 2007 onwards)

B.ComyB.Com (CA) DEGREE EXAMINATION, DECEMBER 2008.

FixBt Year

Part III Commerce/Commerce with Computer Applications

PRINCIPLES OP ACCOUNTANCY

Time : Three hours Maximum : 100 marks

Answer any FIVE questions.

Each answer carries 20 marks.

(5 x 20 = 100)

1. What are accounting conventions? Explain them.

i0L{rT iurro>Qj? meu(bf$la>VT

2. What do you mean by renewal of a bill? Give the various journal entries which are recorded in the books of the drawer and the drawee an renewal of a bill.

uarrpp* Ljg|uiS)<i) upjfil fcSh

ujrrgi? Liwrpjpj iLiq.ai qiuiS)Cb Qm_irufrn @ffiluGuiLuu)ajA>ert cSigpuLjcniT uwbpih Qugjoni CturTpgi ($.

3. The following are the ledger balances extracted from the books of weifa.

|

Ha. | |

|

Weifas capital |

50,000 |

|

Bank over draft |

8,400 |

|

Furniture |

5,200 |

|

Business Promises |

40,000 |

|

Creditors |

26.600 |

|

Opening stock |

44,000 |

|

Debtors |

36,000 |

|

Rent from tonunts |

2,000 |

|

Purchases |

2,20,000 |

|

Sul os |

3,01,000 |

|

Return inwards |

5,000 |

|

Discount (cr) |

800 |

|

Taxes and Insurance |

4,000 |

|

Genera! expenses |

8,000 |

|

Salaries |

18,000 |

|

Commission allowed |

4,400 |

|

Carriage on purchuscs |

3,600 |

|

Provision for Doubtful debts |

1,000 |

|

Bad debts written off |

1,600 |

Adjustments ;

(a) Stock on hand on 31-12-1995 wa6 estimated as Ks. 40,120.

(b) Write off depreciation of business premises

Rs. 600 and furniture Ks. 520.

(c) Make a provision of 5% on debtors for bad and doubtful debts.

(d) Allow interest on capital at 5% and carry forward Rs. 1400 for unexpired insurance.

Prepare Final Accounts for the year ended

31.12.1995.

|

Qeuiuuttefilebt iipftirgpib CuCpuQ $0ULjAtih T**UUUL1. | ||||||||||||||||||||||

|

|

c.0i)0uuib |

5.000 |

|

0n(g}un (qiijoj) |

800 |

|

jifl mpgjib &rtui5(9 |

4.000 |

|

Qunpj 0o>e{c)i |

0.000 |

|

510 DOT lb |

18.000 |

|

4.400 | |

|

QnTQpd) ifl$rri <taeS |

3.600 |

|

ajgn.t_ain f?g*6Q |

1.000 |

|

GuqnMi-tvasn (iun)*(ipt'jiji_i..gf |

1,600 |

(,jw) 31.12 199b 01/9 0>&u9oj #9&0ulj (jj. 40,120 6T$ it u fT n A U U C L_ &

(<) efflujnuno 9TQjnt_tu&n u>$gju> sia)|Ds)(tiMi

t$nai Gajujfraiif) 600 io{b>pij> 520

Gun*Qa.(ij5>uui_i_gj.

(@) 6U<7n IDfpgJlb &l_OT&0T A(_|TrTof)ftaT li$$J

5% 0#uj*

(ff) iBpnm on-iq b% .jg)Cicgjtb Qpen

GsgypliL *frui5 0. 1.400.

31.1? 199b vewt (i/huj

pujrrrfla**

4. A partner has with drawn the following sums of money during the half year ending 30.6.04.

Jan 15 Rs. 300

Feb 18 Rh. 250

Mar 10 Rs. 150

Mar 26 Rs. 200

April 20 Rn. 400

May 16 Rs. 300

June 18 Rfi. 500

Interest is to bo charged at 8% p.a. Find out the average due date and calculate the amount of interest to be debited to the partner.

30.6.04 ojyiurtcwi (ipiquj {0 Mill nofl Q$fWA*>6n ci@pirn.

ggaisuitl 15 300

iS)ugjrfl 18 $> 250

u)iitt0 10 ISO

mu iVA ?6 <it> ?00

90 (jj> 400

(#ID 16 QJ; i00

18 0. 500

<3,rofQL-iraig)i&( 8% eutliq. ms4Duuu(i){Di.

