Bangalore University 2009-2nd Year P.U.C Economics 2008 - Accountancy - y%2C - Question Paper

Code No. 30

Total No. of Questions : 24 ] [ Total No. of Printed Pages : 16

( Kannada and English Versions )

Time : 3 Hours 15 Minutes ] [ Max. Marks : 100

( Kannada Version )

8 x 2 = 16

1. aX dd 0- tiD XoJrt>b)

o

2. d otiro> 0ode ?

cp

3. n$X ,/ra 0ode ?

4. cotooX ,o, <d e aesXDo XdOJd de&D n aes.

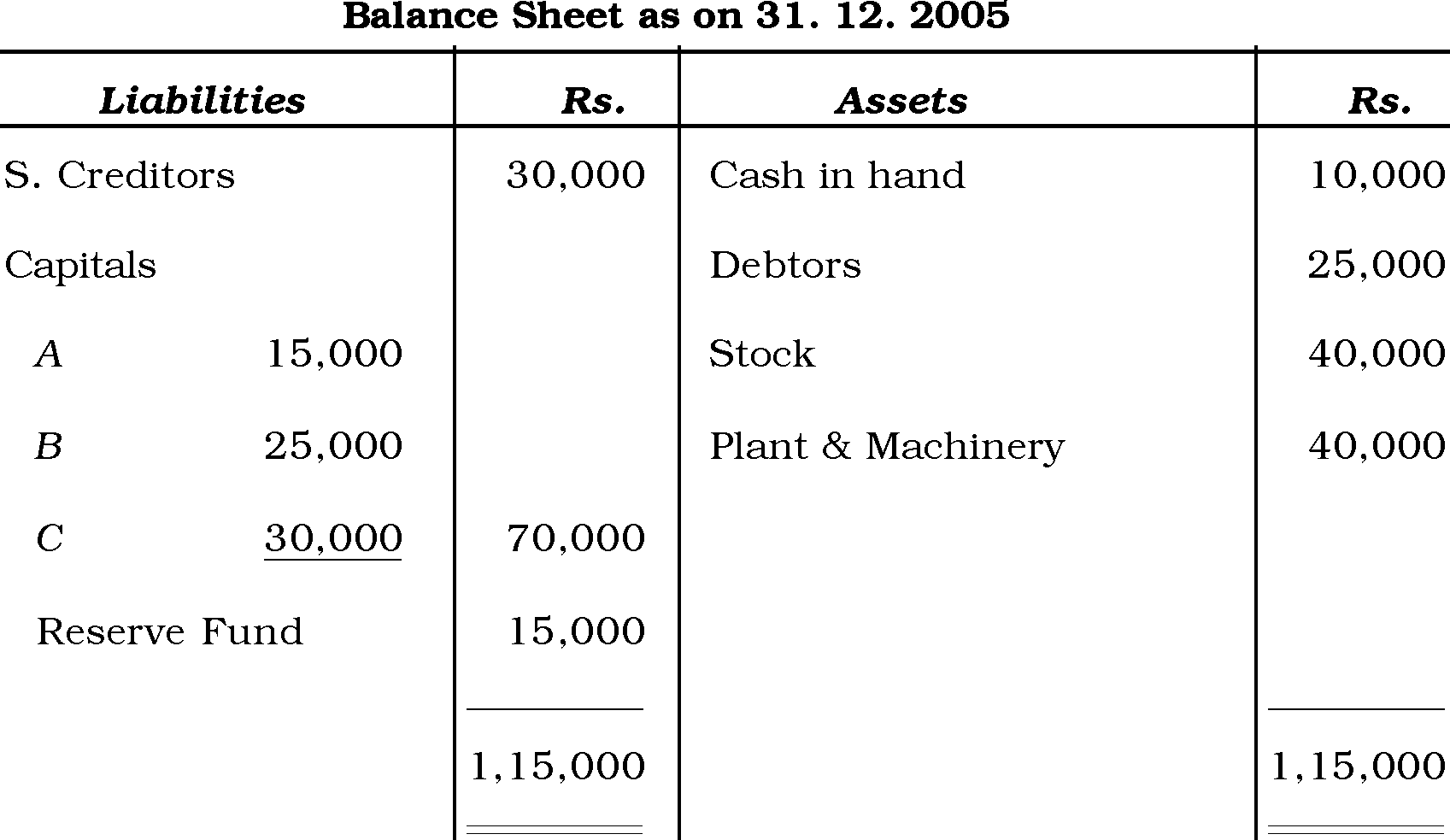

cp ti ot

5. 0</d rt edDrt > tiort ti 0ode ? oD >d} Xs.