6u>ott j&na>cn mgtpib ajl. Qir*a>uj

shuuircifl 0>6Hia)a) i ifpQjDia

v ' 5. 'C* of Kolkata consigns goods to B of Mumbai for sale at invoice price or over. *B is entitled of a commission of 10% on invoice price and 30% on any surplus price realised. B accepted a bill of exchange drawn by *C amounting to 80% of the invoice price.

During the year 1999, goods consigned by C* were invoiced at Rs. 90,000, such goods cost C Rs. 60,000. Sales mde by *B' were Rs. 81,000 and goods in his hands on 31.12.1999, remaining unsold represented an invoice, value of Rs. 21,000. B remitted a sight draft for the amount due after deducting his commission and Proportionate advance applicable to goods sold.

Show the necessary accounts in the books of the consignor.

C gpu>a>iJu9$jeiaT B *< *ij6($aaHn ditjpupgiarTw @l iiuijcdaxu (%*) (Stow

$*gp)uiS@ Q*ujrtn B' tf an juh nuq uSttKu i$& 10% 7($ ifljDjpib i6& 30% Qujd fi-rfU*ujfTi3(Drtn-

gi_rtuLj cficrou ifi$j 80% 0/6'iaxva, *C iDrrjt)giia>/ilip(5, B pui .atiflppiMi

1999 C UA($*u)ei 0 90,000-(i)@

gpuiS Qffiujyin

0, 60,000 B 81.000-lj sfipiDrTri

31.12.1999 cwargi eflpftnp 5*iJ0ui9? gi_nuq efilcnw 0. 21,000 Q(i(9iiL.(itij*nt4u.j Q$na>am9s5i0fb$i

LDjbgjib QS(9, npai uamb Guira

QpnmMQ B iflnppo S\ u>i

igjuqfiBin Q&eftcu CiajQmjaai 9>ssr&<9)e>W9i rrRTiS)&

6. Das and Krishnan entered into a Joint venture sharing profit and losses as 3:2. They opened a Bank A/c by depositing Rs. 40,000 each.

Das purchased 800 kg. of an item @ Rs. 60 per kg. and his expenses were Rs. 13,000. Krishnan purchased a second item of 10,000 kg. @ Rs. 2.10 per kg. and his expenses were Rs. 11,000. Expenses were met from private sources and purchases were paid from bank account.

Krishnan sold 600 kg. of the first item @ Rs. 100 per kg. and his selling expenses were Rs. 5,500. Das sold

8,000 kg. of the second item @ Ra. 5 per kg. and his selling expenses were Rs. 6,000. All the sale proceeds wore doposited in Bank Account and expenses wero met from private sources.

Write up nocessary accounts in the books of the venture. Also prepare a Balance Hheet of the venture, lorbgyii) )u>iu9<b

IblUttOTgl AMU JbL-lllkJdfoC9)U 6 ?. UWI<UfD <2*rTif)cnjDiri. 9djQum0Qj0th #jii 0 40.000D

800 l.). fi-QToi 90 Qtjii0wi 0 dDGam 0. 60 cfyib 0>rrsru Q*rr6h(ipi) Qdujnit tftoguib aj06i_uj Qd&Gn&oi

0. 13,000 $b0in. uaiucufi iDQjpn0 Quft0cv>n

90 ICJojfT 0 2 10 oSgjib 10,000 Qcon aiifru&rrm. Ct&gyib ieu0nuaj Qsua0i 0 11.000 <&(&u> QuM*n wmcnarpgjib Qfrirjfc# lf9u9i> Q#)<jfilL_uuL.i_i iDjfjpib QarraTQpa>acn eutid&a 0.H9f.4)c$0ibg)i Qffg&uui_L_r

)0Q}KTai QppQ) Qurr(5DC! 9(5 o>n 0. 100 600 &&UrT Gfi)fT)(pfTrt LDIDgJILO JfQJ!J| 6fijj)Ufi>Tff Q50*jT

0. 5,500. ncn> lojjQn Qunaxn 0 )&" 0. 5 e&ptb 8000 <9G)n cflpfTjnii u><Diptb efilrj/uojoia Qtfcuttj&fih

0. 6.000 rootgj eSfDLiO)( Qtiat&Ath uru*

6nT&)a> Q*g2)iMH t & ujjpgjiii) QacuajMu ..9ia)ci$gjii} Qenpp, fiflu9g5)0j&i Q#gu>$t kji .1 $t

61aJfTunij $r@<w*Au ($a>aju.mj cfilunun{j q'QAQfld) )ui| j9<f>o>& ($j$)uHJujtb pumrfta*

7. On 31st December 1994, the bank column of the cash book of s&matha showed a credit balance of Rs. 47,240. On examination of cash book and a bank statement for period, you find that:

(9) Cheque received and recorded in the cash book not Bent to bank for collcction Rs. 4,960.