6. X> )rt> Dr Xoa<D Xd Jd X>n Je0,0 ?

a) do$X

b) edD &,eD(D

7. , riXSrt 0d tiD 53drart>o

ot

8. wd-d z>J<d 0dtio oXnD,

9. nraSeXJ X@ /tiDXD Fct

10. rt raSeXJ 0odeD ?

X>Ad)rt> </d)idd dodo drt$n Jo. d dn -d odrt>o:

3 x 6 = 18

11. d,eraD odD diDnioX ,o, <d , d ,oJ dertyi.fi

Z/ cp co co7 o3 v

d,3 ort> di,dod d&. 2,000 rt>o JrtdDXoSdD Ji. di&rX eXi 12

ZS ZS * co ct _o

d oJ 31. 12. 2008 X@ Xrtd ddrX@ BdD ,oJ dertyi.A >d rad doe <dd ,di,o da dd (dD XodDaDo.

ca ct * cp co

12. odD diDnioX ,o, <dD ,de, ddoe doJ dDe diDniddiAdD, dd

Cp CO _o co

2 : 2 : 1 d dd/rad, 1$-4jd0 oX>oAO,> ddDeD ,o,poo ad dodDJi. ddoe ad) <dD oJd ,de doJ dDdedddD diDnioX(dD

_0 _0 _D

i$do ,dDiA oX><o &,dDJid. ,de doJ dDeddd rt$X

* c{ s *J 0 0

dd/radd XoDSDO.

13. A, B dDJo C dKDHlddlAdo !$- dd/rad) 2:2:1 doJ d. QioX 31. 12. 2005 X@ dd id d,X X>Xodod :

31. 12. 2005 d d&,

|

&}ndQirt>o |

d&. |

rt& |

d&. |

|

dan> |

30,000 |

x, n d |

10,000 |

|

UDn >o |

25,000 | ||

|

A 15,000 |

,dXDrt>o |

40,000 | |

|

B 25,000 |

,i d d doJb doJ, Cp o J |

40,000 | |

|

C 30,000 |

70,000 | ||

|

De,co aa |

15,000 | ||

|

1,15,000 |

1,15,000 |

aioX 30. 06. 2006 d oD A ad oad. d did,Di>dart , ,eyiddD :

CO CO

a) d oddi>, oa ddrd id XdoJ.

b) d di De,D aa, oa ddrd d,X(dDoJ.

c) d di 1, ad asioXdddrt, oa ddrd i$do wO.

d) d di Serd?, X>d i<d@ ddrrt> id ,di,o<dD dDdD ddrrt> noean ,d 0od don.

X>d oa ico@ ddrrt> i$ :

2002 - d. 23,000 ; 2003 - d&. 20,000 ; 2004 - d. 19,000 ; dDJo 2005 - d. 18,000.

a doad di<Dnid did,idart ,,,eyid d> JdD

XodDSDo.

14. rod5, do><bb d&. 100 bbn(b 1,000 6% aodbrt>b, abrtd /ab.

ot

be d>doo dedb :

a) Foart d. 20

b) d}(b be d&. 30

c) d bb ob ddoart d&. 50.

0> a o dort >o on/Ab rab ,0/A d<b>bb.