(b) A cheque of Rs. 1,400 paid into bonk in Nov. 1994 had been debited by the bank by error in Dec. 1994.

(c) Cheques issued amounting to a 70,080 in Dec. 1994 had been entered in the cash book as to Rs. 69,000. These cheques were not presented at the bank for payment until January 1995.

(d) Interest of Rs. 3,520 charged by the bank was not recorded in the cash book.

(e) Payments side of the cash book had been under cast by Rs. 400.

(f). Rs. 17,960 was entered in the cash book as paid into the bank on 31st Dec. 1994 but not credited by the bank until the following day.

(g) Payment received from a customer direct by the bank Rs. 10,920 but no entry was made in the cash book.

Prepare bank reconciliation statement as on 31st Dec. 1994 afler making necessary correction in cash book.

31 ut.#ibufT 1994 ih aioprtetita Ofjrris

1L.0T9T UfbjdQuj$CTT IJtq. @0L1LJ 47.240

,j)iftafTG>$l6vt Qr;ttaa v iop0ii> utu Jxilu.ajai<wru9a>n ijfTUjOTfD CufT#] jJeSlr'i *ncwu

(0 0 4.960 iD)ijL|noi ftrr(?ema>Q) Qujpp Qpfi&t

UjflfcJ QffUJ0$| nrtA> 6Uli>)*0 gp|UUUlJI_fito>a>.

() peutbuA 1994w 0. 1.400 lojPugarar 90 ftrrCJftcncu eurb))uSla> Qtfg?jjfci'juL.@ tiupiTA kihurr

1994 cb eurufluS)irr> upp T(ipuuL.i-$i.

(@) ibuii 1994i> 0. 70,080 iDULtffrar afrGtfiroocoaat QeucrfluSlft) jcfl&uuuL.$i. ama Qtffre* ilud) 0. 69.000 ciot Qjujujuull.#.

arr(p#fT6V)6UerT enriiluSlw Q*}g>>{g5&Art* jgerajifl 1995

6UOOIJ 5L)ITUl51ffiftUUl_6filcUDfcO

(ff) 6UL.4 0. 3.520 jju)u9in(u Qo&j ctquuL

OgaA Ctruiq.Q> u$tuuui_6$V65)a>

(ear) 31 tffibun 1994 ib j&nefifib 0 17,960 Qijn&s GjCiq-GO 6uriii)u9o> Qjgaiunft u}ttjff rno>

0j&n0T sucno cuiuuSwmw ajqaj >A*Lnji_.6flU6*>u

(6T) 0 10.920 Q>:P*RUJ 0 U It IJMP AUJ (I CJijuujrTft OprrcnAuQroat Qffgyarnn amd) QtjnM uainseflwaw.

Qprr** 9iLiq.Q) $<nrfbjbiQ Qoujp i9|p(5 31 iq.*u>un 1994 tb prafto euru) ut .ujoxu $ujn(fl&

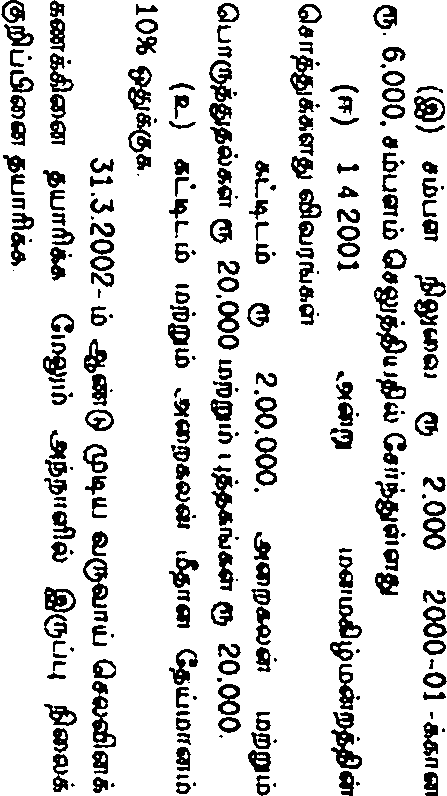

8. The following is the receipts and payment account of Kandan Rccreation club for the year ended 31st March 2002.

Its Payments K.

Receipts To Balonco b/d To subscription* : 2000-2001 2001-2002 2002-2003 To Rent for use of conferoncc room To Koccipts from entertainment facilities To Sales of old magazine?

7,000 By utlanM 28,000 By General

6.000 Expenses 6,000 *20,000 By Electricity 4.000

4.000 29.000 By Boolla purchased

10,000

14.000 By Periodical*

purchased 8,000

28.000 By loan repaid 20,000

2.000 By Balance c/d 4,000

80,000

80.000

Additional data :

(a) The club has 50 members, each paying Rs. 500 p.a as subscription.

(b) Subscriptions outstanding on 31.3.2002 Rs. 6,000.

(c) Salaries outstanding Rs. 2,000. Salaries paid include Rs. 6,000 for 2000-01.

(d) On 1.4.2001, the clubs properties were :

Building Rs. 2,00,000, Furniluro and fillings Rs. 20,000 and Books Rs. 20,000.

(e) Provide 10% Depreciation on building and furniture.

Prepare Income and Expenditure Account for the year ending 31.3.2002 and Balance sheet on that date.

31, toirft* 2002-ib t&taiQ Qpiuj 90

i9noj(r$umjpi.

Quppttatui C5 Q$ppttpa>mai 0

<yjLj ilQ*tt 7.000 louwia 28,000

opfiKts*1 UufipA 6,000

2000-2001 5.000 iAUbpu> 4,000

2001-2002 20,000 , euewAL#il0,000

O <

O

8r| 2r *

? | > 8'

B- |. 6- |* gj

** 5 g

Kj a-

1 2

o

o

*N3

e-

Is

<3

cr 5>

81

3-

*s

i

e-

T>-

0

1 $ ) % 3 >

tc

|

? i |

|

tC O | |

i e

g

1 5

I 1-

oo

o

Cn

93

o

|

f |

o | |

|

g- | ||

|

to g |

G c | |

|

1 |

W |

t |

$ 9

o 9

i

07 DCCA 03]

(For the candidates admitted from 2007 onwards)

B.Com./B.Com. (C.A) DEGREE EXAMINATION, DECEMBER 2010.

Second Year

Part Iir Commerce/Commerce with Computer Applications

FINANCIAL ACCOUNTING

Time : Three hours Maximum : 100 marks

Answer any FIVE questions.

Each question carries 20 marks.

(5 x 20=100)

1. What is depreciation? Explain its causes. GpujiDirarib rdrprra> erctaai? amratfMDflr

2. What is single entry syetem? What are the salient features of it?

QpGcp erorpird) croror? <(< 4)0ui9aja>Lj66T ujrrarau?

3. A firm purchases a 5 years lease for Rs. 80,000 on 1* January. It decides to write off depreciation on the annuity method. Presuming the rate of interest to be 5% per annum. The annuity tables show that a sum of Rs. 18,478, should be written off every year, show the lease account for five years. Calculations are to be made to the nearest rupee.

1. ggCTQjfl <5*0*51 5 ($a>&ci>uj 90

{9p&ja?ib . 80,000-i<5 curnbDtugj. ,<wrQrrer> Qf>a>p u9s* &<# QfiMJ\s>nemh CuiT4Qs<ip$iajQr (yMq.Qu#W*nT. &du/Tc*{pt6<5 cuili* cflpib 5% qct<& $<ili-ua>airu96Tu.

9uQ&jrr0 Q$ns <$. 18.476

CuirsQ(ipuut- Cu<w0ib.

smtms an&nSis guffuSW*

U$Ul9ft> sflrsAi_uut_ (JUT@li>.

4. On 1.1.2005 Rama Collieries Ltd. Leased a piece of land agreeing to pay a minimum rent of Rs. 2,000 in the first year, Rs. 4,000 in the second year and thereafter Rs. 6,000 per annum merging into a royalty of 40 paiae per tonne, with power to recoup short workings over the first three years only.