CO CO <=i

de&b n rt>b dbO.

ot

15. nraSedj d@ Qb 3bdrt>344 ?

e)rt - C

x>A)rt> /)d x4 p. a<b@ odn>o:

4 x 14 = 56

16. &/D5f>(DD ad bb b d, ), dn>b dado>>. d>do

> C> CO o ct _0

/&3bo a>od 31. 12. 2005 dob bb )fd5f

,d ,bb </O :

6 cp eo ot

|

01. 01. 2005 d&. |

31. 12. 2005 d&. | |

|

<boe ddrart> |

20,000 |

20,000 |

|

&ede ddrart> |

2,000 |

2,000 |

|

>ei>do ydo |

10,000 |

10,000 |

|

Ubrt >d |

10,000 |

16,000 |

|

,ddb |

12,000 |

13,000 |

|

nb |

8,000 |

5,000 |

|

art>D |

20,000 |

10,000 |

|

dj n >d |

25,000 |

25,000 |

w f db d&. 3,800 n>b ro.>dao ,,od, >doado>d dd

co ot 5 ci u _o _o

d&. 1,200 bb>, ,ddbrt>b rt >b <eAdoadbd. < w

v t k) -> _o co

f& d&. 5,000 rt>b DO ro>,dd, Ado>d.

co ot 2 6 u -c

a) wdo oro> be 2e. 5 do a dedb

* CS>

b) Ubrt > be dd d ,<d@ 2e. 10 be,b rtao

d) bort> be 2e. 5 bb &ededdrart> be 2e. 10 ,d$ rtbO.

17. a3/ $e/ 3on3dd 2 : 1 - 0 Xod. S3oX 31. 12. 2008 do >- X X>Aorf :

|

Q&dcti31. 12. 2008 - mSjX | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

Xr/dart X>A Xd3Cbrt> oed 3on3OXrt e aedod.

4 * * u o

derjiqwjh d. 30,000 rt deXr.

b) derjio.b, ><r OTOdd oX, d.

6 ot u _o

c) (ort> oed e. 10 -tj ,X$ Jrto.

d) &ede Xdra d&. 2,000 rtoO.

' -o co

e) Xdr ,3< oe, d. 2,400 -tj .

f) rt> d. 4,400 Xe53fio. wOo , Jrt>3.

' * CO CO c

18. dk. do Jo Aes d>on3da3Ado, dd 3 : 2 - dd/rad d3odo 0

& o co7 ZS co <=i

Xd do. axX 31. 12. 2006 d od dd dd d,X X>AoJ d :

|

0531. 12. 2006 mSjX | ||||||||||||||||||||||||||||||||||||||||||||

|

doe ai>oddodo deb d>onoX ,o, (doo ,rdo, .adedo

Cp ct CO 0

a) dJX@ dooart> d&. 7,500; ,TOdcb do Jo ,dXo d,X dd<do e. 10 -y Xado, <dooJedXdra e. 5 -y drt, d 12,000 X@ X/do do Jo 3erdji,d dd dAd .

6 co

b) &ededXdra do Jo SXrt> dodo X,dodA d&. 4,000 doJ dk& doJo Aes JrtdoXoSd d. ,&f nor d&. 600. 0d ortrt

0 CO CO CO

d&d d/ddArf.

d w z>Jrt>o doo.

6

19. aioX 01. 01. 2005 dod? d,aed ?oJedXdrad? d&. 30,000 X@ Xod. aioX 30. 06. 2007 X@ d>d? Xod <?oJ,edXdrad d&. 10,000 d irtdrf? d&. 7,200 X, d/0d!. de adod? d. 8,000 X, d, oJedXdradrf?

v co u ZJ ot

noea d/ad!. ,d> dezi ,dX$ dd d,5id di&rX e. 10 doJ ,dX$ >a&. 4

CO CjD

drrtrt (?oJedXdra sirfi ,dX$(? ziJrt>? Jeo.

20. X>A did d,X d?J? w?-d62 ziJ >1,0 elf X,, >1,0 dotf , ooddjd :

|

_S30g 31. 12. 2007 - &%& dg__ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

e0ujrtXrt& :

a) 2008 e d rd deyid dort d&. 6,000.

b) 2009 e d rd d??ortd ddad?d dort d. 2,000.

c) wtd ,id/?rt> d?e d&. 10,000 d?J? &ededXdrart> d?e d&. 1,000 ,dX$ Jrt?0.

d) dde 2q@d? oddieXo.

e) Xd eyi ,o> d. 3,600 d?J? d?,j5 d d&. 600.