The figures of annual output for the four years to 31B December 2008 were 1,000, 10,000, 18,000 and 20,000 tonnes respectively. Record these transactions in the ledger of the company.

1.1.2005 cA&rgy pmorr jfipiou) 90

@>pcnp cr@0J (ipft)fub d>

0. 2.000. g)?vrLjnb ,snq.e) 0. 4.000. *npan9p< <QmQi.nGn$jb< 0. 6,000 crw uqi Q*ffOTfimjuLi_grf. 90 i_raflT c-if)o>ix>Q(rcr> 40 a>u*rr 4b<b. QpfiA pargj 3fecwr($*jftd) <jnjD ft_jbu#8a>uj iflilu#b!rar arnjLii K_OTengj.

31 utJibuiT 2008 (tpi-UJ iLdrarr prrdrQ T&mQ&eig U0i_rrij (Ljbul Qpa>p<3tu 1.000, 10,000, 18,000 LDpgLO 20,000 L.OT&0T -fcLD. /001&U CuCgiljq. Qtyb i_cuia)aa)OT ulaj Qrtus.

5. Tho position of a businessman who keeps his books on single entry was as under on 31.12.2007 and 31.12.2008.

|

2007 |

2008 | |

|

Rs. |

Rs. | |

|

Cash in hand |

400 |

480 |

|

Cash at bank |

6,000 |

2,500 |

|

Stock |

6,500 |

5,000 |

|

Debtors |

4,000 |

5,200 |

|

Furniture |

300 |

350 |

|

Sundry Creditors |

4,100 |

3,100 |

He withdraws Rs. 7,500 from business on 2.1.2008, out of which he spent Rs. 5,200 for purchase of a motor trucks for the business.

Adjustments:

(a) Depreciation on dosing balance of furniture and truck at 10%.

(b) Write off Rs. 220 as bad debts.

(c) 5% provision for bad and doubtful debts is needed.

Find out the profit or loss for the year 2008.

|

9{j)a>{DUu)cfi)ol CMUOTOT 90 eflturrumfluSlai jflaw 31.12.2007 LDfbpib 31.12.2008 | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

2.1.2008 | tifitLmuiT9ft))($i 0. 7.500 frQuuir* <r$uuuLL$i. iQrT!>su9a) 0. 5.200 6fliL)fnjrri7)0}(5 90 Cmmlimi u*rq. ufrrii(5u$g)< Q 99>e& L-U u Ul_$|. |

$iflL_i_ebBn:

($0 ui_i 9t0DpftA>a7 iD{bg|(b Gucvr&arrtiK

(3#iiju>nju> 10% 3b($Lb

(dfr) 0.220 ajijfT*i_araT CurrsQ&(ipuuLx.i

(@) U(jiTL5r u}g)g)iiii 9pG$&& sl.tst ttywesi 5% Ca>euuu0{D.

2008ii> ,6WTtc|.2)rTn affuijo (,*) j,\LL.pm$

6. The balance sheet of Padma and Renuka on

31 Dec. 2008 is set out below :

They share profit and losses in the ratio of 3 : 1.

Liabilities Rs. Assets Rs.

Capital: Land & Buildings 30,000

Padma 40,000 Furniture 2,000

Renuka 30,000 Stock 8,000

General Reserve 20,000 Sundry Debtors 60,000

Sundry Creditors 20,000 Cash 4,000

Profit and Loss a/c 6,000

They agreed to admit Kavitha into the firm subject to the following conditions :

(a) She will be entitled to one-fourth share of the profit.

(b) She will bring in Ra. 21,000 of which Re. 10,000 will be treated as her share of good will to be retained in the business.

(c) Depreciation is to be provided on furniture @ 15%.

(d) Stock to be revalued at Rs. 6,500.

(e) 50% of the General reserve is to remain as a provision for Bad and Doubtful debts.

Prepare ledger accounts and construct the balance sheet of the new firm.

|

31 iibuiT 2008ib prreDOTuJ u>jbg|ib Cffqpsff 0UL| jpottws Qfr(pMuuL.00T9T|. 3 1 &&&$ t Q&nm&frponrt, | ||||||||||||||||||||||||

|

|

anjpLxJidQ |

6.000 |

|

1,10,000 |

1,10,000 |

fil#fT>aj CiruuQfirr $ul(S Q*rr5n_nT.

() 1/4 u%>( >rruib 0u([|uzujutnri)pm7.

(<$>) 21,000 QffifTem|iirTfT @$a> 0. 10,000 $IQj0a>t_UJ prnx)uL|U urusrra 6flujfnjrrgo) a>euj)0s GcudrQtb.

() *&&>$&&&! dni (Jujinnanb 15%

Ceuc&rQib.

(r>) 5/j4fi0uq u>jfiui9u 0. 6.500.

(a.) OuaggA *mjiSIb 50% Qjprr u>{i)jptb

SL-ctoajgj&affS GcuOTr0ii>.

CuCpiiQA ocT0a>T pujmflis tDjpptb qjfitu j%|Gu ?$! @0UU| $*>>* @0ut9a>ar 0UJfTlft&S.

7. P, Q and R were equal partners. R retired on

31.03.2009. The balance sheet of the firm on 31.12.2008 stood as follows :

Liabilities Rs. Assets Rs

Capital a/c: Good will 25,000

P 50,000 Buildings 50.000

Q 30,0001nvc8tjnent (coat) 10,000

R 30.000Stock 12.000

Investment Fluctuation Debtors 20,000

Fund 2,000(-) provision 1,000 19,000

Liabilities Ka. Assets Rs.

Contingency Reserve 6,000Cft*h m hand 2.000

Creditors 22,000Cash at bank 22.000

1,40,000 1.40,000

On the date of retirement it was found that

(a) Building be valued at Rs. 60,000

0>) Investment fluctuation fund be brought to Rs. 1,100

(c) Debtors being all good no reserve is required

(d) Stock to be taken at Rs. 11,000

(e) Goodwill will be valued at 2 years purchase of the average profit of the past five years

(f) Rs share of profit to the date of retirement he calculated on the basis of average profit of the preceding three years. The profit for the preceding five years were as under.

2004 : Rs. 12,000, 2005 Rs. 13,500, 2006 : Rs. 8,000, 2007 : Rs. 10,000, 2008 : Rs. 9,000. Pass journal entries, give partners capital a/c and the balance sheet.

|

P, Q LOjpgstb E iJGujfrrr ffujsulLjrerfWr euir. 31.3.2009 <4t) R 6fil)($<%)rT(7. 31.12.2008lo piroxmu jSgjaienejr uLifierwu* @$ut-j ft_grcng|. | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

6fi)co0i(D /Brrafld) er>L.$$a>u6fln;

(3t) L.iq.L-u> 0. 60,000 era* u>)uiSlL_LJu@ilp$i.

(%b) GP torrj&gp fifi 0. 1,100*$ Qsnete 6UIJLIUL-L-gl.

(@) ai_65T(TofliT ner><nith pexucuftMT. attljl) Cen&juSlcbaxu.

(ft) tfijdwuiSfinsn 0. 1,100 cren T(iQ&ff8Tar

Ccucwrii).

(b_) Q*i;d gfrwrsftan eiprfto extupfim

g)i76OTurrjT@*iTgj Q&rrar(ip<b crat{p

9ituua)i_uS1o) j5inDui9xr ioui9u (kurib.

(fiff) Qpj&60UJ QpGKgl Qimjpfien

$iq.uua>t_ii9<b Rj cixruu utii@ e6)co(yrjD Coj)(7 stmsL. CcucvrQib. Qpp,WfilU nrS9T axruib 6_ncrT.

2004 : . 12,000, 2005 <3. 13,500, 2006 :

0. 8,000, 2007 ; . 10,000, 2008: . 9,000.

(j0uQuil@U UjS&JSfiDOT A.L.LJTafl0Tg|

QP MTS0 U)jDg|U> g)0UL| j&axu* {f)uJDT $UjrT(fts.

A, B and C are partners in a firm sharing profits and losses in the proportion of 3:3:2. Their balance sheet on 31.2.2008 was as follows :

8.

|

liabilities Sundry Creditor* Partners CapiUl A/e: A-76,000 B-76.000 C- 1.00.000 Partners Cumnt A/c: A- 16,000 B - 26,000 C- 12.600 |

Ra. Aaaeta Ra. 66.000 69.000 6,000 70.000 47,600 Bank Stock Inveauntnt Debtor* 2.60,000 Land and Building 1.26,000 Goodwill 26,000 62.600 |

3.60,000

3,60.000

They decided to dissolve the firm on 1.1.2009. A reports the result of realization as follows :

Rs.