' -e t li

i) Wdi<? d?J dd ziJ

_o ti

ii) aioX 31. 12. 2008 dod CbdoJ did d,X

21. abod 31. 12. 2008 - doa a<ooJ, ,el d Jb> j

X>Aorf :

|

31. 12. 2008 - | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

eoujrtXrt& :

a) edo oro>> oe e. 15 doJ dkdo&i oe,O.

ot

b) oe,o apn d&. 10,000 n>o nbro.

c) ,bd oJ <ooJ, oe e. 10 ,d$ JrtoO.

' cp -0 V 0

d) d J oe e. 5 d oJ ,d$ JrtoO.

e) 31. 12. 2008 X@ oo ,ddo 5<o@ d&. 12,000.

ib:w~Jbd oJo ] ZbJ, aert ZbJ oJo "b

&Xoo artaJ J</O.

V ct CO

X> /)d 0rfo JO. d oXrt>o :

2 x 5 = 10

22. XoaD ti ,xd /oddr j/o. (Jdoan /J)

23. Xa d JvX os-osn>J>noti j >D>d OTd,>d

o & ot e;

zJ J/0.

24. X> )rt> Dr Xo><d dJo otiro> orts :

a) D\Jo, tiD

' e) 6 -e co

b) nraX (Dojao o ra

c) onrt>D, tiD

ot CO

d) sxn> oe s

CS>

e) X&.ti rfert ti d

eo co

( English Version ) SECTION - A

Answer any eight questions, each carrying two marks. 8 x 2 = 16

1. State the two merits of single entry system.

2. What is fixed capital system ?

3. What is 'Benefit Ratio' ?

4. Give Journal Entry for Realisation Expenses paid on dissolution of firm.

5. What is issue of shares at a discount ? Give one example.

6. Under what heading are the following items shown in the company's Balance Sheet ?

a) Preliminary Expenses

b) Share Premium.

7. State any two causes of depreciation.

8. State any two features of Income and Expenditure Account.

9. Give the meaning of Computerised Accounting.

10. What is a file in computer ?

Answer any three questions, each carrying six marks. 3 x 6 = 18

11. Mr. Praveen, a partner in a firm withdrew Rs. 2,000 at the beginning of each month for his private use. Calculate interest on drawings of Praveen at 12% p.a. for the year ended 31-12-2008 under Average Period Method.

12. Suresh, Ramesh and Mahesh are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Ramesh retires from the firm. Suresh and Mahesh agrees to share the future profits equally.

Calculate the benefit ratio of partners.

A died on 30. 06. 2006. His executors should be entitled to :

13. A, B and C are partners sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet as on 31. 12. 2005 was as follows :

a) his capital on the date of last Balance Sheet.

b) his proportion of reserve on the date of last Balance Sheet

c) his proportion of profit to the date of death, on the basis of previous year's profit.

d) his share of goodwill is calculated on the basis of three years' purchase of average profits of the past four years.

The profit of the firm for the past four years were :

2002 - Rs. 23,000 ; 2003 - Rs. 20,000 ; 2004 - Rs. 19,000 and 2005 - Rs. 18,000.

You are required to ascertain the amount payable to the executors of the deceased partner.

14. Bharat Company issued 1,000 6% debentures of Rs. 100 each payable as under :

a.) on application Rs. 20

b) on allotment Rs. 30

c) on first and final calls Rs. 50.

All the debentures were subscribed and amounts were duly received.

Pass necessary Journal Entries.

15. What are the advantages of computerised accounting ?

Answer any four from the following questions, each carrying fourteen marks : 4 x 14 = 56

16. Priyadarshini keeps her books on single entry system. From the following information, prepare a Statement of profits or losses for the year ended 31-12-2005 and a Revised Statement of Affairs as on that date :

|

Particulars |

01. 01. 2005 Rs. |

31. 12. 2005 Rs. |

|

Machinery |

20,000 |

20,000 |

|

Furniture |

2,000 |

2,000 |

|

Motor car |

10,000 |

10,000 |

|

Debtors |

10,000 |

16,000 |

|

Stock |

12,000 |

13,000 |

|

Cash |

8,000 |

5,000 |

|

Creditors |

20,000 |

10,000 |

|

Buildings |

25,000 |

25,000 |

During the year, she has withdrawn Rs. 3,800 for personal use and used goods valued Rs. 1,200 for domestic purpose. She had also introduced Rs. 5,000 as additional capital during the year.