Land and Building 90,000 Debtors 60,000

Investments 5,500

Stock 75.500

Goodwill . Nil

The realization expenses amounted to Rs. 2,000. Close the accounts of the firm.

90 A, B LO|i)g|ii> C Auijraftan

fuscrrgi curry piLL-nuctinar 3:3:2 crartffl) edifippfiio QsrTarAarpfiVTfr. 31.12.2008u> prrawtu 0um

$na)& (gjfilun i9nU0U>iTg)r

|

Qurrpu 14**1 ujfrutt *urf/kCflA4h /(g: A - 76.000 B - 76,000 A- 16.000 B-26,000 C-l&SfiQ |

ajitd flaxy**, pmstfluu 47,600 2.60,000 62,600 3,50,000 |

- 66,000 69.000 6,000 70.000 1.26.000 26.000 3,60,000 |

D 529

11

1.1.2009 ru>i sauuTrs

(}Iq.Qcu@anT. S6frflBruO>6U4QT U$<8**UULJ_1TS

'A' ps&jcb aeft$mT.

-

j)cuQpib 90,000

si_oTrraBs4r 60,000

Qpn 5,500

<ri0uq 75,500

PfeUty0ULt *>xo

f,irei\9 Q4a>ajaflcfe Qpiraui 0. 2.000. jfilgjajar ?@a>cn GP**#*-

D 530 Q.P. Code : [07 DC 05/

07 DCCA 04]

(For the candidates admitted from 2007 onwards)

B.Com./B.Com. <CA) DEGREE EXAMINATION, DECEMBER 2010.

Sccond Year

Part 111 Commerce/Commerce with Computer Applications

PRINCIPLES OF MANAGEMENT MARKETING MANAGEMENT

Time : Three hours Maximum : 100 marks

Answer any FIVE questions.

Each question carries 20 marks.

(5 x 20 = 100)

1. Define marketing. Explain the evolution of marketing concept.

fr(6Gyjg,uS)ujd> ueojjajgi #0)u9uja>

2. Discuss the various approaches to the study of marketing.

<fB6r>juSiaJGn60 *sir5i&iji>rrT u>G&igj

3. What is product life cycle? Discuss the various stages involved in it.

eunip&en&ff ($&> cranpfrd) crren? @$ycrrai uwCtaijp JcmcoacRGn cfileurrl.

4. What do you mean by 'Branding'? Discuss its functions.

euerafl&u Quujfl> upjfil jefiir ,r$6u$) ujrrgj? U6Wfif>Cirefi)6liH$.

5. Define 'pricing*. Explain the various methods of setting prices.

<6fila>4UuSll-&, aio7UJ{pi. cflowuSlcnwr /9rinu9a><5u>

uuC?Qj[F)j QpropacnGTT efilcn&(5.

6. Define 'Sates promotion. Discuss its kind*.

*Gfi)U)60l CeU)|j)UrT@k' GYJOlljUJgB cWt eUGMMWDOT

aflcurr,

7. Advertising is a waste. Do you agree? Discuss.

"efilcnbuijib craiugi GScwmengT. >Bn $ul| QafrTT(aT,o3(;rT? efilGurTfi&cLb.

8. What is iC-marketing? Explain its significance in the modern era.

uStear ff/B68>uS)ujv srenprra) ct6btct? jeSer

eS)CTT($.

Reg. No.:................................

D 545 Q.P. Code : [07 DCCA 10]

(For the candidates admitted from 2007 onwards)

B.Com. (CA) DEGREE EXAMINATION, DECEMBER 2010.

Third Year

Part III Commerce with Computer Applications SOFTWARE DEVELOPMENT AND VISUAL BASIC Time : Three hours Maximum : 100 marks

Answer any FIVE questions.

(5 x 20 = 100)

1. Discuss in detail client/server models.

2. Discuss various menus in Integrated Development Environment.

3. Explain the following :

(a) Visual Basic data types with example.

(b) Date and time functions.

4. Discuss in detail the List box properties and List box events.

5. Discuss about:

(a) Various forms of controlling program flow with an example.

(b) Command button properties in the interface.

6. Explain various financial functions available in Visual Basic with example.

7. Write a Visual Basic Program to develop a Scientific Calculator.

8. Discuss in detail the different types of cliont/sorvor technical Architecture.

D 545

2

|

Attachment: |

| Earning: Approval pending. |