Adjustments :

a) Provide 5% interest on opening capital

b) Reserve 10% on debtors for Bad debts

c) Outstanding salaries Rs. 300

d) Depreciate Machinery by 5% and Furniture by 10%.

17. Rama and Bheema are partners sharing profits and losses in the ratio of

2 : 1. Their Balance Sheet as on 31. 12. 2008 was as follows :

|

Balance Sheet as on 31. 12. 2008 | ||||||||||||||||||||||||||||||||||||||||

|

Kumar is admitted into partnership on the following terms :

a.) He should bring Rs. 80,000 as capital for 4. share and Rs. 30,000 towards goodwill.

b) Goodwill is withdrawn by the old partners

c) Machinery is depreciated by 10%

d) Furniture is written down by Rs. 2,000

e) Increase R.B.D. by Rs. 2,400

f) An amount of Rs. 4,400 due to a creditor is not likely to be claimed and hence to be written off.

Prepare :

i) Revaluation Account

ii) Partners Capital Account

iii) New Balance Sheet.

18. Rashmi and Geetha are partners sharing profits and losses in the ratio of

3 : 2. Their Balance Sheet as on 31-12-2006 is as follows :

|

Balance Sheet as on 31. 12. 2006 | ||||||||||||||||||||||||||||||||||||||||||||

|

On the above date the firm was dissolved and the assets were realised as follows :

a) Bills Receivable Rs. 7,500, Sundry Debtors and Stock 10% less than the book value ; value of the Machinery is to be increased @5%. Buildings realised Rs. 12,000. Goodwill is considered worthless.

b) Furniture and investments were taken over by Rashmi and Geetha @ Rs. 4,000 each respectively. Dissolution expenses were Rs. 600. All the liabilities were discharged in full.

Show the necessary Ledger Accounts.

19. On 01-01-2005 Mr. Pradeep purchased Machinery for Rs. 30,000. On 30-06-2007 he sold a part of the machinery costing Rs. 10,000 for Rs. 7,200. On the same day he bought new machinery for Rs. 8,000. Every year depreciation was charged at 10% per annum on Straight Line Method.

Show the Machinery Account and Depreciation Account for four years.

20. Following is the Balance Sheet and Receipts and Payments Account of Bellary Sports Club, Bellary.

Balance Sheet as on 31. 12. 2007

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Outstanding Salary |

4,000 |

Cash Balance |

14,600 |

|

Capital Fund |

65,000 |

Outstanding Subscriptions |

2,400 |

|

Sports Materials |

32,000 | ||

|

Furniture |

20,000 | ||

|

69,000 |

69,000 |

|

Receipts and Payments Account for the year ended 31. 12. 2008 | ||||||||||||||||||||||||||||||||||||||||

|

Adjustments :

a) Subscriptions outstanding for the year 2008 - Rs. 6,000

b) Subscriptions received in advance for the year 2009 - Rs. 2,000

c) Depreciate Sports Materials by Rs. 10,000 and Furniture by Rs. 1,000

d) Capitalise Entrance fees

e) Outstanding salaries Rs. 3,600 and lighting charges Rs. 600.

Prepare :

i) Income and Expenditure Account

ii) Balance Sheet as on 31. 12. 2008.

|

Trial Balance as on 31. 12. 2008 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Adjustments : |

a) Dividend at 15% on Share capital is to be provided

b) Transfer Rs. 10,000 to Reserve fund

c) Depreciate Plant and Machinery at 10%

d) Provide depreciation on Buildings at 5%

e) Stock on 31-12-2008 was valued at Rs. 12,000.

Prepare Trading, Profit and Loss Account, Profit and Loss Appropriation Account and Balance Sheet in the prescribed form.

SECTION - D ( Practical Oriented Questions )

Answer any two of the following questions. Each question carries five marks : 2 x 5 = 10

22. Prepare a proforma of a company Balance Sheet (with heads only).

23. Prepare Executor's Account with at least five imaginary figures.

24. Classify the following receipts into revenue and capitals :

a) Legacies received

b) Sale proceeds of computers

c) Subscription received

d) Interest on investments

e) Building donations received.

}jirdbioX Z3

ii) coTOdd oro> zJrt>o

iii) ($ 3 X

|

Attachment: |

| Earning: Approval pending. |